In today’s competitive industrial landscape, sandpaper and abrasives are indispensable components across manufacturing, construction, automotive, and woodworking sectors. Their critical role in surface preparation, finishing, and material shaping directly impacts product quality and operational efficiency. For international B2B buyers—especially those operating in dynamic markets such as Africa, South America, the Middle East, and Europe—understanding the complexities of sourcing these materials is paramount to maintaining a competitive edge.

This comprehensive guide offers an authoritative roadmap to mastering the global sandpaper and abrasives market. It delves into the diverse types of abrasives, from natural to synthetic, and explores the range of materials including aluminum oxide, silicon carbide, and ceramic blends. Additionally, it highlights key manufacturing processes and quality control standards that ensure product consistency and performance.

Buyers will benefit from detailed insights into identifying reputable suppliers and manufacturers, evaluating cost structures, and navigating logistical challenges unique to cross-border procurement. The guide also presents an up-to-date market overview, spotlighting emerging trends and regional considerations critical for buyers in countries like Nigeria and Italy.

Illustrative Image (Source: Google Search)

Designed as a practical tool, this resource empowers international procurement professionals to make informed, strategic sourcing decisions that align with their operational goals and market demands. By leveraging this knowledge, buyers can optimize supplier partnerships, reduce risk, and enhance product outcomes in a complex global supply environment.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Aluminum Oxide | Durable, versatile abrasive; available in various grits | Metal fabrication, woodworking, automotive refinishing | Pros: Long-lasting, cost-effective; Cons: Less effective on very hard materials |

| Silicon Carbide | Extremely sharp and hard; friable | Glass polishing, stone finishing, wet sanding | Pros: Excellent for hard, brittle materials; Cons: Shorter lifespan on soft metals |

| Ceramic Alumina | High-performance, tough abrasive grain | Heavy-duty grinding, aerospace, industrial manufacturing | Pros: Long life, high material removal rate; Cons: Higher cost upfront |

| Garnet | Natural abrasive; medium hardness | Fine woodworking, furniture finishing | Pros: Smooth finish, eco-friendly; Cons: Wears out faster, less durable |

| Zirconia Alumina | Tough, self-sharpening abrasive grain | Metalworking, heavy grinding, weld cleaning | Pros: High durability, good for aggressive grinding; Cons: Pricier than common abrasives |

Aluminum Oxide

Aluminum oxide is the most commonly used abrasive in industrial settings due to its balance of durability and cost-efficiency. It is suitable for a wide range of materials including metals, wood, and plastics, making it ideal for diverse manufacturing sectors across Africa, South America, the Middle East, and Europe. Buyers should consider grit size and backing type based on their specific application to optimize performance and cost.

Silicon Carbide

Known for its sharpness and hardness, silicon carbide excels in applications involving hard and brittle materials such as glass and stone. It is often used in wet sanding processes to reduce heat buildup. B2B buyers should note its relatively shorter lifespan on softer metals but appreciate its superior finish quality in precision industries like electronics and automotive glass manufacturing.

Ceramic Alumina

Ceramic alumina abrasives provide exceptional toughness and longevity, making them suitable for heavy-duty industrial tasks such as aerospace component finishing and high-volume metal grinding. Though the initial investment is higher, the extended lifespan and faster material removal can reduce overall operational costs. Buyers should evaluate their production scale to justify the premium cost.

Garnet

As a natural abrasive, garnet is favored in eco-conscious markets and fine woodworking industries, especially in European and Middle Eastern furniture manufacturing. It produces a smooth finish but wears out faster than synthetic abrasives. Buyers prioritizing environmental considerations and surface quality over abrasive longevity will find garnet advantageous.

Zirconia Alumina

Zirconia alumina offers a self-sharpening property and high durability, ideal for aggressive grinding tasks like weld cleaning and heavy metalworking. It is widely used in industrial sectors requiring robust abrasive performance. Though it carries a higher price point, its effectiveness in reducing downtime and replacement frequency can be appealing to large-scale manufacturers in emerging and developed markets alike.

Related Video: A Guide to Festool Abrasives

| Industry/Sector | Specific Application of sandpaper and abrasives | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Surface finishing and paint preparation on vehicle bodies | Ensures smooth, defect-free finishes, improving aesthetics and durability | High-quality grit size and consistent abrasive material to avoid surface damage; compliance with environmental standards for coatings |

| Metal Fabrication & Engineering | Deburring, polishing, and surface conditioning of metal parts | Enhances precision and longevity of metal components, reduces rework costs | Abrasive hardness and durability suited to metal type; availability of varied abrasive forms (discs, belts) for different machinery |

| Woodworking & Furniture Production | Sanding raw wood surfaces and finishing furniture pieces | Achieves smooth textures and flawless finishes, increasing product value | Abrasives that minimize clogging and ensure consistent finish; adaptability to different wood types common in target markets |

| Construction & Building Maintenance | Surface smoothing, rust removal, and preparation of materials | Improves adhesion of paints/coatings and extends structure lifespan | Durable abrasives resistant to dust and moisture; availability of bulk supply for large-scale projects |

| Aerospace & Precision Engineering | Fine polishing and finishing of aerospace components | Critical for safety, aerodynamic efficiency, and compliance with strict standards | Abrasives with ultra-fine grit, consistent particle size, and traceability; sourcing from certified suppliers with quality assurance |

Automotive Manufacturing

In the automotive sector, sandpaper and abrasives are essential for preparing vehicle surfaces before painting and finishing. They help remove imperfections such as scratches, rust, and old paint layers, ensuring a smooth surface that enhances paint adhesion and final appearance. For international buyers, especially in regions like Europe and South America, sourcing abrasives that meet environmental regulations and deliver consistent grit quality is critical to maintain production standards and reduce waste.

Metal Fabrication & Engineering

Abrasives play a pivotal role in metalworking by deburring edges, polishing surfaces, and conditioning metals to precise finishes. This reduces defects and improves the lifespan of parts used in machinery and infrastructure. B2B buyers from industrial hubs in Africa and the Middle East must prioritize abrasives with suitable hardness and longevity to handle diverse metals, while also ensuring compatibility with existing machinery such as belt sanders and polishing wheels.

Woodworking & Furniture Production

In woodworking, abrasives are used to smooth raw timber and prepare surfaces for staining or varnishing. The right sandpaper prevents clogging and ensures an even finish, which is essential for high-quality furniture. Buyers in Nigeria and Italy, where local wood varieties differ, should consider abrasives tailored to specific wood hardness and texture, along with supply reliability to support continuous production.

Construction & Building Maintenance

Sandpaper and abrasives are widely used in construction for surface smoothing, rust removal from metal fixtures, and preparation of walls or floors before painting or sealing. These applications demand durable abrasives that resist dust and moisture, particularly in harsh climates like those in parts of Africa and the Middle East. Bulk purchasing options and consistent product quality are important for cost-effective large-scale operations.

Aerospace & Precision Engineering

In aerospace manufacturing, abrasives are critical for ultra-fine polishing and finishing of components to meet stringent safety and aerodynamic standards. Buyers in Europe and South America require abrasives with very fine grit and tight quality control, often sourced from certified suppliers to ensure traceability and compliance with industry regulations. These abrasives must deliver consistent performance to avoid costly rework or component failure.

Related Video: How sandpaper is made 2021 by Maverick Abrasives

Aluminum oxide is the most widely used abrasive material for sandpaper, favored for its excellent durability and versatility. It offers high resistance to heat and pressure, making it suitable for heavy-duty sanding tasks and prolonged use. Its corrosion resistance ensures consistent performance even in humid or chemically aggressive environments, which is critical for buyers in regions with high humidity like parts of Africa and South America.

Pros: Aluminum oxide provides a good balance of cost and performance. It is durable, widely available, and compatible with a variety of substrates including wood, metal, and plastics. Manufacturing processes for aluminum oxide abrasives are well-established, ensuring consistent quality.

Cons: It may wear faster than some premium abrasives when used on very hard materials. For buyers in Europe (e.g., Italy), compliance with standards such as ASTM and DIN ensures product reliability but may increase cost slightly. In the Middle East, where abrasive applications often involve metal fabrication, aluminum oxide’s versatility is a key advantage.

Application Impact: Aluminum oxide abrasives are ideal for woodworking, metal finishing, and automotive refinishing. Their adaptability makes them a preferred choice for B2B buyers seeking a cost-effective yet reliable abrasive.

Silicon carbide is a sharper and harder abrasive than aluminum oxide, characterized by its superior cutting ability and high thermal conductivity. It excels in applications requiring precision and fine finishing, such as polishing glass, ceramics, and non-ferrous metals. Its high hardness also means it can withstand higher temperatures without degradation.

Pros: It offers excellent cutting performance and long-lasting sharpness. Silicon carbide is effective in wet or dry sanding, which is valuable in industries requiring wet grinding processes common in Europe and the Middle East.

Cons: Silicon carbide abrasives are more brittle and prone to fracturing under heavy pressure, which can reduce lifespan in aggressive sanding applications. Cost is generally higher than aluminum oxide, which may impact procurement budgets in emerging markets like Nigeria.

Application Impact: Best suited for fine finishing and polishing tasks. International buyers must consider compatibility with their machinery and adherence to standards like JIS in Asia or DIN in Europe to ensure optimal performance.

Ceramic alumina is a high-performance abrasive known for its exceptional durability and self-sharpening properties. It maintains cutting efficiency under extreme conditions, such as high pressure and temperature, making it ideal for industrial-scale metalworking and aerospace applications.

Pros: Offers superior longevity and cutting speed, reducing downtime and replacement frequency. Its resistance to heat and wear is unmatched, appealing to buyers in heavy manufacturing sectors in Europe and the Middle East.

Cons: The manufacturing complexity results in a higher price point, which might be a barrier for cost-sensitive buyers in South America and Africa. Additionally, ceramic alumina abrasives require specialized handling and storage to maintain their properties.

Application Impact: Ideal for heavy-duty grinding and finishing of hard metals. B2B buyers should ensure supplier compliance with international quality standards and consider total cost of ownership rather than upfront cost alone.

Garnet is a natural abrasive material favored for its eco-friendly profile and suitability for fine woodworking and finishing. It offers moderate hardness and good sharpness, with a natural ability to produce a smooth finish without deep scratches.

Pros: Renewable and biodegradable, garnet appeals to environmentally conscious buyers, especially in Europe where green procurement policies are increasingly influential. It is also relatively cost-effective and easy to source in certain regions.

Cons: Garnet has lower durability compared to synthetic abrasives and is less suitable for heavy metalworking. Its performance can be inconsistent due to natural variability, which requires careful supplier vetting.

Application Impact: Best for woodworking, finishing, and light sanding tasks. Buyers in Africa and South America should assess local availability and quality consistency, while European buyers may leverage garnet’s sustainability credentials for compliance with environmental standards.

| Material | Typical Use Case for sandpaper and abrasives | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Oxide | General purpose sanding on wood, metal, plastics | Durable and versatile with good heat resistance | Moderate wear on very hard materials | Low |

| Silicon Carbide | Precision finishing on glass, ceramics, non-ferrous metals | Superior cutting ability and thermal conductivity | Brittle, prone to fracturing under heavy pressure | Medium |

| Ceramic Alumina | Heavy-duty metal grinding and aerospace applications | Exceptional durability and self-sharpening | High cost and complex manufacturing | High |

| Garnet | Fine woodworking and eco-friendly finishing | Natural, renewable, and environmentally friendly | Lower durability and inconsistent quality | Low |

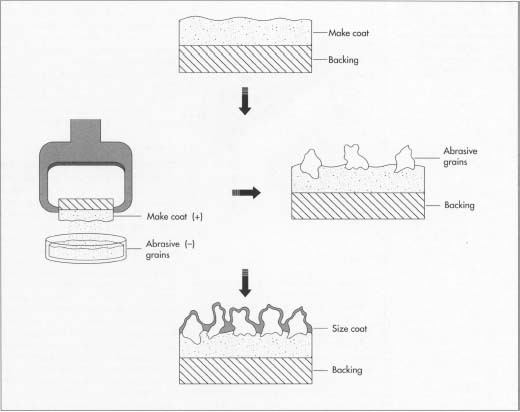

The production of sandpaper and abrasives involves a series of precise stages designed to ensure consistent product performance and durability. International B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, benefit from understanding these stages to evaluate supplier capabilities and product quality effectively.

The process begins with selecting high-quality raw materials:

- Backing Material: Typically paper, cloth, or polyester film, chosen for flexibility, strength, and application type.

- Abrasive Grains: Common types include aluminum oxide, silicon carbide, ceramic alumina, and garnet. The grain choice depends on intended use, such as metalworking or woodworking.

- Adhesives (Bonding Agents): Resins or glues that affix abrasive grains to backing; phenolic resins and latex are widely used.

Raw materials undergo conditioning to meet specifications, such as moisture content control for backing materials to prevent warping.

Key techniques for applying abrasive grains include:

- Electrostatic Coating: Abrasive grains are electrostatically charged and aligned vertically on the adhesive-coated backing for maximum cutting efficiency.

- Gravity Coating: Grains are sprinkled onto the adhesive surface, suitable for heavier grit sizes.

- Closed-Coat vs. Open-Coat: Closed-coat involves full surface coverage with grains for fine finishes; open-coat leaves gaps to reduce clogging in softer materials.

The coating is then cured under controlled temperature and humidity to solidify the adhesive bond.

Post-coating processes enhance usability and durability:

- Backing Treatment: Additional layers may be added for waterproofing or heat resistance.

- Calendering: The abrasive sheet passes through rollers to ensure uniform thickness and grain adhesion.

- Cutting and Packaging: Sheets, rolls, or discs are cut to customer specifications and packaged under protective conditions to maintain product integrity.

Robust quality control is essential to meet international standards and buyer expectations. The QA/QC framework for sandpaper and abrasives typically involves multiple checkpoints and adherence to recognized certifications.

Buyers should verify that suppliers hold valid certifications and can provide documentation upon request.

International buyers must adopt proactive measures to confirm supplier quality and compliance, especially when sourcing from diverse markets.

Illustrative Image (Source: Google Search)

For international B2B buyers, a thorough understanding of sandpaper and abrasives manufacturing and quality assurance processes is indispensable. Evaluating suppliers based on their material sourcing, coating techniques, assembly precision, and adherence to international quality standards helps ensure procurement of reliable, high-performance abrasives. Employing rigorous verification methods—such as audits, documentation review, and sample testing—further safeguards against quality risks, supporting successful long-term partnerships across Africa, South America, the Middle East, and Europe.

Understanding the cost and pricing dynamics of sandpaper and abrasives is crucial for international B2B buyers aiming to optimize procurement and ensure competitive margins. This analysis breaks down key cost components, price influencers, and strategic buyer considerations tailored for markets in Africa, South America, the Middle East, and Europe.

Prices for sandpaper and abrasives vary widely depending on product grade, volume, and supplier. Buyers should use supplier quotations as a baseline and perform due diligence, including sampling and testing, before finalizing procurement decisions.

This comprehensive approach equips international B2B buyers with the insight necessary to navigate complex pricing structures effectively, ensuring cost-efficient sourcing of sandpaper and abrasives tailored to regional market nuances.

Understanding the critical technical properties and trade terminology of sandpaper and abrasives is essential for international B2B buyers aiming to optimize procurement and ensure product suitability. This knowledge helps buyers from regions such as Africa, South America, the Middle East, and Europe make informed decisions, negotiate effectively, and align supplies with their production requirements.

Abrasive Material Type

The abrasive grit material (e.g., aluminum oxide, silicon carbide, zirconia alumina) determines the durability and suitability for specific applications. Aluminum oxide is common for wood and metal, while silicon carbide is sharper and ideal for glass or plastic. Selecting the right material affects performance and cost-efficiency.

Grit Size (Mesh)

Grit size indicates the coarseness or fineness of the abrasive particles, typically measured by a number (e.g., 40, 120, 400). Lower numbers mean coarser grit for heavy material removal, while higher numbers provide finer finishes. Accurate grit specification ensures the abrasive matches the required surface finish and processing speed.

Backing Material and Weight

The backing (paper, cloth, film) supports the abrasive grains and influences flexibility, strength, and durability. Cloth-backed abrasives are more robust and reusable, suitable for heavy-duty industrial use. Paper backing is common for light to medium tasks. Backing weight (expressed in grams per square meter) also affects tear resistance and longevity.

Bonding Agent

The bond holds abrasive grains onto the backing and can be resin, glue, or electrostatic coating. Resin bonds offer heat resistance and durability, critical for high-speed operations. Understanding bonding types helps buyers select abrasives that withstand their specific manufacturing conditions.

Tolerance and Dimensions

Thickness, width, and length tolerances must meet buyers’ machinery and process requirements. Precise dimensional control reduces waste and downtime. Buyers should confirm tolerance ranges to ensure compatibility with automated sanding equipment or manual use.

Coating Type and Density

Coating refers to how abrasive grains are distributed on the backing—open coat (grains spaced apart) prevents clogging on soft materials, while closed coat covers the surface fully for aggressive cutting. Choosing the right coating type enhances efficiency and extends abrasive life.

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing sandpaper or abrasives that are branded and sold by other companies. Buyers looking for private labeling or specialized product designs often engage OEMs to tailor products to their market needs.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in a single order. Understanding MOQ is crucial for budgeting and inventory planning, especially for buyers in emerging markets who may require smaller, flexible batches.

RFQ (Request for Quotation)

A formal inquiry sent by buyers to suppliers to obtain pricing, lead times, and terms. A well-prepared RFQ detailing technical specs and quantities expedites supplier responses and ensures accurate offers.

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) that define responsibilities for shipping, insurance, and customs clearance. Familiarity with Incoterms helps buyers negotiate costs and logistics, reducing risks in international transactions.

Shelf Life / Storage Conditions

Some abrasives, especially those with resin bonds, have recommended shelf lives and storage requirements to maintain performance. Buyers should clarify these terms to avoid receiving degraded products, particularly when importing to humid climates.

Lead Time

The period from order confirmation to delivery. Knowing typical lead times helps B2B buyers coordinate production schedules and manage customer commitments, especially when sourcing from overseas suppliers.

For international buyers, mastering these technical properties and trade terms enhances sourcing accuracy and supplier communication. It reduces procurement risks and ensures that sandpaper and abrasives meet operational demands across diverse industries and markets.

The global sandpaper and abrasives market is experiencing steady growth driven by expanding industrialization, automotive manufacturing, aerospace, and construction sectors. Key international buyers, particularly from regions such as Africa (e.g., Nigeria), South America, the Middle East, and Europe (e.g., Italy), are witnessing an increased demand for high-performance abrasives that deliver efficiency, durability, and precision. The rise of advanced manufacturing techniques like automation and robotics has escalated the need for abrasives that are compatible with automated sanding and finishing systems, pushing suppliers to innovate with enhanced product consistency and specialized grain technologies.

Sourcing trends reveal a growing preference for suppliers offering integrated solutions, including customized abrasives tailored to specific substrates and applications. Buyers are increasingly valuing shorter lead times and flexible order volumes to adapt to fluctuating project demands in emerging markets. Additionally, digital platforms and e-procurement channels are gaining traction, enabling buyers to compare specifications, certifications, and pricing transparently. For regions like the Middle East and Africa, local distribution partnerships and regional warehouses are becoming critical to mitigate logistical challenges and reduce supply chain disruptions.

Market dynamics also reflect a shift towards multi-functional abrasive products that combine grinding, polishing, and finishing capabilities to reduce operational steps and costs. This trend aligns with the demand for productivity enhancement and lean manufacturing practices prevalent in European and South American industrial environments. Furthermore, the growing urbanization and infrastructure projects in developing economies are boosting demand for cost-effective abrasives that maintain quality without premium pricing, urging suppliers to balance innovation with affordability.

Environmental sustainability is becoming a core consideration for B2B buyers in the sandpaper and abrasives sector. Abrasive manufacturing traditionally involves energy-intensive processes and generates particulate waste, making environmental impact a significant concern. Buyers from Europe and progressive markets in the Middle East are prioritizing suppliers who adopt eco-friendly manufacturing practices, such as using renewable energy, minimizing hazardous chemical use, and implementing waste recycling programs.

Ethical sourcing has emerged as a vital element in supplier evaluation. Buyers increasingly demand transparency in the supply chain, ensuring raw materials like mineral grains and resins are sourced responsibly, without contributing to environmental degradation or social exploitation. Certifications such as ISO 14001 (Environmental Management), REACH compliance (chemical safety in the EU), and OEKO-TEX (for chemical safety in materials) are becoming baseline requirements for suppliers targeting these markets.

The rise of “green abrasives” — products made with biodegradable binders, recycled materials, or low-emission production methods — is a notable trend. These products appeal to companies aiming to reduce their carbon footprint and comply with tightening environmental regulations. For example, water-based adhesives and non-toxic abrasive grains help reduce volatile organic compound (VOC) emissions during use and disposal. African and South American buyers are progressively integrating sustainability criteria into procurement decisions, recognizing that long-term cost savings and regulatory compliance outweigh initial price premiums.

The sandpaper and abrasives industry has evolved from rudimentary natural abrasives such as sand and sharkskin used in ancient times to highly engineered synthetic materials today. The industrial revolution marked a turning point with the invention of coated abrasives in the 19th century, enabling mass production and standardized quality. Advances in abrasive grain technology, including aluminum oxide and silicon carbide, expanded applications across metalworking, woodworking, and automotive refinishing.

In recent decades, the integration of precision engineering and material science has transformed abrasives into critical components for high-tech manufacturing sectors, such as aerospace and electronics. This evolution reflects the sector’s shift from simple surface finishing to complex material removal and polishing tasks that require tailored abrasive solutions. Understanding this history provides B2B buyers insight into product capabilities and innovation trajectories, helping them align sourcing strategies with evolving industrial needs.

How can I effectively vet sandpaper and abrasives suppliers internationally?

Start by verifying the supplier’s business credentials, including licenses and export permits relevant to their country. Request product samples to assess quality firsthand. Check for customer reviews or references, especially from buyers in your region (Africa, South America, Middle East, Europe). Ensure the supplier complies with international quality standards such as ISO certifications. Utilize platforms with verified suppliers and consider conducting factory audits or third-party inspections to minimize risks before committing to large orders.

Is it possible to customize sandpaper specifications to fit unique industrial needs?

Yes, many manufacturers offer customization options including grit size, backing material, abrasive type, and sheet dimensions. When negotiating, clearly communicate your technical requirements and intended applications. Custom orders may have higher minimum order quantities (MOQs) and longer lead times. Confirm the supplier’s ability to produce samples or prototypes for approval before mass production. Tailored abrasives can improve operational efficiency and product quality, especially for specialized industries like automotive or aerospace.

What are typical minimum order quantities (MOQs) and lead times for international sandpaper orders?

MOQs vary widely depending on the supplier and product complexity, typically ranging from a few hundred to several thousand units. Lead times depend on order size, customization, and shipping method, often between 3 to 8 weeks. For buyers in Africa, South America, and the Middle East, account for additional transit and customs clearance time. Negotiate flexible MOQs if possible, especially for first orders, to test product quality. Always confirm lead times upfront and factor them into your supply chain planning to avoid production delays.

Which payment terms and methods are safest for international B2B transactions in abrasives?

Secure payment methods such as letters of credit (LC), escrow services, or verified payment platforms (e.g., PayPal Business, Trade Assurance on Alibaba) protect both parties. Advance payment of 30% to 50% is common, with the balance paid upon shipment or delivery. Always ensure clear contractual terms specifying payment schedules, product specifications, and penalties for non-compliance. For buyers in regions with currency volatility, negotiate payment in stable currencies (USD, EUR) to mitigate exchange risks.

What quality assurance (QA) certifications should I look for when sourcing sandpaper?

Look for internationally recognized certifications such as ISO 9001 (quality management), REACH compliance (chemical safety), and RoHS (restriction of hazardous substances). Certifications related to abrasive grain quality or backing materials can also indicate product reliability. Request batch test reports and material safety data sheets (MSDS) to verify compliance. For industries like automotive or aerospace, additional certifications or traceability documentation may be required. QA certifications provide confidence in product consistency and regulatory compliance.

How can I manage logistics and shipping challenges for sandpaper imports?

Choose suppliers experienced with international shipping and customs documentation. Opt for Incoterms that clearly define responsibilities, such as FOB (Free on Board) or CIF (Cost, Insurance, Freight). For bulk orders, sea freight is cost-effective but slower; air freight offers speed but at higher cost. Coordinate with reliable freight forwarders familiar with your country’s import regulations (e.g., Nigeria, Italy). Plan for customs duties, taxes, and possible delays. Consolidate shipments when possible to reduce costs and simplify handling.

What steps should I take if I encounter product quality disputes with my sandpaper supplier?

Immediately document all issues with detailed photographs and descriptions. Review your purchase contract and agreed quality standards. Notify the supplier promptly and provide evidence to support your claim. Many suppliers offer replacement, refund, or credit policies for defective goods. If direct negotiation fails, consider mediation or arbitration clauses included in your contract. Engage third-party inspection services for impartial verification. Maintaining clear communication and thorough documentation is key to resolving disputes efficiently.

How can I ensure compliance with environmental and safety regulations when importing abrasives?

Verify that the abrasives comply with local and international environmental laws, such as restrictions on hazardous substances (e.g., lead, chromium). Request environmental compliance certificates and MSDS from your supplier. For regions with strict import regulations like the EU, confirm REACH and RoHS certifications. Implement proper handling and disposal procedures in your operations to meet workplace safety standards. Staying compliant avoids legal penalties and enhances your reputation as a responsible B2B buyer.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing in the sandpaper and abrasives sector is essential for international B2B buyers aiming to optimize quality, cost-efficiency, and supply chain resilience. Key takeaways emphasize the importance of partnering with reliable suppliers who offer certifications and demonstrate sustainable manufacturing practices. Buyers from regions such as Africa, South America, the Middle East, and Europe should prioritize suppliers that provide customizable abrasive solutions tailored to their specific industrial needs and regulatory environments.

Illustrative Image (Source: Google Search)

Key strategic considerations include:

Looking ahead, the abrasives market is poised for growth driven by rising industrialization and demand for eco-friendly products. Buyers are encouraged to adopt a proactive sourcing approach—focusing on long-term partnerships, continuous market intelligence, and flexible procurement strategies. By doing so, businesses in Italy, Nigeria, and beyond can secure competitive advantages and sustainable supply chains in a rapidly evolving global marketplace.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina