In today’s interconnected economy, sourcing sic 4h components and products represents a strategic opportunity for international B2B buyers seeking reliability, efficiency, and competitive advantage. This material’s unique properties make it indispensable across diverse industries, from electronics and automotive to industrial manufacturing. For buyers from regions such as Africa, South America, the Middle East, and Europe—including emerging markets like Egypt and Vietnam—understanding the nuances of sic 4h sourcing is crucial for optimizing supply chains and minimizing risks.

This comprehensive guide delves into every aspect of sic 4h, equipping decision-makers with the knowledge to evaluate types, grades, and material specifications relevant to their applications. It offers detailed insights into manufacturing processes and quality control standards, enabling buyers to discern supplier capabilities and ensure product consistency. Additionally, the guide explores global supplier landscapes, highlighting key players and regional considerations that affect lead times, costs, and compliance.

Beyond technical and logistical details, the guide provides a thorough analysis of market trends and pricing dynamics, empowering buyers to negotiate effectively and forecast procurement budgets with confidence. The included FAQs address common concerns and practical challenges faced by international buyers, streamlining the decision-making process.

By synthesizing technical expertise with market intelligence, this resource is designed to help B2B buyers from diverse geographies make informed, strategic sourcing decisions for sic 4h. Whether expanding existing partnerships or entering new supplier markets, readers will gain actionable insights to drive operational excellence and sustainable growth.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard sic 4h | Basic model with core functionalities; cost-effective | General industrial use, manufacturing lines | Pros: Affordable, widely compatible; Cons: Limited customization, basic performance |

| Enhanced sic 4h+ | Advanced sensors and automation integration | High-precision manufacturing, quality control | Pros: Improved accuracy, automation-ready; Cons: Higher upfront cost, requires skilled operators |

| Modular sic 4h M | Customizable modules for flexible configurations | Diverse industrial sectors, R&D facilities | Pros: Highly adaptable, scalable; Cons: Complexity in setup, longer lead times |

| Heavy-duty sic 4h HD | Reinforced build for extreme environments | Mining, heavy machinery, outdoor installations | Pros: Durable, withstands harsh conditions; Cons: Bulkier, more expensive maintenance |

| Eco sic 4h E | Energy-efficient design with sustainable materials | Green manufacturing, energy-sensitive markets | Pros: Lower operational costs, eco-friendly; Cons: May have limited power for heavy tasks |

The Standard sic 4h serves as the foundational variant, ideal for buyers seeking cost-effective solutions without advanced features. It fits well into general manufacturing and industrial applications where basic performance suffices. For B2B buyers, the primary consideration is balancing budget constraints with operational needs, ensuring compatibility with existing systems.

The Enhanced sic 4h+ incorporates advanced sensors and automation capabilities, tailored for sectors requiring precision and quality control, such as electronics or pharmaceuticals. This type demands higher investment but delivers superior accuracy and integration potential, making it suitable for businesses aiming to upgrade production quality and efficiency.

With its Modular sic 4h M design, this variant offers unparalleled flexibility through customizable modules. It is particularly beneficial for R&D centers and industries with evolving requirements. Buyers should evaluate the complexity of integration and the potential for scalability, weighing the benefits of adaptability against longer deployment timelines.

The Heavy-duty sic 4h HD is engineered for rugged environments, making it indispensable in mining, heavy machinery, and outdoor industrial settings. Its robust construction ensures longevity under stress but may require more maintenance and incur higher costs. Buyers must consider environmental demands and lifecycle expenses carefully.

Lastly, the Eco sic 4h E targets companies prioritizing sustainability and energy efficiency. It uses green materials and optimized power consumption, appealing to markets with strict environmental regulations or cost-saving goals. However, buyers should assess whether its performance meets the demands of heavier industrial tasks before committing.

Related Video: Sicilian Defense ALL Variations Explained [Chess Opening Crash Course]

| Industry/Sector | Specific Application of sic 4h | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-performance semiconductor devices | Enhanced efficiency and thermal stability in power systems | Ensure material purity and consistency; verify supplier's quality control |

| Automotive & EV | High-temperature and high-voltage power modules | Improved durability and energy efficiency in electric vehicles | Compliance with automotive standards; availability of technical support |

| Renewable Energy | Photovoltaic inverters and power converters | Increased reliability and lifespan under harsh environmental conditions | Local regulations on import/export; logistics for timely delivery |

| Aerospace & Defense | High-frequency, high-temperature electronics | Superior performance in extreme environments | Certifications for aerospace-grade materials; traceability of supply chain |

| Industrial Automation | Robust power switching and motor control systems | Reduced downtime and maintenance costs | Long-term supply agreements; customization capabilities |

Silicon carbide 4H (SiC 4H) is extensively used in power electronic devices such as MOSFETs and diodes due to its exceptional electrical properties and thermal conductivity. For B2B buyers in regions like Africa and South America, sourcing high-purity SiC 4H can significantly improve the efficiency and thermal management of power systems, reducing energy losses and operational costs. Buyers should prioritize suppliers that demonstrate stringent quality control and consistent material specifications to ensure device reliability.

In the automotive sector, SiC 4H is critical for high-temperature and high-voltage power modules that drive electric vehicles. Its ability to operate efficiently at elevated temperatures translates into improved vehicle range and reduced cooling system complexity. For international buyers, especially in emerging EV markets such as the Middle East and parts of Europe, it is vital to select SiC 4H suppliers compliant with automotive industry standards and capable of providing technical support for integration and testing.

SiC 4H plays a pivotal role in photovoltaic inverters and power converters, where it enhances system reliability and efficiency even in harsh environmental conditions. For buyers in regions with abundant solar potential like Egypt and Vietnam, investing in SiC 4H components ensures longer operational life and reduced maintenance. Understanding local import regulations and securing reliable logistics are crucial to avoid supply chain disruptions and meet project timelines.

The aerospace and defense industries utilize SiC 4H for high-frequency and high-temperature electronic components that must perform reliably in extreme environments. Buyers must source materials that meet rigorous aerospace certifications and maintain full traceability. This is especially important for European and Middle Eastern companies engaged in defense projects, where compliance and quality assurance directly impact contract eligibility and operational safety.

In industrial automation, SiC 4H is used in power switching and motor control systems that demand robustness and minimal downtime. By incorporating SiC 4H, businesses can reduce maintenance costs and increase system uptime. For international buyers, securing long-term supply contracts with manufacturers offering customization options ensures consistent availability and alignment with specific industrial requirements, which is critical for markets in South America and Africa aiming to modernize their manufacturing infrastructure.

Related Video: Material and Their Uses-Science 4-MATATAG Curriculum-Q1-Week 2

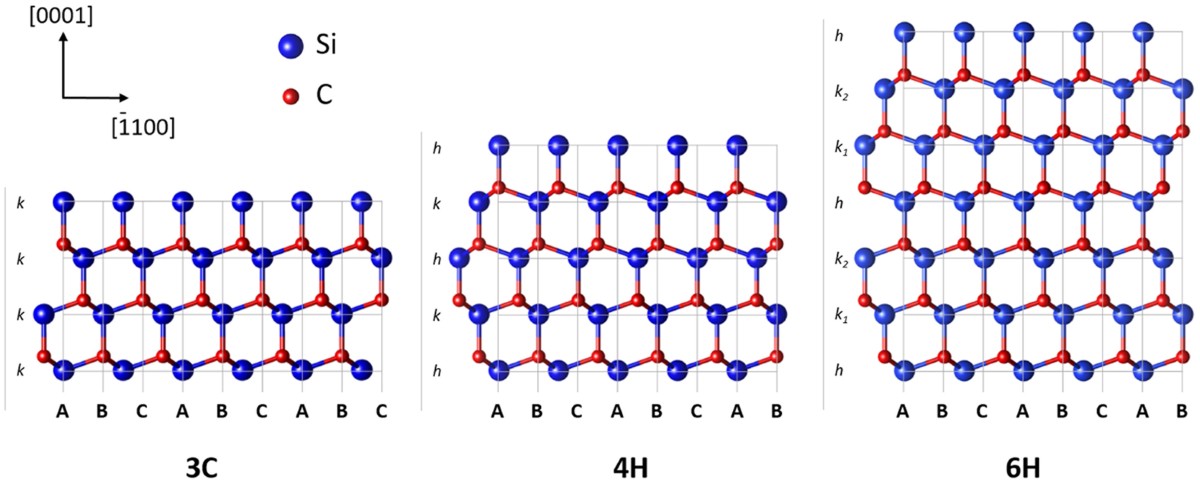

When selecting materials for applications involving SiC 4H, understanding the interplay between material properties and operational demands is critical. The 4H polytype of silicon carbide is prized for its wide bandgap, high thermal conductivity, and excellent chemical stability, making it ideal for high-power, high-frequency electronic devices and harsh environment components. Below, we analyze four common material forms or composites used with SiC 4H, focusing on their relevance for international B2B buyers from regions such as Africa, South America, the Middle East, and Europe.

Key Properties:

Bulk single-crystal 4H-SiC offers exceptional electron mobility, a wide bandgap (~3.26 eV), high thermal conductivity (~4.9 W/cm·K), and excellent chemical inertness. It withstands high temperatures (up to 600°C in oxidizing environments) and high voltages, making it ideal for power electronics.

Pros & Cons:

- Pros: Superior electrical performance, excellent thermal management, and long-term durability.

- Cons: High production cost due to complex crystal growth (physical vapor transport method), and relatively brittle nature complicates machining and handling.

Impact on Application:

Ideal for high-voltage power devices, RF amplifiers, and harsh environment sensors. Its chemical inertness ensures compatibility with corrosive media, such as acidic or saline environments common in oil & gas or chemical industries.

International Buyer Considerations:

Buyers in Egypt, Vietnam, and similar markets should verify compliance with ASTM F1289 and IEC 60747-17 standards for SiC devices. Import regulations and tariffs on semiconductor-grade crystals may affect cost. European buyers often require RoHS and REACH compliance, while Middle Eastern buyers prioritize long-term supplier reliability due to infrastructure projects.

Key Properties:

Polycrystalline SiC ceramics provide excellent mechanical strength, high thermal conductivity (~3.0 W/cm·K), and good chemical resistance. These substrates are less expensive than single crystals and offer good thermal shock resistance.

Pros & Cons:

- Pros: Cost-effective, easier to manufacture in bulk, and robust for mechanical applications.

- Cons: Lower electrical performance due to grain boundaries, which can affect device efficiency.

Impact on Application:

Widely used in power modules, LED substrates, and heat spreaders. Their resistance to oxidation and corrosion suits applications in harsh industrial environments, including petrochemical plants and solar energy systems.

International Buyer Considerations:

Standards such as DIN EN 60664 and JIS C 7035 are relevant for ceramic substrates. Buyers from South America and Africa should consider local supplier capabilities for machining and finishing, as well as logistics for fragile ceramic materials. European buyers often demand certification for thermal cycling reliability.

Key Properties:

SiC composites combine SiC with carbon fibers or metal matrices to enhance toughness, thermal shock resistance, and mechanical strength. Thermal conductivity varies but can be tailored for specific applications.

Pros & Cons:

- Pros: Improved fracture toughness and impact resistance, customizable thermal and electrical properties.

- Cons: More complex manufacturing processes, higher cost, and potential chemical reactivity depending on composite constituents.

Impact on Application:

Ideal for aerospace components, automotive brake systems, and high-performance heat exchangers. The composite nature allows for tailored solutions where pure SiC might be too brittle or costly.

International Buyer Considerations:

Compliance with ASTM C1275 (for ceramic composites) and regional aerospace material standards is critical. Buyers in the Middle East and Europe should ensure suppliers provide detailed material certification and traceability. For African and South American markets, evaluating local fabrication capabilities and after-sales support is essential.

Key Properties:

SiC thin films provide excellent surface hardness, chemical inertness, and high-temperature stability. Thickness and deposition methods (CVD, PVD) influence film quality and adhesion.

Pros & Cons:

- Pros: Enhanced surface protection, corrosion resistance, and wear resistance without bulk material cost.

- Cons: Limited mechanical load-bearing capacity, potential delamination under thermal cycling.

Impact on Application:

Used as protective coatings on cutting tools, semiconductor wafers, and sensor surfaces exposed to corrosive gases or plasmas. Their thin nature allows integration into microelectronic devices and MEMS components.

International Buyer Considerations:

Buyers should verify coating standards such as ISO 20502 and ensure compatibility with substrate materials. In regions like Vietnam and South America, assessing local coating service providers’ capabilities is crucial for cost-effective procurement. European buyers often require environmental compliance certifications for coating processes.

| Material | Typical Use Case for sic 4h | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Bulk 4H-SiC Single Crystals | High-power electronics, RF devices | Superior electrical and thermal performance | High cost and brittle, complex manufacturing | High |

| SiC Ceramic Substrates | Power modules, LED substrates, heat spreaders | Cost-effective, robust mechanical strength | Lower electrical performance due to grain boundaries | Medium |

| SiC Composite Materials | Aerospace parts, automotive brakes, heat exchangers | Enhanced toughness and thermal shock resistance | Complex manufacturing, higher cost | High |

| SiC Thin Films and Coatings | Protective coatings on tools and sensors | Excellent surface hardness and corrosion resistance | Limited mechanical load capacity, potential delamination | Medium |

This guide equips international B2B buyers with critical insights to navigate the complex material landscape of SiC 4H applications. By aligning material properties with application needs and regional procurement considerations, buyers can optimize performance, cost, and compliance in their supply chains.

The manufacturing of sic 4h—a specialized material or component widely used in industrial applications—follows a multi-stage process designed to ensure precision, durability, and performance. Understanding these stages helps B2B buyers assess supplier capabilities and tailor specifications to their market needs.

Material preparation is foundational and involves sourcing high-purity raw materials, often silicon carbide powders or related compounds for sic 4h. Suppliers typically conduct initial sieving and blending to achieve consistent particle size and chemical composition. Advanced suppliers may use proprietary pre-treatment techniques such as:

Buyers should verify that raw materials meet international chemical purity standards and are traceable to ensure consistent performance.

The forming stage transforms prepared powders into near-net shapes. Common techniques include:

Each method influences the microstructure and mechanical properties of sic 4h. B2B buyers should inquire about forming technologies to ensure the final product matches their application-specific tolerances and strength requirements.

Post-forming, components undergo:

Suppliers often customize sintering profiles based on batch size and part geometry, impacting final density and fracture toughness. Buyers should request detailed sintering parameters and process control documentation.

Final finishing enhances dimensional accuracy and surface properties:

For international buyers, especially in regions with varied operating environments (e.g., humid climates in Africa or abrasive conditions in the Middle East), surface treatments can be critical to product longevity.

Robust quality assurance (QA) is vital for sic 4h products, given their use in demanding industrial applications. International buyers should prioritize suppliers aligned with globally recognized standards and transparent QA processes.

Verification that suppliers hold current certifications is essential for regulatory compliance and market acceptance in Europe, South America, and other regions.

Quality control is integrated at multiple points:

Buyers should request documentation for each checkpoint and assess the supplier’s capacity for real-time monitoring and corrective actions.

Testing protocols focus on material integrity and performance:

International buyers should ensure suppliers provide detailed test reports with traceable calibration data and, where possible, third-party laboratory verification.

For B2B buyers from Africa, South America, the Middle East, and Europe, due diligence on supplier QC is non-negotiable. Consider the following actionable steps:

Buyers should also be mindful of regional nuances. For example, suppliers exporting to Europe must strictly comply with CE requirements, while Middle Eastern buyers might prioritize API certifications due to the oil and gas sector’s dominance.

Illustrative Image (Source: Google Search)

Understanding these regional requirements enables buyers to negotiate contracts with precise QC clauses and tailor inspection regimes accordingly.

For international B2B buyers sourcing sic 4h, a deep understanding of manufacturing stages and quality assurance protocols is essential. Evaluating suppliers on material preparation, forming techniques, assembly processes, and finishing methods, combined with rigorous quality management aligned to international standards, ensures product reliability and compliance across diverse markets. Leveraging audits, third-party inspections, and detailed testing reports empowers buyers from Africa, South America, the Middle East, and Europe to mitigate risks and secure high-performance sic 4h solutions tailored to their specific industrial needs.

Understanding the detailed cost components behind sic 4h sourcing is crucial for international B2B buyers aiming to optimize procurement strategies. The primary cost factors include:

Raw Materials: The quality and type of raw materials directly influence the base cost. Sic 4h products often require high-grade silicon carbide and other specialized materials, which vary in price depending on global commodity trends and supplier sourcing locations.

Labor Costs: Labor expenses depend on the manufacturing country’s wage standards and skill levels. Regions with advanced automation may have lower labor costs but higher initial capital expenses.

Manufacturing Overhead: This includes factory utilities, equipment depreciation, and indirect labor. Efficient manufacturing processes and economies of scale can significantly reduce overhead per unit.

Tooling and Setup: Initial tooling and machine setup can represent a sizable upfront cost, especially for customized or small-batch orders. These costs are amortized over production runs.

Quality Control (QC): Rigorous QC is essential for compliance with international standards, particularly for buyers in regulated markets like Europe or the Middle East. QC costs cover inspections, testing, and certifications.

Logistics and Freight: Transportation, customs duties, and insurance fees vary widely depending on shipment size, origin, and destination. For buyers in Africa, South America, and the Middle East, port handling fees and inland transportation can add notable expenses.

Supplier Margin: Suppliers include a profit margin that reflects market conditions, competition, and their value-added services such as technical support or after-sales service.

Several factors cause pricing variations across different suppliers and contracts:

Order Volume and Minimum Order Quantities (MOQ): Larger orders typically unlock discounts due to economies of scale. However, buyers from emerging markets should balance MOQ requirements with inventory carrying costs.

Specifications and Customization: Tailored product features or special tolerances increase complexity, tooling, and QC efforts, thus raising costs. Standardized products tend to be more cost-efficient.

Material Grades and Certifications: Higher material purity and certifications (e.g., ISO, RoHS, REACH) command premium prices but may be necessary for compliance with European or Middle Eastern regulations.

Supplier Reputation and Location: Established suppliers with strong track records often price higher but offer reliability and consistent quality. Proximity to supplier facilities can reduce logistics costs and lead times.

Incoterms: Terms like FOB, CIF, or DDP affect who bears shipping and customs risks and costs. Buyers should carefully negotiate Incoterms to optimize cost and risk management.

To maximize cost-efficiency and minimize procurement risks when sourcing sic 4h products, consider the following:

Negotiate Beyond Unit Price: Engage suppliers in discussions about tooling amortization, payment terms, and after-sales support. Bulk orders or long-term contracts can be leveraged for better overall terms.

Evaluate Total Cost of Ownership (TCO): Look beyond initial price to include logistics, customs fees, inventory holding, and potential rework costs. This is especially relevant for buyers in Africa and South America, where supply chain complexities can inflate costs.

Understand Regional Pricing Nuances: Suppliers may price differently for buyers in Egypt, Vietnam, or the Middle East due to currency fluctuations, trade agreements, or local market demand. Maintain currency risk mitigation strategies.

Prioritize Quality and Certifications: While cheaper options may be tempting, non-compliance with local or international standards can lead to costly delays or product rejections.

Use Incoterms Strategically: For example, buyers with strong local logistics capabilities might prefer FOB to reduce costs, whereas others may opt for DDP to simplify customs clearance.

Prices for sic 4h products are indicative and subject to change based on market conditions, raw material availability, and geopolitical factors. Buyers should request detailed, updated quotations from multiple suppliers and factor in all ancillary costs for an accurate cost assessment.

Understanding the core technical specifications of sic 4h is crucial for making informed purchasing decisions, ensuring product compatibility, and maintaining quality standards across global supply chains. Here are the most critical properties:

Material Grade: Sic 4h typically refers to a silicon carbide variant with specific purity and crystalline structure. The grade affects thermal conductivity, hardness, and chemical resistance. For B2B buyers, specifying the correct grade ensures performance aligns with application requirements, such as high-temperature stability or wear resistance.

Dimensional Tolerance: This defines the allowable deviation in size and shape during manufacturing. Tight tolerances are essential for applications demanding precision, such as semiconductor components or high-performance mechanical parts. Understanding tolerance limits helps buyers reduce assembly issues and improve product reliability.

Thermal Conductivity: Sic 4h exhibits excellent heat dissipation properties. The thermal conductivity rating indicates how efficiently heat transfers through the material, which is vital for industries like electronics and automotive where overheating risks must be minimized.

Hardness (Mohs Scale): This property measures resistance to scratching and abrasion. Sic 4h’s hardness level impacts its suitability for cutting tools, abrasives, or protective coatings. Buyers should assess hardness relative to the operational environment to avoid premature wear.

Chemical Resistance: The ability to withstand corrosive environments without degradation is a key factor, especially for buyers in chemical processing or harsh environmental conditions. Sic 4h’s resistance to acids, bases, and oxidizing agents can significantly extend service life.

Electrical Resistivity: For applications in electronics or insulation, the electrical resistivity value is critical. Sic 4h typically has high resistivity, making it suitable for insulating components where electrical isolation is necessary.

Navigating international B2B transactions for sic 4h requires familiarity with standard trade terms and industry jargon. These terms facilitate clear communication, help manage expectations, and streamline procurement processes:

OEM (Original Equipment Manufacturer): Refers to companies that produce parts or products that are purchased by another company and retailed under the purchasing company’s brand. Understanding OEM relationships can help buyers negotiate better pricing and ensure compatibility with existing systems.

MOQ (Minimum Order Quantity): The smallest quantity a supplier is willing to sell in a single order. MOQs impact inventory management and cost-efficiency, especially for buyers in emerging markets or smaller businesses. Negotiating MOQs can optimize cash flow and reduce storage costs.

RFQ (Request for Quotation): A formal document sent to suppliers asking for pricing, availability, and terms for specific quantities and specifications. Crafting clear RFQs is essential for obtaining competitive bids and comparing suppliers accurately.

Incoterms (International Commercial Terms): Standardized trade terms published by the International Chamber of Commerce that define responsibilities between buyers and sellers for shipping, insurance, and tariffs. Familiarity with Incoterms such as FOB (Free on Board) or CIF (Cost, Insurance, Freight) helps buyers from different regions clarify delivery obligations and cost allocation.

Lead Time: The period between placing an order and receiving the goods. Understanding lead times is critical for production planning and supply chain coordination, particularly when sourcing from overseas suppliers.

Batch Number: A unique identifier assigned to a specific production run. This is important for traceability, quality control, and addressing any issues related to a particular batch of sic 4h materials.

By mastering these technical properties and trade terms, international B2B buyers can enhance procurement efficiency, ensure product quality, and foster stronger supplier relationships. This knowledge is especially valuable for buyers in diverse markets such as Africa, South America, the Middle East, and Europe, where supply chain complexities require precise communication and clear expectations.

The sic 4h sector is experiencing dynamic growth driven by global digital transformation, increasing demand for efficiency, and the rise of integrated supply chain solutions. For B2B buyers from regions such as Africa, South America, the Middle East, and Europe, understanding these market dynamics is critical to capitalizing on emerging opportunities. Key drivers include technological advancements like AI-powered analytics, IoT-enabled asset tracking, and blockchain for transparent transactions. These innovations are enabling businesses to optimize operations, reduce costs, and enhance supplier collaboration across borders.

Sourcing trends reveal a strong shift towards regional diversification to mitigate risks related to geopolitical tensions and supply chain disruptions. Buyers in Egypt, Vietnam, and similar markets are prioritizing partnerships with suppliers who offer agility and localized support. Additionally, there is a growing emphasis on digital platforms that facilitate seamless procurement, real-time inventory management, and automated compliance checks. This evolution is particularly important for buyers managing complex international logistics and regulatory environments.

Another notable trend is the integration of customizable, modular solutions tailored to specific industry needs, allowing buyers to scale operations efficiently. For B2B buyers, leveraging data-driven insights from suppliers enhances decision-making and fosters long-term partnerships. Furthermore, sustainability considerations are increasingly influencing purchasing strategies, with buyers seeking vendors committed to reducing environmental footprints and adhering to ethical standards.

Sustainability has become a cornerstone of competitive advantage in the sic 4h sector. International buyers are recognizing that environmental impact and ethical sourcing are not just compliance issues but strategic imperatives. The sector’s supply chains can significantly affect carbon emissions, resource consumption, and waste generation. Hence, B2B buyers are prioritizing suppliers who demonstrate commitment to green manufacturing processes, use of renewable materials, and energy-efficient technologies.

Ethical sourcing practices are equally crucial, particularly in regions where labor rights and environmental regulations vary widely. Buyers from Africa, South America, the Middle East, and Europe must ensure their supply chains are transparent and compliant with international labor standards. This includes verifying fair wages, safe working conditions, and community engagement initiatives.

Certification schemes such as ISO 14001 (Environmental Management), FSC (Forest Stewardship Council), and Fair Trade are increasingly used as benchmarks for sustainability and ethical compliance in the sector. Incorporating these certifications into procurement criteria helps buyers mitigate reputational risks and meet evolving regulatory requirements. Moreover, adopting circular economy principles, such as product lifecycle management and waste reduction, can enhance sustainability outcomes while driving cost efficiencies.

The sic 4h sector has evolved from traditional, labor-intensive operations to a highly digitized and interconnected ecosystem over the past two decades. Early stages focused primarily on manual sourcing and localized supply chains. However, globalization and technological innovation have transformed the landscape, introducing advanced automation, data analytics, and cross-border collaboration.

This evolution has been driven by increasing demand for faster turnaround times, higher quality standards, and greater transparency. For international buyers, understanding this historical shift helps contextualize current market expectations and supplier capabilities. The sector’s maturity now supports sophisticated, multi-tiered sourcing strategies that align with both commercial and sustainability goals, making it a critical area for strategic investment and partnership development.

Illustrative Image (Source: Google Search)

How can I effectively vet suppliers of sic 4h to ensure reliability and quality?

To vet suppliers, start by verifying their business licenses and certifications relevant to sic 4h products. Request detailed product specifications, samples, and client references, especially from buyers in your region. Use third-party inspection services to audit manufacturing processes and compliance with international standards. Platforms with verified supplier profiles and trade assurance can reduce risk. Additionally, engaging in video calls and factory visits, if possible, provides deeper insights into supplier capabilities and commitment to quality.

Is it possible to customize sic 4h products to meet specific regional requirements?

Yes, many suppliers offer customization options, including material specifications, dimensions, and packaging tailored to regional standards or industry-specific needs. When negotiating, clearly communicate your technical requirements and regulatory compliance expectations upfront. Confirm the supplier’s ability to adapt production lines and assess any cost or lead time implications. Customization is especially important for markets in Africa, the Middle East, and Europe where regulatory standards may vary significantly.

What are typical minimum order quantities (MOQs) and lead times for sic 4h, and how flexible are these terms?

MOQs for sic 4h vary widely depending on the supplier and product complexity but typically range from small batches for prototyping to larger quantities for mass production. Lead times can range from 4 to 12 weeks, influenced by customization, order size, and supplier location. Negotiation is key—some suppliers may reduce MOQs for long-term partnerships or higher-priced orders. Plan orders well in advance to accommodate shipping and customs clearance, particularly when importing into Africa or South America.

Which payment terms are standard in international B2B transactions for sic 4h, and how can buyers mitigate risks?

Common payment terms include a 30% advance deposit with the balance paid upon shipment or after inspection. Letters of Credit (LC) and escrow services provide additional security for buyers. To mitigate risks, use trade assurance programs offered by reputable platforms, request third-party inspections before payment, and consider staggered payments aligned with production milestones. For buyers in emerging markets, working with established financial institutions can streamline currency exchange and reduce transaction delays.

Illustrative Image (Source: Google Search)

What quality assurance certifications should I look for when sourcing sic 4h internationally?

Look for ISO certifications (such as ISO 9001 for quality management), product-specific certifications, and compliance with regional standards like CE (Europe) or local regulatory approvals in target markets. Suppliers should also provide test reports from accredited labs verifying material properties and performance. Quality assurance extends beyond certificates—request documentation on production processes, quality control measures, and traceability to ensure consistent product reliability.

How can I optimize logistics for importing sic 4h to regions like Africa, the Middle East, or South America?

Choose suppliers experienced with international shipping and familiar with customs regulations in your target country. Consolidate shipments where possible to reduce costs and negotiate Incoterms that clearly define responsibilities. Use freight forwarders with regional expertise to navigate complex import procedures and documentation. Plan for potential delays due to customs inspections, seasonal demand, or geopolitical factors. Establishing a local distribution partner can facilitate last-mile delivery and inventory management.

What dispute resolution mechanisms are recommended for international contracts involving sic 4h?

Incorporate clear dispute resolution clauses in contracts, specifying arbitration venues, governing law, and mediation processes. International arbitration bodies like ICC or LCIA offer neutral platforms trusted by global buyers and suppliers. Maintain comprehensive records of communications, contracts, and quality checks to support claims. Early engagement with suppliers to resolve issues amicably is advisable, but formal mechanisms protect your interests if disputes escalate, especially in cross-border transactions.

How can I ensure ongoing supplier performance and product consistency with sic 4h?

Establish key performance indicators (KPIs) related to quality, delivery times, and communication responsiveness. Schedule regular audits and inspections, either remotely or on-site, and implement a feedback loop to address issues promptly. Consider long-term contracts with performance incentives to motivate suppliers. Leveraging digital tools for supply chain transparency and real-time tracking can enhance oversight. Building strong relationships based on trust and mutual benefit is critical for sustained success in international B2B sourcing.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing within the sic 4h sector offers international B2B buyers a robust framework to enhance supply chain resilience, optimize costs, and drive innovation. For stakeholders in Africa, South America, the Middle East, and Europe, leveraging localized expertise while integrating global best practices is crucial to unlocking competitive advantages. Prioritizing supplier relationships, transparency, and sustainability can yield long-term value beyond transactional gains.

Key takeaways include the importance of thorough market analysis, agile risk management, and collaboration with suppliers who align with your company’s strategic goals. Embracing digital tools and data analytics further empowers buyers to make informed decisions and respond swiftly to market fluctuations. This strategic approach not only mitigates disruptions but also fosters continuous improvement and scalability.

Looking ahead, the sic 4h industry is poised for transformation driven by technological innovation, regulatory shifts, and evolving customer demands. International buyers are encouraged to adopt a proactive sourcing mindset—investing in partnerships that emphasize innovation, sustainability, and regional diversification. By doing so, businesses across Egypt, Vietnam, and other key markets can secure a resilient supply base, capitalize on emerging opportunities, and achieve sustained growth in an increasingly interconnected global economy.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina