In the rapidly evolving industrial landscape, the green grinding wheel stands out as a pivotal component for precision machining, surface finishing, and efficient material removal. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding the nuances of green grinding wheels is essential to enhance manufacturing quality, reduce operational costs, and comply with environmental standards. This abrasive tool’s critical role in sectors ranging from automotive to aerospace demands a comprehensive grasp of its specifications and market dynamics.

This guide delivers an in-depth exploration tailored to the complexities faced by global buyers. It covers key types and compositions of green grinding wheels, highlighting how material variations influence performance and longevity. You will gain insights into advanced manufacturing processes and stringent quality control measures that ensure consistency and reliability. Additionally, the guide provides a detailed overview of leading suppliers across major regions, including emerging markets in South Africa and established hubs in Spain, enabling strategic sourcing decisions.

Understanding cost structures and market trends forms another cornerstone of this guide, empowering buyers to negotiate effectively and forecast procurement budgets with confidence. The inclusion of frequently asked questions addresses common challenges and clarifies technical aspects, ensuring buyers can make informed choices aligned with their operational goals.

By synthesizing technical expertise with practical market intelligence, this resource equips international B2B buyers with the tools necessary to navigate the green grinding wheel market confidently and competitively—ultimately driving efficiency and innovation in their supply chains.

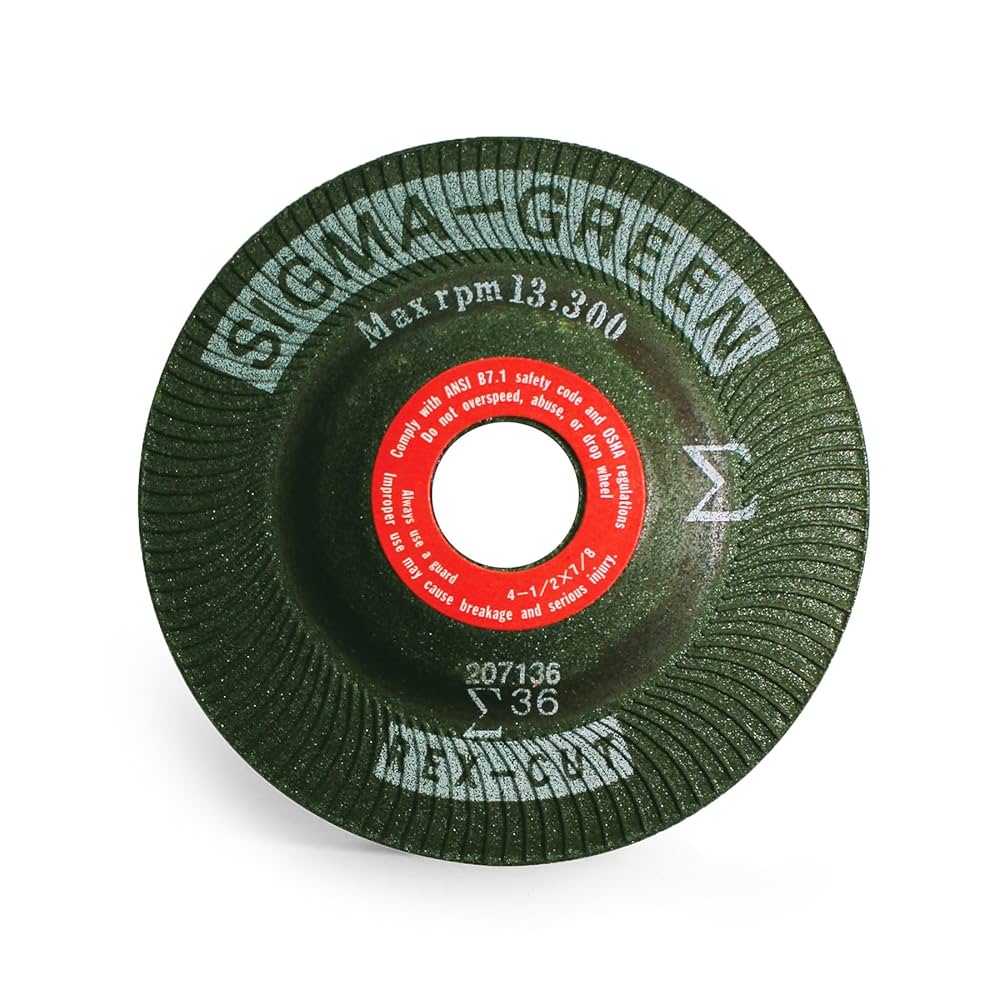

Illustrative Image (Source: Google Search)

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Vitrified Green Grinding Wheel | Made from vitrified bond with silicon carbide abrasive | Precision grinding in automotive and aerospace | Pros: High durability, excellent precision Cons: Higher initial cost, brittle under impact |

| Resin-Bonded Green Grinding Wheel | Resin bond with green silicon carbide abrasive | General metalworking, tool sharpening | Pros: Good flexibility, faster cutting speed Cons: Lower heat resistance, shorter lifespan |

| Electroplated Green Grinding Wheel | Thin layer of abrasive electroplated on steel core | Fine finishing, hard-to-grind materials | Pros: Superior sharpness, minimal wheel wear Cons: Expensive, limited to light grinding |

| Ceramic Bond Green Grinding Wheel | Ceramic bond with green abrasive for high-performance | Heavy-duty industrial grinding | Pros: High strength and heat resistance Cons: Costly, requires skilled operation |

| Rubber Bond Green Grinding Wheel | Rubber bond providing shock absorption and flexibility | Grinding of delicate or precision components | Pros: Reduced vibration, good surface finish Cons: Lower material removal rate, less durable |

Vitrified Green Grinding Wheel

These wheels use a vitrified bonding agent to hold green silicon carbide abrasives, resulting in a rigid and porous structure. They are ideal for applications requiring high precision and durability, such as automotive part finishing and aerospace component manufacturing. For B2B buyers, the key considerations include the wheel’s brittleness, which demands careful handling and storage, and the higher upfront cost offset by longer service life and consistent performance.

Resin-Bonded Green Grinding Wheel

Resin bonds offer flexibility and faster cutting speeds, making these wheels suitable for general metalworking and tool sharpening tasks common in manufacturing and maintenance sectors. Buyers should weigh the trade-off between lower heat resistance and a shorter lifespan against the advantage of reduced grinding cycle times. These wheels are a cost-effective option for businesses prioritizing productivity over extreme durability.

Electroplated Green Grinding Wheel

Electroplated wheels feature a thin abrasive coating on a steel core, providing exceptional sharpness and minimal wear. They excel in fine finishing tasks and grinding hard-to-cut materials, valuable in precision engineering and electronics manufacturing. However, the higher cost and limited grinding depth mean buyers should reserve these wheels for specialized, high-precision applications where surface quality is paramount.

Ceramic Bond Green Grinding Wheel

With a ceramic bond, these wheels offer superior strength and heat resistance, making them suitable for heavy-duty industrial grinding operations. They are preferred in sectors like heavy machinery and tool manufacturing where aggressive material removal is needed. Buyers must consider the higher cost and the need for skilled operators to maximize the benefits and avoid premature wheel failure.

Rubber Bond Green Grinding Wheel

Rubber-bonded wheels provide excellent shock absorption and flexibility, reducing vibration and delivering a fine surface finish. They are ideal for grinding delicate or precision components, often used in the electronics and fine mechanics industries. The trade-offs include a lower material removal rate and reduced durability, making them best suited for applications where surface integrity outweighs throughput.

Related Video: GC Grinding Wheel Green Silicon Carbide Grinding Wheels

| Industry/Sector | Specific Application of green grinding wheel | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Precision grinding of engine components and transmission parts | Enhances component durability and reduces waste through precision | Consistent quality, compliance with automotive standards, delivery reliability |

| Aerospace | Machining of turbine blades and structural alloys | Improves surface finish and extends part lifespan | High-performance abrasives, certification, and supply chain transparency |

| Tool and Die Making | Sharpening cutting tools and dies | Maintains tool sharpness, reduces downtime, and improves output | Abrasive grit size, bonding type, and compatibility with tool materials |

| Metal Fabrication | Surface finishing and deburring of stainless steel and alloys | Achieves smooth finishes, reduces rework, and supports complex shapes | Abrasive durability, heat resistance, and cost-effectiveness |

| Electronics | Grinding of semiconductor wafers and electronic components | Ensures precision and minimal contamination | Ultra-fine grit, contamination control, and supply consistency |

Automotive Industry

Green grinding wheels are extensively used in the automotive sector for precision grinding of engine components such as camshafts, crankshafts, and transmission gears. These wheels enable high-precision machining that enhances the durability and performance of parts while minimizing material waste. For international buyers in Africa, South America, the Middle East, and Europe, sourcing wheels that meet stringent automotive quality standards and offer consistent performance is critical. Reliable delivery schedules and supplier certifications can significantly impact production timelines and compliance.

Aerospace Sector

In aerospace manufacturing, green grinding wheels are essential for machining high-strength alloys used in turbine blades and airframe components. These wheels provide superior surface finishes and improve the lifespan of critical parts by minimizing micro-cracks and surface defects. Buyers from regions such as Spain and South Africa should prioritize suppliers offering high-performance abrasives with aerospace-grade certifications and transparent supply chains to ensure traceability and quality assurance.

Tool and Die Making

The tool and die industry relies on green grinding wheels for sharpening and maintaining cutting tools and dies. These wheels help maintain sharpness, reduce downtime, and improve the quality of stamped or molded parts. For B2B buyers, understanding abrasive grit size, bonding materials, and compatibility with the specific tool steels used is vital. This ensures optimal tool life and consistent production output, especially in highly competitive manufacturing environments in Europe and the Middle East.

Metal Fabrication

Green grinding wheels are used for surface finishing and deburring stainless steel and various metal alloys in fabrication shops. They enable smooth finishes, reduce the need for rework, and support the shaping of complex geometries. Buyers in South America and Africa should consider abrasive durability and heat resistance to maintain performance under heavy workloads while balancing cost-effectiveness for large-scale operations.

Electronics Manufacturing

In the electronics industry, green grinding wheels are employed to grind semiconductor wafers and delicate electronic components. Precision and contamination control are paramount to avoid defects. International buyers must source ultra-fine grit wheels that meet stringent cleanliness standards and ensure supply consistency to support high-volume production lines in advanced manufacturing hubs across Europe and the Middle East.

Related Video: Norton Live: Choosing the best bench and pedestal grinding wheel

When selecting materials for green grinding wheels, international B2B buyers must carefully evaluate the properties, performance characteristics, and regional compliance requirements of each option. The choice of material directly influences grinding efficiency, wheel durability, and compatibility with specific applications. Below is an in-depth analysis of four common materials used in green grinding wheels, tailored for buyers across Africa, South America, the Middle East, and Europe.

Key Properties:

Silicon Carbide is a hard, sharp abrasive with excellent thermal conductivity and high resistance to heat and wear. It performs well under moderate to high pressure and maintains structural integrity at elevated temperatures, making it suitable for grinding non-ferrous metals, ceramics, and cast iron.

Pros & Cons:

- Pros: High grinding efficiency, sharp cutting action, good for brittle materials, relatively affordable.

- Cons: Lower durability compared to some alternatives, can wear quickly under heavy-duty applications, manufacturing complexity is moderate due to brittle nature.

Impact on Application:

SiC wheels excel in applications involving non-ferrous metals and materials prone to heat damage, such as aluminum and brass. They are less suitable for grinding hardened steel due to lower toughness.

Considerations for International Buyers:

Buyers in regions like South Africa and Spain should verify compliance with ASTM and DIN standards for abrasive materials to ensure quality and safety. Silicon Carbide wheels are widely accepted globally, but buyers should confirm the grit size and bonding type to match local machinery and operational practices. Import regulations in the Middle East may require certification for industrial abrasives, so sourcing from certified suppliers is advisable.

Key Properties:

Aluminum Oxide is a versatile abrasive with high toughness and good wear resistance. It operates effectively under high pressure and temperature, making it suitable for grinding steel and other ferrous metals.

Pros & Cons:

- Pros: Durable, cost-effective, widely available, suitable for a broad range of materials including hardened steels.

- Cons: Slightly less sharp than Silicon Carbide, may generate more heat during grinding, which requires proper cooling systems.

Impact on Application:

Aluminum Oxide wheels are preferred for heavy-duty grinding tasks, including tool sharpening and surface finishing of steel components. They are compatible with most grinding machines and media.

Considerations for International Buyers:

European buyers, especially in countries like Spain, often require adherence to EN and ISO standards for abrasives, ensuring consistency and safety. In Africa and South America, buyers should assess the availability of local suppliers offering certified Aluminum Oxide wheels to reduce lead times and import costs. The Middle East market values abrasion resistance and durability due to harsh operational environments, making Aluminum Oxide a favorable choice.

Key Properties:

Ceramic Alumina is an advanced abrasive known for its superior hardness, self-sharpening ability, and exceptional heat resistance. It maintains performance under extreme pressure and high-temperature conditions.

Pros & Cons:

- Pros: Long-lasting, maintains sharpness over time, excellent for high-precision grinding, reduces wheel dressing frequency.

- Cons: Higher cost, more complex manufacturing process, requires specialized machinery for optimal performance.

Impact on Application:

Ideal for precision grinding of hardened steels, aerospace components, and automotive parts where surface finish and dimensional accuracy are critical. Ceramic Alumina wheels improve productivity by extending wheel life and reducing downtime.

Considerations for International Buyers:

Buyers in Europe and the Middle East should prioritize suppliers that meet stringent quality certifications such as ISO 9001 and comply with environmental regulations regarding abrasive manufacturing. In South America and Africa, the higher upfront cost might be offset by lower replacement frequency and improved operational efficiency, making it a strategic investment for high-volume industrial users.

Key Properties:

Zirconia Alumina combines toughness and sharpness, offering excellent wear resistance and the ability to withstand heavy grinding loads. It performs well at elevated temperatures and resists corrosion.

Pros & Cons:

- Pros: Durable under heavy use, good for rough grinding and stock removal, corrosion-resistant, moderate manufacturing complexity.

- Cons: Higher cost than Aluminum Oxide, less sharp than Silicon Carbide, may require specific bonding agents.

Impact on Application:

Commonly used in heavy stock removal and grinding of tough materials such as stainless steel and high-alloy steels. It is well-suited for applications requiring aggressive grinding and long wheel life.

Considerations for International Buyers:

For buyers in Africa and the Middle East, Zirconia Alumina wheels offer a balance between durability and cost, particularly in industries like mining and oil & gas. Compliance with ASTM and DIN standards is critical to ensure performance and safety. European buyers should consider environmental and safety certifications, while South American buyers may benefit from sourcing from regional manufacturers to reduce logistics costs.

| Material | Typical Use Case for green grinding wheel | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | Grinding non-ferrous metals, ceramics, cast iron | Sharp cutting, excellent heat resistance | Lower durability under heavy load | Low |

| Aluminum Oxide | Grinding steel and ferrous metals | Durable and cost-effective | Generates more heat, less sharp | Medium |

| Ceramic Alumina | Precision grinding of hardened steels and aerospace parts | Long-lasting, self-sharpening | High cost, requires specialized machinery | High |

| Zirconia Alumina | Heavy stock removal on stainless and high-alloy steels | Tough and corrosion-resistant | Higher cost, less sharp than SiC | Medium to High |

This detailed material analysis equips international B2B buyers with actionable insights to select the optimal green grinding wheel material based on application needs, cost considerations, and regional compliance requirements. Prioritizing certified suppliers and understanding local standards will ensure procurement efficiency and operational success across diverse industrial environments.

Green grinding wheels, known for their superior cutting performance and durability, undergo a meticulous manufacturing process that ensures both functionality and safety. For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, understanding these stages is crucial for selecting reliable suppliers and ensuring product consistency.

1. Material Preparation

The foundation of a green grinding wheel lies in its raw materials, primarily comprising abrasive grains (such as silicon carbide or aluminum oxide), bonding agents, fillers, and additives. Material preparation involves:

2. Forming

The forming stage shapes the grinding wheel and sets its internal structure. Key techniques include:

3. Assembly and Curing

After forming, wheels may be assembled if composed of multiple layers or components. Curing is critical:

4. Finishing

The finishing phase prepares the wheel for application and quality verification:

For B2B buyers, especially across diverse international markets, a robust quality assurance (QA) system is paramount. It ensures that green grinding wheels meet performance expectations, safety regulations, and compliance standards.

Relevant International and Industry Standards

Quality Control Checkpoints

Common Testing Methods

Given the critical nature of grinding wheels, buyers must proactively assess supplier QA capabilities:

International buyers face specific challenges and considerations when sourcing green grinding wheels:

By comprehensively understanding the manufacturing and quality assurance processes of green grinding wheels, international B2B buyers can make informed purchasing decisions that enhance operational efficiency, safety, and cost-effectiveness across their supply chains.

Illustrative Image (Source: Google Search)

When sourcing green grinding wheels, it is essential for international B2B buyers to grasp the underlying cost structure that manufacturers factor into their pricing. The primary cost components include:

Several factors affect the final price that B2B buyers from Africa, South America, the Middle East, and Europe will encounter:

Prices for green grinding wheels vary significantly based on the factors discussed above. The figures presented by suppliers should be considered indicative and subject to negotiation, market conditions, and currency fluctuations. Buyers are encouraged to request detailed quotations and perform comparative analyses before finalizing procurement decisions.

Understanding the key technical specifications of green grinding wheels is vital for B2B buyers to ensure optimal performance, cost-efficiency, and compatibility with their production processes.

Material Grade (Abrasive Type and Quality):

Green grinding wheels typically use silicon carbide as the abrasive material, known for its sharp cutting properties and suitability for hard, brittle materials. The grade indicates the hardness of the abrasive particles, affecting wheel durability and cutting speed. For buyers, selecting the right grade balances wear resistance and grinding efficiency, directly impacting operational costs.

Grit Size:

This refers to the size of the abrasive grains embedded in the wheel, usually expressed in mesh numbers. Finer grits (higher numbers) produce smoother finishes but remove material slower, while coarser grits cut faster but leave rougher surfaces. Understanding grit size helps buyers specify wheels aligned with their precision and surface finish requirements.

Bond Type and Strength:

The bond holds abrasive grains together and influences wheel toughness and wear rate. Common bonds include vitrified (ceramic-based) and resin bonds. Vitrified bonds offer rigidity and heat resistance, ideal for precision grinding, whereas resin bonds provide flexibility and shock resistance. Buyers should choose bond types based on the grinding application and machine type.

Wheel Dimensions and Tolerances:

Precise wheel diameter, thickness, and bore size are critical for machine compatibility and operational safety. Tolerances define allowable deviations in these dimensions. Buyers must ensure wheels meet strict tolerance standards to avoid installation issues and maintain grinding accuracy.

Hardness:

This property denotes the wheel’s resistance to abrasive grain shedding and deformation under pressure. Hardness affects how aggressively a wheel cuts and its service life. Selecting the appropriate hardness ensures a balance between grinding efficiency and wheel longevity.

Porosity:

Porosity refers to the volume and distribution of voids within the wheel structure. Higher porosity improves coolant flow and chip clearance, reducing heat buildup and wheel clogging. For B2B buyers, specifying porosity can enhance process stability and product quality.

Grasping essential trade terminology empowers buyers to negotiate effectively, understand supplier communications, and manage procurement logistics.

OEM (Original Equipment Manufacturer):

This term refers to companies that produce grinding wheels either for their own branded products or for other manufacturers. Buyers may seek OEM-certified wheels to ensure compatibility and quality standards aligned with their machinery.

MOQ (Minimum Order Quantity):

MOQ defines the smallest quantity of grinding wheels a supplier is willing to sell in one order. Understanding MOQ helps buyers plan inventory and manage budget constraints, especially important for small or medium-sized enterprises in diverse markets.

RFQ (Request for Quotation):

An RFQ is a formal inquiry sent to suppliers requesting detailed pricing and terms for specific grinding wheels. Mastering RFQ processes allows buyers to compare offers transparently and secure competitive pricing.

Incoterms (International Commercial Terms):

These standardized trade terms clarify responsibilities regarding shipping, insurance, and customs between buyers and sellers. Familiarity with Incoterms such as FOB (Free On Board) or CIF (Cost, Insurance, Freight) ensures buyers understand cost implications and risk transfer during international transactions.

Grinding Wheel Structure:

This term describes the spacing between abrasive grains and affects wheel porosity and cutting behavior. Buyers must specify structure levels appropriate to their grinding applications to optimize performance and wheel life.

Balance Grade:

Indicates the precision of wheel balancing, crucial for high-speed grinding operations to minimize vibrations and ensure safety. Buyers in industries with strict quality and safety standards should prioritize wheels with certified balance grades.

By understanding these technical properties and trade terms, international B2B buyers—from South Africa to Spain—can make informed purchasing decisions, optimize their procurement strategies, and enhance operational efficiency with green grinding wheels tailored to their specific industrial needs.

The global market for green grinding wheels is experiencing steady growth, driven by rising demand for precision machining and finishing solutions across diverse industries such as automotive, aerospace, and heavy machinery. For B2B buyers in Africa, South America, the Middle East, and Europe, understanding regional market dynamics is crucial to optimizing sourcing strategies. In regions like South Africa and Spain, manufacturing sectors are increasingly adopting advanced abrasive technologies to improve operational efficiency and product quality.

Key market drivers include the push for higher productivity, cost reduction, and enhanced surface finish quality. Technological advancements such as vitrified bond systems and superabrasive materials (e.g., CBN and diamond) are reshaping the green grinding wheel landscape by offering longer tool life and improved cutting performance. Additionally, integration of Industry 4.0 technologies—such as smart sensors and IoT-enabled monitoring—allows for predictive maintenance and real-time process optimization, which are becoming essential procurement criteria for international buyers seeking to reduce downtime and operational risks.

Sourcing trends reveal a shift towards strategic partnerships with suppliers who offer customization capabilities and flexible supply chain solutions. Buyers in emerging markets are increasingly prioritizing suppliers with strong local presence or reliable logistics networks to mitigate delays and import complexities. Moreover, there is a growing preference for suppliers that provide comprehensive technical support and training, enabling manufacturers to fully leverage green grinding wheel technologies.

Sustainability has become a pivotal consideration in the procurement of green grinding wheels. The environmental impact of abrasive manufacturing, including raw material extraction and energy-intensive production processes, is under scrutiny. B2B buyers from Europe and the Middle East often face stringent regulatory frameworks mandating lower carbon footprints and responsible resource management. Consequently, there is heightened demand for grinding wheels made from eco-friendly materials and produced under sustainable practices.

Ethical sourcing is equally critical, especially for buyers in Africa and South America, where supply chain transparency can be challenging. Partnering with manufacturers who adhere to internationally recognized certifications such as ISO 14001 (Environmental Management) and OHSAS 18001 (Occupational Health and Safety) ensures compliance with global standards. Additionally, certifications like REACH and RoHS confirm that grinding wheels are free from hazardous substances, aligning with buyer commitments to sustainability and corporate social responsibility (CSR).

Innovations in green grinding wheel production, such as the use of recycled abrasives and bio-based resins, are gaining traction. These alternatives reduce environmental impact without compromising performance. For international buyers, incorporating sustainability criteria into supplier evaluation not only mitigates reputational risks but also enhances competitive advantage in markets increasingly driven by eco-conscious procurement policies.

The evolution of green grinding wheels reflects broader advancements in abrasive technology. Originating from traditional bonded abrasives, green grinding wheels initially utilized aluminum oxide abrasives with conventional resin bonds. Over time, the introduction of vitrified bonds significantly improved wheel strength and heat resistance, enabling high-speed, precision grinding.

The term "green" often denotes vitrified wheels, known for their durability and superior finish quality. Over the past decades, the sector has embraced superabrasives like cubic boron nitride (CBN) and synthetic diamond, which have revolutionized grinding performance in hard-to-machine materials. This progression has been accompanied by enhanced manufacturing processes that prioritize consistency, balance, and reduced environmental impact.

For B2B buyers, understanding this historical context underscores the importance of selecting grinding wheels that align with modern manufacturing demands—balancing performance, sustainability, and cost-effectiveness across diverse industrial applications.

How can I effectively vet suppliers of green grinding wheels for international B2B transactions?

To vet suppliers, start by verifying their certifications such as ISO 9001 and relevant environmental standards to ensure quality and sustainability compliance. Request samples to assess product performance and consistency. Check their export experience, particularly in your region (Africa, South America, Middle East, or Europe), to confirm familiarity with local regulations and customs procedures. Evaluate financial stability through trade references or credit reports. Finally, use digital tools like supplier audits via video calls and third-party inspection services to mitigate risks before committing to large orders.

What customization options are typically available for green grinding wheels, and how should I approach this with suppliers?

Green grinding wheels can be customized in terms of abrasive material, grit size, bonding agent, and dimensions to suit specific industrial applications. When negotiating customization, clearly communicate your technical requirements and end-use scenarios to the supplier. Request detailed product datasheets and compatibility with your machinery. Discuss minimum order quantities (MOQs) for custom products and lead times. Establish a sample approval process to validate performance before full-scale production, reducing the risk of costly rework or returns.

What are typical minimum order quantities (MOQs) and lead times for green grinding wheels in international trade?

MOQs vary widely depending on supplier capabilities and customization levels but commonly range from 100 to 500 units per order. Standard products may have lower MOQs, while custom wheels typically require larger quantities. Lead times generally span 3 to 8 weeks, influenced by order complexity, raw material availability, and shipping logistics. Buyers should negotiate realistic timelines upfront, considering potential delays due to customs clearance or seasonal demand spikes, and plan inventory accordingly to avoid production downtime.

Illustrative Image (Source: Google Search)

Which payment terms are most secure and practical for international B2B purchases of green grinding wheels?

Common payment methods include Letters of Credit (LC), Telegraphic Transfers (T/T), and escrow services. Letters of Credit provide high security by involving banks to guarantee payment upon fulfillment of contract terms, ideal for new supplier relationships. T/T is faster but riskier without established trust. Escrow services offer a balanced approach by holding funds until buyer confirmation of delivery and quality. Negotiate payment schedules, such as deposits combined with balance payments after inspection, to protect cash flow while minimizing risk.

What quality assurance measures and certifications should I expect from green grinding wheel suppliers?

Quality assurance should include adherence to ISO 9001 management systems and compliance with industry-specific standards like ANSI or EN for abrasive products. Suppliers should provide test reports for wheel hardness, bonding strength, and abrasive grain size distribution. Environmental certifications (e.g., RoHS, REACH) are increasingly important for green products. Insist on third-party inspection or factory audits, especially for bulk orders, to verify production consistency. A comprehensive quality agreement defining acceptance criteria and rejection procedures reduces disputes.

How can I optimize logistics and shipping for green grinding wheel imports to regions like Africa or South America?

Optimize logistics by selecting suppliers experienced in international shipping and familiar with your region’s customs processes. Consolidate shipments where possible to reduce freight costs and minimize handling damage by using appropriate packaging materials. Choose reliable freight forwarders offering multimodal transport options (sea, air, road) to balance cost and speed. Ensure clear documentation including commercial invoices, packing lists, and certificates of origin to prevent customs delays. Establish contingency plans for potential port congestion or regulatory changes.

What strategies should I use to manage and resolve disputes with international suppliers of green grinding wheels?

To manage disputes, establish clear contractual terms covering product specifications, delivery timelines, payment conditions, and dispute resolution mechanisms before order confirmation. Use Incoterms to clarify responsibilities for shipping and risk transfer. In case of quality or delivery issues, document all communications and evidence such as photos or inspection reports. Attempt amicable negotiation or mediation first. If unresolved, consider arbitration clauses under recognized international bodies like ICC to avoid lengthy court proceedings and protect your business interests.

Are there specific considerations for sourcing green grinding wheels from suppliers in Europe versus Africa or the Middle East?

European suppliers often provide advanced product innovation, strict compliance with environmental regulations, and robust quality certifications, but may have higher costs and longer lead times. African and Middle Eastern suppliers might offer competitive pricing and faster turnaround due to proximity but require thorough vetting for quality consistency and export experience. Understand regional trade agreements, tariffs, and logistics infrastructure differences. Tailor your sourcing strategy by balancing cost, quality, and supply chain reliability to meet your operational priorities effectively.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of green grinding wheels is pivotal for businesses aiming to enhance operational efficiency while meeting sustainability goals. For B2B buyers across Africa, South America, the Middle East, and Europe, prioritizing suppliers who demonstrate consistent quality, environmental compliance, and innovation ensures not only superior product performance but also long-term supply chain resilience. Key considerations include verifying raw material origins, supplier certifications, and logistical capabilities to mitigate risks associated with international procurement.

Value-driven sourcing decisions empower buyers to optimize cost-efficiency without compromising on product durability or eco-friendliness. Establishing strong partnerships with manufacturers who invest in green technologies can unlock competitive advantages, such as reduced waste and improved workplace safety. Moreover, leveraging regional trade agreements and local distribution networks in markets like South Africa and Spain can streamline delivery times and reduce tariffs.

Looking ahead, the green grinding wheel market is poised for growth fueled by increasing industrial demand and tightening environmental regulations. B2B buyers should proactively engage with suppliers embracing circular economy principles and digital supply chain tools to stay ahead. Taking a strategic, informed approach today will position businesses to capitalize on emerging opportunities and contribute to a sustainable industrial future.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina