The global demand for silicon carbide (SiC) carborundum continues to surge across diverse industrial sectors, making it a cornerstone material for cutting-edge manufacturing, electronics, and abrasives. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding the complexities of sourcing high-quality SiC carborundum is critical to maintaining competitive advantage and operational excellence.

Sic carborundum offers unparalleled hardness, thermal conductivity, and chemical stability, enabling its use in applications ranging from high-performance semiconductors to durable abrasive tools. However, navigating the global marketplace requires more than recognizing its technical merits; it demands insight into product variations, manufacturing standards, quality control protocols, and cost structures tailored to regional supplier dynamics.

This comprehensive guide equips buyers with a deep dive into:

By consolidating critical market intelligence and actionable sourcing strategies, this guide empowers international buyers—from Argentina to Vietnam—to make informed, strategic decisions. Whether you aim to establish reliable supply chains or enhance product quality, understanding the nuances of SiC carborundum sourcing is indispensable for sustainable growth in today’s interconnected industrial ecosystem.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Fused Sic (Fused Silicon Carbide) | Manufactured by fusing silica sand and coke at high temperatures; coarse grain size | Abrasives, refractories, kiln furniture | Pros: High thermal conductivity, excellent wear resistance; Cons: Higher cost, limited chemical resistance |

| Reaction Bonded Sic (RBSIC) | Formed by reacting silicon with porous carbon preforms; fine to medium grain size | Mechanical seals, semiconductor industry | Pros: High purity, good mechanical strength; Cons: Lower thermal shock resistance, complex manufacturing |

| Sintered Sic | Produced by sintering SiC powders with additives; fine grain structure | High-performance ceramics, armor, electronics | Pros: Exceptional hardness and strength; Cons: Expensive, requires specialized processing |

| Black Sic | Contains free carbon; darker color, higher electrical conductivity | Electrical components, heating elements | Pros: Good electrical conductivity, thermal stability; Cons: Lower purity may affect some applications |

| Green Sic | High purity SiC with minimal free carbon; light greenish hue | LED substrates, high-power electronics | Pros: Superior purity, excellent thermal conductivity; Cons: Higher price, limited availability |

Fused Silicon Carbide (Fused Sic) is the most widely produced form, created by melting silica sand with carbon at extreme heat. It features a coarse grain structure, making it ideal for heavy-duty abrasive applications and refractory linings in furnaces. B2B buyers from industrial sectors such as metallurgy and ceramics manufacturing should consider fused Sic for its durability and thermal stability. However, its higher cost and limited chemical resistance may restrict its use in highly corrosive environments.

Reaction Bonded Silicon Carbide (RBSIC) is manufactured through a chemical reaction between molten silicon and porous carbon preforms, resulting in a product with high purity and mechanical strength. This variation suits applications requiring precision and chemical inertness, such as mechanical seals and semiconductor components. Buyers should note that RBSIC offers lower thermal shock resistance and involves more complex production, which can affect lead times and pricing.

Sintered Silicon Carbide is produced by compacting and sintering SiC powders with additives to form a dense, fine-grained ceramic. It is prized for its exceptional hardness and strength, making it suitable for high-performance applications like armor plating, advanced electronics, and wear-resistant parts. For B2B buyers, sintered Sic represents a premium option with superior mechanical properties but comes with higher costs and requires specialized fabrication capabilities.

Black Silicon Carbide contains free carbon, which imparts a darker color and enhances electrical conductivity. It is commonly used in electrical components and heating elements where thermal stability and conductivity are critical. Buyers focusing on electrical or thermal management applications will find black Sic advantageous, though its lower purity compared to other types may limit its suitability for ultra-high-purity demands.

Green Silicon Carbide is characterized by its high purity and light green hue, making it ideal for high-technology applications such as LED substrates and high-power electronics. Its superior thermal conductivity and purity levels justify its premium price. B2B buyers in advanced electronics and semiconductor industries should weigh the benefits of green Sic’s performance against its cost and availability constraints, especially in emerging markets across Africa, South America, and the Middle East.

Related Video: The Genius Behind Bach's Goldberg Variations: CANONS

| Industry/Sector | Specific Application of sic carborundum | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Abrasives & Grinding | Production of grinding wheels, sanding belts, and cutting tools | High hardness and thermal conductivity improve cutting efficiency and durability | Consistent particle size, purity, and thermal stability are critical; reliable supply chain for bulk orders |

| Refractories & Ceramics | Manufacture of kiln linings, furnace parts, and ceramic composites | Excellent thermal resistance and chemical inertness extend service life under extreme conditions | Quality certifications for thermal performance; supplier capacity to meet volume demands for industrial furnaces |

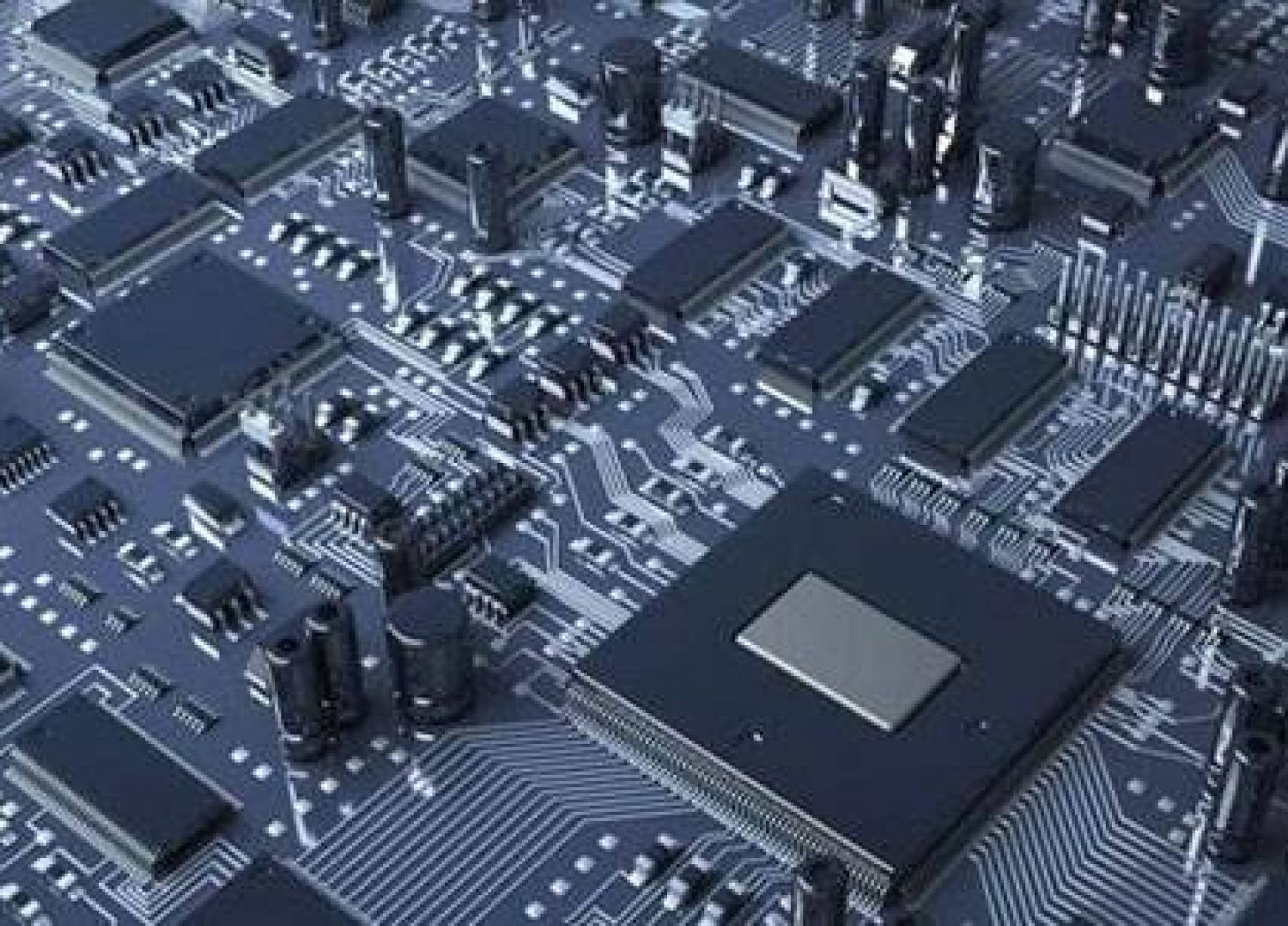

| Electronics & Semiconductors | Substrates for high-power, high-frequency electronic devices | Superior electrical insulation and heat dissipation enhance device reliability | Precise crystallographic quality and defect control; sourcing from certified producers with traceability |

| Automotive & Aerospace | Wear-resistant coatings and brake components | Enhances component lifespan and performance under high stress and temperature | Material purity and consistency; supplier compliance with industry standards for aerospace-grade materials |

| Metallurgy & Foundry | Crucibles and molds for metal casting and smelting processes | High melting point and chemical inertness reduce contamination and improve casting quality | Supplier expertise in refractory-grade SiC; availability of tailored particle sizes and forms |

Silicon carbide (SiC) carborundum is widely used in abrasives manufacturing due to its exceptional hardness and thermal conductivity. It forms the basis for grinding wheels, sanding belts, and cutting tools used across metalworking and woodworking industries. For B2B buyers in Africa, South America, the Middle East, and Europe, sourcing SiC with consistent particle size and purity is crucial to ensure optimal cutting performance and tool longevity. Buyers should prioritize suppliers who can guarantee uniformity in grain size and thermal stability to meet the demands of high-volume abrasive production.

In refractory applications, SiC carborundum serves as a key material for kiln linings, furnace parts, and ceramic composites. Its ability to withstand extreme temperatures and resist chemical attack significantly extends the operational life of industrial furnaces and reactors. International buyers, especially from regions with growing metallurgy and ceramics industries such as Argentina and Morocco, must focus on suppliers offering certified thermal performance and consistent quality. Bulk supply capability and technical support in material handling are also important to maintain uninterrupted production cycles.

SiC substrates are increasingly critical in the electronics industry for high-power and high-frequency devices. Their superior electrical insulation combined with excellent heat dissipation properties help improve device reliability and efficiency. Buyers targeting semiconductor fabrication in Europe and the Middle East need to source SiC with precise crystallographic quality and minimal defects. Partnering with certified manufacturers who provide traceability and quality assurance is essential to meet stringent industry standards and ensure successful device performance.

In automotive and aerospace sectors, SiC carborundum is used to produce wear-resistant coatings and brake components that must endure high mechanical stress and temperature fluctuations. This enhances the durability and safety of critical parts. B2B buyers from regions with advanced automotive manufacturing, such as parts of Europe and South America, should seek suppliers who comply with aerospace-grade material standards. Material purity, consistency, and certification for high-performance applications are decisive factors when selecting a supplier.

SiC carborundum is instrumental in metallurgy and foundry processes, particularly for manufacturing crucibles and molds used in metal casting and smelting. Its high melting point and chemical inertness prevent contamination and improve the quality of cast metals. For buyers in emerging industrial hubs across Africa and the Middle East, sourcing refractory-grade SiC with tailored particle sizes and forms is critical. Suppliers with expertise in refractory materials and the capacity to meet customized specifications will provide a competitive advantage in these markets.

Related Video: Akua Carborundum Gel with Wax Mediums

Alpha Silicon Carbide is the most common polymorph used in industrial applications. It exhibits excellent thermal stability, withstanding temperatures up to 1600°C, and offers outstanding hardness and wear resistance. Its chemical inertness provides superior corrosion resistance against acids and alkalis, making it suitable for harsh chemical environments.

Pros: High mechanical strength and thermal conductivity, excellent resistance to oxidation and chemical attack, and good electrical properties. It is widely available and compatible with many international standards such as ASTM C799 and DIN EN 62867.

Cons: Manufacturing complexity can lead to higher costs compared to other ceramics. Its brittleness requires careful handling during fabrication and installation. Not ideal for applications involving rapid thermal cycling due to potential cracking.

Application Impact: Ideal for abrasive media, high-temperature furnace components, and chemical processing equipment. In markets like Africa and the Middle East, where high-temperature industrial processes are common, α-SiC’s durability justifies the investment despite higher initial costs.

International Buyer Considerations: Buyers from South America (e.g., Argentina) and Europe should ensure compliance with ASTM or DIN standards for quality assurance. Supply chain reliability and certification for food-grade or chemical-grade SiC may be critical depending on end-use.

Beta Silicon Carbide is a metastable form, typically synthesized at lower temperatures. It has slightly lower hardness and thermal resistance than α-SiC but offers better toughness and impact resistance.

Pros: More cost-effective due to simpler manufacturing processes, better fracture toughness, and suitable for applications requiring some mechanical flexibility. It also performs well in abrasive environments.

Cons: Lower thermal stability (up to ~1400°C) and less chemical resistance compared to α-SiC. Its electrical properties are less favorable for semiconductor applications.

Application Impact: Suitable for mechanical seals, grinding media, and components exposed to moderate thermal conditions. For buyers in regions with emerging industrial sectors, such as parts of Africa and South America, β-SiC offers a balance between performance and cost.

International Buyer Considerations: Ensure material traceability and conformity with regional standards like JIS (Japan Industrial Standards) or ASTM, especially when sourcing from Asian suppliers. Consider local availability and logistics to optimize cost-effectiveness.

Sintered SiC is produced by sintering SiC powder with additives, resulting in a dense, high-strength ceramic with excellent thermal shock resistance and chemical inertness.

Pros: Superior mechanical strength and thermal shock resistance compared to reaction-bonded or recrystallized SiC. Excellent corrosion resistance in aggressive chemical environments, including molten metals and acids.

Cons: Higher manufacturing costs and longer lead times. Complex sintering process requires advanced facilities, which may limit supplier options in some regions.

Application Impact: Preferred in highly demanding applications such as pump seals, valve components, and heat exchangers in petrochemical and power generation industries. For Middle Eastern buyers dealing with oil and gas applications, sintered SiC offers unmatched durability.

International Buyer Considerations: Compliance with ASTM C1464 and ISO standards is essential. Buyers in Europe and the Middle East should prioritize suppliers with certified quality management systems (ISO 9001) and proven track records in industrial ceramics.

RB-SiC is manufactured by infiltrating porous carbon or silicon with molten silicon, producing a material with a unique microstructure combining SiC and residual silicon.

Pros: Lower cost compared to sintered SiC, good thermal conductivity, and excellent wear resistance. It is easier to machine before final processing, reducing manufacturing complexity.

Cons: Presence of residual silicon reduces chemical resistance, especially in acidic environments. Lower mechanical strength and thermal shock resistance compared to sintered SiC.

Application Impact: Suitable for applications where moderate corrosion resistance suffices, such as kiln furniture, wear parts in dry environments, and some automotive components. Buyers in developing industrial markets like Vietnam or parts of Africa may find RB-SiC a cost-effective solution.

International Buyer Considerations: Verify chemical compatibility with intended media, especially if used in corrosive environments. Confirm adherence to ASTM C799 and regional standards. Consider supplier proximity to reduce shipping costs and lead times.

| Material | Typical Use Case for sic carborundum | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alpha Silicon Carbide (α-SiC) | High-temperature furnace parts, chemical processing equipment | Exceptional thermal stability and chemical resistance | Brittle, higher manufacturing complexity | High |

| Beta Silicon Carbide (β-SiC) | Mechanical seals, grinding media, moderate temperature applications | Better toughness, cost-effective | Lower thermal stability and chemical resistance | Medium |

| Sintered Silicon Carbide (SSiC) | Pump seals, valves, heat exchangers in aggressive environments | Superior strength and thermal shock resistance | Expensive, longer lead times | High |

| Reaction-Bonded Silicon Carbide (RB-SiC) | Kiln furniture, wear parts in dry, less corrosive environments | Lower cost, easier machining | Residual silicon reduces corrosion resistance | Low |

This detailed analysis equips international B2B buyers, especially from Africa, South America, the Middle East, and Europe, with critical insights to select the most appropriate SiC material for their carborundum applications. Consideration of local industrial standards, supply chain logistics, and end-use environment will optimize material performance and cost-efficiency.

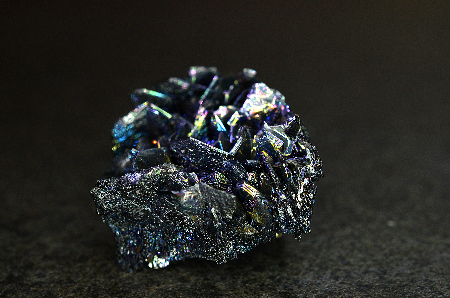

Silicon Carbide, commonly known as SiC or carborundum, is a highly durable and versatile material widely used in abrasives, refractories, semiconductors, and high-performance ceramics. For international B2B buyers, understanding the core manufacturing steps is essential to assess supplier capabilities and product quality.

The manufacturing of SiC begins with the preparation of raw materials. The primary components include silica sand (SiO2) and carbon sources such as petroleum coke or coal. These are carefully selected for purity to avoid impurities that can degrade product performance.

SiC is synthesized primarily through the Acheson process, a high-temperature electric resistance heating technique:

For international B2B buyers, especially from Africa, South America, the Middle East, and Europe, rigorous quality assurance and control are paramount to ensure consistent performance and compliance with global standards.

To mitigate risks and confirm supplier reliability, international buyers should employ multiple strategies:

For buyers in Africa, South America, the Middle East, and Europe, understanding regional compliance and logistics considerations can enhance procurement effectiveness:

By integrating these manufacturing and quality assurance insights, B2B buyers can confidently select SiC carborundum suppliers that deliver reliable, high-performance products suited to diverse industrial applications across Africa, South America, the Middle East, and Europe.

When sourcing silicon carbide (SiC) carborundum, understanding the detailed cost structure and pricing dynamics is essential for international B2B buyers aiming to optimize procurement and ensure competitiveness. Below is a thorough analysis of the key cost components, pricing influencers, and actionable tips tailored to buyers from Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Raw Materials

Silicon carbide production depends heavily on high-purity silica sand and petroleum coke. Fluctuations in these raw material prices directly impact the base cost. Buyers should monitor global commodity trends, especially since supply chains can be affected by geopolitical factors or regional disruptions.

Labor Costs

Labor expenses vary significantly by manufacturing location. Countries with lower labor costs may offer more competitive pricing, but buyers must balance cost with quality and delivery reliability. For example, sourcing from established European manufacturers may incur higher labor costs but often comes with superior process controls.

Manufacturing Overhead

This includes energy consumption (notably high in SiC production due to electric furnace usage), plant maintenance, and indirect labor. Energy costs vary regionally, influencing overhead and, consequently, pricing.

Tooling and Equipment

Specialized equipment for grinding, shaping, and finishing SiC products adds to initial and ongoing costs. Custom tooling for specific product shapes or sizes can increase unit costs, particularly for smaller order volumes.

Quality Control and Certifications

Stringent QC processes and international certifications (e.g., ISO, REACH compliance) add to costs but are critical for ensuring product consistency, safety, and regulatory adherence—especially important for buyers in regulated markets in Europe and the Middle East.

Logistics and Freight

Shipping costs can be substantial due to the weight and volume of abrasive materials. International buyers should consider freight terms, customs duties, and potential delays. Port proximity and transport infrastructure in sourcing countries affect these costs.

Supplier Margin

Suppliers include a margin reflecting business sustainability, market positioning, and volume discounts. Margins vary based on supplier scale and relationship strength.

Order Volume and Minimum Order Quantities (MOQ)

Larger volumes typically attract significant price reductions. Small or sample orders often carry premium pricing due to setup costs and lower economies of scale.

Product Specifications and Customization

Specialized grain sizes, bonding agents, or forms (e.g., powders, blocks, or wheels) influence prices. Custom formulations or certifications (food-grade, medical-grade) may increase costs.

Raw Material Grade and Purity

Higher purity SiC commands premium pricing, especially for applications in electronics or advanced abrasives.

Quality Certifications and Compliance

Certifications required by specific regions (e.g., CE marking for Europe) can add to costs but are often non-negotiable for legal importation and market access.

Supplier Reliability and Location

Suppliers with proven track records, shorter lead times, and local warehouses may price higher but reduce risk and inventory costs.

Incoterms and Payment Terms

Terms such as FOB, CIF, or DDP significantly affect landed costs. Buyers should carefully negotiate terms to optimize cash flow and minimize unexpected expenses.

Negotiate Volume-Based Discounts:

Consolidate orders or collaborate with other buyers in your region (e.g., South America or Africa) to increase volumes and access better pricing tiers.

Evaluate Total Cost of Ownership (TCO):

Beyond unit price, consider logistics, inventory holding, quality-related rework, and downtime costs. Sometimes a higher upfront cost leads to savings in the supply chain.

Leverage Local and Regional Suppliers When Possible:

For buyers in Europe or the Middle East, sourcing closer to home can reduce shipping time and costs, and simplify compliance.

Assess Supplier Certifications and Quality Assurance:

Prioritize suppliers with robust QC systems and relevant certifications to avoid hidden costs from defective products or regulatory penalties.

Understand Pricing Nuances by Region:

For buyers in Argentina, Vietnam, or other emerging markets, factor in currency fluctuations, import tariffs, and local taxes. Use Incoterms strategically to share risk and cost.

Request Detailed Quotes with Cost Breakdowns:

Transparent pricing helps identify negotiation levers and avoid unexpected fees.

Prices for SiC carborundum vary widely depending on specifications, supplier, order size, and market conditions. The analysis above provides a framework rather than fixed pricing. Buyers are encouraged to obtain multiple quotes and conduct due diligence aligned with their unique operational and regulatory contexts.

By carefully analyzing these cost drivers and price influencers, international B2B buyers can make informed sourcing decisions, optimize procurement strategies, and build resilient supply chains for silicon carbide carborundum.

Understanding the essential technical specifications of silicon carbide (SiC), commonly known as carborundum, is crucial for international buyers aiming to source quality materials tailored to their industrial needs. Here are the critical properties to consider:

Illustrative Image (Source: Google Search)

Material Grade (Purity Level): SiC is available in various purity grades, typically ranging from 95% to over 99.5%. Higher purity grades ensure better thermal conductivity, chemical resistance, and mechanical strength. For industries such as abrasives, refractories, or semiconductors, selecting the appropriate grade impacts product performance and longevity.

Particle Size and Distribution: This defines the granularity of SiC particles, commonly measured in microns or mesh sizes. Finer particles are preferred for polishing and finishing applications, while coarser grades suit cutting and grinding. Consistent particle distribution ensures uniformity in product batches, critical for quality control.

Bulk Density: Bulk density affects handling, packaging, and the volume-to-weight ratio for shipping. It also influences the sintering process in ceramics manufacturing. Buyers should verify bulk density specifications to optimize logistics and production efficiency.

Mohs Hardness: SiC is known for its exceptional hardness, typically around 9.5 on the Mohs scale. This property makes it ideal for abrasive applications. Confirming hardness levels helps buyers ensure the material meets the durability requirements of end-use industries.

Tolerance and Dimensional Stability: For SiC products shaped as grains, powders, or blocks, tight tolerances in size and shape are vital. This impacts compatibility with machinery and consistency in industrial processes, especially in precision manufacturing sectors.

Thermal and Chemical Resistance: SiC exhibits excellent thermal stability and resistance to oxidation, acids, and alkalis. These properties are essential for buyers in harsh environment applications like furnace linings and high-temperature semiconductors.

Navigating international SiC procurement involves familiarity with key trade terms that streamline communication and contractual clarity:

OEM (Original Equipment Manufacturer): Refers to companies that purchase SiC materials to incorporate into their own products. Buyers sourcing for OEM purposes should confirm compliance with specific quality standards required by end-product manufacturers.

MOQ (Minimum Order Quantity): The smallest quantity a supplier is willing to sell. Understanding MOQ helps buyers plan their inventory and negotiate pricing, especially important for SMEs or buyers in emerging markets seeking cost-effective orders.

RFQ (Request for Quotation): A formal inquiry sent to suppliers to obtain price, delivery, and specification details. A well-prepared RFQ accelerates procurement by providing clear requirements, facilitating accurate and competitive supplier responses.

Incoterms (International Commercial Terms): Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs. Common Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, Freight). Awareness of Incoterms ensures smooth cross-border transactions and cost transparency.

Lead Time: The time between placing an order and receiving the shipment. For SiC buyers, especially in sectors with tight production schedules, negotiating realistic lead times is critical to avoid supply chain disruptions.

Certification and Compliance: Terms like ISO, REACH, or RoHS indicate adherence to quality, safety, and environmental standards. International buyers should request relevant certifications to ensure regulatory compliance and reduce risks.

By prioritizing these technical properties and mastering essential trade terminology, international B2B buyers from Africa, South America, the Middle East, and Europe can make informed purchasing decisions, optimize supply chain efficiency, and foster strong supplier partnerships in the SiC carborundum market.

Silicon carbide (SiC) carborundum, prized for its exceptional hardness, thermal conductivity, and chemical stability, is a critical material in various industrial sectors, including abrasives, semiconductors, automotive, and renewable energy. Globally, demand for SiC is accelerating, driven by the growing adoption of electric vehicles (EVs), high-power electronics, and energy-efficient manufacturing processes. For B2B buyers in Africa, South America, the Middle East, and Europe, understanding these market drivers is essential for strategic sourcing and supplier selection.

Key Market Drivers:

Emerging Sourcing Trends:

Market Dynamics:

Sustainability is increasingly reshaping the SiC carborundum sector, reflecting broader global trends toward responsible industrial supply chains. For international B2B buyers, particularly from environmentally conscious markets in Europe and emerging regions, embedding sustainability into procurement is both a compliance necessity and a competitive advantage.

Illustrative Image (Source: Google Search)

Environmental Impact Considerations:

Ethical Supply Chains:

Green Materials & Innovations:

Silicon carbide, historically known as carborundum, was first synthesized in the late 19th century as an abrasive material due to its remarkable hardness second only to diamond. Over the decades, its applications expanded from traditional grinding and cutting tools to critical components in high-performance electronics and power systems.

The evolution of SiC technology accelerated in the 21st century, driven by breakthroughs in crystal growth and wafer fabrication, enabling its use in semiconductor devices that operate at higher voltages, frequencies, and temperatures than silicon-based counterparts. This transformation has positioned SiC as a cornerstone material in modern industrial and energy sectors, making it a strategic commodity for international B2B procurement.

For buyers, understanding this historical trajectory highlights the increasing complexity and value embedded in SiC products, underscoring the importance of sourcing from technologically advanced and sustainable suppliers to meet future market demands.

How can I effectively vet suppliers of SiC carborundum for international B2B transactions?

To vet SiC carborundum suppliers, start by verifying their business licenses, manufacturing capabilities, and years of experience. Request product samples and detailed technical datasheets to assess quality. Check for industry certifications such as ISO 9001 or specific abrasive material standards. Review client testimonials or case studies, especially from buyers in your region (Africa, South America, Middle East, Europe). Conduct remote factory audits or use third-party inspection services to ensure compliance with production and labor standards. Establish clear communication channels and transparency before committing to large orders.

Is customization of SiC carborundum products available, and how can it be arranged?

Many manufacturers offer customization for SiC carborundum, including particle size, grain shape, purity, and packaging. Clearly communicate your technical specifications and end-use requirements upfront. Request a technical consultation to discuss feasibility and minimum quantities for custom grades. Confirm lead times and cost implications for bespoke products. For buyers in diverse markets like Argentina or Vietnam, consider local regulatory requirements and compatibility with existing equipment. Always request pre-production samples and test results to validate custom specifications before mass production.

What are typical minimum order quantities (MOQ) and lead times for SiC carborundum shipments internationally?

MOQ varies widely depending on supplier scale and product form (powder, grains, or blocks). Common MOQs range from 500 kg to several tons. Lead times typically span 4 to 8 weeks, influenced by customization, production schedules, and shipping routes. For buyers in Africa or the Middle East, factor in additional transit time due to port clearance and customs. Negotiate MOQs and lead times early to align with your inventory and project timelines. Some suppliers may offer trial orders or consolidated shipments to reduce upfront investment and logistics complexity.

Which payment terms are standard for international B2B purchases of SiC carborundum, and how to mitigate risks?

Common payment methods include Letters of Credit (LC), Telegraphic Transfers (T/T), and Escrow services. LCs offer security by ensuring payment only after shipment verification, preferred for first-time international deals. T/T payments often require a 30% deposit upfront, balance before shipment. Negotiate clear payment milestones linked to production and quality checkpoints. Employ trade credit insurance or work with reputable banks to minimize financial risk. For buyers from emerging markets, building long-term supplier relationships can improve payment flexibility over time.

What quality assurance measures and certifications should I expect for SiC carborundum products?

Reputable suppliers provide ISO 9001 certification and specific product test reports confirming particle size distribution, purity, hardness, and contamination levels. Request Certificates of Analysis (CoA) and Material Safety Data Sheets (MSDS). Third-party lab testing or inspection upon receipt can validate quality consistency. For critical industrial applications, inquire about batch traceability and compliance with regional standards (e.g., REACH in Europe). Establish contractual quality clauses and rejection criteria to protect your interests and ensure product reliability.

How can international buyers optimize logistics and shipping for SiC carborundum imports?

Plan shipments considering bulk density and packaging to optimize freight costs. Choose suppliers near major ports with experience exporting to your region to reduce transit delays. Utilize consolidated container shipments or multimodal transport options for cost-efficiency. Ensure proper packaging to prevent moisture ingress or contamination during transit, especially in humid climates common in Africa and South America. Collaborate with experienced freight forwarders familiar with customs regulations in your country. Track shipments proactively and prepare documentation to expedite clearance.

What steps should be taken if there is a dispute regarding SiC carborundum quality or delivery?

Immediately document the issue with photos, test reports, and communication logs. Notify the supplier promptly and seek amicable resolution through negotiation. Refer to contract terms on quality standards, inspection rights, and dispute resolution mechanisms. If unresolved, use third-party mediation or arbitration under international trade rules (e.g., ICC). Retain legal counsel knowledgeable in cross-border trade law. For ongoing partnerships, consider building a corrective action plan with the supplier to prevent recurrence and maintain trust.

Are there specific considerations when sourcing SiC carborundum from suppliers in emerging markets like Vietnam or Argentina?

Emerging markets may offer competitive pricing but require careful due diligence on quality and compliance. Verify supplier certifications and capacity to meet international standards. Consider potential language barriers and time zone differences impacting communication. Factor in longer lead times due to evolving infrastructure and customs procedures. Engage local agents or consultants to navigate regulatory and cultural nuances. Building strong relationships and conducting periodic audits can help ensure reliability and smooth operations in these dynamic sourcing regions.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of SiC carborundum represents a critical lever for international B2B buyers seeking to enhance product quality, operational efficiency, and cost-effectiveness. Across diverse markets such as Africa, South America, the Middle East, and Europe, understanding supplier capabilities, raw material origins, and logistical nuances enables businesses to mitigate risks and secure reliable supply chains. Prioritizing suppliers with proven expertise in SiC production and sustainable practices will unlock long-term value and innovation potential.

Key takeaways for buyers include:

Looking ahead, the SiC carborundum market is poised for growth driven by expanding industrial applications, including electronics, abrasives, and automotive sectors. International buyers are encouraged to adopt a proactive sourcing approach, continuously monitoring market trends and technological advances to maintain competitive advantage. Embracing strategic sourcing not only secures supply but also positions businesses to capitalize on emerging opportunities in this dynamic material landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina