Understanding the critical role of silicon carbide (SiC) density is essential for businesses seeking to optimize performance, durability, and cost-efficiency in high-tech applications. SiC density directly influences the material’s mechanical strength, thermal conductivity, and electrical properties—factors that are pivotal in sectors such as electronics, automotive, aerospace, and industrial manufacturing. For international B2B buyers, particularly those operating in diverse markets like Africa, South America, the Middle East, and Europe, mastering the nuances of SiC density can unlock significant competitive advantages.

This comprehensive guide delves into every aspect of SiC density, offering a deep dive into its various types and grades, the raw materials and manufacturing processes that impact density, and the rigorous quality control measures that ensure consistency and reliability. Buyers will gain insights into selecting the right suppliers globally, understanding cost drivers, and navigating market trends that influence availability and pricing.

By addressing frequently asked questions and providing actionable advice tailored to the unique challenges faced by businesses in regions such as the UAE and Kenya, this guide empowers procurement professionals to make informed, strategic sourcing decisions. Whether you are evaluating new suppliers or optimizing existing supply chains, understanding SiC density is a foundational step toward achieving superior product quality and operational excellence in today’s competitive global marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Bulk Density SiC | Measures mass per unit volume including voids | Ceramics manufacturing, refractory materials | Pros: Cost-effective, easy to measure; Cons: Less precise for material purity assessment |

| True Density SiC | Mass per unit volume excluding pores and voids | High-performance electronics, abrasives | Pros: Accurate for quality control; Cons: Requires specialized equipment, higher cost |

| Apparent Density SiC | Includes open pores but excludes closed pores | Structural composites, sintered components | Pros: Balances cost and accuracy; Cons: Can vary with sample preparation methods |

| Tap Density SiC | Density after mechanically tapping to reduce volume | Powder metallurgy, additive manufacturing | Pros: Indicates powder flowability; Cons: May not reflect actual material density |

| Particle Density SiC | Density of individual particles without voids | Catalyst supports, coatings | Pros: Useful for particle size analysis; Cons: Limited use in bulk material assessment |

Bulk Density SiC

Bulk density measures the overall mass of silicon carbide per unit volume, including the void spaces between particles. This type is commonly used in industries like ceramics and refractory manufacturing where material bulk properties matter more than microscopic porosity. For B2B buyers, bulk density offers a cost-effective and straightforward metric for ordering and inventory management. However, it is less suitable when precise material purity or performance characteristics are critical.

True Density SiC

True density excludes all pores and voids, reflecting the intrinsic density of the silicon carbide material itself. It is vital for high-performance applications such as electronics and abrasive tools where material consistency and purity directly affect product quality. Buyers should consider the higher costs and need for specialized measurement tools but benefit from enhanced quality assurance and specification compliance.

Apparent Density SiC

Apparent density accounts for open pores but not closed ones, providing a middle ground between bulk and true density. This makes it suitable for structural composites and sintered parts where some porosity affects performance. For B2B purchasing, apparent density helps balance cost and accuracy, but buyers must ensure standardized sample preparation to avoid variability in measurements.

Tap Density SiC

Tap density is determined after mechanically tapping the powder to minimize volume by settling particles. It is particularly relevant in powder metallurgy and additive manufacturing, where flowability and packing density impact processing efficiency. While tap density offers insights into powder behavior, it may not accurately represent the material’s true density, so buyers should use it alongside other metrics for comprehensive evaluation.

Particle Density SiC

Particle density measures the density of individual silicon carbide particles, excluding voids and pores. This is essential for applications such as catalyst supports and coatings, where particle size and surface area influence performance. Although limited for bulk material assessment, particle density aids buyers in selecting materials tailored for surface-sensitive applications and ensuring consistency in particle size distribution.

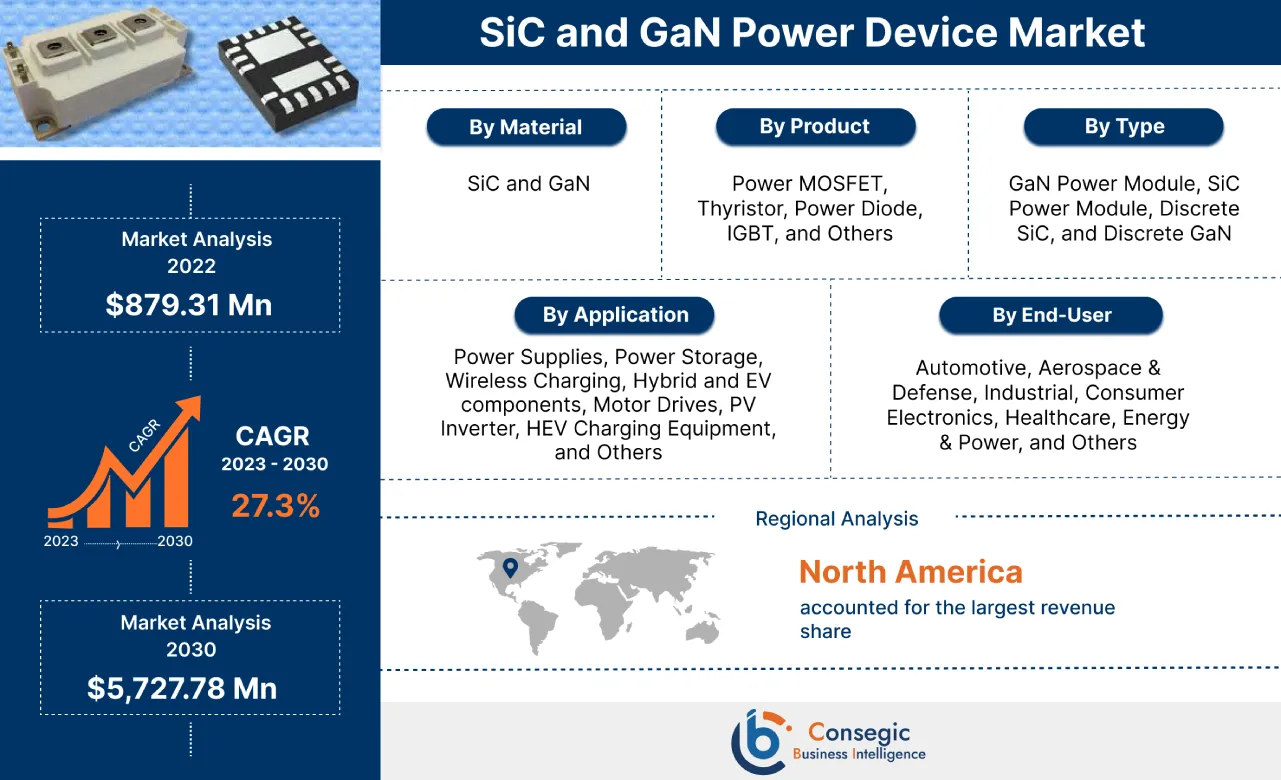

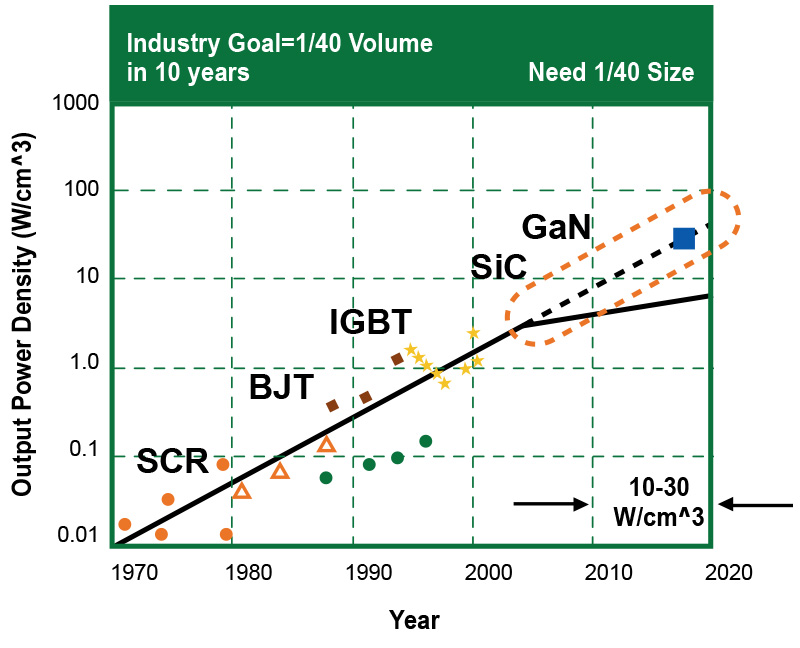

Related Video: Wide Bandgap SiC and GaN Devices - Characteristics & Applications

| Industry/Sector | Specific Application of sic density | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Electronics Manufacturing | High-performance semiconductor substrates | Enhanced thermal management and electrical efficiency | Consistent density for reliable conductivity, supplier certification, and purity |

| Automotive & Aerospace | Lightweight, high-strength composite materials | Improved fuel efficiency and component durability | Uniform density critical for mechanical properties, compliance with safety standards |

| Energy & Power Systems | Heat exchangers and high-temperature insulation components | Increased operational lifespan and energy efficiency | Density uniformity to withstand thermal stress, supplier reliability, and logistics |

| Industrial Abrasives | Precision grinding and cutting tools | Superior wear resistance and longer tool life | Density affects hardness and toughness, sourcing from trusted manufacturers |

| Chemical Processing | Catalyst supports and filtration media | Optimized reaction rates and filtration efficiency | Consistent density for uniform flow and reaction, quality control, and supply chain transparency |

In electronics manufacturing, silicon carbide (SiC) density plays a critical role in producing semiconductor substrates. The density directly impacts thermal conductivity and electrical insulation properties, which are essential for managing heat dissipation in high-power devices. For B2B buyers in Africa, South America, the Middle East, and Europe, sourcing SiC with consistent density ensures device reliability and longevity. Buyers should prioritize suppliers offering certified purity levels and stable density metrics to avoid costly production failures.

Illustrative Image (Source: Google Search)

SiC density is vital in automotive and aerospace industries for manufacturing lightweight composites that enhance fuel efficiency and structural durability. Uniform density guarantees mechanical strength and resistance to thermal and mechanical stress, critical for safety and performance. International buyers, especially in regions like the UAE and Kenya, must consider suppliers’ adherence to international safety certifications and the ability to provide consistent batch quality to meet stringent industry standards.

In energy and power systems, SiC density is leveraged in heat exchangers and insulation materials that operate under high temperatures. Proper density ensures materials can withstand thermal cycling without degradation, improving system efficiency and lifespan. Buyers from emerging markets and developed regions alike should focus on suppliers who provide detailed density specifications and demonstrate robust quality assurance processes to support long-term operational stability.

SiC density directly influences the hardness and toughness of abrasives used in precision grinding and cutting tools. High-density SiC abrasives offer superior wear resistance, reducing downtime and tool replacement costs. For B2B buyers worldwide, it is essential to verify density consistency through supplier certifications and to understand the impact of density on the specific abrasive application to optimize performance and cost-efficiency.

In chemical processing, SiC serves as catalyst supports and filtration media where density affects flow uniformity and reaction efficiency. Consistent SiC density ensures predictable performance in filtration and catalysis, reducing process variability. Buyers from Africa, South America, the Middle East, and Europe should seek suppliers with transparent quality control measures and the ability to supply materials that meet strict density tolerances to enhance process reliability and output quality.

Related Video: The Uses of Static Electricity - GCSE Physics | kayscience.com

Key Properties: Silicon carbide ceramics exhibit exceptional hardness, high thermal conductivity, and outstanding chemical inertness. They withstand temperatures exceeding 1600°C and resist corrosive environments, making them ideal for high-temperature and abrasive applications.

Pros & Cons: SiC ceramics offer excellent durability and wear resistance, significantly extending product lifespan. However, their brittleness can pose manufacturing challenges, requiring precision machining and handling. The material cost is relatively high but justified by performance benefits in demanding conditions.

Impact on Application: SiC ceramics are well-suited for applications involving abrasive slurries, corrosive chemicals, and high-temperature gas flows. Their chemical stability ensures compatibility with aggressive media, such as acids and alkalis, common in chemical processing industries.

Considerations for International Buyers: Buyers in regions like the UAE and Kenya should verify compliance with ASTM C799 or DIN EN 60672 standards to ensure quality and performance. Additionally, local manufacturing capabilities may influence lead times and costs, so sourcing from established suppliers with global certifications is advisable.

Key Properties: These refractories combine SiC with other materials to enhance thermal shock resistance and mechanical strength. They typically operate effectively up to 1500°C and exhibit excellent resistance to slag and molten metals.

Pros & Cons: The composite nature improves toughness compared to pure SiC ceramics, reducing the risk of cracking under thermal cycling. However, they are heavier and may have slightly lower thermal conductivity. Production complexity is moderate, with costs generally lower than pure SiC ceramics.

Impact on Application: Ideal for furnace linings, kiln furniture, and metallurgical processes where thermal shock and corrosion resistance are critical. Their robustness supports continuous operation in harsh industrial environments.

Considerations for International Buyers: In South America and Europe, adherence to standards like ASTM C610 or JIS R 2207 ensures product reliability. Importers should assess supplier certifications and the availability of technical support for installation and maintenance.

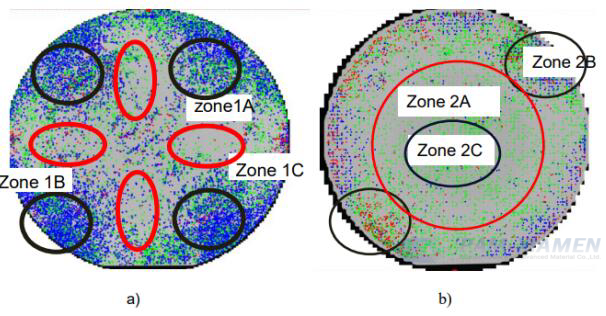

Key Properties: SiC powders are fine particulates used primarily in sintering and composite manufacturing. They offer controlled particle size distribution and high purity levels, essential for consistent densification and mechanical properties.

Pros & Cons: Powders provide versatility for custom material formulations and are generally more cost-effective than finished ceramics. However, handling requires strict quality control to avoid contamination, and sintering processes demand specialized equipment.

Impact on Application: Widely used in producing dense SiC components for electronics, abrasives, and heat exchangers. Their adaptability allows tailoring density and porosity to specific application needs.

Considerations for International Buyers: Buyers in Africa and the Middle East should confirm compliance with ISO 9001 and relevant ASTM powder standards. Logistics considerations include secure packaging to prevent moisture ingress and contamination during transit.

Key Properties: SiC fibers exhibit high tensile strength, excellent thermal stability up to 1400°C, and resistance to oxidation. They are used to reinforce ceramic matrices, improving toughness and fracture resistance.

Pros & Cons: Incorporating SiC fibers enhances composite performance significantly, especially in aerospace and automotive sectors. The downside includes high production costs and the need for precise processing conditions to maintain fiber integrity.

Impact on Application: Best suited for high-performance composites requiring lightweight yet strong materials. Their use is expanding in thermal management systems and structural components exposed to extreme environments.

Considerations for International Buyers: European and South American buyers should verify compliance with ASTM C1245 or DIN EN 14624 standards. Additionally, understanding local regulations on fiber handling and disposal is important for environmental compliance.

| Material | Typical Use Case for sic density | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicon Carbide Ceramics | High-temperature, abrasive, and chemical-resistant components | Exceptional hardness and chemical inertness | Brittleness complicates manufacturing | High |

| Silicon Carbide Refractories | Furnace linings and metallurgical applications | Enhanced thermal shock resistance | Heavier and slightly lower thermal conductivity | Medium |

| Silicon Carbide Powders | Raw material for sintering and composite manufacturing | Versatility in formulation and cost-effective | Requires strict quality control and specialized sintering | Low |

| Silicon Carbide Fibers | Reinforcement in high-performance composites | High tensile strength and thermal stability | High production cost and processing complexity | High |

Silicon carbide (SiC) density is a critical parameter influencing the performance of SiC-based components, especially in high-temperature, high-wear, and high-power applications. Understanding the manufacturing processes that affect SiC density is essential for B2B buyers aiming to source high-quality materials or components.

The initial stage involves selecting high-purity raw SiC powders with controlled particle size distribution. The purity and particle morphology directly impact the achievable density after sintering. Additives such as sintering aids (e.g., boron, carbon) may be introduced to enhance densification during subsequent stages.

The SiC powders are shaped into the desired form using one of several techniques, each influencing the final density:

The forming method chosen impacts the initial packing density, which correlates with final sintered density.

Sintering is the core process determining the SiC density. It involves heating the compacted parts at high temperatures (typically 1900-2200°C) in controlled atmospheres.

The sintering method strongly affects the final microstructure and mechanical strength.

Post-sintering, SiC components may undergo machining (grinding, polishing) or coating to meet dimensional and surface finish requirements. These finishing steps must preserve material integrity and density characteristics.

Ensuring consistent SiC density requires rigorous quality control (QC) protocols aligned with international and industry-specific standards. B2B buyers need to understand these QC practices to evaluate supplier reliability effectively.

International buyers, especially from regions like Africa, South America, the Middle East, and Europe, should adopt a proactive approach to QC verification:

In summary, understanding the manufacturing stages—from raw material preparation to finishing—and the robust QC systems behind SiC density enables B2B buyers to make informed sourcing decisions. Verifying supplier compliance with international standards, leveraging third-party inspections, and tailoring quality expectations to regional regulatory frameworks will ensure procurement of high-performance SiC components tailored to demanding industrial applications.

Understanding the cost structure and pricing dynamics of sourcing silicon carbide (SiC) density materials is crucial for international B2B buyers aiming to optimize procurement strategies. This analysis breaks down the key cost components, identifies pricing influencers, and offers actionable tips to navigate pricing complexities, especially for buyers from Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Illustrative Image (Source: Google Search)

Labor:

Skilled labor for processing and manufacturing SiC density products varies by country. Labor costs in Europe or the UAE tend to be higher than in Kenya or parts of South America, influencing overall pricing.

Manufacturing Overhead:

This includes energy consumption (notably high for SiC sintering), equipment depreciation, facility maintenance, and indirect labor. Efficient production facilities with advanced technology can reduce overhead per unit.

Tooling and Equipment:

Specialized tooling for shaping and finishing SiC materials represents a significant upfront investment that manufacturers amortize over production volumes. Custom tooling for specific product designs can increase costs.

Quality Control and Certification:

Rigorous QC processes and certifications (e.g., ISO, RoHS, REACH) ensure product reliability but add to operational costs. Buyers targeting regulated markets in Europe or the Middle East should factor these costs into pricing.

Logistics and Freight:

Shipping costs depend on the weight, volume, and destination. For buyers in Africa and South America, inland transportation and customs duties can notably increase landed costs. Incoterms chosen also determine which party bears freight risk and cost.

Supplier Margin:

Profit margins vary with market competition, supplier reputation, and product specialization. Established suppliers with certifications may price higher but offer better reliability and post-sale support.

Order Volume and Minimum Order Quantity (MOQ):

Larger orders usually attract volume discounts, reducing per-unit cost. However, high MOQs may strain cash flow or inventory capacity, especially for smaller enterprises.

Product Specifications and Customization:

Tailored SiC density products with specific grain size, density, or shapes command premium pricing due to additional processing complexity.

Material Quality and Certifications:

Certified products meeting stringent international standards cost more but mitigate risks of product failure and compliance issues.

Supplier Location and Reputation:

Proximity to the buyer can reduce shipping time and costs. Suppliers with proven track records and technical support often justify higher prices.

Incoterms and Payment Terms:

Terms like FOB, CIF, or DDP affect who covers freight, insurance, and customs. Favorable payment terms (e.g., letters of credit, net 60) may influence pricing negotiations.

Negotiate Beyond Price:

Engage suppliers on payment terms, lead times, and after-sales support. For buyers in emerging markets such as Kenya or Brazil, building long-term relationships can unlock better pricing and priority allocation.

Assess Total Cost of Ownership (TCO):

Consider not just unit price but shipping, duties, storage, and potential downtime costs. For instance, faster shipping via air freight may justify higher upfront costs if it reduces production delays.

Leverage Group Purchasing:

Companies in Africa or South America can collaborate to place consolidated orders, achieving volume discounts and shared logistics savings.

Understand Local Import Regulations:

Compliance with customs documentation and import tariffs in regions like the UAE or Europe can avoid unexpected charges and delays.

Request Transparent Cost Breakdowns:

Ask suppliers to itemize costs, enabling targeted negotiations on specific components such as tooling or QC.

Plan for Currency Fluctuations:

Given variable exchange rates in emerging markets, locking in prices or using hedging instruments can protect procurement budgets.

Prices for silicon carbide density products vary significantly based on specifications, supplier, and market conditions. The analysis above provides indicative cost factors and pricing influencers but should not be taken as exact quotations. Buyers are advised to request detailed quotes and perform due diligence tailored to their sourcing context.

By understanding these cost components and pricing influencers, international B2B buyers can develop more informed sourcing strategies, negotiate effectively, and optimize their total cost of ownership when procuring SiC density materials.

Understanding the technical properties and trade terminology related to silicon carbide (SiC) density is crucial for international B2B buyers to make informed purchasing decisions. This knowledge helps ensure product quality, compliance with specifications, and smooth communication with suppliers across Africa, South America, the Middle East, and Europe.

Material Grade

Silicon carbide comes in different grades, typically distinguished by purity and particle size. Higher-grade SiC has fewer impurities and a more consistent density, which affects performance in applications like abrasives, refractories, and semiconductors. Knowing the grade helps buyers match material properties to their specific industrial needs.

Bulk Density

Bulk density measures the mass of SiC per unit volume, including the void spaces between particles. It’s critical for logistics (e.g., shipping weight calculations) and process parameters such as mixing or packing. Buyers should verify bulk density to ensure compatibility with production equipment.

True Density (Particle Density)

True density refers to the mass per unit volume of the solid SiC particles themselves, excluding pores and voids. This property influences thermal conductivity and mechanical strength. Accurate true density data enables buyers to assess material performance under operational stresses.

Tolerance (Density Variation Limits)

Tolerance defines the acceptable range of density variation from the specified value. Tight tolerance means more uniform material quality, which is essential for high-precision applications. Understanding tolerance helps buyers negotiate quality control standards with suppliers.

Porosity

Porosity indicates the volume fraction of void spaces within the SiC structure. Lower porosity usually means higher density and better mechanical properties. Buyers should consider porosity when selecting SiC for structural or wear-resistant components.

Particle Size Distribution

Although indirectly related to density, particle size affects packing density and flow characteristics. A narrow particle size distribution often results in more consistent bulk density and material behavior.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or equipment that incorporate SiC materials. Understanding whether the supplier serves OEMs can indicate the quality standards and certifications they adhere to, which is vital for buyers aiming for high-reliability applications.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. MOQs can vary significantly depending on the SiC grade and density specifications. Buyers must balance MOQ requirements with inventory capacity and budget constraints, especially when sourcing internationally.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing and terms for specific SiC density grades and quantities. Crafting a clear RFQ with detailed technical requirements ensures accurate and comparable quotations, facilitating efficient supplier evaluation.

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities, risks, and costs between buyers and sellers during shipping. Common Incoterms like FOB (Free On Board) or CIF (Cost, Insurance, and Freight) clarify who handles transportation, customs clearance, and insurance—critical for cross-border transactions.

Certificate of Analysis (CoA)

A document provided by suppliers verifying the technical properties of SiC batches, including density measurements. Requesting a CoA ensures material consistency and compliance with contract specifications.

Lead Time

The period between order placement and delivery. SiC materials with specialized density requirements may have longer lead times due to production or quality testing. Buyers should plan procurement schedules accordingly to avoid production delays.

By mastering these technical properties and trade terms, B2B buyers can improve supplier negotiations, ensure product quality, and optimize supply chain management for silicon carbide density materials. This is especially important for buyers in regions like Africa, South America, the Middle East, and Europe, where sourcing reliability and clarity in international trade are paramount.

The silicon carbide (SiC) density sector is experiencing robust growth driven by increasing demand across automotive, electronics, and industrial applications. Globally, the surge in electric vehicles (EVs) and renewable energy systems has intensified the need for SiC-based components due to their superior thermal conductivity, high breakdown electric field, and efficiency at high voltages. For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe, understanding these drivers is critical to sourcing competitive and innovative SiC density materials.

Key market dynamics include:

Technological Advancements: The integration of advanced manufacturing processes like chemical vapor deposition (CVD) and improved crystal growth techniques is enhancing SiC material quality and availability. This progress reduces production costs, making SiC density materials more accessible to emerging markets.

Regional Sourcing Hubs: Europe and the UAE are evolving into strategic sourcing hubs due to proximity to high-tech manufacturing and favorable trade policies. Meanwhile, Africa and South America are poised to increase their share through partnerships and investments in local production capabilities.

Supply Chain Resilience: Recent global disruptions have underscored the importance of diversified supply chains. Buyers are increasingly prioritizing suppliers with transparent logistics, multiple sourcing options, and local warehousing solutions to mitigate risks.

Customization and Application-Specific Solutions: B2B buyers are seeking suppliers who offer tailored SiC density materials optimized for specific applications such as power electronics, LEDs, and semiconductor substrates, enabling higher performance and integration efficiency.

Sustainability is becoming a cornerstone of procurement strategies in the SiC density sector. The environmental impact of SiC production—particularly energy-intensive manufacturing and raw material extraction—requires buyers to prioritize ethical and green sourcing practices.

Environmental considerations include:

Energy Consumption: SiC crystal growth and wafer fabrication are power-intensive. Buyers should engage with suppliers who invest in renewable energy sources or energy-efficient manufacturing technologies to reduce carbon footprints.

Waste Management: Effective recycling and reduction of hazardous waste during production are crucial. Partnerships with suppliers committed to circular economy principles can significantly lower environmental impact.

Green Certifications: Certifications such as ISO 14001 (Environmental Management) and adherence to RoHS (Restriction of Hazardous Substances) standards signal responsible sourcing. Buyers should demand transparency and third-party verification to ensure compliance.

Ethical Supply Chains: Traceability of raw materials and fair labor practices are vital, especially when sourcing from regions with developing regulatory frameworks. Collaborating with suppliers who enforce strict social responsibility policies helps mitigate reputational and operational risks.

By integrating sustainability criteria into supplier evaluation, B2B buyers not only align with global ESG goals but also enhance long-term supply chain resilience and stakeholder trust.

Silicon carbide’s journey from a niche abrasive material to a critical semiconductor component spans over a century. Initially discovered in the late 19th century, SiC was primarily used for its hardness in industrial applications. The late 20th century marked a turning point with the advent of high-purity SiC crystals suitable for electronic devices, enabling breakthroughs in high-power, high-frequency applications.

For B2B buyers, understanding this evolution highlights the material’s growing strategic importance. The shift towards SiC density materials tailored for next-generation electronics underscores the need for informed sourcing strategies that anticipate technological shifts and market demands. This historical perspective also emphasizes the ongoing innovation cycle, making continuous supplier evaluation and market intelligence essential for competitive advantage.

How can I effectively vet suppliers of SiC density products to ensure quality and reliability?

To vet suppliers, start with verifying their business licenses, certifications (such as ISO 9001), and export credentials. Request detailed technical datasheets and sample products to assess quality firsthand. Check their track record through customer references and independent reviews, particularly focusing on clients from your region (Africa, Middle East, South America, Europe). Engage in video calls or factory visits if possible, and confirm their capacity to meet your volume and customization requirements. A thorough supplier audit reduces risks and builds a foundation for long-term partnerships.

Is customization of SiC density products available, and how should I approach it as an international buyer?

Many suppliers offer customization in terms of density grades, particle size distribution, and packaging. Clearly communicate your technical specifications and end-use requirements upfront. Collaborate closely with the supplier’s R&D or technical teams to ensure the product matches your needs. Customization may affect lead times and minimum order quantities (MOQs), so plan accordingly. For buyers in regions like the UAE or Kenya, ensure that customized products comply with local standards and import regulations to avoid delays at customs.

What are typical minimum order quantities (MOQs), lead times, and payment terms for SiC density purchases?

MOQs vary widely depending on supplier capacity and product type but typically range from one to several metric tons. Lead times can range from 2 to 8 weeks, influenced by production schedules and shipping logistics. Payment terms often require a 30% advance with the balance before shipment or upon delivery, especially for new buyers. Negotiate terms based on your relationship and order size; established buyers may secure more flexible arrangements. Consider suppliers offering trade finance options or letters of credit to mitigate risk.

Which quality assurance certifications should I look for when sourcing SiC density internationally?

Look for suppliers certified with ISO 9001 for quality management systems and ISO 14001 for environmental compliance. Additional certifications like REACH (for chemical safety) and RoHS (for hazardous substances) are crucial for buyers in Europe and increasingly important worldwide. Request third-party lab test reports verifying density, purity, and particle size to ensure product consistency. Certifications not only guarantee compliance but also facilitate smoother customs clearance and enhance buyer confidence.

What logistics considerations should I keep in mind when importing SiC density products from overseas?

Given the typically heavy and bulk nature of SiC density materials, sea freight is the most cost-effective option, though air freight may be used for urgent orders. Understand Incoterms (e.g., FOB, CIF) clearly to know your responsibilities for shipping, insurance, and customs clearance. Work with freight forwarders experienced in handling industrial minerals and check port capabilities in your country (e.g., Mombasa for Kenya, Jebel Ali for UAE). Ensure packaging is robust to prevent contamination and damage during transit.

How can I handle disputes or quality issues with SiC density suppliers effectively?

Maintain thorough documentation of all agreements, specifications, and communications. On receiving goods, conduct immediate quality inspections and compare with agreed standards. If discrepancies arise, notify the supplier promptly with evidence such as photos and lab reports. Use dispute resolution clauses in contracts—such as mediation or arbitration in neutral jurisdictions—to resolve conflicts amicably. Building strong relationships and clear communication channels often prevent disputes or enable quicker resolutions.

Are there regional challenges in sourcing SiC density for buyers in Africa, South America, the Middle East, and Europe?

Yes, buyers may face challenges such as longer shipping times, customs delays, and fluctuating import tariffs. Infrastructure limitations in some African and South American ports can impact delivery speed. Currency volatility and differing payment system preferences also affect transactions. To mitigate these, work with suppliers familiar with your region, use local agents or distributors where possible, and stay updated on trade policies and sanctions. Leveraging regional trade agreements can also reduce costs and simplify compliance.

What strategies can international B2B buyers use to optimize cost and supply chain efficiency for SiC density?

Consolidate orders to achieve better pricing and reduce shipping frequency. Negotiate long-term contracts to lock in favorable terms and improve supplier commitment. Utilize local warehousing or bonded facilities to manage inventory closer to your production sites. Collaborate with suppliers on demand forecasting to minimize stockouts and excess inventory. Finally, invest in supplier relationship management and technology tools for real-time tracking and communication, ensuring a resilient and transparent supply chain.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

In navigating the complexities of sourcing silicon carbide (SiC) density, international B2B buyers must prioritize a strategic approach that balances quality, cost-efficiency, and supply chain resilience. Understanding the nuances of SiC density directly impacts product performance, manufacturing efficiency, and ultimately, competitive advantage. For buyers in Africa, South America, the Middle East, and Europe, leveraging local market insights alongside global supplier capabilities is essential to optimize procurement outcomes.

Key takeaways include:

Looking ahead, the demand for high-quality SiC materials is expected to grow alongside advancements in electric vehicles, renewable energy, and power electronics. Buyers who embed strategic sourcing principles into their procurement processes will not only secure superior materials but also build agile supply chains capable of adapting to evolving market dynamics.

Action for buyers: Engage proactively with suppliers, invest in technical due diligence, and foster cross-regional collaborations to unlock the full potential of SiC density in your product development and manufacturing strategies. This forward-thinking approach will position your organization at the forefront of innovation and operational excellence.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina