Silicon carbide (SiC) applications are rapidly transforming industries ranging from automotive and aerospace to renewable energy and electronics. As a material known for exceptional thermal conductivity, high voltage endurance, and outstanding durability, SiC enables cutting-edge performance improvements that are vital for companies seeking competitive advantages in global markets. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding the complexities of SiC technology and supply chains is essential for making strategic sourcing decisions.

This guide offers a comprehensive exploration of the SiC landscape, designed to empower international buyers with actionable insights. You will find detailed coverage of key SiC types and material grades, essential manufacturing and quality control processes, and profiles of leading global suppliers. Additionally, the guide addresses cost structures, market trends, and practical FAQs tailored to diverse regional requirements and business environments.

By equipping you with a thorough understanding of both technical and commercial factors, this resource helps mitigate risks associated with supply volatility, quality inconsistencies, and pricing fluctuations. Whether you represent a manufacturing enterprise in Argentina seeking reliable SiC components or a UAE-based firm exploring new market opportunities, the information herein supports informed decision-making and optimized procurement strategies.

Key benefits for international B2B buyers include:

Harnessing the full potential of SiC applications begins with knowledge — this guide is your strategic partner in navigating the evolving global market landscape.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Power Electronics SIC | High voltage, high frequency, superior thermal performance | Renewable energy inverters, electric vehicles, industrial motor drives | Pros: High efficiency, reduced cooling needs; Cons: Higher upfront cost, requires specialized integration expertise |

| RF and Microwave SIC | Excellent high-frequency response, low noise | Telecommunications, radar systems, satellite communications | Pros: Enhanced signal clarity, compact design; Cons: Limited availability, complex manufacturing processes |

| Sensor SIC | Integrated sensing and signal processing | Industrial automation, environmental monitoring, medical devices | Pros: Miniaturization, improved accuracy; Cons: Sensitivity to environmental conditions, calibration complexity |

| Automotive SIC | Robustness under extreme conditions, high reliability | Electric vehicle powertrains, advanced driver-assistance systems (ADAS) | Pros: Durability, performance under harsh conditions; Cons: Certification requirements, higher cost of ownership |

| Consumer Electronics SIC | Cost-effective, optimized for mass production | Smartphones, wearable devices, home appliances | Pros: Scalability, lower unit cost; Cons: Lower power handling, limited industrial-grade robustness |

Power Electronics SIC devices are designed to handle high voltages and frequencies efficiently, making them ideal for heavy-duty industrial applications such as renewable energy inverters and electric vehicle motor drives. Their superior thermal management reduces the need for extensive cooling systems, which can lower operational costs. B2B buyers should consider the initial investment and integration complexity, ensuring suppliers provide technical support for seamless adoption. These components are particularly valuable in regions focusing on sustainable energy and electric mobility, such as Europe and the UAE.

SIC components tailored for RF and microwave applications excel in high-frequency performance with minimal signal loss, crucial for telecommunications infrastructure and satellite communication systems. They enable clearer signal transmission and more compact device designs. Buyers in emerging markets like South America and Africa should evaluate supplier capabilities in advanced manufacturing and product consistency, as these components often require precise specifications and quality assurance to meet stringent communication standards.

Sensor-integrated SICs combine sensing elements with signal processing on a single chip, offering compact solutions for industrial automation, environmental monitoring, and medical devices. Their miniaturization facilitates deployment in constrained environments, a key advantage for automation projects in diverse markets. However, buyers must assess environmental robustness and calibration needs, especially in regions with extreme climatic conditions. Partnering with suppliers who provide calibration services and environmental testing can mitigate operational risks.

Illustrative Image (Source: Google Search)

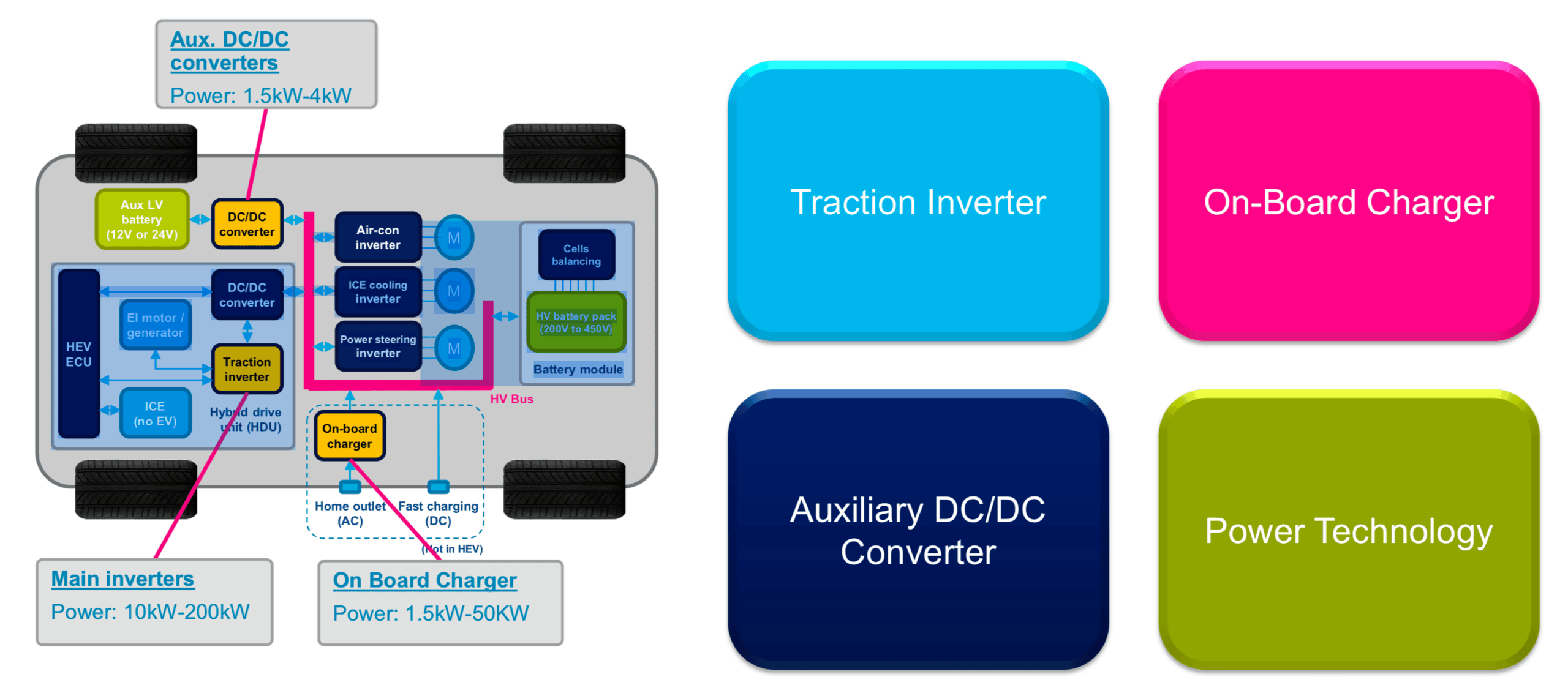

Automotive-grade SICs are engineered for reliability and durability under harsh conditions, supporting electric vehicle powertrains and ADAS. These components must comply with stringent automotive standards, which can extend procurement timelines but ensure long-term performance. B2B buyers from regions expanding EV infrastructure, such as the Middle East and Europe, should prioritize suppliers with proven automotive certifications and after-sales support to navigate regulatory and technical challenges efficiently.

Consumer-focused SICs are optimized for cost-effective mass production, powering devices like smartphones and wearables. While they offer scalability and affordability, their power handling and robustness are limited compared to industrial-grade variants. For B2B buyers targeting large-scale consumer electronics manufacturing in markets like Argentina and the UAE, evaluating supplier capacity for volume production and supply chain reliability is critical to maintain competitive pricing and product availability.

Related Video: QSPICE - A New Simulation Tool Suited to SiC Applications - EEI Show #29

| Industry/Sector | Specific Application of SiC Applications | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Renewable Energy | Power inverters for solar and wind energy systems | Enhanced efficiency and reliability in power conversion, reducing energy losses and operational costs | Ensure compliance with regional electrical standards; focus on thermal management and durability for harsh climates |

| Automotive & EV | High-performance power electronics in electric vehicles | Improved energy efficiency, faster charging, and extended battery life | Verify supplier expertise in automotive-grade SiC components; assess supply chain stability and certification standards |

| Industrial Motor Drives | SiC-based motor controllers for heavy machinery | Higher efficiency, reduced size and weight, and improved thermal performance leading to lower maintenance costs | Prioritize suppliers with proven industrial-grade SiC devices; consider compatibility with existing systems and local service support |

| Aerospace & Defense | High-frequency, high-temperature electronic devices | Increased reliability under extreme conditions, weight reduction, and enhanced power density | Source from certified manufacturers with aerospace qualifications; evaluate product traceability and compliance with export regulations |

| Telecommunications | RF and microwave components for 5G infrastructure | Superior signal performance, lower power consumption, and extended device lifespan | Confirm adherence to international telecom standards; focus on component longevity and supplier capacity for volume orders |

SiC applications in renewable energy primarily focus on power inverters that convert DC to AC electricity with significantly higher efficiency than traditional silicon devices. This reduces energy losses and improves overall system reliability, which is critical for large-scale solar farms and wind turbines. For international buyers, especially in regions with high solar potential like South America and the Middle East, selecting SiC components that withstand temperature fluctuations and harsh environmental conditions is essential. Buyers should ensure suppliers provide components compliant with local grid standards and offer robust thermal management solutions.

Illustrative Image (Source: Google Search)

The automotive sector benefits from SiC semiconductors in power electronics that drive electric vehicles (EVs), enabling faster charging times, higher energy efficiency, and extended battery life. SiC’s superior thermal conductivity and switching speed support lighter and more compact designs, which are crucial for EV manufacturers targeting markets in Europe and Africa where energy efficiency regulations are tightening. B2B buyers should prioritize suppliers with automotive-grade certifications and a proven track record in delivering high-reliability SiC devices, ensuring stable supply chains that align with evolving industry standards.

In industrial applications, SiC devices are used in motor drives controlling heavy machinery and manufacturing equipment. These components offer enhanced efficiency, reduced size and weight, and improved thermal performance, which translates into lower operational and maintenance costs. For buyers from industrial hubs in regions like the UAE and Argentina, sourcing SiC motor controllers that integrate seamlessly with existing infrastructure is critical. Buyers must evaluate supplier expertise in industrial-grade components and ensure post-sale technical support and local service availability.

SiC’s ability to operate reliably at high frequencies and extreme temperatures makes it invaluable in aerospace and defense electronics, where performance and weight reduction are paramount. These applications demand SiC devices that meet stringent aerospace certifications and offer traceability for compliance with export controls. International B2B buyers should focus on suppliers with specialized aerospace qualifications and a history of compliance with international defense standards, ensuring that components can endure harsh operational environments while maintaining peak performance.

The telecommunications sector leverages SiC components in RF and microwave devices critical for 5G network infrastructure. SiC offers superior signal quality, lower power consumption, and longer device lifespan compared to traditional materials. For global buyers expanding 5G networks in emerging markets across Africa and South America, ensuring that SiC components comply with international telecom standards is vital. Sourcing considerations include supplier capacity to meet large volume demands and the durability of components to support long-term network reliability.

Related Video: Wide Bandgap SiC and GaN Devices - Characteristics & Applications

Silicon carbide (SiC) applications demand materials that can withstand extreme conditions such as high temperatures, corrosive environments, and mechanical stress. Selecting the right complementary materials is critical to optimize performance, durability, and cost-efficiency. Below is an analysis of four common materials used in conjunction with SiC, tailored for international B2B buyers across Africa, South America, the Middle East, and Europe.

Key Properties:

SiC is renowned for its exceptional hardness, high thermal conductivity, and outstanding chemical inertness. It maintains structural integrity at temperatures exceeding 1600°C and resists corrosion from acids and alkalis, making it ideal for harsh industrial environments.

Pros & Cons:

SiC offers superior wear resistance and thermal shock tolerance, but its brittleness can pose manufacturing challenges. The cost of high-purity SiC is relatively high due to complex production processes, but the long service life often justifies the investment.

Impact on Application:

SiC is especially suitable for abrasive media, high-temperature reactors, and semiconductor devices. Its chemical resistance ensures compatibility with aggressive chemicals, making it a preferred choice in chemical processing industries.

Considerations for International Buyers:

Buyers in regions like the UAE and Europe should verify compliance with ASTM C799 (Standard Specification for Silicon Carbide Abrasive) and ISO 9001 quality standards. In South America and Africa, sourcing from suppliers who meet these international certifications is crucial to ensure material reliability and performance consistency.

Key Properties:

Alumina offers excellent hardness and good thermal stability up to around 1700°C. It has moderate corrosion resistance and is electrically insulating, which is beneficial in electronic SiC applications.

Pros & Cons:

Alumina is generally less expensive than SiC and easier to machine, making it suitable for complex shapes. However, it is less resistant to thermal shock and chemical attack compared to SiC, limiting its use in highly aggressive environments.

Impact on Application:

Alumina is often used in wear parts, insulating components, and substrates for electronic devices involving SiC. It performs well in dry, abrasive conditions but is less suited for acidic or basic media.

Considerations for International Buyers:

European and Middle Eastern buyers should ensure alumina materials conform to DIN EN 60672-3 or ASTM C799 standards. In African and South American markets, verifying supplier adherence to these standards is essential to avoid quality variability, especially for critical electronic applications.

Key Properties:

Tungsten carbide is known for its extreme hardness, high melting point (~2870°C), and excellent wear resistance. It also exhibits good corrosion resistance but is more susceptible to oxidation at elevated temperatures compared to SiC.

Pros & Cons:

WC offers superior mechanical strength and durability, ideal for cutting tools and wear-resistant coatings. However, it is heavier and more expensive than alumina, and its oxidation resistance is inferior to SiC, which can limit its use in high-temperature oxidizing environments.

Impact on Application:

WC is preferred for tooling and components subjected to high mechanical stress in SiC manufacturing or processing lines. It is less common in chemical processing due to its oxidation sensitivity.

Considerations for International Buyers:

Buyers in Argentina and the UAE should verify tungsten carbide materials against ASTM B777 and ISO 4499 standards. Given the cost and specialized nature, sourcing from reputable suppliers with certifications is critical to ensure performance and avoid premature failures.

Key Properties:

Boron nitride, particularly hexagonal BN, offers excellent thermal stability, chemical inertness, and lubricating properties. It withstands temperatures up to 1000°C and is electrically insulating, making it complementary to SiC in electronic and high-temperature applications.

Pros & Cons:

BN provides excellent thermal shock resistance and chemical stability but has lower mechanical strength compared to SiC and alumina. It is also relatively expensive and can be challenging to process into complex shapes.

Impact on Application:

BN is widely used as a coating or additive in SiC applications to improve thermal management and reduce friction. It is suitable for environments requiring chemical inertness without high mechanical load.

Considerations for International Buyers:

In Europe and the Middle East, BN materials should meet ASTM C795 and ISO 9001 standards. African and South American buyers should prioritize suppliers with proven quality management systems to ensure consistent BN performance in critical applications.

| Material | Typical Use Case for SiC Applications | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide | High-temperature reactors, abrasive media handling | Exceptional hardness and corrosion resistance | Brittle, high manufacturing cost | High |

| Alumina | Wear parts, insulating components in electronics | Cost-effective and machinable | Lower chemical and thermal shock resistance | Medium |

| Tungsten Carbide | Cutting tools, wear-resistant coatings in manufacturing | Superior mechanical strength | Susceptible to oxidation at high temperatures | High |

| Boron Nitride | Thermal management coatings, lubricating additives | Excellent chemical inertness and thermal shock resistance | Lower mechanical strength, higher cost | High |

This guide equips B2B buyers with a clear understanding of material trade-offs for SiC applications, enabling informed procurement decisions aligned with regional standards and operational demands.

Silicon Carbide (SiC) applications demand precision and stringent control throughout the manufacturing process due to the material's unique properties such as high thermal conductivity, hardness, and chemical stability. For international B2B buyers, understanding these manufacturing stages is crucial for selecting reliable suppliers and ensuring product performance.

1. Material Preparation

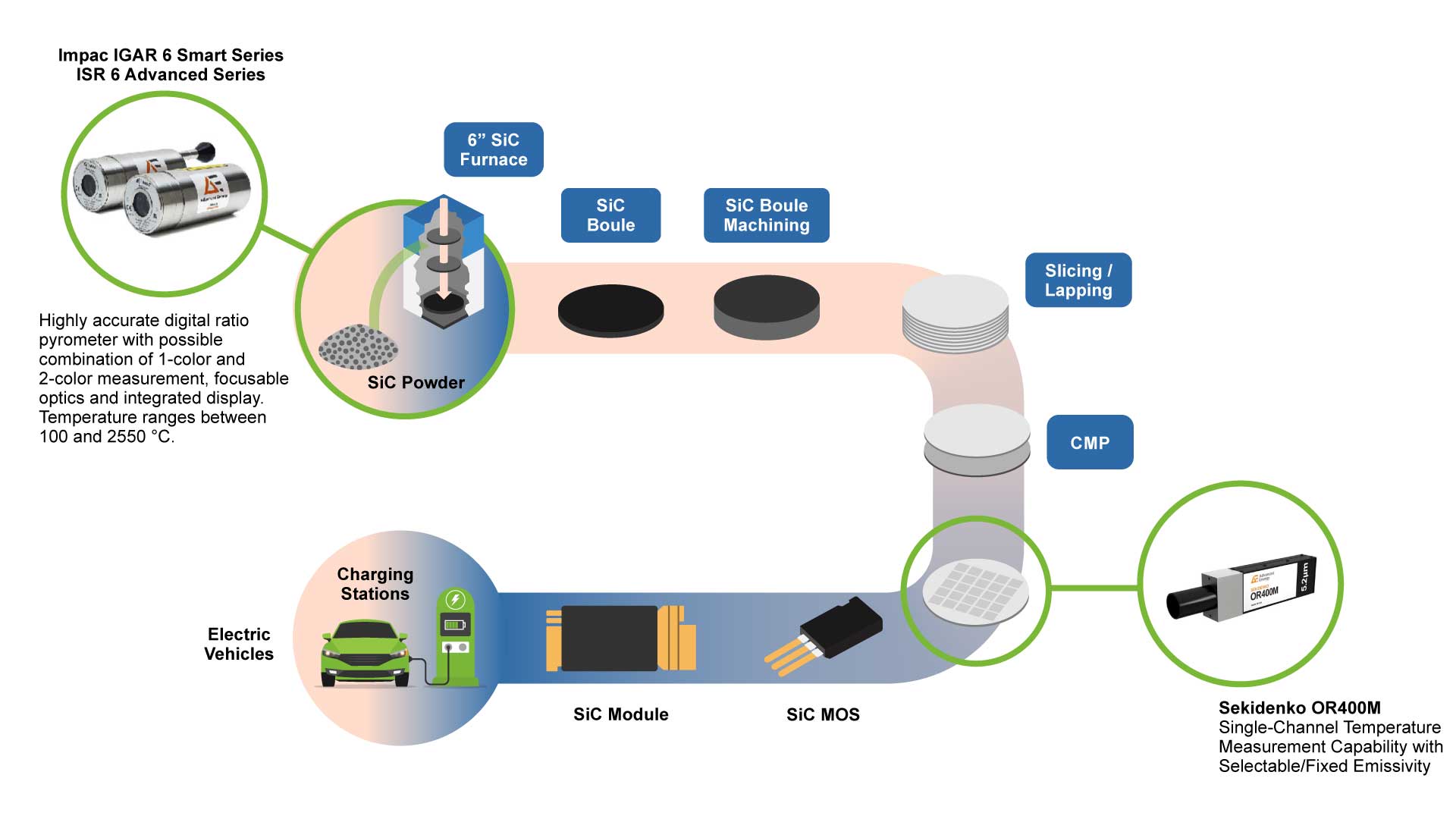

The manufacturing journey begins with sourcing high-purity raw materials. SiC powder is typically synthesized through the Acheson process or chemical vapor deposition (CVD), depending on the application. The powder undergoes refinement to achieve uniform particle size and purity, which directly impacts the final product’s electrical and mechanical properties. For buyers, verifying the purity levels and supplier adherence to raw material standards is essential.

2. Forming and Shaping

Forming SiC components requires advanced techniques due to the material's hardness. Common methods include:

- Hot Pressing and Sintering: Applying heat and pressure to shape and densify SiC powder into complex geometries. This process ensures high mechanical strength and thermal stability.

- Slip Casting and Injection Molding: Used for intricate shapes, these methods involve creating a slurry or feedstock that is molded and then sintered.

- Chemical Vapor Deposition (CVD): For thin films or coatings, CVD provides precise control over layer thickness and material properties.

B2B buyers should assess the forming techniques used by suppliers relative to their application requirements, as this impacts durability and performance.

3. Assembly and Integration

In many SiC applications, components are integrated into larger systems (e.g., power electronics modules or mechanical assemblies). This stage requires meticulous alignment, bonding (often with high-temperature adhesives or brazing), and sometimes, additional surface treatments. Buyers should inquire about the supplier’s capabilities in system-level integration and compatibility with downstream processes.

4. Finishing and Surface Treatment

Final finishing processes enhance surface quality, dimensional accuracy, and functional properties. Techniques include:

- Grinding and Polishing: Achieves tight tolerances and smooth surfaces critical for semiconductor or optical applications.

- Coating: Protective or conductive coatings can improve wear resistance or electrical contact.

- Etching and Cleaning: Removes contaminants or unwanted surface layers to ensure product reliability.

For B2B buyers, confirming finishing standards and surface quality certifications is vital, especially for high-precision applications.

Quality assurance (QA) in SiC manufacturing ensures that products meet rigorous performance, safety, and regulatory standards. For international buyers, understanding QA processes helps mitigate risks and secure compliance across different jurisdictions.

Relevant International and Industry Standards

- ISO 9001: The global benchmark for quality management systems, ensuring consistent processes and continual improvement. Suppliers certified to ISO 9001 demonstrate robust QA frameworks.

- CE Marking: Particularly for European buyers, the CE mark indicates compliance with EU safety, health, and environmental requirements.

- API Standards: For SiC components used in oil & gas or petrochemical industries, adherence to API (American Petroleum Institute) standards ensures suitability for harsh environments.

- Other Regional Standards: Buyers from the Middle East or South America should verify compliance with local certifications or regulations, such as GCC Conformity Mark or INMETRO in Brazil.

Key Quality Control (QC) Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials and components to verify conformity with specifications before production.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing to detect deviations early, including dimensional checks, temperature control, and process parameter validation.

- Final Quality Control (FQC): Comprehensive testing of finished products including visual inspection, functional tests, and packaging verification.

Buyers should request detailed QC protocols and evidence of these checkpoints to assess supplier reliability.

Testing SiC components is critical to validate their performance under operational conditions. Key methods include:

International buyers should request test reports and certificates from accredited laboratories to verify these test results.

Ensuring supplier QC integrity is paramount, especially when sourcing SiC components across continents. Here are actionable strategies:

Buyers from Africa, South America, the Middle East, and Europe face unique challenges and opportunities when sourcing SiC applications:

By proactively addressing these nuances, international B2B buyers can secure high-quality SiC components that meet both technical and regulatory demands.

In summary, understanding the detailed manufacturing processes and rigorous quality assurance protocols for SiC applications empowers international B2B buyers to make informed sourcing decisions. Emphasizing supplier certification, comprehensive QC checkpoints, and regional compliance ensures that buyers from Africa, South America, the Middle East, and Europe receive reliable, high-performance SiC products tailored to their market needs.

When sourcing silicon carbide (SiC) applications, understanding the multifaceted cost structure and pricing dynamics is crucial for making informed purchasing decisions. The cost components and price influencers can vary significantly based on product specifications, supplier location, and market conditions. This detailed analysis provides international B2B buyers—especially those from Africa, South America, the Middle East, and Europe—with actionable insights to optimize procurement strategies.

Raw Materials

Silicon carbide raw materials are a primary cost driver. High-purity SiC powder or wafers, essential for performance and reliability, tend to command premium prices. Variations in material grade, grain size, and purity directly impact cost.

Labor

Labor costs depend on manufacturing location and complexity. Countries with higher labor rates, such as some parts of Europe, may incur increased production costs compared to emerging markets. However, skilled labor is critical for precision in SiC device fabrication.

Manufacturing Overhead

Overhead includes energy consumption, facility maintenance, and process control systems. Given the energy-intensive nature of SiC crystal growth and processing, overhead can represent a significant portion of total costs.

Tooling and Equipment

Specialized tooling for cutting, polishing, and shaping SiC components requires substantial investment. Tool wear rates and maintenance frequency also influence per-unit costs.

Quality Control (QC) and Testing

Rigorous QC protocols, including electrical testing and defect inspection, add to costs but ensure product reliability. Certifications (e.g., ISO, RoHS compliance) often require additional testing layers.

Logistics and Customs

Shipping SiC applications internationally involves freight charges, insurance, and import duties. For buyers in regions like Africa and South America, logistics complexity and customs clearance can substantially affect landed cost.

Supplier Margin

Supplier profit margins vary based on market competition, brand reputation, and after-sales support. Negotiating favorable margins is a key lever for buyers.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes typically yield lower per-unit costs due to economies of scale. Buyers should assess forecasted demand to negotiate volume discounts or flexible MOQs.

Technical Specifications and Customization

Customized SiC components tailored to specific electrical or mechanical requirements incur higher costs than standard products. Complexity in design and additional R&D efforts contribute to price increases.

Material Quality and Certifications

Higher-grade materials and certified products command premium prices but reduce risk and potential failure costs.

Supplier Location and Capabilities

Suppliers in regions with advanced semiconductor ecosystems may charge more but offer superior quality and lead times. Conversely, emerging market suppliers can be cost-competitive but may require additional due diligence.

Incoterms and Delivery Terms

Understanding and negotiating Incoterms (e.g., FOB, CIF, DDP) affects who bears transportation risk and cost. Buyers in remote or developing regions should carefully evaluate these terms to avoid unexpected expenses.

Negotiate Beyond Price

Focus on total value, including lead times, payment terms, and technical support. In markets like the UAE or Argentina, building long-term supplier relationships can unlock better terms.

Evaluate Total Cost of Ownership (TCO)

Consider downstream costs such as installation, maintenance, and potential downtime. Investing in higher-quality SiC applications can reduce TCO despite higher upfront prices.

Leverage Group Purchasing or Consortia

Buyers from smaller markets in Africa or South America can benefit from pooling orders to meet MOQs and improve bargaining power.

Factor in Currency Fluctuations and Tariffs

Currency volatility can impact final costs. Hedging strategies and awareness of regional trade agreements are essential for budgeting.

Due Diligence on Certification and Compliance

Verify supplier certifications to ensure compliance with regional standards, which can prevent costly rejections or delays.

Prices for silicon carbide applications are indicative and subject to change based on market conditions, raw material availability, and geopolitical factors. Buyers should request detailed quotations and confirm all cost elements before finalizing procurement decisions.

By thoroughly understanding these cost and pricing factors, international B2B buyers can strategically navigate the complexities of sourcing SiC applications, achieving optimal cost-efficiency and supply chain resilience.

When sourcing Silicon Carbide (SiC) components, understanding the key technical properties is vital for ensuring product performance and compatibility with your application. Here are the primary specifications to consider:

Material Grade

SiC is available in various purity and crystalline forms, such as alpha-SiC (hexagonal) and beta-SiC (cubic). The material grade affects electrical conductivity, thermal stability, and mechanical strength. For buyers, selecting the correct grade ensures durability and efficiency, particularly in high-power electronics or abrasive environments.

Tolerance

This refers to the permissible variation in dimensions or electrical parameters. Tight tolerances are critical in applications like semiconductor devices or precision abrasives, where even minor deviations can cause malfunction or reduced lifespan. Requesting detailed tolerance specifications helps avoid costly production errors.

Thermal Conductivity

SiC’s ability to dissipate heat efficiently makes it ideal for power electronics and high-temperature environments. Understanding the thermal conductivity rating allows buyers to match materials with their cooling requirements, preventing overheating and improving reliability.

Dielectric Strength

This property measures the material’s ability to withstand electrical stress without breakdown. High dielectric strength is essential for insulation components in electrical systems. Buyers should verify this property to ensure safety and compliance with international electrical standards.

Particle Size Distribution (for powders and abrasives)

The size and uniformity of SiC particles impact surface finish and processing speed in grinding, polishing, or coating applications. Buyers should specify particle size ranges based on their production needs to optimize performance and reduce waste.

Purity Level

Impurities can affect the electrical and thermal behavior of SiC materials. High purity levels are often required for semiconductor applications to ensure consistent performance and longevity. Understanding purity specifications helps buyers assess quality and suitability.

Navigating international B2B trade for SiC products involves understanding essential terminology that governs transactions and technical communication:

OEM (Original Equipment Manufacturer)

Refers to companies that produce components to be used in another company’s final product. Knowing if your supplier is an OEM or a distributor can affect pricing, customization options, and after-sales support.

MOQ (Minimum Order Quantity)

This is the smallest quantity a supplier is willing to sell. MOQs vary widely depending on the SiC product and supplier. For buyers in emerging markets or smaller businesses, negotiating MOQ can be crucial for managing inventory and cash flow.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, delivery times, and terms for specific SiC products. A well-structured RFQ with detailed technical requirements ensures accurate and competitive offers, reducing procurement cycle time.

Incoterms (International Commercial Terms)

Standardized trade terms defined by the International Chamber of Commerce, Incoterms clarify responsibilities regarding shipping, insurance, and customs clearance. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps avoid misunderstandings and extra costs.

Lead Time

The period between placing an order and receiving the goods. SiC components often require precise manufacturing processes, so lead times can be longer than standard materials. Clear communication on lead time is essential for production planning.

Traceability

The ability to track the origin and manufacturing history of a SiC product. Traceability is increasingly important for quality assurance and regulatory compliance, especially in aerospace, automotive, and energy sectors.

By mastering these technical properties and trade terms, international buyers—from Africa to South America, the Middle East, and Europe—can make informed decisions, negotiate effectively, and secure SiC materials that meet their operational and commercial needs.

The silicon carbide (SiC) applications sector is experiencing robust growth driven by global demand for high-performance, energy-efficient technologies. SiC’s superior thermal conductivity, high breakdown electric field, and exceptional durability make it indispensable in power electronics, electric vehicles (EVs), renewable energy systems, and industrial automation. For international B2B buyers, particularly in Africa, South America, the Middle East, and Europe, understanding the evolving market dynamics is crucial for strategic sourcing.

Key market drivers include the accelerating shift toward electrification, with regions like Europe and the UAE aggressively investing in EV infrastructure and renewable energy projects. South American countries such as Argentina are expanding their lithium and battery manufacturing sectors, increasing the demand for SiC components. Meanwhile, Africa's growing industrial base and energy infrastructure modernization projects are creating new opportunities for SiC applications in power conversion and smart grids.

Emerging B2B sourcing trends highlight an increased preference for vertically integrated supply chains and partnerships with specialized SiC manufacturers. Buyers are focusing on securing stable supplies amid global semiconductor shortages and geopolitical uncertainties. Additionally, digital procurement platforms and AI-driven supply chain analytics are gaining traction, enabling buyers to optimize costs, reduce lead times, and enhance quality assurance.

Regional market dynamics also influence sourcing strategies. For example, Middle Eastern buyers benefit from proximity to raw material suppliers and government-backed innovation hubs, facilitating faster product development cycles. European companies prioritize compliance with stringent regulatory standards and invest heavily in R&D collaborations. For African and South American buyers, cost-efficiency and supplier reliability remain top priorities, often necessitating diversified sourcing from Asia, Europe, and North America.

Sustainability has become a cornerstone for B2B buyers in the SiC applications sector, reflecting broader global commitments to reducing environmental impact and promoting ethical supply chains. The production of SiC materials, while energy-intensive, is increasingly adopting greener manufacturing processes, such as utilizing renewable energy sources and improving material yield to minimize waste.

International buyers must prioritize suppliers who demonstrate transparent environmental management systems and hold recognized certifications like ISO 14001 (Environmental Management) or industry-specific green labels. Ethical sourcing extends beyond environmental considerations to include responsible labor practices and conflict-free raw material procurement, particularly relevant for regions like Africa where mining operations can be sensitive.

Green materials and eco-friendly alternatives are gaining importance in SiC device manufacturing. Buyers are encouraged to assess suppliers’ lifecycle assessments (LCAs) and carbon footprint disclosures to ensure alignment with corporate sustainability goals. Additionally, leveraging circular economy principles—such as recycling SiC wafers and components—can enhance sustainability while reducing costs.

Illustrative Image (Source: Google Search)

For buyers in regions with ambitious climate targets, such as the European Union and UAE, integrating sustainability criteria into procurement policies is not only a regulatory necessity but also a competitive advantage. Engaging with suppliers who invest in sustainable innovation can future-proof supply chains and improve brand reputation across global markets.

The evolution of SiC applications traces back to the 20th century when SiC was primarily used as an abrasive material due to its hardness. Its semiconductor properties were identified mid-century, but widespread adoption was limited by manufacturing complexities and high costs. The last two decades have seen significant technological breakthroughs in SiC crystal growth and device fabrication, dramatically reducing costs and enhancing performance.

This evolution has transformed SiC from a niche industrial material into a strategic component in modern electronics, particularly for power devices capable of operating at high voltages and temperatures. For B2B buyers, this historical context underscores the importance of partnering with suppliers who leverage the latest manufacturing advances and maintain robust R&D pipelines to meet the sector’s growing and diverse demands.

How can I effectively vet suppliers of SiC applications to ensure reliability and quality?

Begin by reviewing the supplier’s certifications, such as ISO 9001 and industry-specific standards relevant to SiC applications. Request samples and technical datasheets to verify product specifications. Check references and client testimonials, especially from similar industries or regions. Conduct factory audits if possible, or use third-party inspection services to assess manufacturing capabilities. Engaging in initial small orders can also help evaluate responsiveness and product consistency before scaling up.

What customization options are typically available for SiC applications, and how can I communicate my specific needs?

Many suppliers offer customization in terms of device dimensions, doping levels, packaging, and electrical characteristics. Clearly outline your technical requirements in a detailed specification document, including performance targets and environmental conditions. Collaborate closely with the supplier’s engineering team during early discussions to align capabilities and timelines. Use CAD models or prototypes to facilitate understanding. Ensure any custom work is reflected in the contract with agreed milestones and quality checkpoints.

What should I expect regarding minimum order quantities (MOQs), lead times, and payment terms when sourcing SiC applications internationally?

MOQs vary widely depending on the complexity of the SiC application and supplier policies, often ranging from hundreds to thousands of units. Lead times can be lengthy due to specialized manufacturing processes, typically spanning 8 to 16 weeks or more. Payment terms commonly involve an upfront deposit (30-50%) with the balance payable upon shipment or delivery. Negotiate flexible terms where possible, especially for first-time orders, and consider letters of credit or escrow services to mitigate financial risk.

Which quality assurance certifications and testing standards should I verify to ensure compliance and performance in SiC applications?

Key certifications include ISO 9001 for quality management, IATF 16949 for automotive-related SiC products, and RoHS compliance for hazardous substances. Testing standards such as JEDEC for semiconductor reliability and MIL-STD for military-grade applications are also important. Request test reports for parameters like thermal conductivity, breakdown voltage, and lifetime reliability. Confirm that the supplier performs batch-level quality control and traceability to quickly address any defects or recalls.

What logistical challenges are common when importing SiC applications from regions like Asia or Europe, and how can I optimize shipping?

Challenges include customs clearance delays, import tariffs, and the need for temperature-controlled transport for sensitive components. Work with freight forwarders experienced in handling high-value electronics and verify all documentation (commercial invoices, certificates of origin, import licenses) is accurate and compliant with local regulations. Consolidating shipments can reduce costs, but ensure packaging protects against electrostatic discharge and mechanical damage. Plan lead times with buffer for potential delays during peak seasons or geopolitical disruptions.

How can I resolve disputes or quality issues with SiC suppliers in international trade effectively?

Establish clear contract terms covering warranties, return policies, and dispute resolution methods before placing orders. Use written communication to document all issues and responses. Engage in direct negotiation first to find amicable solutions like replacement shipments or discounts. If unresolved, consider mediation or arbitration through trade organizations or chambers of commerce relevant to your regions. Retaining legal counsel familiar with international trade law and the supplier’s jurisdiction is advisable for serious conflicts.

Are there specific considerations for sourcing SiC applications in regions like Africa or the Middle East compared to Europe or South America?

Infrastructure and regulatory environments vary significantly; ensure your supplier understands local import regulations, certifications, and taxes. Logistics can be more complex in Africa and the Middle East, requiring partnerships with local distributors or agents to navigate customs and after-sales support. Currency fluctuations and payment system limitations may also impact transactions. In Europe and South America, compliance with stricter environmental and safety standards is often mandatory, so verify supplier adherence to these regulations.

What are the best practices for establishing long-term partnerships with SiC application suppliers internationally?

Focus on transparency and consistent communication, sharing forecasts and feedback regularly. Invest time in understanding the supplier’s production cycles and challenges to align expectations. Incorporate performance metrics into contracts, such as on-time delivery rates and defect levels, to incentivize quality. Explore joint development projects or volume discounts to deepen collaboration. Building trust through reliability and mutual benefit often results in priority treatment, better pricing, and innovation opportunities tailored to your market needs.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of SiC applications presents a compelling opportunity for international B2B buyers seeking to enhance performance, reduce costs, and future-proof their supply chains. Key takeaways include the critical importance of partnering with suppliers who offer not only cutting-edge SiC technologies but also robust quality assurance and regional support tailored to markets in Africa, South America, the Middle East, and Europe. Leveraging local expertise and understanding geopolitical dynamics can further optimize procurement outcomes.

Emphasizing strategic sourcing enables buyers to secure competitive advantages through improved supplier collaboration, risk mitigation, and innovation alignment. This approach ensures access to scalable SiC solutions that meet evolving industry standards and sustainability goals.

Looking ahead, the SiC market is poised for accelerated growth driven by increasing demand in electric vehicles, renewable energy, and industrial automation. Buyers in regions like Argentina, UAE, and beyond should actively engage with global and regional suppliers to capitalize on emerging trends. Proactive investment in strategic partnerships and supply chain resilience will be essential to unlocking the full potential of SiC applications in the coming years.

Actionable next steps: Evaluate your current SiC sourcing strategy, prioritize supplier diversification, and explore collaborative innovation opportunities to stay ahead in this dynamic market landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina