In the dynamic world of industrial manufacturing and tooling, understanding the prix du carbure au kg—the price of carbide per kilogram—is a pivotal factor for businesses aiming to optimize cost-efficiency and product quality. For international B2B buyers, particularly those operating in diverse markets across Africa, South America, the Middle East, and Europe (including key hubs like Thailand and Turkey), mastering the nuances of carbide pricing is essential to making informed procurement decisions that drive competitive advantage.

This comprehensive guide delves deeply into the multifaceted aspects influencing carbide pricing, from the types and grades of carbide materials to advanced manufacturing processes and rigorous quality control standards. It also illuminates the global supply landscape, highlighting trusted suppliers and emerging market trends that impact cost and availability. By unpacking these critical elements, the guide equips buyers with the knowledge to evaluate offers effectively, negotiate better terms, and mitigate risks associated with price volatility and quality inconsistencies.

Key areas covered include:

By leveraging this resource, international buyers can confidently navigate the complexities of the global carbide market, ensuring that every kilogram purchased aligns with their operational needs and financial goals. This strategic approach empowers businesses to foster sustainable supplier relationships and secure optimal value in an increasingly competitive environment.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Calcium Carbide (CaC2) | High reactivity, solid lumps or granules | Steel manufacturing, acetylene gas production | Pros: Widely available, cost-effective; Cons: Requires safe handling due to reactivity |

| Silicon Carbide (SiC) | Hard, abrasive crystalline form, various grit sizes | Abrasives, refractories, ceramics | Pros: Durable and versatile; Cons: Higher price point, niche applications |

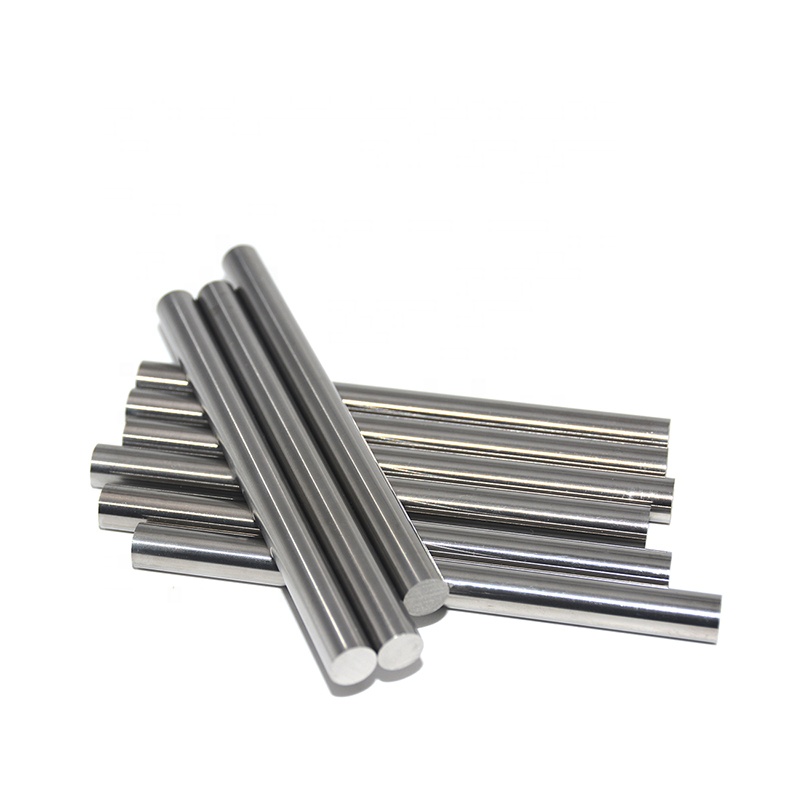

| Tungsten Carbide (WC) | Extremely hard, dense, metal-like appearance | Cutting tools, mining equipment, industrial machinery | Pros: Long-lasting, high performance; Cons: Premium cost, specialized sourcing |

| Boron Carbide (B4C) | Lightweight, extremely hard, neutron absorber | Armor plating, nuclear industry, abrasives | Pros: High strength-to-weight ratio; Cons: Limited suppliers, higher price volatility |

| Carbide Powder | Fine particulate form of various carbides | Powder metallurgy, coatings, additive manufacturing | Pros: Customizable particle size; Cons: Requires processing expertise, storage sensitivity |

Calcium Carbide (CaC2) is the most commonly traded carbide type, especially relevant for B2B buyers in heavy industries such as steel production and chemical manufacturing. It is prized for its ability to generate acetylene gas upon reaction with water. Buyers should prioritize suppliers with consistent quality and ensure compliance with safety regulations due to its highly reactive nature. Bulk purchasing often yields better pricing but demands robust logistics to prevent moisture exposure.

Silicon Carbide (SiC) serves primarily the abrasives and refractory markets. Its hardness and thermal stability make it ideal for grinding, polishing, and high-temperature applications. B2B buyers in manufacturing sectors such as ceramics and electronics will find SiC essential. Price fluctuations depend on grit size and purity; sourcing from reputable producers ensures consistent performance in industrial processes.

Tungsten Carbide (WC) is synonymous with durability and precision in cutting tools and heavy machinery components. Its high density and wear resistance justify the premium price in sectors like mining and metal fabrication. International buyers should assess the availability of grades suited to their tooling requirements and consider lead times, as production involves complex metallurgy.

Boron Carbide (B4C) is notable for its exceptional hardness combined with lightweight properties, making it valuable in defense, nuclear, and abrasive applications. Buyers in these industries must navigate limited global suppliers and potential price volatility. Due diligence on certification and material traceability is critical, especially for applications demanding stringent quality standards.

Carbide Powder offers flexibility for advanced manufacturing techniques, including powder metallurgy and additive manufacturing. Its fine particle size enables customization for coatings and composite materials. B2B purchasers should focus on particle size distribution, purity, and storage conditions to maintain material integrity. Partnering with suppliers who provide technical support can optimize end-use performance.

| Industry/Sector | Specific Application of prix du carbure au kg | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Steel Manufacturing | Use of calcium carbide in steel refining and desulfurization | Enhances steel quality and reduces impurities, improving product durability and performance | Quality consistency, purity levels, and supplier reliability; logistics for bulk delivery |

| Chemical Industry | Production of acetylene gas for chemical synthesis | Enables efficient synthesis of chemicals and plastics, reducing production costs | Compliance with safety standards, availability of high-grade carbide, and transport regulations |

| Mining & Metallurgy | Generation of acetylene for underground welding and cutting | Provides reliable, portable fuel source for maintenance and repair in remote locations | Supplier’s capacity to meet urgent demands, product shelf life, and certification for hazardous materials |

| Agriculture | Carbide-based ripening of fruits | Accelerates fruit ripening, allowing better market timing and reducing post-harvest losses | Consistency in carbide quality, environmental regulations, and safe handling instructions |

| Construction & Fabrication | Welding and metal cutting operations using carbide-derived acetylene | Increases precision and efficiency in metalwork, reducing downtime and costs | Bulk purchasing options, product traceability, and compliance with local safety standards |

Steel Manufacturing

In steel production, calcium carbide priced per kilogram is essential for desulfurization and refining processes. It reacts with impurities to improve the steel's strength and longevity. For B2B buyers in regions like Africa and the Middle East, ensuring carbide purity is critical to avoid contamination that could degrade steel quality. Reliable suppliers capable of consistent bulk deliveries and compliance with import regulations are vital for uninterrupted production lines.

Chemical Industry

Calcium carbide serves as a precursor for generating acetylene gas, a key building block in producing plastics, synthetic rubber, and other chemicals. International buyers from South America and Europe must prioritize suppliers who adhere to stringent safety and quality certifications, as acetylene is highly flammable. Efficient logistics and access to high-grade carbide enable manufacturers to optimize production costs and maintain steady output.

Mining & Metallurgy

In mining operations, particularly underground, carbide-derived acetylene is used for welding and cutting metal structures in hard-to-reach areas. This application demands a dependable supply chain capable of rapid delivery to avoid operational delays. Buyers from Turkey and Africa should focus on suppliers with expertise in handling hazardous goods and providing materials with adequate shelf life to maintain safety and efficiency on-site.

Agriculture

Calcium carbide is widely used to induce artificial ripening of fruits such as bananas and mangoes, allowing producers in tropical regions to better control market supply timing. For B2B buyers in South America and Africa, sourcing consistent-quality carbide that complies with environmental and health regulations is crucial to ensure consumer safety and meet export standards. Clear handling guidelines from suppliers also mitigate risks during storage and application.

Construction & Fabrication

The construction sector utilizes carbide-based acetylene gas for metal cutting and welding, which demands precision and operational efficiency. Buyers in Europe and the Middle East should consider suppliers offering bulk purchase options with traceability and compliance to local safety standards. This ensures cost-effective procurement while maintaining high safety and quality levels in fabrication projects.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

Key Properties: Tungsten carbide is renowned for its exceptional hardness, high melting point (~2870°C), and excellent wear resistance. It maintains structural integrity under high pressure and temperature, making it suitable for demanding industrial applications. Its corrosion resistance is moderate but can be enhanced with coatings.

Pros & Cons: Tungsten carbide offers outstanding durability and longevity, significantly reducing replacement frequency. However, it is relatively expensive and requires complex manufacturing processes such as powder metallurgy and sintering. Its brittleness under impact is a limitation in shock-prone environments.

Impact on Application: Ideal for cutting tools, mining equipment, and wear parts exposed to abrasive media. Its performance excels in dry, high-temperature, and high-pressure conditions but may require protective coatings in corrosive environments.

International B2B Considerations: Buyers from Africa, South America, the Middle East, and Europe should verify compliance with ASTM B777 or DIN EN ISO standards for tungsten carbide powders and finished products. Regions like Turkey and Thailand emphasize adherence to JIS standards, especially for tooling applications. Import regulations and tariffs on tungsten raw materials can affect pricing, so sourcing from certified suppliers with transparent supply chains is critical.

Key Properties: Silicon carbide exhibits excellent thermal conductivity, high hardness (though slightly less than tungsten carbide), and outstanding chemical inertness. It withstands extreme temperatures (up to 1600°C) and aggressive chemical environments, including acids and alkalis.

Pros & Cons: SiC is highly resistant to corrosion and oxidation, making it suitable for harsh chemical processing. It is less brittle than tungsten carbide but generally has lower toughness. Manufacturing complexity is moderate, with options for sintered or reaction-bonded forms.

Impact on Application: Widely used in chemical reactors, seals, and abrasive media handling where corrosion resistance is paramount. It performs well in fluidized bed reactors and high-temperature filtration systems.

International B2B Considerations: For buyers in regions with stringent chemical industry regulations (e.g., Europe and the Middle East), ensuring materials meet ASTM C799 or DIN EN 60672 standards is essential. South American and African buyers should consider local environmental compliance and the availability of certified suppliers. SiC's lower density also benefits logistics costs for international shipping.

Key Properties: Calcium carbide is a chemical compound primarily used for acetylene gas production rather than as a structural material. It has moderate hardness and reacts vigorously with water to release acetylene.

Pros & Cons: It is relatively low-cost and widely available, especially in developing regions. However, it is chemically reactive and requires careful handling and storage to prevent moisture exposure. Its application is limited to chemical synthesis rather than mechanical wear parts.

Impact on Application: Essential in industries requiring acetylene for welding, lighting, or chemical synthesis. Not suitable for high-wear or structural applications.

International B2B Considerations: Buyers from Africa and South America often rely on calcium carbide imports for local acetylene production. Compliance with safety standards such as ISO 9001 and local hazardous material regulations is critical. Packaging and transportation standards must be strictly followed to avoid accidents during transit, especially in regions with less developed infrastructure.

Key Properties: Boron carbide is one of the hardest materials available, with excellent neutron absorption properties and high chemical stability. It withstands temperatures up to 2763°C and exhibits outstanding resistance to abrasion and corrosion.

Pros & Cons: It offers superior wear resistance and is lighter than tungsten carbide, making it advantageous for weight-sensitive applications. However, it is expensive and difficult to machine, with limited availability compared to WC and SiC.

Impact on Application: Commonly used in ballistic armor, nuclear applications, and abrasive powders. Its neutron absorption makes it unique for nuclear shielding, while its hardness suits extreme wear environments.

International B2B Considerations: European and Middle Eastern buyers involved in defense or nuclear sectors prioritize compliance with ASTM C799 and ISO 9001 certifications. African and South American markets may face supply constraints and higher costs due to limited regional production. Importers must verify material traceability and supplier reliability to meet strict quality and safety standards.

| Material | Typical Use Case for prix du carbure au kg | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Tungsten Carbide | Cutting tools, mining equipment, wear parts | Exceptional hardness and wear resistance | High cost and brittleness under impact | High |

| Silicon Carbide | Chemical reactors, seals, abrasive media handling | Excellent corrosion resistance and thermal stability | Lower toughness than WC | Medium |

| Calcium Carbide | Acetylene gas production, chemical synthesis | Low cost and wide availability | Highly reactive, limited to chemical use | Low |

| Boron Carbide | Ballistic armor, nuclear shielding, abrasive powders | Extreme hardness and neutron absorption | High cost and machining difficulty | High |

The production of carbide materials, often priced per kilogram (prix du carbure au kg), involves a series of meticulous manufacturing stages designed to ensure product performance and consistency. Understanding these stages allows B2B buyers to evaluate supplier capabilities and negotiate effectively.

Raw Material Preparation

Carbide manufacturing starts with the selection and preparation of raw materials, primarily tungsten carbide powder combined with a metallic binder, commonly cobalt. The purity and particle size distribution of these powders critically impact the final product’s hardness and toughness. Suppliers typically source high-grade powders and may blend them to achieve specific material characteristics tailored to customer needs.

Mixing and Forming

The powders undergo thorough mixing to achieve a homogeneous blend, often using ball milling or other mechanical alloying techniques. This stage ensures uniform distribution of binder and carbide particles. The mixed powder is then shaped using pressing methods such as uniaxial pressing, isostatic pressing, or extrusion to form “green” compacts with the desired geometry.

Sintering

These green compacts are sintered at high temperatures in controlled atmospheres to fuse the particles into a dense, solid mass. Sintering parameters—temperature, time, and atmosphere composition—are carefully optimized to enhance hardness, density, and wear resistance. Advanced sintering technologies, like hot isostatic pressing (HIP), may be employed to improve microstructural uniformity.

Finishing and Assembly

Post-sintering, parts undergo finishing processes such as grinding, polishing, or coating to meet dimensional tolerances and surface quality standards. For composite carbide tools or components, assembly with other materials or inserts may be required. Final inspection ensures the product meets the agreed specifications.

For international B2B buyers, particularly from diverse regions like Africa, South America, the Middle East, and Europe, stringent quality assurance (QA) is critical to mitigate risks related to performance variability and compliance.

ISO 9001 Certification

This global quality management standard is a baseline expectation for carbide manufacturers. ISO 9001 certification indicates that a supplier maintains a robust quality management system (QMS), ensuring consistent product quality, traceability, and continuous improvement.

Industry-Specific Certifications

Depending on the application, additional certifications may apply:

Effective quality control (QC) is embedded throughout the carbide manufacturing lifecycle. Buyers should request detailed documentation of QC procedures and results.

Incoming Quality Control (IQC)

Raw materials and powders are verified for chemical composition, particle size, and impurities. Techniques such as X-ray fluorescence (XRF) and laser diffraction particle sizing are commonly used.

In-Process Quality Control (IPQC)

During mixing, forming, and sintering, parameters like density, hardness, and microstructure are monitored. Non-destructive testing (NDT) methods, such as ultrasonic testing or visual inspection, help detect defects early.

Final Quality Control (FQC)

Finished products undergo dimensional inspection using coordinate measuring machines (CMM), hardness testing (e.g., Rockwell or Vickers), and wear resistance evaluation. Mechanical properties may be assessed via bending strength or impact tests.

To ensure the reliability of carbide suppliers, buyers should implement a multi-faceted verification approach:

Factory Audits

Conduct on-site or virtual audits focusing on manufacturing processes, equipment maintenance, workforce competence, and QMS adherence. Audits provide insight into operational rigor and potential risks.

Review of Quality Documentation

Request and analyze QC reports, material certificates, and calibration records. Consistent traceability from raw materials to finished goods demonstrates supplier transparency.

Third-Party Inspection and Testing

Employ independent inspection agencies to verify product conformity and conduct sample testing. This is especially important for buyers in regions with less stringent local enforcement or where trust-building is ongoing.

Pilot Orders and Long-Term Sampling

Initiate small batch orders to evaluate product performance under real operational conditions before scaling procurement volumes.

Each geographic market presents unique challenges and considerations for carbide procurement:

Regulatory Variations

While ISO 9001 is widely recognized, local regulations may impose additional standards or documentation requirements. For example, Middle Eastern buyers might prioritize API certification for oilfield applications, whereas European buyers will focus on CE compliance.

Logistics and Supply Chain Transparency

Buyers in Africa and South America often face extended lead times and potential customs scrutiny. Ensuring supplier QC includes packaging integrity and shipment condition reports can reduce damage risks.

Cultural and Communication Factors

Clear communication regarding quality expectations, inspection protocols, and corrective actions is essential. Buyers from Turkey or Thailand may prefer suppliers familiar with export standards and flexible to adapt QC documentation formats.

Cost vs. Quality Balance

While pricing per kilogram is a key consideration, buyers must evaluate total cost of ownership, including product lifespan and failure risks. Investing in suppliers with rigorous QC pays dividends in reliability and reduced downtime.

By comprehensively understanding carbide manufacturing processes and implementing stringent quality assurance verification steps, international B2B buyers can confidently source carbide materials that meet their operational and regulatory needs. This strategic approach minimizes risk and enhances value in global procurement of prix du carbure au kg.

When sourcing carbide priced per kilogram (prix du carbure au kg), understanding the detailed cost structure and pricing influencers is crucial for international B2B buyers. This knowledge enables better negotiation, cost control, and supplier selection, especially across diverse regions such as Africa, South America, the Middle East, and Europe (including markets like Thailand and Turkey).

Raw Materials

The primary cost driver is the raw materials used in carbide production, typically tungsten and carbon. Fluctuations in tungsten ore prices, which are influenced by global mining output and geopolitical factors, directly affect the base price per kilogram.

Labor Costs

Labor expenses vary significantly by region. Manufacturers in countries with lower labor costs may offer more competitive prices, but buyers should weigh this against quality and delivery reliability.

Manufacturing Overhead

This includes energy consumption, factory maintenance, and equipment depreciation. High-tech carbide production demands precision machinery, which can increase overhead costs.

Tooling and Equipment

Specialized tooling for shaping and processing carbide impacts the cost, especially when dealing with custom specifications or small batches.

Quality Control (QC) and Certifications

Rigorous QC processes and international certifications (e.g., ISO, REACH compliance) add to production costs but are essential for buyers seeking consistent quality and regulatory compliance.

Logistics and Shipping

Freight costs, customs duties, and insurance contribute notably to the landed price. International buyers must consider shipping modes (air, sea, land) and Incoterms to estimate total logistics expenses accurately.

Supplier Margin

Suppliers incorporate profit margins based on market demand, competition, and their positioning. Margins may vary with volume commitments and long-term contracts.

Order Volume and Minimum Order Quantity (MOQ)

Larger orders typically yield better unit prices due to economies of scale. Buyers should analyze their consumption patterns to negotiate favorable MOQs.

Product Specifications and Customization

Customized carbides with specific grain sizes, hardness, or coating requirements increase costs. Standardized products generally come at lower prices.

Material Grade and Purity

Higher-purity carbide grades command premium prices but offer better performance and longevity, impacting total cost-effectiveness.

Quality Certifications

Products certified for specific industries (e.g., aerospace, automotive) incur higher costs but reduce risk and improve supplier credibility.

Supplier Location and Reliability

Proximity to suppliers reduces shipping costs and lead times. However, reliability and supplier reputation can justify higher prices.

Incoterms and Payment Terms

Understanding Incoterms (e.g., FOB, CIF, DDP) clarifies which party bears transportation and insurance costs, affecting the final price.

Negotiate Based on Total Cost of Ownership (TCO)

Beyond the unit price, consider durability, replacement frequency, and after-sales support. Sometimes a higher upfront cost leads to lower overall expenses.

Leverage Volume Aggregation

Pooling orders with partners or scheduling bulk purchases can unlock volume discounts.

Verify Supplier Certifications and QC Processes

Prioritize suppliers with transparent quality assurance to avoid costly rejections and delays.

Clarify Incoterms Early

Agree on shipping terms upfront to avoid unexpected logistics costs and customs delays.

Monitor Market Price Trends

Regularly tracking tungsten and carbide market indices helps anticipate price shifts and plan procurement accordingly.

Factor in Regional Import Regulations and Taxes

Each region (Africa, South America, Middle East, Europe) has unique import duties and regulatory requirements affecting landed cost.

Engage Local Experts or Agents

For markets like Turkey or Thailand, local sourcing agents can provide insights on supplier reliability, pricing norms, and negotiation tactics.

Prices for carbide per kilogram are indicative and subject to change due to raw material volatility, currency fluctuations, geopolitical factors, and supplier-specific conditions. Buyers should obtain multiple quotes, validate terms rigorously, and update cost models regularly to maintain procurement efficiency.

By thoroughly understanding these cost elements and pricing influencers, international B2B buyers can make informed sourcing decisions, negotiate effectively, and optimize their supply chain for carbide procurement.

Understanding the technical specifications of carbide is essential for international B2B buyers aiming to optimize cost, quality, and application suitability. Here are key properties that directly impact the prix du carbure au kg and purchasing decisions:

Illustrative Image (Source: Google Search)

Material Grade

Carbide grades vary based on composition, primarily tungsten carbide content and cobalt binder percentage. Higher tungsten carbide content typically delivers better hardness and wear resistance but at a higher price. For B2B buyers, specifying the correct grade ensures the material meets operational demands without overpaying for unnecessary performance.

Purity and Chemical Composition

The purity level affects carbide’s durability and performance, especially in cutting or mining tools. Impurities can reduce lifespan and increase tool failure rates. Buyers from diverse industries should request detailed composition reports to verify quality and avoid costly downtime.

Particle Size Distribution

Fine vs. coarse grain sizes influence carbide hardness and toughness. Finer grains often yield better wear resistance but can be more expensive. Understanding this property helps buyers negotiate prices aligned with their product’s performance requirements.

Dimensional Tolerance

This refers to the allowable variance in size or weight per kilogram batches. Tighter tolerances mean higher precision, crucial for OEM manufacturers who require consistency in parts. Buyers should clarify tolerance limits to ensure material compatibility with their production processes.

Bulk Density

Bulk density impacts shipping costs and volume calculations. Denser carbide batches may cost more per kg but reduce logistics expenses. Buyers with high-volume orders should assess this property to optimize overall procurement costs.

Moisture Content

Excess moisture can degrade carbide during storage or transport, affecting quality and pricing. Sellers often specify maximum moisture levels, and buyers should include this in contracts to maintain material integrity.

Navigating international carbide procurement requires familiarity with trade terms that influence pricing, delivery, and contract conditions. Here are essential terms every B2B buyer should know:

OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products using carbide. OEM buyers often demand higher-grade materials and tighter specifications, affecting pricing and minimum order quantities.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell at a given price. Understanding MOQ is critical for buyers to balance inventory costs against price advantages. Negotiating MOQ can lead to better pricing or flexible contract terms.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, terms, and specifications. A well-prepared RFQ including technical requirements and delivery expectations helps buyers receive accurate and competitive offers.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and tariffs. Common Incoterms like FOB (Free On Board) or CIF (Cost, Insurance, and Freight) affect the landed cost of carbide and risk allocation. Buyers must specify preferred Incoterms to avoid misunderstandings.

Lead Time

The duration between order placement and delivery. Lead times influence inventory planning and cash flow. Buyers should confirm realistic lead times to synchronize supply with production schedules.

Certificate of Analysis (CoA)

A document provided by suppliers verifying the chemical and physical properties of carbide batches. Requesting a CoA ensures compliance with technical standards and safeguards against substandard materials.

By mastering these technical properties and trade terms, international B2B buyers—from Africa to Europe and beyond—can make informed decisions, negotiate better pricing, and secure carbide supplies that align with their operational goals.

The global market for prix du carbure au kg (price of carbide per kilogram) is shaped by a complex interplay of industrial demand, raw material availability, and geopolitical factors. Carbide, primarily used in metal cutting, mining, and chemical synthesis, remains a critical commodity for manufacturing sectors across Africa, South America, the Middle East, and Europe. Countries like Turkey and Thailand are emerging as important hubs due to their strategic locations and growing industrial bases.

Illustrative Image (Source: Google Search)

Key drivers influencing the market include:

- Industrial growth in emerging economies: Rapid infrastructure development in Africa and South America is boosting demand for carbide, particularly in construction and automotive sectors.

- Technological advancements: Innovations in carbide production and processing technologies enhance product quality and reduce costs, benefiting buyers through improved price-performance ratios.

- Raw material supply constraints: Variability in the availability of key inputs like calcium and carbon sources affects pricing and supply stability, prompting buyers to seek diversified sourcing.

- Currency fluctuations and trade policies: Exchange rate volatility and tariffs impact international procurement costs, requiring buyers to adopt flexible pricing strategies.

Emerging sourcing trends include:

- Digital procurement platforms: International buyers increasingly leverage online marketplaces and AI-driven analytics to identify competitive suppliers and optimize purchase timing.

- Collaborative sourcing networks: Regional alliances, especially in the Middle East and Europe, facilitate bulk buying and knowledge sharing to mitigate supply risks.

- Customization and value-added services: Suppliers offering tailored carbide grades or enhanced technical support are gaining preference among B2B buyers aiming for efficiency gains.

For buyers from Africa and South America, prioritizing suppliers with robust logistics capabilities is crucial to overcome infrastructural challenges. European and Middle Eastern buyers often focus on compliance and certification standards, reflecting stringent regulatory environments. Overall, understanding these nuanced market dynamics enables smarter negotiation and sourcing decisions.

Sustainability has become a pivotal factor in the prix du carbure au kg sector, driven by increasing regulatory scrutiny and stakeholder expectations across all regions. Carbide production involves energy-intensive processes with notable carbon footprints and potential environmental pollutants, including hazardous waste from chemical reactions.

Environmental impact considerations:

- Emissions from fossil fuel consumption during production.

- Waste management challenges related to by-products.

- Water usage and contamination risks in processing plants.

International B2B buyers are progressively prioritizing suppliers who demonstrate commitment to reducing environmental impacts through cleaner technologies and circular economy principles. This includes using renewable energy sources, recycling carbide scrap, and implementing advanced filtration systems.

Ethical sourcing is equally critical. Ensuring supply chain transparency helps mitigate risks associated with labor rights violations, conflict minerals, and environmental degradation. Buyers from Europe and the Middle East, in particular, often require adherence to internationally recognized standards such as:

- ISO 14001 (Environmental Management)

- Responsible Minerals Initiative (RMI) certification

- REACH compliance for chemical safety

Additionally, green certifications specific to carbide materials—such as low-carbon footprint labeling or eco-friendly process endorsements—are emerging and can serve as differentiators in supplier selection. African and South American buyers benefit from partnering with suppliers who can document sustainable practices, which is increasingly important for accessing global markets.

Ultimately, integrating sustainability criteria into procurement policies not only aligns with global ESG goals but also enhances supply chain resilience and brand reputation.

The prix du carbure au kg has evolved alongside industrial revolutions and technological progress in manufacturing. Historically, carbide was a niche product primarily used for lighting (carbide lamps) before its widespread adoption in metalworking and mining during the 20th century. The post-war industrial boom expanded carbide demand significantly, especially in Europe and North America.

In recent decades, globalization and the rise of emerging economies have reshaped supply chains. Production centers have diversified beyond traditional hubs to include Turkey, Thailand, and parts of Africa, driven by resource availability and cost advantages. Innovations such as chemical vapor deposition and sintering techniques have improved carbide performance, influencing pricing structures.

For international B2B buyers, understanding this evolution highlights the importance of adapting sourcing strategies to a market that balances legacy production methods with cutting-edge innovations and shifting geographic centers of supply. This historical perspective also underscores the increasing relevance of sustainability and digitalization in shaping future market trajectories.

Illustrative Image (Source: Google Search)

How can I effectively vet suppliers of carbure priced per kilogram to ensure reliability and quality?

To vet suppliers, start by verifying their business licenses and certifications relevant to chemical or industrial materials. Request samples to test quality and consistency before committing to large orders. Check their track record through customer reviews and references, especially from buyers in your region. Utilize third-party inspection services for factory audits or product verification. Confirm their compliance with international standards such as ISO or REACH, which is crucial for markets in Europe and the Middle East. A thorough vetting process minimizes risks of substandard product and unreliable delivery.

What customization options are typically available for carbure products, and how can I negotiate these for my regional market needs?

Many suppliers offer customization in terms of purity levels, granule size, and packaging formats. Discuss your specific application requirements upfront to determine if the supplier can tailor the product accordingly. For example, buyers in South America may require certain grades for agricultural use, while European industries might demand higher purity standards. Negotiate minimum order quantities (MOQs) and pricing based on these customizations, ensuring the supplier can scale production without compromising quality. Clear communication of technical specifications and end-use will streamline customization agreements.

What are typical minimum order quantities (MOQ), lead times, and payment terms I should expect when sourcing carbure internationally?

MOQs vary widely depending on the supplier’s production capacity and product type but often range from 500 kg to several tons. Lead times generally span 2 to 6 weeks, factoring in production and international shipping. Payment terms commonly include 30% upfront deposit with the balance upon shipment or letter of credit arrangements for higher-value transactions. Negotiate terms that align with your cash flow and risk tolerance; for example, buyers in Africa or the Middle East may prefer extended payment terms due to currency volatility. Always clarify these details in the contract to avoid delays.

What quality assurance measures and certifications should I require from my carbure suppliers?

Demand certifications such as ISO 9001 for quality management and ISO 14001 for environmental standards. Compliance with REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) is critical for European buyers to meet regulatory requirements. Request detailed certificates of analysis (CoA) for each batch, showing purity and contaminant levels. Some suppliers may also provide third-party lab testing reports. Implementing your own incoming quality checks upon receipt can further safeguard your supply chain integrity.

How do I navigate logistics challenges when importing carbure from suppliers in Asia or Europe to markets in Africa or South America?

Plan for potential delays due to customs clearance, port congestion, or transport infrastructure limitations. Engage freight forwarders experienced in chemical shipments and familiar with your destination’s import regulations. Consider multimodal transport solutions (sea, air, rail) to optimize cost and speed. Ensure all documentation, including MSDS (Material Safety Data Sheets), commercial invoices, and certificates, are complete and accurate to avoid hold-ups. Establish clear Incoterms (e.g., FOB, CIF) to define responsibilities and reduce risks during transit.

What are the best practices for resolving disputes related to product quality or delivery delays with international carbure suppliers?

Address disputes promptly by documenting all communications, contracts, and product inspections. Engage in direct negotiation to seek amicable solutions such as replacement shipments or partial refunds. If unresolved, consider mediation or arbitration clauses agreed upon in the contract, ideally under neutral jurisdictions or international trade bodies like ICC. Use trade finance instruments such as letters of credit that provide some protection against non-performance. Building strong relationships with suppliers and clear contractual terms reduces the likelihood of disputes escalating.

How can I optimize pricing negotiations for carbure per kilogram, considering currency fluctuations and regional market dynamics?

Stay informed about global carbide market trends and raw material cost drivers, as these influence pricing. Use forward contracts or hedging strategies to mitigate currency risks, especially when dealing with volatile currencies in Africa or South America. Leverage bulk purchasing or long-term agreements to secure volume discounts. Compare multiple supplier offers across regions to benchmark pricing. Highlight your reliability as a repeat buyer to negotiate better terms. Transparency about your expected order volumes and payment capabilities helps suppliers tailor competitive quotes.

What are the environmental and safety compliance considerations when importing carbure, and how do they affect international trade?

Carbure handling and transportation are subject to strict environmental and safety regulations, particularly in Europe and the Middle East. Ensure your supplier provides MSDS and complies with local hazardous material regulations. Confirm packaging meets international standards to prevent leaks or contamination during transit. Non-compliance can lead to shipment delays, fines, or bans. Buyers should also be aware of import restrictions or tariffs related to chemical products in their countries. Partnering with suppliers who prioritize sustainability can enhance your corporate social responsibility profile and reduce regulatory risks.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complexities of the prix du carbure au kg, international B2B buyers must prioritize strategic sourcing to optimize cost-efficiency and supply reliability. Key considerations include monitoring global market trends, understanding regional pricing dynamics, and leveraging strong supplier relationships across diverse markets such as Africa, South America, the Middle East, and Europe. Buyers should emphasize thorough supplier evaluation, risk mitigation strategies, and flexible contract terms to adapt to price volatility and geopolitical factors affecting the carbide supply chain.

For B2B stakeholders in regions like Thailand and Turkey, integrating local market intelligence with global insights can unlock competitive advantages and ensure sustainable procurement. Additionally, investing in technology-driven sourcing platforms and fostering transparent communication with suppliers will enhance decision-making and operational agility.

Looking ahead, the carbide market is expected to evolve with shifts in raw material availability and increasing demand from emerging industrial sectors. International buyers are encouraged to adopt a proactive, data-driven approach to sourcing, continuously reassessing market conditions and supplier capabilities. By doing so, they will not only secure favorable pricing but also build resilient supply chains poised for long-term growth and innovation.

Take action now: deepen your market intelligence, diversify sourcing channels, and engage in strategic partnerships to stay ahead in the dynamic carbide market landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina