Navigating the global market for silicon carbide (SiC) chip manufacturers can be a daunting task for international B2B buyers, particularly those based in Africa, South America, the Middle East, and Europe. The rapid evolution of technology has made SiC chips essential in various applications, from electric vehicles to renewable energy systems. However, the challenge lies in sourcing reliable manufacturers that meet specific performance and quality standards while also providing competitive pricing.

This comprehensive guide aims to equip B2B buyers with the knowledge needed to make informed purchasing decisions. We delve into various aspects of the SiC chip market, including different types of chips, their applications across industries, and strategies for effectively vetting suppliers. Additionally, we discuss factors influencing cost and pricing structures, helping buyers understand the financial implications of their choices.

By addressing common concerns and providing actionable insights, this guide empowers international B2B buyers to navigate the complexities of sourcing SiC chips effectively. Whether you are in South Africa, the UK, or elsewhere, understanding the nuances of the SiC market will enable you to forge successful partnerships with manufacturers, ensuring that your business remains competitive in an increasingly technology-driven world.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Power SiC Devices | High voltage and current handling capabilities | Electric vehicles, renewable energy | Pros: High efficiency, thermal stability. Cons: Higher initial costs. |

| SiC MOSFETs | Fast switching speeds and high efficiency | Power management, industrial automation | Pros: Reduced energy loss, compact design. Cons: Complexity in integration. |

| SiC Diodes | Low reverse recovery time, high thermal conductivity | Power supplies, inverters | Pros: Improved reliability, lower heat generation. Cons: Limited availability in certain regions. |

| SiC Schottky Diodes | Ultra-fast recovery times, ideal for high-frequency applications | RF applications, power electronics | Pros: Enhanced performance in high-frequency circuits. Cons: Sensitive to voltage spikes. |

| SiC Substrates | High thermal conductivity, excellent electrical properties | Semiconductor fabrication, LED lighting | Pros: Superior performance in high-power applications. Cons: Costly compared to traditional substrates. |

Power SiC devices are designed for high voltage and current applications, making them ideal for sectors such as electric vehicles and renewable energy systems. Their ability to handle significant power loads with high efficiency and thermal stability is a crucial advantage for B2B buyers looking for reliable solutions in demanding environments. When considering a purchase, it is essential to evaluate the total cost of ownership, including potential savings from energy efficiency over time.

SiC MOSFETs are known for their fast switching speeds and high efficiency, making them suitable for power management and industrial automation applications. These components can significantly reduce energy losses, contributing to lower operational costs. However, their complexity in integration may require specialized knowledge or support, which buyers must consider when selecting suppliers.

SiC diodes exhibit low reverse recovery times and high thermal conductivity, providing improved reliability in power supplies and inverters. Their ability to generate less heat enhances overall system efficiency. Buyers should assess the availability of SiC diodes in their region, as limited supply could impact project timelines and costs.

SiC Schottky diodes offer ultra-fast recovery times, making them ideal for RF applications and power electronics. Their enhanced performance in high-frequency circuits can lead to improved system performance and efficiency. However, buyers should be aware of their sensitivity to voltage spikes, which may necessitate additional protective measures in circuit design.

SiC substrates are characterized by high thermal conductivity and excellent electrical properties, making them suitable for semiconductor fabrication and LED lighting applications. While they offer superior performance in high-power environments, the higher costs compared to traditional substrates can be a barrier for some buyers. Evaluating the long-term benefits of SiC substrates against their initial investment is crucial for informed purchasing decisions.

Related Video: How Silicon Carbide (SiC) Chips Are Made at PAM-XIAMEN?

| Industry/Sector | Specific Application of sic chip manufacturers | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Electric Vehicle (EV) Power Electronics | Enhanced efficiency and performance in EV systems | Reliability, thermal management, and supplier certifications |

| Renewable Energy | Solar Inverters | Improved energy conversion efficiency | Compliance with international standards and durability |

| Telecommunications | 5G Infrastructure | Increased data transfer speeds and network reliability | Scalability, integration with existing systems, and lead times |

| Aerospace and Defense | High-Power RF Amplifiers | Superior performance in communication and radar systems | Strict adherence to industry regulations and quality standards |

| Industrial Automation | Motor Drives and Controllers | Higher efficiency and reduced operational costs | Customization options and long-term support availability |

In the automotive sector, Sic chips are crucial in electric vehicle (EV) power electronics. They help in managing energy distribution and improving the efficiency of electric drivetrains. The benefits for businesses include enhanced performance and reduced energy losses, which are critical for meeting consumer demand for longer-range EVs. International buyers should focus on sourcing chips that provide high reliability and effective thermal management, as these factors significantly impact vehicle performance and safety.

Sic chips are pivotal in solar inverters, converting direct current (DC) from solar panels into alternating current (AC) for use in homes and businesses. Their high efficiency translates to better energy conversion rates, which can lead to increased revenue for renewable energy providers. When sourcing these components, businesses should ensure compliance with international standards and consider the durability of the chips, as they will be subjected to various environmental conditions.

In the telecommunications industry, Sic chips are integral to 5G infrastructure, enhancing data transfer speeds and network reliability. The deployment of 5G technology requires robust power management solutions, which Sic chips provide through their high efficiency and thermal performance. B2B buyers should consider scalability and the ability to integrate these chips with existing systems, as rapid deployment is often essential in this fast-evolving sector.

Sic chips are used in high-power RF amplifiers within aerospace and defense applications, offering superior performance for communication and radar systems. Their ability to operate efficiently under high temperatures and voltages makes them ideal for these critical applications. Buyers in this sector must prioritize suppliers that adhere to strict industry regulations and quality standards, ensuring reliability in mission-critical operations.

In industrial automation, Sic chips are used in motor drives and controllers, leading to higher efficiency and reduced operational costs. These chips allow for precise control over machinery, improving productivity and energy consumption. When sourcing Sic chips for industrial applications, businesses should look for customization options that meet specific operational needs and long-term support from suppliers to ensure seamless integration into existing systems.

The Problem: As industries increasingly demand high-performance power electronics, B2B buyers face the challenge of sourcing Silicon Carbide (SiC) chips that can withstand harsh environments while delivering superior efficiency. Buyers often struggle to find manufacturers who not only meet rigorous performance specifications but also comply with international standards. This can lead to delays in production and increased costs due to the need for re-evaluation or replacement of inferior components.

The Solution: To address this issue, B2B buyers should prioritize manufacturers with proven track records in high-performance applications. Start by conducting thorough research into suppliers who specialize in SiC technology for power electronics. Look for certifications such as ISO 9001 or IATF 16949, which indicate adherence to quality management standards. Engage directly with manufacturers to discuss your specific application needs and request samples to assess performance. Additionally, consider partnering with local distributors who have established relationships with reputable SiC manufacturers to streamline communication and logistics.

The Problem: Many international B2B buyers, especially in Africa and South America, encounter significant supply chain disruptions when sourcing SiC chips. Factors such as geopolitical tensions, transportation issues, and fluctuating material costs can lead to unexpected delays, ultimately affecting production schedules and business operations.

The Solution: To mitigate supply chain risks, establish a diversified supplier base. Engage with multiple SiC chip manufacturers across different regions to ensure that you have backup options in case of disruptions. Implement an inventory management system that enables you to forecast demand accurately and maintain safety stock levels for critical components. Additionally, consider leveraging technology such as blockchain to enhance transparency and traceability in your supply chain, making it easier to track shipments and respond to potential delays proactively.

The Problem: B2B buyers often find themselves overwhelmed by the technical specifications of SiC chips, leading to compatibility issues with existing systems. The complexity of semiconductor technology can make it challenging to determine which chip is suitable for specific applications, leading to costly mistakes and project delays.

The Solution: To overcome this challenge, buyers should invest in building a technical knowledge base within their procurement teams. This can be achieved through training sessions, workshops, or collaborating with engineers and technical consultants who specialize in SiC technology. When evaluating SiC chips, create a checklist of essential specifications, such as breakdown voltage, thermal conductivity, and switching frequency, tailored to your specific applications. Engaging directly with manufacturers during the selection process can also help clarify compatibility questions, ensuring that the chosen chips integrate seamlessly into your existing systems. Additionally, consider utilizing simulation software to model the performance of different SiC components before making a purchase decision, reducing the risk of incompatibility.

By addressing these common pain points with targeted solutions, B2B buyers can enhance their procurement processes and ensure successful integration of SiC chips into their operations.

When selecting materials for silicon carbide (SiC) chip manufacturing, international B2B buyers must consider various factors including performance properties, cost implications, and regional compliance standards. Below is an analysis of four common materials used in SiC chip manufacturing, focusing on their key properties, advantages and disadvantages, and specific considerations for buyers from Africa, South America, the Middle East, and Europe.

Silicon carbide itself is a widely used material in semiconductor applications due to its exceptional thermal conductivity, high-temperature resistance, and robustness under high-voltage conditions. SiC chips can operate in extreme environments, making them suitable for applications in automotive, aerospace, and industrial sectors.

Pros:

- Excellent thermal management and high breakdown voltage.

- Enhanced efficiency in power electronics.

Cons:

- Higher manufacturing costs compared to traditional silicon chips.

- Complexity in fabrication processes may require specialized equipment.

Gallium Nitride is another semiconductor material that is often compared to SiC. It offers high electron mobility and can operate at high frequencies.

Pros:

- Superior efficiency in high-frequency applications.

- Lower on-resistance, which leads to reduced power loss.

Cons:

- More expensive than SiC and requires advanced manufacturing techniques.

- Limited thermal conductivity compared to SiC.

Aluminum Nitride is primarily used for its excellent thermal properties and electrical insulation capabilities. It is often used as a substrate material for SiC chips.

Pros:

- High thermal conductivity which aids in heat dissipation.

- Good dielectric properties, making it suitable for high-voltage applications.

Cons:

- More brittle than SiC, leading to potential mechanical failures.

- Limited availability and higher costs.

Silicon remains a foundational material in semiconductor manufacturing. It is often used in conjunction with SiC for specific applications.

Pros:

- Lower cost and widely available.

- Established manufacturing processes make it easier to integrate.

Cons:

- Lower thermal and electrical performance compared to SiC.

- Not suitable for high-temperature applications.

International buyers must be aware of compliance with local and international standards such as ASTM, DIN, and JIS. Understanding the regulatory landscape in their respective regions is crucial to ensure product compatibility and quality. Additionally, considerations around the availability of materials, local manufacturing capabilities, and logistical factors can impact the overall cost and feasibility of sourcing SiC chips.

| Material | Typical Use Case for sic chip manufacturers | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | Power electronics, automotive applications | High thermal conductivity and efficiency | Higher manufacturing costs | High |

| Gallium Nitride | RF and high-frequency applications | Superior efficiency and lower power loss | More expensive and complex fabrication | High |

| Aluminum Nitride | Substrates for high-power devices | Excellent thermal management | Brittle and limited availability | Medium |

| Silicon | General semiconductor applications | Cost-effective and widely available | Lower performance in high-temperature settings | Low |

This material selection guide provides valuable insights for international B2B buyers, enabling them to make informed decisions when sourcing materials for SiC chip manufacturing. Understanding the pros and cons of each material, along with regional compliance requirements, can significantly impact the success of their procurement strategies.

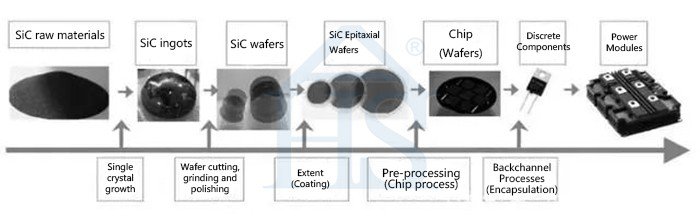

The manufacturing of Silicon Carbide (SiC) chips is a complex and meticulous process that involves several key stages. Understanding these stages is critical for international B2B buyers to assess the capabilities of potential suppliers.

Material Preparation

The first step in SiC chip manufacturing is the preparation of raw materials. SiC is produced through a chemical vapor deposition (CVD) process, where silicon and carbon sources are combined at high temperatures. This process creates high-purity SiC crystals, which are essential for the performance of the final product. Buyers should inquire about the source of raw materials and the methods used to ensure quality and purity.

Forming

Once the raw materials are prepared, they undergo a forming process. This typically involves cutting the SiC crystals into wafers. The wafers are then polished to achieve a smooth surface, which is crucial for subsequent processes. It is important for buyers to understand the techniques used for wafer slicing and polishing, as these directly impact the yield and quality of the final chips.

Assembly

After the wafers are prepared, the next stage is the assembly of the SiC devices. This includes layering various materials to create the necessary electronic structures. Techniques such as photolithography and ion implantation are commonly used to define circuit patterns on the wafer. B2B buyers should evaluate whether the manufacturer employs advanced techniques that ensure precision and reliability in assembly.

Finishing

The final stage involves finishing processes such as dicing, packaging, and testing. Dicing breaks the wafer into individual chips, which are then packaged for protection and ease of integration into electronic systems. Finishing also includes extensive testing to ensure that each chip meets performance specifications. Buyers should seek manufacturers that implement stringent finishing processes to guarantee product reliability.

Quality assurance (QA) is critical in SiC chip manufacturing, given the stringent performance requirements in applications such as power electronics and high-frequency devices. International standards and industry-specific certifications play a significant role in ensuring product quality.

What International Standards Are Relevant for SiC Chip Manufacturers?

Compliance with international quality standards such as ISO 9001 is essential for manufacturers. This standard emphasizes a quality management system that focuses on continuous improvement and customer satisfaction. Additionally, industry-specific standards such as CE marking in Europe and API certification can further assure buyers of the quality and safety of the products.

What Are the Key Quality Control Checkpoints in the Manufacturing Process?

- Incoming Quality Control (IQC): This checkpoint involves inspecting raw materials before they enter the production process. Buyers should verify that suppliers have robust IQC procedures in place to ensure that only high-quality materials are used.

- In-Process Quality Control (IPQC): Throughout the manufacturing process, IPQC involves monitoring production activities to catch defects early. This includes regular inspections and tests at various stages of manufacturing.

- Final Quality Control (FQC): The final inspection occurs after assembly and finishing, where the chips undergo rigorous testing to confirm they meet specified standards. Buyers should ask for documentation of FQC results to ensure the reliability of the chips.

What Common Testing Methods Are Employed for SiC Chips?

Testing methods for SiC chips include electrical testing, thermal cycling, and reliability testing under extreme conditions. Electrical testing verifies performance characteristics, while thermal cycling assesses the chip's ability to withstand temperature fluctuations. Buyers should ensure that suppliers employ comprehensive testing protocols to guarantee product performance.

For international B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, verifying a supplier's quality control processes is vital for ensuring product reliability.

Conducting Supplier Audits

Regular audits of suppliers can provide insights into their manufacturing and quality assurance processes. Buyers should establish audit protocols that evaluate the adherence to international standards and the effectiveness of the supplier's quality management systems.

Reviewing Quality Reports

Requesting quality reports and certifications from suppliers can offer assurance of their compliance with necessary standards. These documents should detail the results of various quality control checks and testing methods employed throughout the manufacturing process.

Engaging Third-Party Inspection Services

Utilizing third-party inspection services can provide an unbiased assessment of the supplier’s quality control processes. These inspections can validate claims made by suppliers regarding their manufacturing capabilities and adherence to standards.

When dealing with suppliers from different regions, it is essential for international buyers to understand the nuances of quality control that may vary by geography.

Regional Standards and Certifications

Different regions may have varying standards and certifications. For instance, European suppliers may emphasize CE certification, while suppliers in the Middle East may focus on local regulatory compliance. Buyers should be knowledgeable about these differences to ensure compatibility with their own market requirements.

Cultural and Operational Differences

Cultural attitudes towards quality assurance can differ significantly. Buyers should consider these cultural factors when assessing suppliers, as they may influence manufacturing practices and quality control measures. Building strong relationships with suppliers can help bridge these gaps and foster a culture of quality.

Supply Chain Considerations

The complexity of international supply chains can impact quality assurance. Buyers should evaluate the entire supply chain, from raw material sourcing to final delivery, to identify potential quality risks. Implementing stringent supply chain management practices can mitigate these risks and ensure consistent product quality.

By understanding the manufacturing processes and quality assurance measures employed by SiC chip manufacturers, B2B buyers can make informed decisions that align with their business needs and quality expectations.

In today's globalized market, sourcing silicon carbide (SiC) chips requires a strategic approach, especially for international B2B buyers. This guide provides a practical checklist to ensure you make informed decisions when procuring from SiC chip manufacturers, particularly from Africa, South America, the Middle East, and Europe.

Before initiating contact with suppliers, clarify your technical requirements. This includes the type of SiC chips you need, their intended application, and performance criteria.

- Consider factors such as: voltage ratings, thermal conductivity, and package types.

- A well-defined specification helps in narrowing down suitable manufacturers and avoids miscommunication.

Conduct thorough research to identify reputable SiC chip manufacturers. Look for companies that specialize in the type of chips you require and have a proven track record.

- Utilize platforms such as: industry directories, trade shows, and online reviews.

- Pay attention to customer testimonials and case studies, as these provide insight into the manufacturer’s reliability and quality.

Verify that potential suppliers hold relevant certifications and comply with international quality standards. This step is crucial for ensuring the quality and safety of the SiC chips.

- Look for certifications like: ISO 9001, RoHS compliance, and any regional standards applicable to your market.

- Certifications indicate that the manufacturer adheres to established quality management practices.

Before making a large order, request samples of the SiC chips to evaluate their performance against your specifications. Testing samples can reveal any discrepancies and help you assess their suitability.

- Focus on: electrical performance, thermal management, and reliability under operational conditions.

- Conduct tests that mimic your actual usage scenarios to get a realistic understanding of the product.

Engage suppliers in discussions about pricing structures and payment terms. Understanding the cost implications is vital for budget planning and financial forecasting.

- Consider factors such as: bulk order discounts, payment methods, and delivery costs.

- Clarifying these details upfront can prevent misunderstandings and ensure smooth transactions.

Evaluate the supplier’s ability to meet your logistical needs, including shipping times, delivery methods, and customs handling. This aspect is particularly important for international buyers.

- Discuss: lead times for production, shipping schedules, and any potential delays.

- A reliable logistics framework ensures timely delivery and minimizes disruptions in your supply chain.

Finally, ensure that you have clear lines of communication with your chosen supplier. This is essential for addressing any issues that may arise post-purchase.

- Inquire about: support availability, response times, and the method of communication (email, phone, etc.).

- A responsive supplier can significantly enhance your overall experience and facilitate smoother operations.

By following this checklist, international B2B buyers can streamline their sourcing process for SiC chips, ensuring they partner with manufacturers that meet their technical and operational needs effectively.

Understanding the cost structure of silicon carbide (SiC) chip manufacturers is crucial for international B2B buyers. The primary cost components include:

Several factors influence the pricing of SiC chips, including:

For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, the following strategies can enhance cost-efficiency:

Prices for SiC chips can vary widely based on the aforementioned factors. Buyers are encouraged to conduct thorough market research and request detailed quotations from multiple suppliers to ensure they are making informed purchasing decisions.

In the rapidly evolving landscape of semiconductor technology, international B2B buyers must evaluate various solutions to meet their operational needs. While Silicon Carbide (SiC) chips are renowned for their efficiency and performance in high-power applications, it is crucial to consider alternative solutions that may also serve specific business requirements. In this analysis, we will compare SiC chip manufacturers with two viable alternatives: Gallium Nitride (GaN) technology and traditional silicon-based chips.

| Comparison Aspect | Sic Chip Manufacturers | Gallium Nitride (GaN) Technology | Traditional Silicon Chips |

|---|---|---|---|

| Performance | High efficiency at high temperatures; ideal for electric vehicles and renewable energy applications. | Excellent for high-frequency applications; superior efficiency in power conversion. | Adequate performance for low-power applications; less efficient at high temperatures. |

| Cost | Higher initial cost due to advanced materials and manufacturing processes. | Moderate to high cost; competitive pricing is emerging as technology matures. | Generally lower cost; established manufacturing processes reduce expenses. |

| Ease of Implementation | Requires specialized knowledge and equipment for integration. | Relatively easy integration with existing systems; growing support in the market. | Widely understood and supported; easier to source and implement. |

| Maintenance | Low maintenance due to durability; however, specialized support may be needed. | Low to moderate maintenance; emerging support networks help. | Moderate maintenance; well-established supply chain and support. |

| Best Use Case | Ideal for high-power applications in automotive and industrial sectors. | Best for RF applications, power supplies, and fast chargers. | Suitable for low-power consumer electronics and older technology applications. |

Gallium Nitride (GaN) technology has gained traction for its ability to perform efficiently at high frequencies and voltages. One of the primary advantages of GaN is its smaller size and weight, which translates to a more compact system design. This technology is particularly effective in power conversion applications, such as fast chargers and RF amplifiers. However, the initial cost can be moderate to high, and while the technology is maturing, sourcing GaN components may still present challenges for some buyers.

Traditional silicon chips have been the backbone of the semiconductor industry for decades. They are cost-effective and have a well-established manufacturing process, making them widely available. Silicon chips are suitable for a range of applications, especially in low-power devices. However, they tend to underperform in high-temperature and high-frequency scenarios, which limits their use in advanced applications compared to SiC and GaN solutions. As a result, while they may be less expensive, they are not always the best choice for cutting-edge technology needs.

When selecting between SiC chips, GaN technology, and traditional silicon chips, B2B buyers should assess their specific application requirements, budget constraints, and long-term operational goals. SiC chips excel in high-power applications, making them ideal for industries like automotive and renewable energy. In contrast, GaN technology offers superior performance in high-frequency applications, while traditional silicon chips provide a cost-effective solution for lower-end applications. Ultimately, the decision should be guided by a thorough understanding of the operational context and future scalability needs. By aligning technology choice with strategic business goals, international buyers can optimize their investments and enhance operational efficiency.

Silicon Carbide (SiC) chips are vital components in various industries, particularly in power electronics and high-temperature applications. Understanding their technical properties is crucial for international B2B buyers to ensure they select the right components for their applications. Here are some essential specifications to consider:

A stock image related to sic chip manufacturers.

Material grade refers to the purity and composition of the SiC used in chip manufacturing. Higher grades, such as 4H or 6H, indicate better electrical properties and thermal conductivity. For B2B buyers, selecting the right material grade is critical, as it directly impacts the performance and longevity of the chips in high-demand applications.

Breakdown voltage is the maximum voltage that a semiconductor device can withstand before it fails. SiC chips typically have a higher breakdown voltage compared to traditional silicon chips, making them suitable for high-voltage applications. For buyers, understanding the breakdown voltage is essential for ensuring that the chips can operate efficiently in their intended applications without risk of failure.

Thermal conductivity measures how well a material can conduct heat. SiC chips have superior thermal conductivity, allowing for better heat dissipation in high-power applications. This property is vital for B2B buyers, as it influences the overall reliability and efficiency of the electronic systems in which these chips are used.

Tolerance refers to the allowable deviation in dimensions or performance of the chips. In the context of SiC chips, tighter tolerances can lead to better performance and reliability in end products. Buyers should be aware of the tolerance levels specified by manufacturers, as this can affect the integration of chips into larger systems.

Switching frequency indicates how quickly a chip can turn on and off, which is crucial for power electronics applications. SiC chips typically support higher switching frequencies, leading to more efficient power conversion. Understanding this specification helps B2B buyers select the right components for applications requiring rapid switching, such as in electric vehicles and renewable energy systems.

Navigating the procurement process for SiC chips involves understanding industry-specific terminology. Here are some common trade terms:

An OEM refers to a company that produces components that are used in another company's end products. In the SiC chip market, knowing who the OEMs are can help buyers identify reliable suppliers and manufacturers, ensuring they source quality components for their applications.

MOQ is the smallest amount of product that a supplier is willing to sell. Understanding MOQ is essential for B2B buyers, especially when managing budgets and inventory levels. It can also affect pricing structures and overall project costs.

An RFQ is a document that a buyer sends to suppliers requesting a price quote for specific products or services. When dealing with SiC chips, submitting an RFQ allows buyers to gather competitive pricing and terms from multiple suppliers, enabling informed purchasing decisions.

Incoterms (International Commercial Terms) are a set of predefined international rules that clarify the responsibilities of buyers and sellers in shipping and delivery. Familiarity with Incoterms is crucial for B2B buyers, as it influences logistics, cost management, and risk assessment during international transactions.

Lead time refers to the time taken from placing an order to receiving the product. In the SiC chip industry, understanding lead times helps buyers plan their production schedules and manage inventory effectively, ensuring that they can meet their operational demands without delays.

By grasping these essential technical properties and trade terms, B2B buyers from Africa, South America, the Middle East, and Europe can make more informed decisions when sourcing SiC chips, ultimately enhancing their procurement strategies and operational efficiency.

A stock image related to sic chip manufacturers.

The silicon carbide (SiC) chip manufacturers sector is witnessing significant transformation driven by increasing demand for high-efficiency power electronics. Global initiatives to transition toward renewable energy sources, such as wind and solar, are propelling the need for SiC technology, which offers superior thermal conductivity and efficiency compared to traditional silicon. Additionally, the automotive industry's shift towards electric vehicles (EVs) is a pivotal market driver, as SiC chips are essential for optimizing the performance of EV powertrains.

Emerging B2B tech trends include the adoption of advanced manufacturing techniques, such as automation and AI, which enhance production efficiency and reduce costs. International buyers, particularly from Africa, South America, the Middle East, and Europe, should be aware of the growing trend of vertical integration among manufacturers, which enables better control over supply chains and quality assurance. This shift may also influence sourcing strategies, as buyers increasingly seek partnerships with vertically integrated firms to ensure reliability and performance.

Furthermore, geopolitical factors and trade policies are affecting the sourcing landscape. For instance, the European Union's commitment to reducing dependency on external suppliers has led to increased investment in local SiC production capabilities. Buyers should monitor these dynamics closely to adapt their sourcing strategies accordingly, ensuring they are aligned with regional developments and supply chain shifts.

Sustainability is becoming a non-negotiable aspect of sourcing in the SiC chip manufacturers sector. The environmental impact of semiconductor manufacturing processes, particularly in terms of energy consumption and waste generation, has prompted a push for greener practices. Companies are increasingly adopting 'green' certifications and materials, which not only reduce ecological footprints but also enhance brand reputation among environmentally conscious consumers and businesses.

Ethical sourcing is integral to this sustainability narrative. International B2B buyers should prioritize suppliers who demonstrate commitment to ethical labor practices and transparency in their supply chains. This includes ensuring that raw materials are sourced responsibly, particularly in regions where mining practices may raise human rights concerns. By choosing partners who prioritize ethical sourcing, buyers can mitigate risks associated with reputational damage and regulatory compliance.

Additionally, embracing sustainable practices can lead to cost savings in the long term. For instance, manufacturers investing in energy-efficient technologies often experience reduced operational costs. Buyers can also leverage sustainability as a differentiator in their market positioning, appealing to a growing base of eco-conscious clients.

The evolution of the SiC chip manufacturers sector can be traced back to the early 1970s when researchers first recognized the potential of silicon carbide for high-temperature applications. Initially, the technology was limited due to manufacturing challenges and high costs. However, advancements in crystal growth techniques and wafer production have significantly improved the viability of SiC chips.

In the 2000s, a surge in demand for high-performance semiconductors, driven by the telecommunications and automotive sectors, catalyzed investment in SiC technology. Today, the sector is characterized by rapid innovation and growth, with numerous players entering the market to meet the rising demand for energy-efficient solutions. This historical context is crucial for B2B buyers to understand the trajectory of SiC technology and its implications for future sourcing strategies.

How do I solve supply chain disruptions when sourcing SiC chips?

Supply chain disruptions can be mitigated by diversifying your supplier base. Engage multiple SiC chip manufacturers across different regions to ensure continuity. Establishing strong relationships with suppliers also helps in negotiating better terms and receiving timely updates about potential delays. Implementing risk management strategies, such as maintaining safety stock and developing contingency plans, is crucial. Additionally, utilizing technology for supply chain visibility can help identify issues before they escalate.

What is the best method for evaluating SiC chip manufacturers?

The best method for evaluating SiC chip manufacturers involves a comprehensive assessment of their capabilities, quality standards, and market reputation. Start by reviewing their certifications, such as ISO 9001, and their compliance with international quality standards. Conducting site visits or audits can provide insights into their manufacturing processes. Additionally, seek client testimonials and case studies to understand their reliability and performance. Consider their technological advancements and R&D investments to gauge their innovation potential.

What are the minimum order quantities (MOQs) I should expect from SiC chip manufacturers?

Minimum order quantities (MOQs) for SiC chips can vary significantly depending on the manufacturer and the specific product. Generally, MOQs can range from a few hundred to several thousand units. When negotiating with suppliers, clarify your needs and explore whether they can accommodate smaller orders, especially if you are a startup or testing a new application. Some manufacturers may offer flexible terms for initial orders to establish a long-term relationship.

How can I customize SiC chips to meet my specific requirements?

Customizing SiC chips requires close collaboration with your chosen manufacturer. Begin by discussing your specific application requirements, such as voltage ratings, power levels, and thermal characteristics. Many manufacturers offer design services that include simulation and prototyping to ensure the chips meet your specifications. It's essential to provide detailed technical documentation to facilitate the customization process. Be prepared for potential lead times, as customization may require additional testing and validation.

What payment terms are typical when sourcing SiC chips internationally?

Typical payment terms for international sourcing of SiC chips often include options like advance payment, letter of credit, or net payment terms (e.g., net 30 or net 60 days). Discuss payment terms early in the negotiation process to ensure they align with your cash flow needs. Some suppliers may offer discounts for upfront payments, while others might require a deposit followed by payment upon delivery. Always clarify the currency and method of payment to avoid misunderstandings.

How do I ensure quality assurance when sourcing SiC chips?

Ensuring quality assurance when sourcing SiC chips involves implementing a robust quality control process. Request the manufacturer's quality assurance (QA) protocols and testing certifications to understand their commitment to quality. Conduct periodic inspections and audits of the manufacturing facility if possible. Establish clear acceptance criteria and testing procedures for the chips upon delivery. Additionally, consider working with third-party testing labs for independent verification of quality and performance.

What logistics considerations should I take into account when importing SiC chips?

When importing SiC chips, logistics considerations include shipping methods, customs regulations, and import duties. Evaluate the most efficient shipping options—air freight is faster but more expensive, while sea freight is cost-effective for larger volumes. Familiarize yourself with the customs regulations in your country to ensure compliance and avoid delays. It’s also essential to work with experienced freight forwarders who can handle the complexities of international shipping and provide guidance on documentation.

How can I build long-term relationships with SiC chip manufacturers?

Building long-term relationships with SiC chip manufacturers involves consistent communication, transparency, and mutual benefit. Regularly engage with your suppliers to discuss performance, expectations, and any issues that arise. Providing feedback on their products helps them improve and demonstrates your investment in the partnership. Consider collaborating on joint ventures or research projects to strengthen ties. Establishing a partnership mindset rather than a transactional relationship can lead to better service and innovation.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complexities of sourcing silicon carbide (SiC) chips, international B2B buyers from Africa, South America, the Middle East, and Europe must prioritize strategic sourcing as a fundamental aspect of their procurement process. By understanding the unique advantages of SiC technology—such as its efficiency in high-temperature and high-voltage applications—buyers can align their needs with the capabilities of leading manufacturers. This alignment not only enhances operational efficiency but also fosters long-term partnerships that can lead to innovative solutions tailored to specific market demands.

As the demand for SiC chips continues to rise, driven by trends in electric vehicles, renewable energy, and advanced electronics, the importance of a well-structured sourcing strategy becomes even more critical. Buyers are encouraged to conduct thorough market research, leverage supplier networks, and engage in collaborative discussions to identify the best manufacturing partners.

Looking ahead, the future of SiC chip manufacturing is bright, and the opportunities for growth are substantial. By investing in strategic sourcing today, businesses can secure a competitive edge tomorrow. Embrace the potential of SiC technology, and take proactive steps to enhance your supply chain resilience and innovation capabilities.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina