Guide to Graphen Herstellung

In today's rapidly evolving technological landscape, graphene has emerged as a game-changing material with transformative potential across industries such as electronics, energy storage, aerospace, and healthcare. Its unparalleled strength, conductivity, and flexibility make it a strategic asset for forward-thinking manufacturers and developers worldwide. For international B2B buyers—especially those from Africa, South America, the Middle East, and Europe—understanding the nuances of graphen herstellung (graphene production) is critical to securing a competitive edge and ensuring supply chain resilience.

This comprehensive guide offers a deep dive into the multifaceted world of graphene manufacturing. It covers essential topics including types of graphene, raw materials used, manufacturing processes, quality control standards, and reliable suppliers across global markets. Additionally, it provides actionable insights into cost considerations, market trends, and regulatory landscapes, equipping buyers with the knowledge needed to make informed sourcing decisions.

By navigating this guide, international buyers will be empowered to identify high-quality suppliers, evaluate production capabilities, and understand the evolving market dynamics—crucial for strategic procurement. Whether sourcing from emerging markets in Africa and South America or established hubs in Europe and the Middle East, this resource aims to streamline your decision-making process and foster sustainable, profitable partnerships in the competitive graphene landscape.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Mechanical Exfoliation | Uses physical force to peel graphene layers from graphite sources | R&D, high-quality research, specialized components | High purity and quality; limited scalability; higher costs per unit |

| Chemical Vapor Deposition (CVD) | Grows graphene on substrates via chemical reactions at high temperatures | Electronics, sensors, flexible electronics | Large-area production; scalable; potential contamination issues |

| Liquid Phase Exfoliation | Disperses graphite in liquids with sonication to produce graphene flakes | Composites, inks, coatings | Cost-effective; scalable; variable flake quality; requires purification |

| Epitaxial Growth | Grows graphene on silicon carbide (SiC) substrates via thermal decomposition | High-end electronics, quantum devices | Excellent electronic properties; high equipment costs; limited throughput |

| Reduction of Graphite Oxide | Chemically reduces oxidized graphite (graphite oxide) to graphene | Transparent conductors, energy storage | Cost-efficient; suitable for large quantities; potential defects in structure |

Mechanical exfoliation involves peeling layers of graphene from bulk graphite using adhesive tape or other physical means. It produces very high-quality, defect-free graphene with excellent electrical and mechanical properties, making it ideal for research and specialized applications. However, scalability is limited, and costs per unit are relatively high, which can be a significant factor for B2B buyers seeking bulk supplies. This method is suitable for niche markets requiring premium quality, such as advanced electronics or scientific instrumentation.

CVD is a widely adopted method for producing large-area graphene films by depositing carbon atoms onto a heated substrate, typically copper or nickel. It offers scalability and consistent quality, making it attractive for industrial applications like flexible electronics, sensors, and transparent conductive films. Buyers should consider the potential for contamination and the need for post-growth transfer processes, which can introduce defects. CVD's ability to produce uniform, high-quality graphene at scale makes it a top choice for manufacturing at the industrial level.

This technique disperses graphite in liquids using sonication, resulting in graphene flakes suspended in a solution. It is cost-effective, scalable, and suitable for producing graphene for composites, inks, and coatings. Variability in flake size and quality requires careful quality control and purification processes. B2B buyers should evaluate supplier consistency and the specific properties of the graphene flakes to match application requirements, especially where large volumes and affordability are critical.

Epitaxial growth involves heating silicon carbide (SiC) substrates to high temperatures, causing silicon to sublimate and leaving behind a graphene layer. This method produces graphene with excellent electronic properties, suitable for high-performance electronic devices and quantum applications. However, the high cost of equipment and limited throughput make it less suitable for mass production. Buyers in high-end electronics markets should consider this method when performance outweighs cost.

This process chemically reduces oxidized graphite (graphite oxide) to produce graphene, often called graphene oxide reduction. It is cost-efficient and capable of producing large quantities of graphene, making it suitable for energy storage, transparent conductors, and composite materials. The resulting graphene may contain defects or functional groups that affect its electrical properties, so quality control is essential. B2B buyers should assess the application's tolerance for such imperfections and ensure supplier transparency regarding process parameters.

| Industry/Sector | Specific Application of graphen herstellung | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Electronics & Energy | Conductive inks and flexible electronic components | Enables lightweight, high-performance devices with improved conductivity | Quality consistency, scalability, and certification standards |

| Aerospace & Automotive | Lightweight, high-strength composites for structural parts | Reduces weight, enhances fuel efficiency, and improves durability | Purity levels, supply chain reliability, and compliance with safety standards |

| Energy Storage | Advanced batteries and supercapacitors | Increases energy density, charge/discharge rates, and lifespan | Material purity, integration compatibility, and cost-effectiveness |

| Construction & Coatings | Anti-corrosion coatings and enhanced building materials | Extends lifespan of infrastructure, reduces maintenance costs | Durability, environmental safety, and adherence to regional regulations |

| Healthcare & Biotech | Biosensors and advanced medical devices | Improves sensitivity, flexibility, and miniaturization of devices | Biocompatibility, regulatory approval, and supply stability |

Graphen herstellung is pivotal in producing conductive inks and flexible electronic components. These applications benefit from graphene’s exceptional electrical conductivity and flexibility, enabling the development of wearable tech, foldable displays, and printed circuit boards. For international B2B buyers, especially from regions like Europe and Asia, sourcing high-quality, scalable graphene with consistent electrical properties is critical. Meeting industry standards and certifications ensures seamless integration into existing manufacturing processes, reducing time-to-market and operational risks.

Graphene-derived composites are transforming aerospace and automotive manufacturing by providing materials that are both lightweight and mechanically robust. These composites enhance fuel efficiency and safety, vital for markets such as Saudi Arabia’s automotive sector or South America’s aerospace industry. B2B buyers must prioritize suppliers offering high-purity graphene and reliable supply chains to ensure quality and compliance with stringent safety standards. The ability to source cost-effective, scalable graphene will directly influence production costs and product competitiveness.

In energy storage, graphen herstellung enables the creation of advanced batteries and supercapacitors with superior charge capacity and longevity. These innovations are crucial for renewable energy integration and electric mobility, particularly in regions like Africa and the Middle East where energy infrastructure is evolving. Buyers should focus on sourcing graphene with high surface area and purity to maximize device performance. Additionally, suppliers with proven track records in integrating graphene into energy systems can mitigate risks associated with technical compatibility.

Graphene-based coatings and materials offer enhanced corrosion resistance and structural integrity, extending the lifespan of infrastructure and reducing maintenance expenses. This is especially relevant for large-scale projects in Europe or the Middle East, where durability and environmental safety are prioritized. Sourcing considerations include verifying the environmental safety of graphene coatings, ensuring compliance with regional building codes, and assessing long-term stability under local climate conditions.

Graphen herstellung supports the development of biosensors and miniaturized medical devices, benefiting healthcare providers with more sensitive, flexible, and durable tools. These applications are vital for rapid diagnostics and personalized medicine, particularly in regions with emerging healthcare infrastructure like South America or Africa. Buyers should seek suppliers offering biocompatible, regulatory-approved graphene materials. Consistent supply and high purity are essential to meet strict medical standards and ensure device reliability.

Copper is one of the most widely used substrates for chemical vapor deposition (CVD) in graphene production due to its excellent catalytic properties and affordability. Its high electrical and thermal conductivity make it suitable for high-quality graphene synthesis, especially in processes requiring precise temperature control. Copper’s relatively low cost and ease of handling are attractive features for international buyers, particularly in regions like Africa and South America where cost-efficiency is crucial.

Pros:

- Cost-effective and widely available globally.

- Good catalytic activity for graphene growth via CVD.

- Easy to process and clean, facilitating scalable production.

Cons:

- Susceptible to oxidation, requiring protective atmospheres during handling.

- Limited durability at high temperatures over prolonged periods.

- Not suitable for applications requiring transfer to non-metallic substrates without additional processing.

Impact on Application:

Copper’s surface quality directly influences graphene uniformity and defect density. For industrial applications, consistent quality control is essential, especially for electronics or sensors. International buyers should ensure compliance with local safety and environmental standards related to metal handling and emissions.

Regional Considerations:

Copper is widely mined and exported from regions like Africa (Zambia, Congo) and South America (Chile, Peru). Buyers should verify supplier certifications aligning with ASTM or ISO standards to ensure material purity and quality. In the Middle East and Europe, strict environmental regulations may influence sourcing and processing practices.

Nickel is favored for its ability to produce larger-area graphene sheets via CVD, especially when growth on metallic substrates is desired. Its higher melting point and mechanical robustness make it suitable for high-temperature processes, and it can be reused multiple times, reducing long-term costs.

Pros:

- Supports growth of high-quality, large-area graphene.

- Reusable and durable under high-temperature conditions.

- Compatible with various chemical processes, including electrochemical applications.

Cons:

- Higher material and processing costs compared to copper.

- Requires more complex surface preparation and cleaning.

- Potential contamination issues if not properly purified, affecting end-product quality.

Impact on Application:

Nickel’s compatibility with various media makes it suitable for sensor, energy storage, and electronic applications. International buyers should consider local standards for chemical purity and environmental regulations, especially in regions with strict waste disposal laws like Europe.

Regional Considerations:

Nickel is predominantly mined in countries like Indonesia, the Philippines, and Russia. Buyers from the Middle East and Africa should prioritize suppliers with robust certification (e.g., RoHS, REACH) to ensure compliance with regional standards. Cost considerations are significant due to higher raw material prices.

Silicon carbide is increasingly used as a substrate or support material in advanced graphene production, especially for high-performance electronic applications. Its exceptional thermal stability, chemical inertness, and mechanical strength make it ideal for processes requiring extreme conditions.

Pros:

- Excellent thermal and chemical stability.

- Supports high-quality, defect-free graphene growth.

- Suitable for high-power electronic applications.

Cons:

- Significantly higher cost than metals like copper or nickel.

- Manufacturing complexity and limited availability can lead to longer lead times.

- Requires specialized handling and processing equipment.

Impact on Application:

SiC substrates enable the production of high-end graphene devices, including RF and power electronics. International buyers should verify supplier certifications for purity and structural integrity, especially in regions like Europe and North America where standards are stringent.

Regional Considerations:

Manufacturers of SiC are concentrated in Japan, Germany, and the USA. Buyers from emerging markets such as Africa or South America should consider import logistics and potential tariffs, balancing the high initial investment against long-term performance benefits.

Graphite serves as both a raw material and a substrate in various graphene synthesis methods, including exfoliation and chemical reduction. Its layered structure facilitates the production of graphene flakes or sheets, especially for bulk applications like composites.

Illustrative Image (Source: Google Search)

Pros:

- Abundant and relatively low-cost.

- Suitable for scalable production methods.

- Well-understood processing techniques.

Cons:

- Variability in quality and purity across sources.

- Lower control over graphene layer size and quality compared to CVD methods.

- Potential impurities affecting electrical and mechanical properties.

Impact on Application:

Graphite’s suitability depends on the intended end-use. For high-precision electronic applications, purified and defect-free graphite is essential. International buyers should ensure supplier certifications (e.g., ASTM, JIS) to guarantee quality and compliance.

Regional Considerations:

Major graphite producers include China, India, and Brazil. Buyers in regions like the Middle East or Africa should establish reliable supply chains and verify material certifications to meet industry standards and avoid quality issues.

| Material | Typical Use Case for graphen herstellung | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Copper | CVD substrate for high-quality graphene growth | Cost-effective, abundant, good catalytic properties | Susceptible to oxidation, limited durability | Low |

| Nickel | Large-area graphene via CVD, reusable substrate | Supports large sheets, durable at high temps | Higher cost, complex preparation | Med |

| Silicon Carbide (SiC) | High-performance electronic graphene devices | Excellent thermal and chemical stability | Very high cost, limited availability | High |

| Graphite | Raw material or substrate for exfoliation and reduction methods | Abundant, low-cost, scalable | Variability in quality, lower control over graphene layers | Low |

This comprehensive analysis provides international B2B buyers with critical insights into material selection, emphasizing regional considerations, compliance, and cost implications. Proper material choice aligned with application needs and regional standards can significantly influence the success of graphene manufacturing projects.

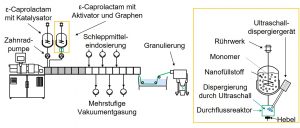

The production of high-quality graphene involves several critical stages, each requiring precise control and advanced techniques. For B2B buyers, understanding these stages helps in assessing supplier capabilities and ensuring product consistency.

1. Material Preparation:

This initial phase involves sourcing raw materials, typically graphite, which serves as the precursor. Suppliers may use natural graphite or synthetic variants, depending on the desired graphene type. Pre-treatment processes such as purification or exfoliation are applied to enhance quality, involving techniques like chemical oxidation or thermal treatment to facilitate subsequent steps.

2. Formation Techniques:

The core manufacturing methods for graphene include:

Mechanical Exfoliation:

While suitable for research, it is rarely used at industrial scale due to limited throughput. It involves peeling layers from graphite using adhesive tapes.

Chemical Vapor Deposition (CVD):

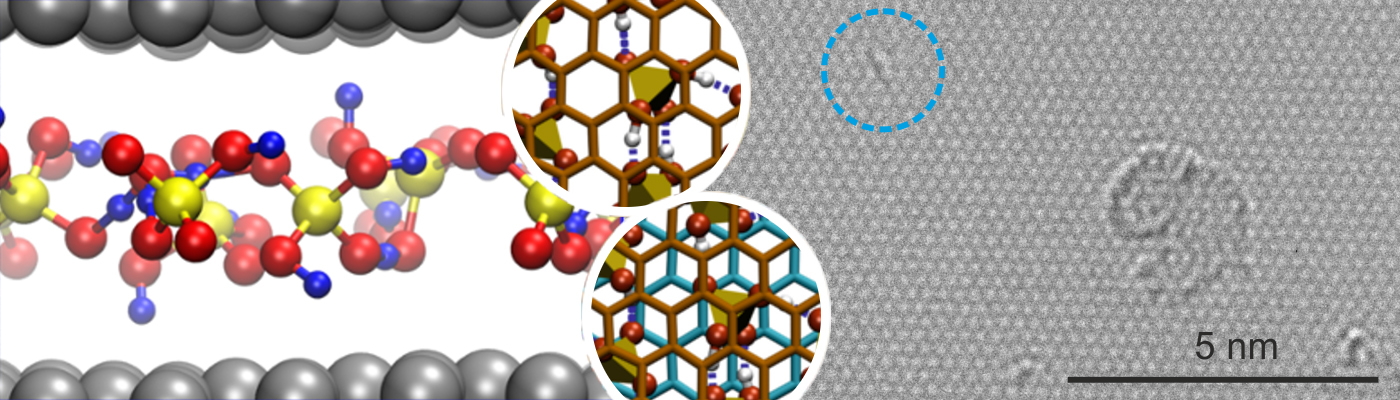

Widely adopted for large-area, high-quality graphene, CVD involves depositing carbon atoms onto a metal substrate (commonly copper or nickel) at elevated temperatures. Precise control of gas flow rates, temperature, and pressure is crucial to ensure uniform layer formation.

Liquid Phase Exfoliation:

This scalable technique disperses graphite in solvents with sonication, producing few-layer graphene. It is cost-effective but may result in variability in layer number and defect density.

Reduction of Graphene Oxide (GO):

Chemical oxidation produces GO, which is then reduced chemically or thermally to yield graphene. This method is favored for producing functionalized graphene with specific properties.

3. Assembly & Transfer:

Post-formation, graphene layers are transferred onto flexible or rigid substrates for application-specific use. Techniques include wet transfer, dry transfer, or roll-to-roll processes, which need to minimize contamination and defects to preserve material integrity.

4. Finishing & Packaging:

Final processing involves drying, surface treatments, and packaging in inert atmospheres or vacuum to prevent oxidation. B2B buyers should ensure that packaging standards align with their logistical and storage requirements.

Ensuring consistent quality in graphene production is essential for B2B buyers, especially when integrating into advanced applications like electronics, composites, or energy storage.

1. International & Industry Standards:

- ISO 9001:

Most reputable suppliers adhere to ISO 9001 for quality management systems, ensuring systematic control over manufacturing processes.

2. QC Checkpoints & Methodologies:

- Incoming Quality Control (IQC):

Raw materials, such as graphite or chemicals, are inspected for purity, particle size, and contaminant levels using techniques like X-ray fluorescence (XRF) or inductively coupled plasma mass spectrometry (ICP-MS).

In-Process Quality Control (IPQC):

During formation, parameters such as temperature, gas flow, and reaction times are monitored continuously. Techniques include in-situ Raman spectroscopy to assess layer number and defect density, and optical microscopy for surface inspection.

Final Quality Control (FQC):

Post-production testing includes:

Raman Spectroscopy:

To determine layer number, defect density (D-band), and quality.

Transmission Electron Microscopy (TEM):

For detailed structural analysis.

Atomic Force Microscopy (AFM):

To measure thickness and surface roughness.

Electrical & Thermal Testing:

Conductivity and thermal performance assessments to verify application-specific properties.

3. Common Testing Methods:

- X-ray Diffraction (XRD):

Assesses crystallinity and layer stacking.

UV-Vis Spectroscopy:

Measures concentration and dispersion stability.

Particle Size Analysis:

Ensures uniform dispersion, critical for composite applications.

Given the complexity and variability in graphene manufacturing, B2B buyers should adopt rigorous verification strategies:

Supplier Audits & Factory Visits:

Conduct on-site audits focusing on production lines, QC procedures, and record-keeping. For buyers from regions like Africa, South America, or the Middle East, partnering with local inspection agencies can facilitate these visits.

Review of Certification & Test Reports:

Request comprehensive documentation, including ISO certifications, third-party test reports, and validation certificates. Cross-referencing these documents with internationally recognized standards assures compliance.

Third-Party Inspection & Testing:

Engage independent testing labs or inspection agencies (e.g., SGS, Bureau Veritas) to verify product quality before shipment. This is especially critical when dealing with suppliers from regions with emerging manufacturing sectors.

Sample Testing & Pilot Orders:

Before large-scale procurement, conduct small batch testing to validate supplier claims. B2B buyers should specify testing protocols aligned with their application needs.

Europe & Middle East:

Manufacturers often adhere to stringent ISO standards and are more likely to have certifications like CE, REACH, or RoHS, facilitating compliance with European regulations. Buyers should prioritize suppliers with documented quality management systems and transparent QC reports.

Africa & South America:

While emerging markets are expanding their capabilities, variability in quality assurance practices can be significant. Buyers should emphasize third-party testing, detailed documentation, and supplier audits. Establishing long-term partnerships with certified suppliers can mitigate risks associated with inconsistent quality.

Thailand & Southeast Asia:

The region has a growing number of advanced manufacturing facilities with ISO 9001 accreditation. Buyers should verify these certifications and request recent test reports. Local inspection agencies can assist in ensuring that the supplier’s QC processes meet international standards.

By understanding the intricacies of graphene manufacturing and implementing rigorous verification protocols, international B2B buyers from Africa, South America, the Middle East, and Europe can mitigate risks, ensure product consistency, and foster reliable supply chains in this highly specialized industry.

Understanding the comprehensive cost components involved in sourcing graphene production is vital for making informed procurement decisions. The primary cost drivers include raw materials, labor, manufacturing overhead, tooling, quality control, logistics, and profit margins. Each element varies significantly based on geographic location, supplier capabilities, and product specifications.

Materials: The cost of precursor materials such as graphite, methane, or other chemicals depends on purity, source, and market fluctuations. High-quality graphene (e.g., monolayer, defect-free) commands a premium, often reflecting in material costs that range from $50 to $200 per gram. Buyers from regions like Africa or South America may benefit from local sourcing of raw materials, potentially reducing costs.

Labor: Labor costs differ markedly across regions. European and Middle Eastern suppliers tend to have higher wages, which can elevate overall prices. Conversely, Asian and some African manufacturers may offer more competitive labor rates, influencing overall cost structures.

Manufacturing Overheads & Tooling: Advanced production processes like chemical vapor deposition (CVD) or liquid-phase exfoliation incur significant capital expenditure. Initial tooling costs are substantial but amortized over large production volumes. Smaller orders or custom specifications may lead to higher per-unit costs due to underutilized capacity.

Quality Control & Certification: Achieving industry standards (e.g., ISO, REACH, RoHS) involves additional testing and certification costs. Buyers requiring high-purity, defect-free graphene with specific certifications should anticipate higher prices, especially when sourcing from regions with less mature quality assurance infrastructure.

Logistics & Incoterms: Shipping costs depend on weight, volume, and destination. FOB (Free on Board) or CIF (Cost, Insurance, and Freight) terms influence who bears transportation risks and costs. For buyers in remote or less-developed regions (e.g., parts of Africa or South America), logistics can constitute a significant portion of total cost, sometimes adding 20-50% to the product price.

Margins & Market Dynamics: Suppliers incorporate profit margins based on production scale, demand, and competitive landscape. Higher-volume orders generally benefit from negotiated discounts, while smaller or bespoke orders tend to carry premium pricing.

Indicative prices for high-quality graphene range from $50 to $200 per gram, depending on specifications, volume, and supplier location. Prices are subject to market fluctuations, raw material costs, and geopolitical factors. Always conduct thorough due diligence and request detailed quotations tailored to your specific requirements.

By understanding these cost components and influencing factors, international B2B buyers from Africa, South America, the Middle East, and Europe can strategically plan their procurement processes, negotiate effectively, and optimize their total cost of ownership in sourcing graphene.

1. Material Quality Grade

The quality grade of graphene indicates its purity and structural integrity, typically classified as monolayer, few-layer, or multilayer. Monolayer graphene, being a single atomic layer, offers superior electrical and mechanical properties and is often preferred for high-end applications. For B2B buyers, selecting the appropriate grade ensures compatibility with their specific use cases, such as electronics, composites, or sensors.

2. Surface Defect Density

This property measures the number of imperfections on the graphene surface, which can affect electrical conductivity and mechanical strength. Low defect density (measured in defects per square centimeter) is crucial for high-performance applications like flexible electronics or conductive inks. Buyers should specify acceptable defect levels to ensure product performance consistency.

3. Electrical Conductivity

Graphene's conductivity is a key performance indicator, typically expressed in Siemens per meter (S/m). High electrical conductivity is essential for applications in electronics, energy storage, and sensors. Understanding the conductivity level helps buyers evaluate if the material will meet their technical requirements.

4. Thickness and Layer Uniformity

Precise control over the number of layers (monolayer vs. multilayer) and uniformity across the batch impacts the material’s optical, electrical, and mechanical properties. For instance, monolayer graphene has unique optical transparency and high electron mobility. Buyers should specify layer thickness tolerances to ensure consistent product performance.

5. Mechanical Strength and Flexibility

Graphene’s tensile strength and flexibility are vital for applications in flexible electronics, composites, and coatings. Mechanical properties are often provided as tensile strength (MPa) or strain capacity (%). Suppliers should provide detailed testing data to ensure the material can withstand operational stresses.

6. Chemical Purity and Functionalization

Purity levels, often expressed as percentage of carbon content, influence the material’s electrical and chemical properties. Functionalization (adding specific chemical groups) can enhance compatibility with other materials. Buyers need to specify purity standards aligned with their end-use requirements.

1. OEM (Original Equipment Manufacturer)

Refers to companies that incorporate graphene into their final products. Understanding OEM relationships helps buyers identify potential partnerships or suppliers who can customize graphene for specific applications, ensuring product integration without extensive re-engineering.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell. For new buyers, understanding MOQ helps in planning procurement budgets and inventory management, especially since graphene often involves high-value, specialized production runs.

3. RFQ (Request for Quotation)

A formal process where buyers request detailed price quotes, technical specifications, and delivery timelines from multiple suppliers. Using RFQs enables buyers from regions like Africa or South America to compare options effectively and negotiate better terms.

4. Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce (ICC) that define responsibilities of buyers and sellers for international shipments. Familiarity with Incoterms (e.g., FOB, CIF, DDP) ensures clear understanding of shipping costs, customs responsibilities, and risk transfer points, critical for smooth cross-border transactions.

5. CVD (Chemical Vapor Deposition)

A common manufacturing process for high-quality monolayer graphene. Recognizing manufacturing techniques helps buyers assess the quality and scalability of the material, as well as compatibility with their production processes.

6. Batch Certification and Traceability

Documentation that verifies the quality, origin, and production conditions of each graphene batch. For international buyers, especially in regions with strict import regulations, traceability ensures compliance and quality assurance.

Understanding these technical properties and trade terms is essential for making informed procurement decisions. Clearly communicating specifications such as defect density, conductivity, and purity helps ensure the supplier can meet your application requirements. Additionally, familiarity with trade terminology like MOQ, RFQ, and Incoterms facilitates smoother negotiations and reduces the risk of misunderstandings during international transactions. By aligning technical expectations with industry standards, buyers from Africa, South America, the Middle East, and Europe can optimize their supply chains, ensure product quality, and foster long-term supplier relationships in the growing graphene market.

The global graphene manufacturing sector is experiencing rapid growth driven by technological advancements, increasing industrial applications, and expanding market demands. Key drivers include the surge in demand for high-performance materials in sectors such as electronics, aerospace, automotive, energy storage, and healthcare. Countries like China, the United States, and members of the European Union are leading innovation and production, but emerging markets are increasingly investing in local capabilities to reduce dependence on imports.

For international B2B buyers from Africa, South America, the Middle East, and Europe, sourcing strategies are evolving. There is a notable shift towards localized production and regional supply chains to mitigate risks associated with global disruptions, such as geopolitical tensions or supply chain bottlenecks. Buyers from regions like Saudi Arabia, Thailand, and South Africa are exploring partnerships with local producers or investing in domestic R&D to secure a stable supply of high-quality graphene.

Emerging trends include the development of greener synthesis methods—such as electrochemical or bio-based processes—that reduce environmental impact and improve sustainability credentials. Additionally, there is a growing emphasis on quality certifications, traceability, and standardization to ensure product consistency across borders. Digital platforms and industry-specific marketplaces are facilitating more transparent and efficient sourcing, enabling buyers to compare offerings and verify supplier credentials more effectively.

Market dynamics are also influenced by fluctuating raw material costs, technological maturation, and evolving regulatory landscapes. Buyers should stay informed about regional policies that support innovation or impose restrictions, especially concerning environmental standards and ethical sourcing, to align procurement strategies with compliance requirements and market expectations.

Sustainability is increasingly central to sourcing decisions in the graphene manufacturing sector. As industries worldwide aim to reduce carbon footprints and adhere to stricter environmental standards, the environmental impact of graphene production has gained prominence. Traditional synthesis methods, such as chemical vapor deposition (CVD) or chemical exfoliation, often involve hazardous chemicals and high energy consumption, raising concerns about ecological footprints.

For B2B buyers, prioritizing suppliers with sustainable practices offers both reputational and operational advantages. Certifications like ISO 14001 (Environmental Management) or Green Seal demonstrate commitment to environmental stewardship. Moreover, sourcing from producers employing 'green' methods—such as electrochemical exfoliation or bio-based synthesis—can significantly reduce environmental harm while ensuring product quality.

Ethical sourcing also encompasses supply chain transparency, fair labor practices, and responsible raw material procurement. Graphene producers that adhere to strict ethical standards and provide traceability documentation are better positioned to meet regulatory requirements and satisfy customer demands for responsible sourcing. Engaging with suppliers committed to reducing environmental impact and maintaining ethical standards fosters long-term partnerships, mitigates risks, and enhances brand integrity across markets.

Furthermore, the adoption of sustainable packaging and logistics solutions—such as recyclable materials and optimized transportation—complements environmentally conscious procurement. B2B buyers should actively seek suppliers with comprehensive sustainability reports and verify claims through third-party audits or certifications, ensuring that their supply chains align with global sustainability goals and local regulatory frameworks.

Illustrative Image (Source: Google Search)

The development of graphene manufacturing has evolved from laboratory-scale research to industrial-scale production over the past two decades. Initially discovered in 2004, graphene’s extraordinary properties spurred global interest, prompting academia and industry to explore scalable synthesis techniques. Early methods relied heavily on mechanical exfoliation, which was limited to small quantities and high costs.

Subsequently, chemical vapor deposition (CVD) and chemical exfoliation emerged as dominant industrial processes, enabling larger-scale production but often at environmental costs. Recently, innovations in greener synthesis methods—such as electrochemical exfoliation and bio-based approaches—have gained traction, aligning production with sustainability goals.

For B2B buyers, understanding this evolution is vital for assessing supplier capabilities and product quality. Suppliers with a history of technological innovation and adherence to evolving standards are better positioned to meet future market needs. Recognizing the shift towards sustainable and ethical production can also influence procurement decisions, ensuring long-term supply chain resilience and compliance with global environmental commitments.

To ensure supplier credibility, start with comprehensive due diligence. Verify their certifications (ISO, ISO/TS, REACH compliance), request detailed product datasheets, and review third-party lab test reports. Engage in direct communication to assess transparency, technical expertise, and responsiveness. Ask for references from other international clients, especially from your region, to gauge their reputation. Consider visiting their facilities or hiring local agents for on-site audits. Establish clear quality benchmarks and include clauses for regular QA audits in your contract to mitigate risks of subpar products.

Graphene manufacturers often offer customization in terms of sheet size, thickness, functionalization, and form (powder, film, or ink). To communicate your needs effectively, provide detailed specifications, including desired conductivity, surface chemistry, and application-specific parameters. Collaborate with technical teams to develop prototypes before bulk orders. Ensure your supplier understands regional standards and certifications relevant to your industry. Clear documentation, including technical drawings and performance benchmarks, will facilitate precise customization and reduce lead times.

MOQs for graphene vary widely, often ranging from a few grams to several kilograms, depending on the supplier and product complexity. Lead times typically range from 2 to 8 weeks, influenced by order size and customization level. Payment terms commonly include 30% upfront with the balance prior to shipment, but flexible arrangements such as letters of credit or open accounts may be negotiable for trusted partners. Establishing clear contractual terms upfront, including penalties for delays, helps manage expectations and ensures smoother transactions.

Seek suppliers with recognized QA certifications such as ISO 9001, ISO 13485 (medical applications), or industry-specific standards. Request detailed test reports, including particle size distribution, purity levels, conductivity, and defect rates. To verify compliance, consider third-party testing from accredited laboratories, especially for critical applications like electronics or aerospace. Establish quality checkpoints during production, such as pre-shipment testing or batch sampling, and include these requirements in your purchase agreement to maintain consistent product standards.

Effective logistics management involves selecting reliable freight forwarders experienced in handling sensitive nanomaterials. Opt for modes balancing cost and delivery speed, such as air freight for urgent needs or sea freight for bulk orders. Ensure proper packaging to prevent contamination or damage during transit, including anti-static and moisture-resistant materials. Clarify customs clearance procedures and documentation requirements for your region, and consider working with suppliers who assist with export procedures. Establish tracking systems and communication protocols to stay updated on shipment status, minimizing delays and ensuring timely delivery.

Proactively include dispute resolution clauses in your contracts, specifying arbitration or jurisdiction preferences. Maintain detailed records of all communications, test reports, and shipment documentation to substantiate claims. If quality issues arise, promptly notify the supplier with documented evidence and request corrective actions, such as replacements or refunds. Consider engaging third-party mediators or legal experts familiar with international trade law if disputes escalate. Building strong supplier relationships based on transparency and mutual understanding can often prevent conflicts and facilitate quicker resolutions.

Illustrative Image (Source: Google Search)

Different regions have varying regulations for nanomaterials, including import controls, safety standards, and environmental compliance. In Africa, South America, the Middle East, and parts of Europe, stay updated on local regulations via official trade or environmental agencies. Ensure your supplier provides necessary documentation like safety data sheets (SDS), certificates of analysis, and compliance declarations. Work with local customs brokers experienced in nanomaterials to navigate import procedures smoothly. Staying ahead of regulatory requirements reduces delays, penalties, and ensures your supply chain remains compliant.

Diversify your supplier base across different regions to avoid dependency on a single source. Establish long-term partnerships with reputable manufacturers who demonstrate consistent quality and reliable delivery. Maintain safety stock levels for critical quantities to buffer against delays. Regularly review supplier performance through audits and performance metrics. Additionally, stay informed about geopolitical, economic, and logistical developments that could impact shipments. Implement digital supply chain management tools for real-time monitoring and develop contingency plans for disruptions, ensuring your operations remain resilient and responsive.

Effective strategic sourcing is essential for international buyers aiming to leverage graphene's transformative potential across diverse industries. By prioritizing quality, supply chain resilience, and cost-efficiency, B2B partners from Africa, South America, the Middle East, and Europe can secure competitive advantages and foster innovation. Developing strong relationships with reliable suppliers, investing in local or regional production capabilities, and staying informed about technological advancements will be key to maintaining a sustainable supply chain.

Looking ahead, the graphene market is poised for rapid growth driven by advancements in manufacturing processes and expanding application fields such as electronics, energy storage, and composites. Buyers should adopt a proactive approach—exploring emerging suppliers, diversifying sourcing channels, and engaging in collaborative R&D initiatives. These strategies will not only mitigate risks but also position buyers at the forefront of this evolving industry.

Ultimately, strategic sourcing in graphene production offers a pathway to unlock significant value and secure a competitive edge in the global marketplace. International buyers from targeted regions should seize this opportunity now, forging partnerships that enable innovation, resilience, and long-term success in the dynamic landscape of graphene manufacturing.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina