Guide to Sic Substrate Manufacturers

In today’s rapidly evolving technological landscape, Silicon Carbide (SiC) substrates are emerging as a critical component across industries such as power electronics, automotive, aerospace, and telecommunications. Their exceptional thermal conductivity, high breakdown voltage, and durability make them indispensable for high-performance, energy-efficient applications. For international B2B buyers—from Africa, South America, the Middle East, and Europe—sourcing reliable SiC substrate manufacturers is vital to maintaining competitive advantage and ensuring product quality.

Illustrative Image (Source: Google Search)

This comprehensive guide is designed to empower you with the insights needed to navigate the complex global SiC substrate market effectively. It covers the spectrum of manufacturers, including emerging and established players, and delves into key factors such as material quality, manufacturing processes, quality control standards, and supplier evaluations. You will gain clarity on cost structures, supply chain considerations, and market dynamics, enabling you to make strategic sourcing decisions.

By understanding these critical aspects, B2B buyers can mitigate risks associated with supply disruptions, ensure compliance with international standards, and optimize procurement strategies tailored to regional needs. Whether you’re sourcing from Europe, exploring suppliers in Australia, or establishing partnerships in Africa, South America, or the Middle East, this guide offers actionable insights to streamline your procurement process and foster long-term supplier relationships. Empowered with this knowledge, you can confidently navigate the global SiC substrate landscape and secure the quality and reliability your business demands.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Silicon Carbide (SiC) Substrates | High purity, uniform crystal structure, commonly used for electronic devices | Power electronics, RF components, sensors | Pros: Widely available, proven reliability. Cons: Limited customization options. |

| Customized SiC Substrates | Tailored doping levels, specific surface finishes, unique geometries | Specialized high-power modules, research | Pros: Optimized for niche applications, improved performance. Cons: Higher cost, longer lead times. |

| Thick-Film SiC Substrates | Thicker layers with embedded conductive or insulating coatings | High-temperature sensors, power modules | Pros: Durable under extreme conditions, versatile integration. Cons: Potentially higher manufacturing complexity. |

| Embedded SiC Substrates | Incorporate additional materials or structures within SiC layers | Advanced high-frequency, microwave devices | Pros: Enhanced electrical properties, better thermal management. Cons: More complex fabrication, limited suppliers. |

| Flexible or Thin-Film SiC | Thin, flexible layers or films, often on flexible substrates | Wearable electronics, flexible sensors | Pros: Lightweight, adaptable to various form factors. Cons: Fragility, limited mechanical robustness. |

This is the most common type of SiC substrate, characterized by high purity and a uniform crystal lattice, making it ideal for mainstream power electronics and RF applications. They are typically produced in standardized sizes and doping levels, ensuring consistent performance. For B2B buyers, these substrates are generally readily available from multiple manufacturers, offering a reliable supply chain. However, their limited scope for customization means they may not meet highly specialized or innovative design requirements. Cost-wise, they tend to be more economical, especially when purchased in bulk, but buyers should verify quality standards and supplier certifications.

Manufacturers offering customized SiC substrates tailor doping concentrations, surface finishes, and geometries to meet specific application needs. These are especially suitable for high-performance power modules, research prototypes, or niche industrial uses where standard substrates fall short. For buyers, customization can mean improved device efficiency, thermal performance, or integration flexibility. The trade-offs include longer lead times and higher costs due to specialized manufacturing processes. Engaging with suppliers experienced in customization and ensuring clear specifications upfront are critical for successful procurement.

Thick-film SiC substrates incorporate layers of conductive or insulating coatings, allowing for integrated electronic functions directly on the substrate. These are favored in high-temperature sensors, power modules, and harsh environment electronics. Their durability under extreme conditions makes them attractive for industrial applications in regions with challenging climates. Buyers should consider the complexity of manufacturing and potential higher prices, but the enhanced performance and longevity can offset initial costs. Selecting suppliers with proven thick-film processing capabilities ensures reliability and consistent quality.

This variation involves embedding additional materials or structures within the SiC layers, such as metallic interconnects or dielectric layers, to improve electrical performance or thermal management. Embedded SiC is suitable for advanced high-frequency, microwave, or optoelectronic devices where performance gains justify the complexity. These substrates often require specialized fabrication techniques, limiting the number of capable suppliers. For B2B buyers, evaluating supplier expertise, quality control, and lead times is vital, as embedded SiC can significantly enhance device capabilities but at a premium.

Flexible or thin-film SiC substrates are designed for applications requiring lightweight, adaptable materials, such as wearable electronics or flexible sensors. Their thin profile allows integration into non-traditional form factors, opening new markets. However, their mechanical fragility and limited mechanical robustness make them less suitable for high-stress environments. Buyers should assess supplier experience in producing high-quality thin films, as consistency and durability are critical. Cost considerations include potential higher prices due to advanced fabrication processes, but the benefits in flexibility and weight reduction can be substantial for innovative applications.

| Industry/Sector | Specific Application of sic substrate manufacturers | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics & Renewable Energy | High-power semiconductor devices, such as IGBTs and diodes | Enhanced thermal management, increased efficiency, and device longevity | Reliability of supply, certification standards, and customization options |

| Automotive & Electric Vehicles | Electric motor inverters, charging stations components | Improved thermal conductivity, compact design, and durability | Quality standards, scalability, and regional compliance requirements |

| Oil & Gas & Petrochemical | High-pressure, high-temperature sensors, and power modules | Superior thermal stability, chemical resistance, and operational reliability | Material compatibility, API or industry-specific certifications |

| Aerospace & Defense | Radar systems, satellite components, and high-frequency modules | High thermal conductivity, radiation resistance, and miniaturization | Precision manufacturing, material purity, and adherence to strict standards |

| Industrial Power & Automation | Power modules, industrial drives, and sensor interfaces | Efficient heat dissipation, robustness, and operational stability | Long-term supply stability, environmental certifications, and customization capabilities |

SIC substrates are critical in high-power semiconductor devices such as Insulated Gate Bipolar Transistors (IGBTs) and diodes used in renewable energy systems like solar inverters and wind turbine controllers. These substrates enable superior thermal management, allowing devices to operate at higher voltages and temperatures without degradation. For international B2B buyers from regions like Africa, South America, and the Middle East, sourcing high-quality SIC substrates ensures energy systems are more efficient and durable, reducing maintenance costs and downtime. Buyers should prioritize suppliers with proven certifications and customizable options to meet specific voltage and thermal requirements.

In the rapidly expanding EV market, SIC substrates are used in electric motor inverters and fast-charging stations. They provide excellent thermal conductivity, enabling compact, lightweight, and highly efficient power modules. For European and Australian automotive manufacturers or component suppliers, sourcing reliable SIC substrates translates into improved vehicle performance and longer lifespan of critical power electronics. International buyers must assess supplier quality, scalability for mass production, and regional compliance to ensure seamless integration into their manufacturing processes.

SIC substrates are employed in high-pressure, high-temperature sensors, and power modules used in challenging environments like offshore platforms and refineries. Their chemical resistance and thermal stability help prevent failures and ensure continuous operation under extreme conditions. For African and Middle Eastern oil and gas companies, sourcing SIC substrates from reputable manufacturers guarantees operational reliability, safety, and compliance with industry standards such as API certifications. Buyers should evaluate material compatibility and supplier certifications to mitigate risks associated with harsh operational environments.

In aerospace and defense sectors, SIC substrates are used in radar systems, satellite components, and high-frequency communication modules. Their high thermal conductivity and radiation resistance support miniaturization and performance in space-constrained environments. European and Middle Eastern defense contractors require suppliers capable of providing precision-engineered substrates with strict adherence to aerospace standards. Long-term supply stability, material purity, and compliance with international aerospace certifications are crucial considerations for B2B buyers.

Industrial automation relies on SIC substrates for power modules, industrial drives, and sensor interfaces that demand high thermal efficiency and operational robustness. These substrates help dissipate heat effectively, enabling continuous operation in demanding industrial environments. Buyers from South America and Africa benefit from sourcing suppliers with scalable manufacturing capabilities, environmental certifications, and customization options to meet specific industrial standards. Ensuring supply chain resilience and technical support is vital for maintaining production uptime.

This strategic application-focused approach helps international B2B buyers identify the most relevant SIC substrate solutions tailored to their sector-specific needs, ensuring optimal performance, compliance, and supply chain stability across diverse regions.

When selecting materials for SIC (Silicon Carbide) substrates, international B2B buyers must consider a range of properties that influence performance, durability, and compliance with regional standards. Here, we analyze four common materials used in SIC substrate manufacturing: Silicon Carbide itself, Alumina (Aluminum Oxide), Silicon, and Silicon Nitride.

Key Properties:

Silicon Carbide is renowned for its exceptional thermal conductivity, high-temperature stability (up to 1600°C), and outstanding mechanical strength. It also exhibits excellent chemical inertness and corrosion resistance, making it ideal for harsh environments. Its electrical properties vary depending on doping but generally support high-power applications.

Pros & Cons:

The primary advantage of SiC is its superior performance in high-temperature, high-voltage, and high-frequency applications. Its robustness ensures long-term durability, especially in corrosive media. However, manufacturing SiC substrates involves complex processes like chemical vapor deposition (CVD), which can be costly and time-consuming, leading to higher production costs.

Impact on Application:

SiC substrates are suitable for power electronics, RF devices, and high-temperature sensors. Their chemical inertness makes them compatible with aggressive media, including certain acids and alkalis, but they require precise handling during fabrication to prevent defects.

International Buyer Considerations:

Buyers from Africa, South America, the Middle East, and Europe should verify compliance with regional standards such as ASTM, DIN, or JIS. For regions with strict environmental regulations (e.g., REACH in Europe), sourcing from manufacturers with certified sustainable practices is advisable. Cost considerations are significant, but the durability and performance benefits often justify the premium price.

Key Properties:

Alumina offers good thermal stability (up to 1700°C), excellent electrical insulation, and high corrosion resistance. It is relatively easy to process into various shapes and sizes, with a broad range of purity grades available.

Pros & Cons:

Its affordability and widespread manufacturing base make Alumina an attractive choice for many applications. It provides reliable performance in electrical insulation and corrosion resistance. However, Alumina is more brittle than SiC, which can impact longevity in mechanically demanding environments. Its thermal conductivity is lower than SiC, limiting its use in high-power, high-frequency applications.

Impact on Application:

Alumina is often used in insulators, substrates for electronic devices, and chemical reactors. Its inertness makes it suitable for media with moderate corrosiveness, but it may not withstand highly abrasive or extreme temperature media as well as SiC.

International Buyer Considerations:

Buyers should ensure that Alumina products meet regional standards like ASTM or DIN. For regions with import tariffs or quality certification requirements, sourcing from established manufacturers with ISO or equivalent certifications is crucial. Cost-wise, Alumina offers a balanced option, especially for applications where extreme conditions are not anticipated.

Key Properties:

Silicon is primarily used in semiconductor applications, with good thermal conductivity and moderate electrical properties. It is less resistant to corrosion compared to SiC or Alumina and can degrade in aggressive media unless properly coated or protected.

Pros & Cons:

Silicon is generally less expensive and easier to process, making it suitable for mass production. Its limitations include lower thermal stability and corrosion resistance, which restrict its use in high-temperature or chemically aggressive environments. Silicon substrates are also more susceptible to mechanical damage.

Impact on Application:

Silicon is ideal for electronic devices, sensors, and low-power applications. For media compatibility, it requires protective coatings or encapsulation when exposed to corrosive or high-temperature media.

International Buyer Considerations:

Buyers should verify compliance with regional standards, especially for high-purity Silicon used in electronics. Importing from regions with established Silicon manufacturing hubs (e.g., Europe, Australia) can ensure quality. Cost advantages are significant, but application-specific limitations must be carefully evaluated.

Key Properties:

Silicon Nitride offers high thermal stability (up to 1800°C), excellent mechanical strength, and good chemical resistance. It is particularly valued for its toughness and resistance to thermal shock.

Pros & Cons:

Its durability in extreme environments makes it suitable for demanding applications. However, manufacturing Si₃N₄ is complex and costly, often resulting in higher prices. Its processing requires specialized equipment, and availability may be limited depending on the region.

Impact on Application:

Silicon Nitride is used in high-performance ceramics, cutting tools, and advanced electronic substrates. Its inertness and stability make it compatible with aggressive media, but the cost may be prohibitive for some applications.

International Buyer Considerations:

Buyers should ensure suppliers meet international quality standards such as ASTM or ISO. For regions like Europe and Australia, sourcing from certified manufacturers ensures compliance and quality. Its higher cost may be justified in high-performance or critical applications.

| Material | Typical Use Case for SIC Substrate Manufacturers | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide (SiC) | High-power electronics, RF devices, high-temperature sensors | Exceptional thermal, mechanical, and chemical stability | High manufacturing complexity and cost | High |

| Alumina (Al₂O₃) | Electronic insulators, chemical reactors, general substrates | Cost-effective, good electrical insulation | Brittle, lower thermal conductivity | Medium |

| Silicon (Si) | Semiconductor substrates, sensors, low-power electronics | Low cost, easy to process | Less resistant to corrosion and high temperatures | Low |

| Silicon Nitride (Si₃N₄) | High-performance ceramics, cutting tools, advanced electronics | High thermal stability, toughness | Expensive, complex manufacturing | High |

This comprehensive analysis aids international B2B buyers in making informed decisions aligned with their specific application requirements, regional standards, and budget constraints. Prioritizing material properties, compliance, and cost-effectiveness ensures optimal sourcing strategies in the competitive SIC substrate market.

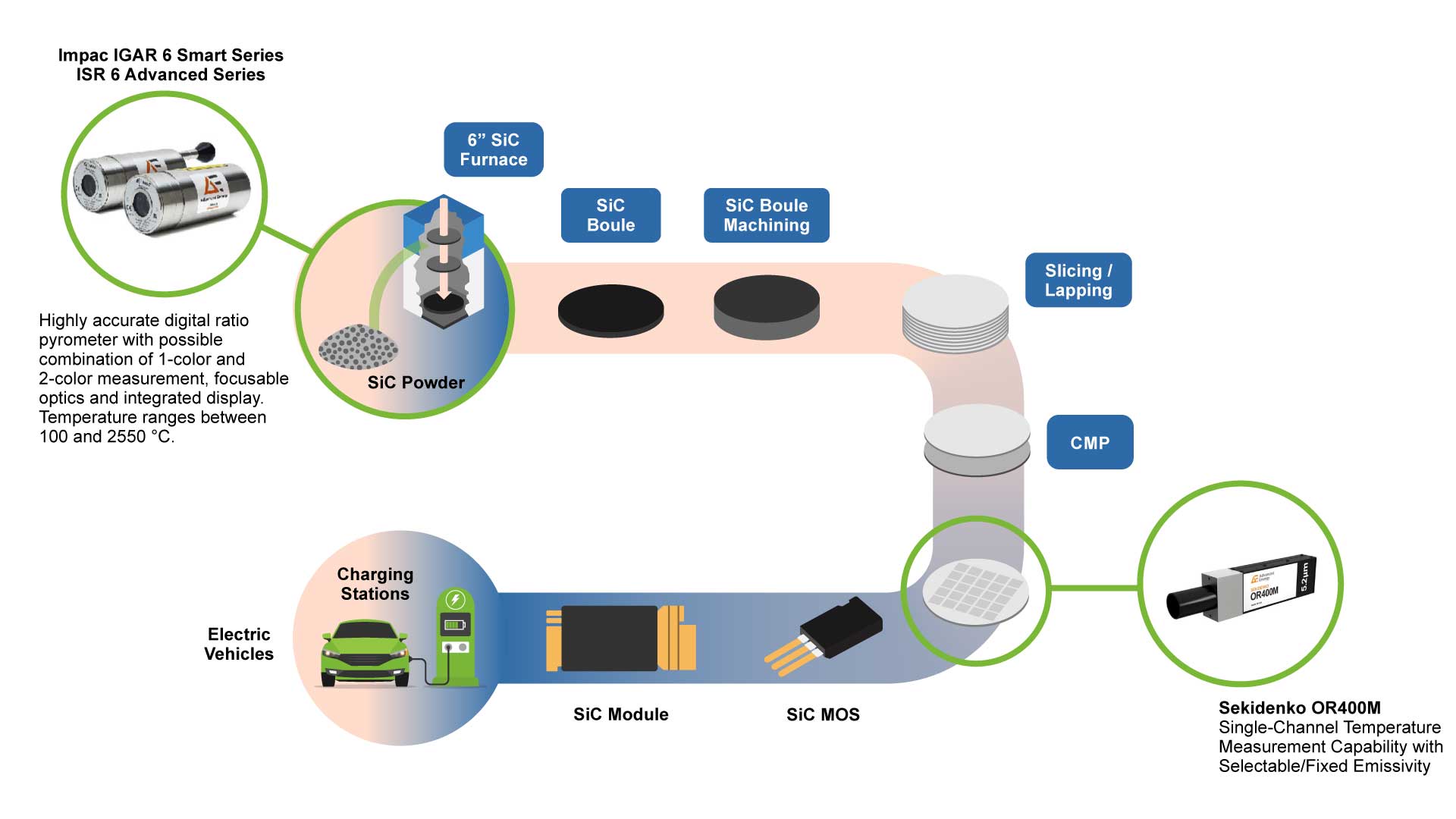

The production of silicon carbide (SiC) substrates involves a complex series of high-precision manufacturing stages designed to ensure optimal material properties and substrate performance. Understanding these stages is crucial for B2B buyers seeking consistent quality and reliable supply chains.

1. Raw Material Preparation

Manufacturers typically source high-purity silica (SiO₂) and carbon sources, such as petroleum coke or graphite. These raw materials are subjected to rigorous quality checks to ensure they meet industry standards for purity and consistency. Advanced beneficiation techniques, including flotation and chemical purification, are employed to minimize impurities that could affect substrate performance.

2. Sintering and Crystal Growth

The core of SiC substrate manufacturing is the crystal growth process, often utilizing the Physical Vapor Transport (PVT) or Chemical Vapor Deposition (CVD) methods. In PVT, high-temperature furnaces facilitate the sublimation of SiC powder, which then recondenses onto seed crystals, forming large, high-quality boules. CVD involves depositing SiC layers onto substrates in a controlled gaseous environment, enabling precise control over crystal quality and doping levels.

3. Forming and Shaping

Once the boules are grown, they undergo slicing using advanced diamond saws to produce wafers of specified thicknesses. These wafers are then polished to achieve atomically flat surfaces, critical for electronic applications. Additional shaping processes, such as etching or grinding, are performed to meet specific customer requirements, including edge profiling and thickness uniformity.

4. Assembly and Dicing

For certain applications, wafers are mounted onto carriers or diced into smaller chips. This process involves cleanroom environments to prevent contamination. Laser dicing or mechanical sawing is employed to cut wafers into individual units, followed by cleaning and inspection to ensure no micro-cracks or surface defects are introduced during processing.

5. Finishing and Coating

Final steps include polishing to achieve optical-grade surfaces and applying protective coatings if necessary. Some manufacturers add surface passivation layers or anti-reflective coatings to enhance substrate performance in specific electronic or optoelectronic applications.

Robust QC protocols are vital for ensuring that SiC substrates meet international standards and specific industry requirements. B2B buyers should scrutinize QC measures at multiple production stages to guarantee reliability and performance.

1. International Standards Compliance

Most reputable SiC substrate manufacturers adhere to ISO 9001 Quality Management Systems, which emphasize process consistency, traceability, and continuous improvement. Additional certifications such as ISO 14001 (Environmental Management) or industry-specific standards like CE marking (for European markets) or API standards (for oil & gas applications) may also be relevant.

2. Industry-Specific Certifications and Testing

Manufacturers targeting high-reliability sectors—such as aerospace, automotive, or power electronics—often pursue certifications like AEC-Q101 or MIL-STD-883, indicating rigorous testing for thermal stability, mechanical strength, and electrical performance. These certifications provide B2B buyers with confidence in the substrate’s suitability for demanding environments.

3. QC Checkpoints and Testing Regimes

- Incoming Quality Control (IQC): Raw materials are tested upon receipt for purity, particle size, and impurity levels using techniques like inductively coupled plasma mass spectrometry (ICP-MS) and X-ray fluorescence (XRF).

- In-Process Quality Control (IPQC): During crystal growth and wafer processing, parameters such as temperature uniformity, growth rate, and doping levels are monitored through real-time sensors and non-destructive testing. Optical microscopy and scanning electron microscopy (SEM) are used for surface and defect inspections.

- Final Quality Control (FQC): Completed wafers undergo comprehensive testing, including surface roughness measurements (via atomic force microscopy), thickness uniformity assessments, and electrical testing (e.g., breakdown voltage, resistivity). Non-destructive testing methods, such as infrared (IR) imaging, detect internal defects or micro-cracks.

4. Common Testing Methods

- Surface Roughness and Flatness: Atomic force microscopy (AFM) and interferometry.

- Electrical Properties: Hall effect measurements, IV characteristics, and breakdown voltage testing.

- Structural Integrity: X-ray diffraction (XRD) for crystal quality, and ultrasonic testing for internal flaws.

- Contamination Checks: Particle counting and residual gas analysis.

For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, verifying a supplier’s QC processes is essential to mitigate risks and ensure product consistency.

1. Conduct Supplier Audits

On-site audits allow buyers to evaluate manufacturing facilities, review QC documentation, and observe testing procedures firsthand. Prioritize suppliers with ISO 9001 certification, as this indicates a structured approach to quality management.

2. Review Certification Documentation and Test Reports

Request detailed certification papers, test reports, and compliance statements. Cross-reference these documents with international standards and industry-specific requirements. For critical applications, consider third-party validation or certification from recognized laboratories.

3. Engage Third-Party Inspection and Testing Services

Employ independent inspection agencies such as SGS, TUV, or Bureau Veritas to conduct pre-shipment inspections and verify QC claims. These inspections can include sampling, testing, and detailed reporting on product conformity.

4. Establish Clear Quality Agreements

Define explicit quality criteria, testing protocols, and acceptance criteria within contractual agreements. Include provisions for batch tracing, non-conformance handling, and corrective actions.

5. Monitor Continuous Quality Performance

Implement ongoing communication, quality scorecards, and periodic audits to maintain supply chain integrity. For high-value or mission-critical components, consider establishing long-term partnerships with vendors demonstrating consistent quality.

Africa and South America: Suppliers may vary significantly in technological maturity. Prioritize manufacturers with international certifications and proven export experience. Consider engaging third-party inspection services early in the procurement process to verify QC claims.

Middle East: Due to geopolitical factors, verify the legal and logistical stability of suppliers. Ensure compliance with local and international export regulations, and request comprehensive QC documentation to mitigate risks.

Europe (e.g., Poland): European manufacturers often adhere to stringent standards and possess advanced testing facilities. Leverage existing trade agreements, and request detailed compliance certifications aligned with European directives (e.g., REACH, RoHS).

Australia: Suppliers are typically well-regulated and certified. Focus on verifying traceability, environmental standards, and adherence to specific industry certifications relevant to high-reliability sectors.

Achieving confidence in SiC substrate quality requires a holistic approach that combines understanding manufacturing processes, rigorous QC evaluation, and verification through independent audits and testing. By aligning these practices with international standards and regional considerations, buyers from Africa, South America, the Middle East, and Europe can mitigate risks, ensure product reliability, and establish resilient supply chains for advanced semiconductor applications.

For international buyers, grasping the fundamental components of SIC (Silicon Carbide) substrate pricing is crucial for effective sourcing. The primary cost drivers include raw materials, labor, manufacturing overheads, tooling, quality control, logistics, and desired profit margins.

Illustrative Image (Source: Google Search)

Materials: The cost of high-purity silicon carbide raw materials significantly impacts the overall price. Variations in raw material quality, supplier location, and market prices can cause fluctuations. Sourcing from regions with stable supply chains and competitive raw material costs—such as certain Asian countries—may offer advantages.

Labor and Manufacturing Overheads: Labor costs vary markedly between regions. For example, manufacturers in Eastern Europe or Asia often have lower labor expenses compared to Europe or Australia, influencing unit costs. Overheads related to factory operations, energy, and maintenance also contribute substantially to the final price.

Tooling and Setup: Initial tooling costs are generally amortized over the production volume. High customization or complex specifications increase tooling expenses, which can significantly affect the unit price, especially at lower volumes.

Quality Control and Certifications: Stringent quality standards and certifications (e.g., ISO, ASTM, military-grade) elevate manufacturing costs but are often necessary for high-reliability applications. Buyers should weigh these costs against the benefits of assured performance and compliance.

Logistics and Incoterms: Shipping costs depend on distance, transportation mode, and Incoterms (e.g., FOB, CIF). International buyers from Africa, South America, or remote parts of Europe and Australia should factor in customs, duties, and freight variability. Bulk shipments typically reduce per-unit logistics costs.

Margins: Manufacturers incorporate profit margins based on market positioning, volume commitments, and competitive landscape. High-volume buyers usually negotiate better margins, but premium pricing may apply for specialized or certified substrates.

Several factors can sway the final price:

Order Volume and MOQ: Larger orders and higher MOQs generally unlock economies of scale, lowering per-unit costs. Buyers should aim to negotiate volume discounts, especially for long-term partnerships.

Specifications and Customization: Customized substrates with specific dimensions, doping levels, or surface finishes command premium prices. Clear communication of specifications upfront can prevent costly rework or adjustments.

Material Quality and Certifications: Higher purity levels, advanced defect tolerances, and industry certifications add to costs but are essential for critical applications like aerospace or high-power electronics.

Supplier Location and Capabilities: Established manufacturers in regions with mature supply chains and advanced infrastructure often charge higher prices but may offer better consistency and support. Conversely, emerging markets might provide cost advantages but require thorough vetting.

Incoterms and Delivery Terms: FOB (Free on Board) prices exclude freight and insurance, shifting logistics costs to the buyer, whereas CIF (Cost, Insurance, and Freight) includes these. Understanding these terms helps compare offers accurately.

Negotiate for Volume and Long-term Contracts: Emphasize volume commitments to secure better pricing. Long-term relationships can yield preferential terms and priority production schedules.

Conduct Total Cost of Ownership (TCO) Analysis: Beyond unit price, consider logistics, customs, quality assurance, and potential rework costs. A slightly higher initial price may reduce overall expenses and risks.

Leverage Regional Manufacturing Advantages: Buyers from Africa, South America, or remote European and Australian markets should explore local or regional suppliers to minimize logistics costs and lead times, but ensure supplier reliability and quality standards.

Understand Pricing Nuances: Prices can vary widely based on specifications, certifications, and market conditions. Always request detailed quotations breaking down each component for accurate comparison.

Factor in Currency Fluctuations and Payment Terms: Exchange rate volatility and flexible payment options can influence the final cost. Negotiating favorable terms can mitigate financial risks.

Indicative prices for SIC substrates can range broadly, from approximately $50 to $200 per square inch depending on specifications, volume, and supplier location. These figures serve as general benchmarks; actual prices may vary based on market conditions, supplier negotiations, and specific technical requirements. Engaging multiple suppliers and requesting detailed quotes is essential for accurate cost assessments.

By understanding these cost components and influencing factors, international B2B buyers can make more informed sourcing decisions, optimize their procurement strategies, and achieve better value in their SIC substrate investments.

1. Material Grade and Purity

The grade and purity of silicon carbide (SiC) directly impact its electrical, thermal, and mechanical performance. Higher purity grades (e.g., 4N or 5N, indicating 99.99% or higher purity) are essential for high-frequency electronics and power devices. B2B buyers should specify required purity levels to ensure optimal device reliability and performance, especially in demanding applications like aerospace or high-power industrial systems.

2. Thickness Tolerance

Precision in substrate thickness (e.g., ±5 microns) is vital for manufacturing consistency and device performance. Tight tolerances reduce the need for additional processing and improve yield rates. Buyers from regions like Europe or Australia should verify tolerance standards to match their production specifications, preventing costly rework or delays.

3. Surface Finish and Flatness

Surface quality, including parameters like surface roughness (Ra value) and flatness, influences device fabrication success. A smoother surface (e.g., Ra < 5 nm) minimizes defects and enhances bonding quality. Ensuring specified surface characteristics helps B2B buyers avoid failures during subsequent manufacturing steps.

4. Thermal Conductivity

High thermal conductivity (e.g., >150 W/m·K) allows efficient heat dissipation, critical in power electronics and high-temperature applications. Suppliers should provide detailed thermal properties to assist buyers in selecting SiC substrates that meet their thermal management needs, especially in regions with high ambient temperatures like the Middle East.

5. Mechanical Strength and Dicing Tolerance

Mechanical robustness, including flexural strength and dicing tolerance, affects handling and wafer slicing processes. Understanding these properties helps prevent breakage and ensures high-quality yields during manufacturing. Regions with advanced fabs, such as Europe or Australia, particularly value substrates that can withstand rigorous processing.

6. Coating and Doping Capabilities

Some applications require specific surface coatings or doping levels to tailor electrical properties. Clear communication of available doping types (n-type, p-type) and coating options allows buyers to select substrates aligned with their device design, reducing customization lead times.

1. OEM (Original Equipment Manufacturer)

Refers to the company that designs and manufactures end products, such as electronic devices or industrial machinery. Understanding OEM requirements helps buyers specify precise technical standards and volume expectations, facilitating tailored supply agreements.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell per order. Recognizing MOQ constraints helps buyers plan procurement strategies, negotiate better terms, and avoid overstocking, especially when sourcing from smaller or specialized SiC manufacturers.

3. RFQ (Request for Quotation)

A formal request from buyers for price and lead time estimates for specific product specifications. Submitting clear RFQs with detailed technical requirements streamlines supplier responses and accelerates procurement decisions.

4. Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) defining responsibilities for shipping, insurance, and customs duties. Familiarity with Incoterms ensures clarity in negotiations, minimizes misunderstandings, and helps buyers from diverse regions like Africa or South America manage logistics costs effectively.

5. Lead Time

The period from order confirmation to product delivery. Critical for planning production schedules, especially in industries with tight deadlines. Buyers should confirm lead times upfront to synchronize supply chains and avoid production delays.

6. Certification and Compliance Standards

References to standards such as ISO, ASTM, or region-specific certifications (e.g., CE, RoHS). Ensuring suppliers meet these standards guarantees product quality, safety, and regulatory compliance, which is essential for international trade.

By understanding these key technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed purchasing decisions, negotiate effectively, and establish reliable supply chains for high-quality SiC substrates. Clear technical specifications coupled with industry-standard terminology foster transparency and efficiency in global sourcing efforts.

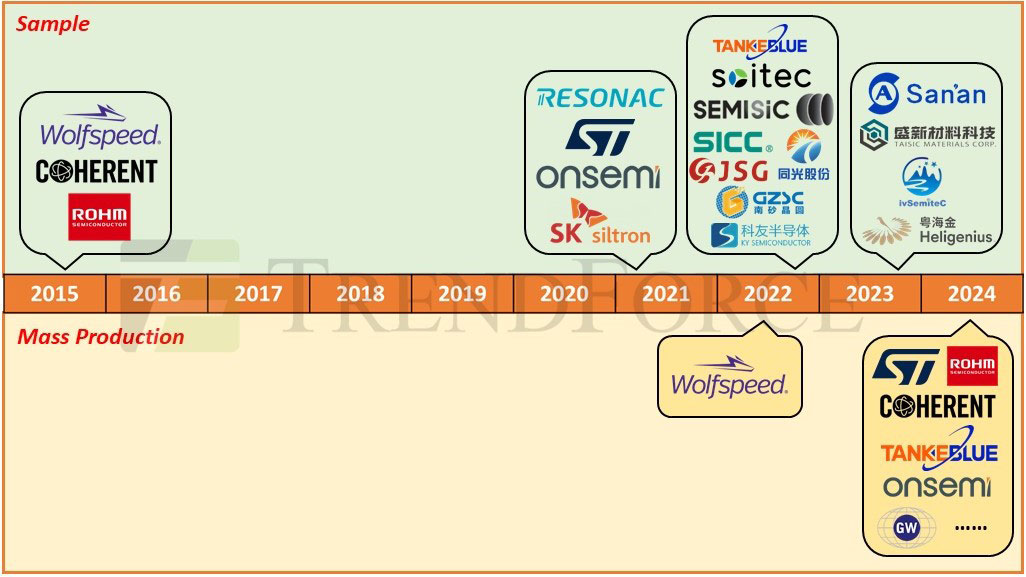

The global SIC (Silicon Carbide) substrate market is experiencing robust growth driven by advancements in power electronics, electric vehicles (EVs), renewable energy infrastructure, and high-frequency communication systems. Key regions such as North America, Europe, and Asia-Pacific dominate production and consumption, yet emerging markets like Africa, South America, the Middle East, and certain European countries (e.g., Poland) are increasingly seeking reliable supply chains and innovative sourcing options.

International B2B buyers from Africa and South America are focusing on diversifying sourcing strategies to mitigate geopolitical risks and supply chain disruptions. These regions are also witnessing a rise in local manufacturing initiatives, often supported by government incentives aimed at developing high-tech industries. The Middle East, with its strategic investments in energy and technology sectors, is emerging as a significant hub for SIC substrate demand, especially for high-performance applications in aerospace and defense.

Emerging sourcing trends include the shift toward vertically integrated supply chains, where buyers prefer manufacturers with in-house capabilities to ensure quality and timely delivery. Digital procurement platforms are gaining traction, providing greater transparency and streamlined sourcing processes. Additionally, there’s a growing emphasis on quality certifications such as ISO 9001, ISO 14001, and industry-specific standards, which are crucial for international buyers seeking dependable suppliers.

Market dynamics are also influenced by technological innovations—such as the development of ultra-pure, defect-free SIC substrates—and environmental regulations that shape manufacturing practices. Buyers are increasingly prioritizing suppliers who can demonstrate compliance with environmental standards, reduce carbon footprints, and adopt sustainable practices, aligning with global trends toward greener electronics and industrial processes.

Sustainability has become a pivotal aspect of sourcing decisions within the SIC substrate sector. Manufacturers are under pressure to minimize environmental impacts throughout the production lifecycle, from raw material extraction to end-of-life disposal. This is particularly relevant for buyers from regions like Europe and Australia, where stringent environmental regulations are enforced.

Ethical sourcing extends beyond environmental concerns to include labor practices and supply chain transparency. Buyers are increasingly scrutinizing suppliers for adherence to fair labor standards, anti-corruption policies, and responsible sourcing of raw materials such as silicon and carbon sources. Certification schemes like ISO 14001 (Environmental Management) and responsible mineral sourcing certifications (e.g., Conflict-Free Certification) are gaining prominence.

Manufacturers that invest in greener production technologies—such as energy-efficient furnaces, waste reduction systems, and water recycling—are better positioned to meet the expectations of environmentally conscious buyers. The adoption of 'green' materials, such as low-impact binders and recycled raw materials, further enhances a company's sustainability profile. Transparent reporting on environmental and social governance (ESG) metrics can serve as a competitive advantage, especially for buyers in Europe, Australia, and Middle Eastern markets where sustainability credentials influence procurement decisions.

The SIC substrate industry has evolved significantly over the past few decades, transitioning from niche high-performance material suppliers to a vital component of the global electronics supply chain. Originally driven by defense and aerospace applications, the market has expanded into consumer electronics, automotive, and renewable energy sectors.

Technological innovations, such as the development of high-quality, defect-free SIC wafers, have expanded application horizons and increased market demand. The industry has also seen a shift toward more sustainable manufacturing practices, driven by regulatory pressures and corporate responsibility initiatives. This evolution underscores the importance for international buyers to partner with manufacturers who are adaptable, innovative, and committed to sustainable growth—attributes that will define competitiveness in the future SIC substrate landscape.

To vet Sic substrate suppliers effectively, start by reviewing their certifications (ISO, RoHS, REACH) and request detailed product datasheets. Conduct site visits or virtual factory audits where possible, focusing on manufacturing processes and quality control protocols. Ask for references from existing clients, especially in similar industries or regions. Evaluate their track record for on-time delivery and responsiveness. Additionally, request sample products for independent testing to verify specifications. A transparent supplier willing to share quality assurance documentation and open communication indicates a trustworthy partner.

Most Sic substrate manufacturers offer customization in dimensions, thickness, surface finish, and doping levels to suit specific applications. Clearly define your technical specifications, including electrical, thermal, and mechanical properties, when communicating with suppliers. Use detailed drawings and technical datasheets to minimize misunderstandings. Engage in early technical discussions to understand manufacturing constraints and lead times for customizations. Confirm whether additional tooling or setup fees apply, and request samples of customized products before bulk orders to ensure they meet your standards.

MOQs for Sic substrates vary depending on the manufacturer, generally ranging from a few hundred to several thousand units, especially for customized products. Lead times can range from 4 to 12 weeks, influenced by order complexity and manufacturing capacity. Payment terms are often negotiated but commonly include 30% upfront deposit with the balance payable before shipment or upon delivery. For large or repeat orders, consider negotiating favorable terms such as letters of credit or open account arrangements, especially if you have a strong relationship with the supplier.

Key certifications include ISO 9001 (quality management), ISO 14001 (environmental management), and industry-specific standards like ASTM or JEDEC compliance. For regions with strict regulatory requirements, certifications such as RoHS and REACH are critical. These certifications demonstrate the supplier’s commitment to quality, environmental responsibility, and regulatory compliance. Request recent audit reports or third-party inspection certificates to verify ongoing compliance. Additionally, inquire about their testing procedures for electrical and thermal performance to ensure product reliability in your application.

Coordinate with your supplier to understand their preferred shipping methods, whether sea, air, or land, based on your urgency and budget. For international shipments, clarify Incoterms (e.g., FOB, CIF, DDP) to define responsibilities and costs. Engage experienced freight forwarders familiar with your region’s import regulations to streamline customs clearance and reduce delays. Ensure proper packaging standards to prevent damage during transit, especially for fragile substrates. Establish clear communication channels for tracking shipments and handling unexpected delays or damages to maintain supply chain continuity.

Immediately document the issue with detailed photos, test results, and correspondence. Review the contract or purchase agreement for clauses related to quality assurance, warranties, and dispute resolution. Engage the supplier promptly to seek a remedy, such as replacement, rework, or refund. If unresolved, consider involving third-party inspectors or industry mediators. Maintaining open, professional communication is key; escalate disputes through contractual channels if necessary. Establishing clear quality standards and acceptance criteria upfront can help prevent disputes and facilitate quicker resolutions.

Research your country’s import regulations, tariffs, and customs procedures related to electronic components and specialty substrates. Work with a knowledgeable customs broker or compliance specialist to navigate import duties, certifications, and documentation requirements. Ensure your supplier provides necessary export documentation, such as commercial invoices, certificates of origin, and testing reports. Staying updated on regional trade agreements can also reduce tariffs and streamline customs clearance. Incorporate compliance considerations into your procurement planning to avoid delays, fines, or shipment rejections.

Establish clear communication channels and transparent expectations from the outset. Engage in regular performance reviews, providing feedback on quality, lead times, and responsiveness. Consider volume commitments or long-term contracts to secure better pricing and priority production. Invest in mutual understanding of technical requirements and cultural nuances, especially when dealing with suppliers from different regions. Foster trust through prompt payments, collaborative problem-solving, and sharing market insights. Building strong relationships can lead to prioritized service, customized solutions, and better terms over time, supporting your strategic growth objectives.

Effective sourcing of SIC substrates demands a nuanced understanding of global manufacturing landscapes, supply chain resilience, and technological innovation. For international buyers across Africa, South America, the Middle East, and Europe, establishing strategic partnerships with reliable, quality-focused manufacturers is essential to securing competitive advantage and ensuring supply continuity.

Key takeaways include:

- Prioritizing manufacturers with proven quality standards, certifications, and capacity for scalable production.

- Diversifying sourcing channels to mitigate geopolitical and logistical risks.

- Leveraging technological advancements and R&D collaborations to access cutting-edge SIC substrate solutions.

- Building long-term relationships based on transparency, compliance, and shared growth objectives.

Looking ahead, the SIC substrate industry is poised for continued innovation driven by demand in high-growth sectors such as power electronics, automotive, and renewable energy. International buyers should proactively engage with emerging manufacturers and explore regional hubs to capitalize on cost efficiencies and supply chain agility.

Illustrative Image (Source: Google Search)

Actionable next steps:

Invest in comprehensive supplier assessments, foster strategic alliances, and stay informed on industry trends to optimize sourcing strategies. Embracing a forward-looking, flexible approach will be vital in navigating the evolving landscape and securing a competitive edge in the global SIC substrate market.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina