Silicon carbide (SiC) fiber stands at the forefront of advanced materials technology, offering unparalleled strength, thermal stability, and chemical resistance. For international B2B buyers, especially those operating across Africa, South America, the Middle East, and Europe, understanding the nuances of SiC fiber is essential to capitalize on its transformative potential in industries ranging from aerospace and automotive to energy and electronics.

This comprehensive guide is designed to equip procurement professionals and technical decision-makers with actionable insights into the global SiC fiber market. It covers the full spectrum of considerations—from the various types and material compositions of SiC fibers to manufacturing processes and stringent quality control measures that ensure product reliability. In addition, the guide delves into supplier landscapes, cost structures, and emerging market trends that influence sourcing strategies.

By navigating this guide, buyers will gain clarity on critical factors such as performance specifications, certification standards, and supplier capabilities—enabling informed negotiations and risk mitigation in international transactions. Special emphasis is placed on regional market dynamics and logistical challenges pertinent to buyers in developing and mature markets like Poland and Argentina, ensuring relevance and practical value.

Ultimately, this resource empowers B2B buyers to optimize their procurement decisions, enhance supply chain resilience, and unlock competitive advantages through strategic sourcing of SiC fiber. Whether initiating first-time purchases or refining existing supplier relationships, readers will find the expert analysis and detailed FAQs indispensable for navigating the complexities of the global SiC fiber marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Continuous Sic Fiber | Long, unbroken fiber strands with high tensile strength | Aerospace components, automotive parts, industrial machinery reinforcement | Pros: Superior mechanical strength, excellent thermal stability; Cons: Higher cost, complex handling |

| Chopped Sic Fiber | Short fiber segments, easier to mix into composites | Construction materials, brake pads, polymer composites | Pros: Cost-effective, versatile in composites; Cons: Lower strength compared to continuous fibers |

| Sic Nanofiber | Ultra-fine fibers with nanoscale diameters | Electronics, high-performance coatings, filtration systems | Pros: Enhanced surface area, improved conductivity; Cons: Production complexity, higher price point |

| Sic Whiskers | Single-crystal fibers with exceptional hardness | Wear-resistant coatings, cutting tools, armor systems | Pros: Extreme hardness, high fracture toughness; Cons: Difficult to process, limited length |

| Sic Fabric | Woven mats or textiles of Sic fibers | Thermal insulation, composite reinforcements, protective clothing | Pros: Easy to handle and shape, good thermal resistance; Cons: Lower strength than continuous fibers |

Continuous Sic Fiber

Continuous Sic fibers are characterized by their long, uninterrupted strands, providing exceptional tensile strength and thermal stability. These fibers are ideal for demanding industrial applications such as aerospace and automotive parts, where structural integrity under high stress is crucial. B2B buyers should prioritize suppliers with proven quality control and consistent fiber length to ensure optimal performance. While costs are higher, the investment pays off in durability and reliability.

Chopped Sic Fiber

Chopped Sic fibers consist of short segments that can be easily integrated into polymer matrices and composites. This type is widely used in construction materials and brake pads due to its cost-effectiveness and adaptability. Buyers seeking budget-friendly reinforcement options should consider chopped fibers but must balance the trade-off with lower mechanical strength compared to continuous fibers. Evaluating supplier consistency in fiber length and dispersion is key.

Sic Nanofiber

Sic nanofibers have diameters in the nanometer range, offering superior surface area and enhanced electrical and thermal properties. These fibers are suited for high-tech applications such as electronics, coatings, and filtration systems. For B2B buyers, sourcing nanofibers requires attention to production technology and purity standards, as these factors significantly impact performance. The higher price point is justified in specialized, performance-critical applications.

Sic Whiskers

Sic whiskers are single-crystal fibers known for their extreme hardness and fracture toughness, making them indispensable in wear-resistant coatings, cutting tools, and armor systems. Their processing complexity and limited length can pose challenges in manufacturing, so buyers should work with experienced suppliers who offer technical support. The high performance of whiskers justifies their premium cost in applications requiring exceptional durability.

Sic Fabric

Sic fabrics are woven mats composed of Sic fibers, providing ease of handling and flexibility in shaping. They are commonly used in thermal insulation, composite reinforcements, and protective clothing. For B2B buyers, Sic fabric offers a balance between performance and manufacturability, though it generally exhibits lower strength than continuous fibers. Assessing fabric weave quality and supplier customization capabilities is essential for optimal integration into end products.

| Industry/Sector | Specific Application of sic fiber | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Defense | High-temperature insulation in turbine engines | Enhances thermal resistance and durability under extreme conditions, reducing maintenance costs and improving engine lifespan | Ensure compliance with aerospace-grade certifications; evaluate supplier capability for consistent quality and traceability |

| Electronics & Semiconductors | Substrate and reinforcement material in high-power electronic devices | Provides superior thermal conductivity and electrical insulation, improving device reliability and performance | Prioritize suppliers with proven purity levels and customization options for fiber dimensions |

| Automotive Manufacturing | Heat shields and brake components | Improves heat resistance and reduces weight, contributing to vehicle efficiency and safety | Verify fiber compatibility with automotive standards and local regulatory requirements |

| Energy & Power Generation | Insulation for gas turbines and nuclear reactors | Increases operational efficiency by withstanding high temperatures and corrosive environments | Assess supplier experience with energy sector applications and availability of technical support |

| Industrial Furnaces & Kilns | Reinforcement in refractory composites | Enhances structural integrity and thermal shock resistance, extending furnace life and reducing downtime | Confirm fiber quality consistency and logistics capabilities for bulk orders in international markets |

Silicon carbide (SiC) fiber plays a pivotal role in aerospace and defense, particularly in turbine engine insulation. Its ability to withstand extreme temperatures and mechanical stress reduces maintenance frequency and prolongs engine life. Buyers in regions like Europe and the Middle East should prioritize suppliers who meet stringent aerospace certifications and can provide reliable quality documentation to ensure compliance with international safety standards.

In the electronics and semiconductor sector, SiC fiber is widely used as a substrate and reinforcement material for high-power devices. Its exceptional thermal conductivity and electrical insulation properties enhance device performance and longevity. B2B buyers from South America and Africa should focus on sourcing fibers with high purity and customizable dimensions to fit specific device architectures, ensuring integration efficiency and product reliability.

Illustrative Image (Source: Google Search)

The automotive industry leverages SiC fiber for heat shields and brake components, where heat resistance and weight reduction are critical for vehicle performance and safety. For buyers in emerging automotive markets such as Poland and Argentina, it is essential to verify that suppliers comply with automotive industry standards and regional regulations, facilitating smoother certification and market entry processes.

In the energy and power generation sector, SiC fiber is used for insulation in gas turbines and nuclear reactors. Its durability in high-temperature, corrosive environments enhances operational efficiency and safety. International buyers should prioritize suppliers with a proven track record in energy applications, ensuring access to technical support and product consistency critical for long-term projects.

Lastly, industrial furnaces and kilns benefit from SiC fiber as reinforcement in refractory composites, where it significantly improves thermal shock resistance and structural stability. Buyers should confirm the supplier's ability to maintain consistent fiber quality and handle large-volume shipments, particularly important for companies in Africa and South America aiming to scale their industrial operations efficiently.

Related Video: Wide Bandgap SiC and GaN Devices - Characteristics & Applications

Silicon carbide (SiC) fibers are critical components in advanced composites, offering exceptional mechanical and thermal properties. Selecting the right type of SiC fiber material is essential for optimizing performance, cost, and compliance in diverse industrial applications. Below is a detailed analysis of four common SiC fiber materials from a B2B perspective, focusing on their key properties, advantages, limitations, and regional considerations for buyers in Africa, South America, the Middle East, and Europe.

Key Properties:

CVD SiC fibers exhibit outstanding temperature resistance, typically up to 1600°C, and excellent chemical inertness against oxidation and corrosion. They have high tensile strength and modulus, making them ideal for high-performance composites.

Pros & Cons:

- Pros: Superior thermal stability and mechanical strength; excellent for aerospace and nuclear applications.

- Cons: High manufacturing complexity leads to higher costs; limited availability outside specialized suppliers.

Impact on Application:

Ideal for environments with extreme thermal and oxidative stress, such as turbine engines and nuclear reactors. Their corrosion resistance also suits chemical processing industries.

International Buyer Considerations:

Buyers in Europe (e.g., Poland) and the Middle East should ensure compliance with ASTM standards (e.g., ASTM C1275) for high-temperature applications. South American and African buyers must evaluate supply chain reliability due to limited local production. Import tariffs and logistics costs may impact final pricing.

Key Properties:

Produced by pyrolyzing polymer precursors, these fibers offer moderate temperature resistance (up to ~1400°C) and good oxidation resistance. They have a relatively lower density and good flexibility.

Pros & Cons:

- Pros: Lower cost compared to CVD fibers; easier to manufacture at scale; good balance of mechanical properties.

- Cons: Slightly lower thermal and chemical resistance; potential variability in fiber quality depending on precursor and process control.

Impact on Application:

Widely used in automotive and industrial components where moderate heat resistance and toughness are required. Suitable for composites in structural parts exposed to corrosive environments.

International Buyer Considerations:

Compliance with DIN and JIS standards is common in Europe and Asia, which may influence procurement decisions. Buyers in emerging markets like Argentina and South Africa should assess supplier quality certifications and batch consistency to ensure performance reliability.

Key Properties:

These fibers are formed by melting and spinning SiC precursors, resulting in fibers with good tensile strength and moderate temperature resistance (up to ~1200°C). They have decent corrosion resistance but lower than CVD fibers.

Pros & Cons:

- Pros: Cost-effective production; suitable for large-volume applications; relatively easier to process.

- Cons: Lower thermal stability and mechanical strength; less suitable for extreme environments.

Impact on Application:

Best suited for applications like thermal insulation, brake pads, and wear-resistant coatings where cost efficiency outweighs the need for extreme performance.

International Buyer Considerations:

Buyers in the Middle East and South America should evaluate local demand for cost-effective materials and consider regional standards like ASTM or ISO for quality assurance. Logistics costs are lower due to availability from multiple suppliers globally.

Key Properties:

Hi-Nicalon fibers are advanced SiC fibers with enhanced tensile strength (~3.5 GPa) and temperature resistance up to 1500°C. They offer improved creep resistance and oxidation stability.

Pros & Cons:

- Pros: Excellent mechanical properties and thermal stability; suitable for aerospace and defense composites.

- Cons: Higher cost and limited manufacturing sources; complex processing requirements.

Impact on Application:

Preferred in high-end aerospace, defense, and energy sectors where performance under stress and temperature is critical. Also used in next-generation nuclear reactors.

International Buyer Considerations:

European buyers, especially in Poland and Germany, often require compliance with stringent aerospace standards (e.g., EN 9100). Middle Eastern buyers should consider long-term supplier partnerships due to the specialized nature of these fibers. African and South American buyers must factor in import duties and technical support availability.

| Material | Typical Use Case for sic fiber | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Chemical Vapor Deposition (CVD) SiC Fibers | Aerospace, nuclear reactors, chemical processing | Exceptional thermal and chemical resistance | High cost and manufacturing complexity | High |

| Polymer-Derived SiC Fibers | Automotive parts, industrial composites | Balanced cost and performance | Moderate thermal resistance and quality variability | Medium |

| Melt-Spun SiC Fibers | Thermal insulation, brake pads, wear-resistant coatings | Cost-effective and scalable | Lower thermal stability and mechanical strength | Low |

| Hi-Nicalon Type SiC Fibers | Aerospace, defense, advanced energy systems | Superior mechanical strength and creep resistance | High cost and limited supplier base | High |

This guide aims to empower international B2B buyers with actionable insights to select the optimal SiC fiber material tailored to their application needs, budget constraints, and regional compliance requirements.

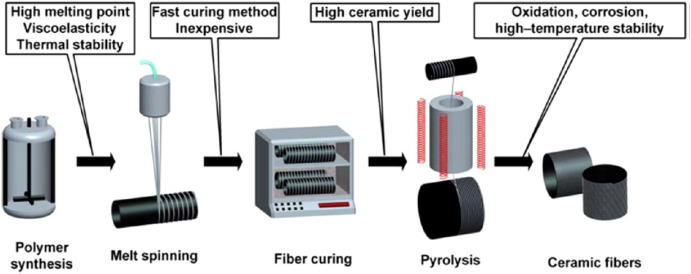

Silicon Carbide (SiC) fiber production involves a series of sophisticated manufacturing stages designed to achieve high-performance characteristics such as exceptional thermal stability, mechanical strength, and chemical resistance. Understanding these processes enables B2B buyers—especially from diverse international markets—to make informed decisions when selecting suppliers.

1. Material Preparation

The process begins with the preparation of precursor materials. Typically, polycarbosilane or other organosilicon polymers serve as the starting point. These precursors are synthesized under controlled conditions to ensure uniform molecular weight and purity, which directly influence fiber quality. For buyers, it is crucial that suppliers source high-grade raw materials and maintain traceability to guarantee consistency.

2. Fiber Forming

The precursor polymer is then spun into fibers using techniques such as melt spinning, dry spinning, or electrospinning. Melt spinning is common for large-scale production, where the polymer is heated and extruded through spinnerets. The resulting fibers are then cooled and collected. Precise control over spinning parameters—temperature, extrusion speed, and atmosphere—is vital to minimize defects and achieve uniform fiber diameter.

3. Pyrolysis and Ceramic Conversion

Post-spinning, fibers undergo pyrolysis, where they are heated in inert or controlled atmospheres to convert the polymer into ceramic SiC. This step may involve multiple heating cycles, reaching temperatures of 1000–1500°C or higher. This conversion imparts the characteristic ceramic properties and determines the final fiber microstructure. Buyers should ensure that suppliers use advanced furnaces with atmosphere control to avoid contamination or incomplete conversion.

4. Surface Treatment and Assembly

To enhance fiber-matrix bonding in composite applications, fibers often receive surface treatments such as oxidation, carbon coating, or chemical vapor deposition (CVD). This stage is critical for improving composite performance and durability. Additionally, fibers may be assembled into bundles, tows, or fabrics depending on end-use requirements. Flexibility in assembly options is important for buyers targeting diverse industrial applications.

5. Finishing and Packaging

Finished fibers are carefully inspected, sized, and packaged under cleanroom or controlled environments to prevent contamination. Packaging is designed to protect fibers during transit, especially for international shipments to regions like Africa, South America, or the Middle East, where logistical challenges can impact product integrity.

Robust quality assurance (QA) and quality control (QC) systems are essential to ensure SiC fibers meet stringent performance criteria and regulatory requirements across global markets.

Relevant International and Industry Standards

- ISO 9001: The foundation for quality management systems, ensuring consistent manufacturing and continuous improvement. Suppliers certified to ISO 9001 demonstrate a commitment to quality processes.

- CE Marking: Relevant for fibers used in European markets, indicating conformity with EU safety, health, and environmental directives.

- API (American Petroleum Institute) Standards: Important for SiC fibers used in oil and gas composites, ensuring material suitability for harsh environments.

- Additional region-specific certifications may apply depending on application and local regulations.

QC Checkpoints in the Manufacturing Cycle

- Incoming Quality Control (IQC): Verification of raw materials and precursors for purity, molecular weight, and contamination. Buyers should request certificates of analysis (CoA) and material safety data sheets (MSDS) during procurement.

- In-Process Quality Control (IPQC): Continuous monitoring during fiber spinning, pyrolysis, and surface treatment stages. Key parameters include fiber diameter, tensile strength, and microstructural uniformity. Real-time data collection and feedback loops enhance process stability.

- Final Quality Control (FQC): Comprehensive testing of finished fibers before shipment, covering mechanical properties, chemical composition, and surface characteristics.

Common Testing Methods

- Tensile Testing: Measures fiber strength and elongation, critical for structural applications.

- Scanning Electron Microscopy (SEM): Evaluates fiber surface morphology and defects.

- X-ray Diffraction (XRD): Assesses crystalline phases and ceramic conversion quality.

- Thermogravimetric Analysis (TGA): Determines thermal stability and composition.

- Chemical Resistance Tests: Ensures fibers withstand corrosive environments, especially vital for Middle Eastern and South American industrial conditions.

For buyers from regions such as Africa, South America, the Middle East, and Europe, verifying supplier QC rigor is crucial to mitigate risks and ensure product reliability.

1. Request Comprehensive Documentation

Demand full quality documentation including ISO certificates, CoAs, test reports, and compliance certificates (CE, API). These documents provide transparency and traceability throughout the supply chain.

2. Conduct Factory Audits

On-site or third-party audits allow buyers to assess manufacturing conditions, process controls, and quality management firsthand. Audits should evaluate equipment calibration, staff training, and adherence to documented procedures.

3. Employ Third-Party Inspections and Testing

Engaging independent inspection agencies to perform sample testing or audit supplier QC processes adds an unbiased layer of verification. This is particularly valuable for buyers sourcing from new or less familiar suppliers.

4. Leverage Remote Monitoring Tools

Advanced suppliers may offer digital dashboards or IoT-enabled monitoring for real-time quality data access, beneficial for buyers managing cross-continental supply chains.

Regional Regulatory Considerations

- Africa and South America: Some countries may have evolving standards or lack stringent local certification bodies. Buyers should prioritize suppliers compliant with international standards (ISO 9001, CE) to ensure global acceptance and quality.

- Middle East: Harsh environmental conditions necessitate fibers with proven chemical and thermal resistance. Certifications aligned with oil & gas industry standards (API) are often mandatory.

- Europe (e.g., Poland): Compliance with EU regulations and CE marking is non-negotiable. Additionally, sustainability and environmental impact certifications are increasingly valued.

Logistics and Quality Preservation

International buyers must consider packaging standards and transport conditions to prevent fiber degradation during shipment. Suppliers with robust export experience typically implement moisture-proof, anti-static packaging and select shipping methods minimizing transit time.

Customization and Technical Support

Buyers in these regions often require tailored fiber specifications to meet local application demands. Partnering with suppliers offering technical consultation and flexible QC protocols ensures alignment with project requirements.

By understanding the detailed manufacturing stages, rigorous quality assurance practices, and regional certification nuances, international B2B buyers can confidently select SiC fiber suppliers that deliver consistent, high-quality products tailored to their market needs. Establishing transparent communication and thorough verification processes will safeguard investments and foster long-term partnerships across Africa, South America, the Middle East, and Europe.

When sourcing silicon carbide (SiC) fiber, understanding the detailed cost components is essential for B2B buyers to optimize procurement strategies and negotiate effectively. The primary cost elements include:

Pricing for SiC fiber is dynamic and influenced by several interrelated factors:

For buyers from Africa, South America, the Middle East, and Europe, navigating SiC fiber pricing requires a strategic approach:

Prices for SiC fiber vary widely based on the factors outlined and current market conditions. Typical price ranges may start from several hundred to over a thousand USD per kilogram depending on quality and customization. Buyers should request detailed, updated quotations from multiple suppliers and factor in all associated costs before finalizing procurement decisions.

By thoroughly analyzing these cost drivers and pricing influencers, international B2B buyers can make informed decisions, negotiate better terms, and establish resilient supply chains for SiC fiber tailored to their regional and technical needs.

Understanding the essential technical specifications of silicon carbide (SiC) fiber is crucial for international B2B buyers to ensure compatibility, performance, and cost-effectiveness in their applications. Here are the key properties to focus on:

Material Grade

SiC fibers come in various grades, typically categorized by purity and crystalline structure. Higher-grade fibers offer superior mechanical strength and thermal resistance, making them ideal for aerospace or high-temperature industrial uses. Knowing the grade helps buyers assess durability and lifespan, reducing the risk of premature failure in critical components.

Tensile Strength

This measures the fiber’s ability to withstand pulling forces without breaking, usually expressed in megapascals (MPa). High tensile strength is essential for reinforcement applications, such as composites in automotive or defense sectors, ensuring structural integrity under stress.

Fiber Diameter and Tolerance

The diameter typically ranges from a few micrometers to tens of micrometers, with tight tolerances critical for consistent product performance. Precise diameter control impacts how fibers integrate with matrices in composites, affecting overall mechanical properties and manufacturability.

Thermal Stability

SiC fibers can maintain structural integrity at temperatures often exceeding 1300°C. This property is vital for buyers in industries like power generation or aerospace, where materials face extreme heat. Thermal stability ensures long-term performance without degradation.

Elastic Modulus

This defines the fiber’s stiffness or resistance to deformation under load. A high elastic modulus indicates rigidity, beneficial for applications requiring dimensional stability under mechanical stress.

Chemical Resistance

SiC fibers exhibit strong resistance to oxidation and corrosion, which is important for buyers operating in harsh chemical environments or exposed to aggressive atmospheres. This property reduces maintenance costs and extends service life.

Navigating the global SiC fiber market requires familiarity with specific trade and industry terms that streamline procurement and communication with suppliers:

OEM (Original Equipment Manufacturer)

Refers to companies that integrate SiC fibers into their products rather than producing the fibers themselves. Understanding if your supplier is an OEM or a raw material producer can influence pricing, customization options, and supply chain reliability.

MOQ (Minimum Order Quantity)

This is the smallest amount of SiC fiber a supplier is willing to sell in one order. MOQ affects inventory management and upfront investment. For buyers in emerging markets like Africa or South America, negotiating MOQs can be critical to align with budget constraints and storage capabilities.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for price, lead time, and terms based on specified technical requirements. Mastering RFQs helps buyers obtain competitive bids and clarify product specifications, which is essential for transparent and efficient procurement.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and tariffs between buyer and seller. Common Incoterms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) impact total landed cost and risk management. Buyers should select terms that optimize logistics and minimize unexpected expenses.

Lead Time

The period from order placement to delivery. Understanding lead times is critical for production planning, especially for buyers in regions with longer shipping durations or customs procedures.

Certification and Compliance

Documentation proving the SiC fiber meets industry standards (e.g., ISO, ASTM) or specific regulatory requirements. Certifications assure buyers of quality and facilitate smoother customs clearance and acceptance in regulated markets.

For B2B buyers across Africa, South America, the Middle East, and Europe, mastering these technical properties and trade terms empowers informed decision-making. It helps optimize supplier selection, mitigate risks, and ensure that SiC fiber acquisitions align with operational goals and regional market conditions.

Silicon carbide (SiC) fiber is increasingly recognized as a high-performance material critical to advanced manufacturing sectors, including aerospace, automotive, electronics, and energy. Globally, demand is driven by the need for materials offering superior thermal stability, high strength-to-weight ratios, and resistance to chemical corrosion. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding these drivers is key to sourcing decisions and competitive positioning.

Key global market dynamics include:

For B2B buyers, staying informed about these evolving trends and engaging in strategic supplier relationships is critical. Leveraging digital sourcing platforms that provide transparency and supplier verification can enhance procurement efficiency and risk mitigation.

Environmental considerations are becoming paramount in the SiC fiber sector, reflecting global regulatory pressures and corporate sustainability commitments. The production of SiC fibers involves energy-intensive processes and raw materials sourcing that can impact carbon footprints and local ecosystems.

Key sustainability insights for B2B buyers include:

By embedding sustainability into procurement strategies, international buyers not only mitigate reputational risks but also align with the increasing demand from end customers for environmentally responsible products.

Silicon carbide fiber technology has evolved significantly since its inception in the late 20th century. Initially developed for high-temperature aerospace applications, SiC fibers gained prominence due to their exceptional mechanical properties and thermal resistance. Early production challenges, including high costs and inconsistent quality, limited widespread adoption.

Over the past two decades, advances in chemical vapor deposition (CVD) and polymer precursor methods have improved fiber uniformity and scalability. This evolution has expanded SiC fiber applications into automotive, electronics, and energy sectors, driving global market growth. For B2B buyers, understanding this historical trajectory highlights the material’s maturity and the ongoing innovation that shapes sourcing opportunities today.

How can I effectively vet suppliers of SiC fiber to ensure quality and reliability?

When sourcing SiC fiber internationally, prioritize suppliers with verifiable certifications such as ISO 9001 and industry-specific quality standards. Request detailed technical datasheets and sample batches for in-house testing. Conduct background checks on the supplier’s manufacturing capabilities, client references, and export history, especially for markets in Africa, South America, and the Middle East. Utilizing third-party inspection services and factory audits can further mitigate risks. Establish clear communication channels to assess responsiveness and technical support availability before finalizing contracts.

What customization options are typically available for SiC fiber, and how do they impact pricing and lead times?

SiC fiber suppliers often offer customization in terms of fiber diameter, surface treatment, weave patterns, and fiber length to meet specific application requirements. Customized fibers may also include enhanced purity levels or specialized coatings for improved performance. These modifications generally increase production complexity, leading to higher costs and extended lead times—commonly 4-8 weeks beyond standard orders. Early discussions with suppliers about your technical needs enable accurate quotations and help integrate customization timelines into your procurement schedule.

What are typical minimum order quantities (MOQs) and lead times for SiC fiber shipments to regions like Africa and South America?

MOQs vary widely depending on the supplier and fiber specifications but typically range from 50 to 500 kilograms per order. For regions such as Africa and South America, expect lead times between 6 to 12 weeks due to production schedules and international logistics. It is advisable to negotiate MOQs upfront, especially if you are testing the market or require smaller batch sizes. Consolidating orders or forming purchasing consortia can help meet MOQ thresholds while optimizing costs and delivery timelines.

Illustrative Image (Source: Google Search)

Which payment terms are standard in international SiC fiber transactions, and how can buyers protect themselves?

Common payment terms include advance payments, letters of credit (LC), and open account with net 30-60 days, depending on buyer-supplier relationships. Letters of credit offer significant protection by ensuring payment only upon meeting shipment and quality documentation requirements. For new suppliers or markets like the Middle East and Africa, combining partial advance payment with LC or escrow services reduces financial risk. Always clarify currency terms, and consider using trade finance solutions or export credit agencies to facilitate secure transactions.

What quality assurance certifications and testing protocols should I look for when purchasing SiC fiber?

Verify that the supplier adheres to international quality standards such as ISO 9001 for quality management and ASTM standards relevant to SiC fiber properties. Request documentation on mechanical strength, thermal stability, and chemical composition tests. Third-party lab certifications and batch-specific quality reports provide additional assurance. For critical applications, consider commissioning independent testing of samples before order approval. Maintaining traceability through batch numbers and certificates of analysis is essential for compliance and audit purposes.

How can international buyers optimize logistics and shipping when importing SiC fiber?

Choose suppliers experienced in exporting to your region to leverage established logistics networks. Understand customs regulations, import duties, and documentation requirements specific to your country, such as import licenses or hazardous material declarations. Consolidate shipments to reduce freight costs and select reliable carriers offering tracking and insurance. For regions with complex logistics like Africa or the Middle East, partnering with freight forwarders familiar with local infrastructure helps avoid delays. Planning for buffer times around customs clearance is critical to maintaining supply chain continuity.

Illustrative Image (Source: Google Search)

What are common dispute issues in international SiC fiber trade, and how can they be minimized?

Disputes often arise from quality discrepancies, delayed deliveries, or misunderstandings of contractual terms. To minimize risks, clearly define product specifications, inspection criteria, and delivery schedules in the contract. Include clauses for dispute resolution mechanisms such as arbitration or mediation under recognized international trade frameworks (e.g., ICC rules). Maintain thorough documentation of communications and inspections. Engaging legal counsel familiar with cross-border trade can help draft enforceable agreements that protect buyer interests.

Are there specific considerations for sourcing SiC fiber from suppliers in Europe compared to those in Africa or South America?

European suppliers often benefit from stringent regulatory compliance, advanced manufacturing technologies, and shorter lead times to European buyers. However, they may have higher costs compared to suppliers in Africa or South America. Conversely, suppliers in emerging markets may offer competitive pricing but require more rigorous vetting and quality verification. Consider geopolitical stability, export controls, and currency fluctuations when sourcing from different regions. Building strategic partnerships and conducting pilot projects can help mitigate risks and optimize supply chain resilience across diverse markets.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The strategic sourcing of silicon carbide (SiC) fiber presents a compelling opportunity for international B2B buyers seeking high-performance materials that drive innovation and competitive advantage. Key takeaways emphasize the importance of evaluating supplier reliability, technological capabilities, and supply chain resilience—critical factors for markets in Africa, South America, the Middle East, and Europe. By prioritizing partnerships with established manufacturers who offer consistent quality and scalable production, buyers can mitigate risks associated with market volatility and evolving industry standards.

Moreover, understanding regional logistics, trade regulations, and emerging market trends empowers buyers to optimize procurement strategies and reduce total cost of ownership. The integration of sustainability criteria and forward-looking material advancements further enhances long-term value and aligns with global industry shifts.

For B2B buyers in regions like Poland, Argentina, and beyond, adopting a strategic sourcing framework for SiC fiber is not just about securing supply—it is about fostering innovation, operational excellence, and market differentiation. Moving forward, proactive engagement with suppliers, continuous market intelligence, and investment in collaborative development will be essential to unlocking the full potential of SiC fiber in diverse industrial applications. Buyers are encouraged to leverage these insights to build resilient, agile sourcing strategies that support growth and technological leadership in their respective markets.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina