Guide to Alumina Oxide Price

Understanding the dynamics of alumina oxide pricing is essential for any international B2B buyer aiming to optimize procurement strategies and maximize profitability. As a critical raw material used across industries such as aluminum production, ceramics, and abrasives, fluctuations in alumina oxide prices can significantly impact supply chain stability and cost structures. For buyers in Africa, South America, the Middle East, and Europe—regions increasingly integrated into global markets—navigating these price variations is vital for maintaining competitiveness and securing reliable sourcing channels.

This comprehensive guide is designed to empower you with in-depth insights into the alumina oxide market. It covers essential aspects such as different types of alumina, material quality standards, manufacturing processes, and quality control measures. You will also learn how to identify reputable suppliers, evaluate costs accurately, and interpret market trends that influence pricing. Additionally, the guide addresses frequently asked questions to clarify common concerns and pitfalls faced by international buyers.

By equipping yourself with this knowledge, you can make more informed sourcing decisions, negotiate better terms, and mitigate risks associated with price volatility. Whether sourcing from Colombia, Poland, or other emerging markets, understanding the nuances of alumina oxide pricing will enable you to develop resilient procurement strategies that align with your business objectives. In a competitive global landscape, this guide serves as a vital resource for turning market complexities into strategic advantages.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Technical Grade Alumina | High purity, consistent composition, used in manufacturing processes | Refractory materials, ceramics, abrasives | Pros: Reliable quality, predictable performance; Cons: Higher cost |

| Refractory Grade Alumina | Slightly lower purity, designed for high-temperature resistance | Steelmaking, cement kilns, foundries | Pros: Cost-effective for high-temp applications; Cons: Limited purity |

| Calcined Alumina | Heat-treated to enhance hardness and stability | Polishing, insulation, ceramics | Pros: Enhanced durability; Cons: Higher energy costs for processing |

| Activated Alumina | Porous, high surface area, used for adsorption | Water treatment, gas purification | Pros: Excellent for filtration; Cons: Not suitable for structural use |

| Brown Alumina | Raw, less processed, contains impurities | Abrasives, blasting, grinding | Pros: Lower initial purchase price; Cons: Lower performance consistency |

Technical Grade Alumina is characterized by its high purity (typically 99% Al₂O₃ or higher), uniform particle size, and consistent chemical composition. It is ideal for manufacturing high-precision ceramics, electronic substrates, and advanced abrasives. B2B buyers should prioritize suppliers that guarantee strict quality control, especially for sectors like electronics or aerospace, where purity directly impacts product performance. While more expensive, its reliability justifies the investment for critical applications.

Refractory Grade Alumina offers a more cost-effective solution, with slightly lower purity levels (around 90-95% Al₂O₃). It is designed to withstand high temperatures and chemical corrosion, making it suitable for steel production, cement kilns, and other heavy-duty industrial processes. Buyers should consider the trade-off between cost and purity—lower-grade alumina may be sufficient for general refractory purposes but less suitable for high-tech applications requiring high purity.

Calcined Alumina undergoes a calcination process (heating at high temperatures) to improve hardness and thermal stability. It is widely used in polishing powders, insulating materials, and ceramic components. For B2B buyers, the key considerations include the energy costs associated with calcination and the specific grade required for their end-use. Selecting the right calcination temperature and process can optimize performance and cost-efficiency.

Activated Alumina features a porous structure with a high surface area, making it excellent for adsorption and filtration applications. It is commonly used in water purification, gas drying, and catalyst supports. Buyers should evaluate their filtration needs carefully, as activated alumina’s benefits are primarily related to its surface properties rather than structural strength. Supply consistency and pore size distribution are critical factors when sourcing.

Brown Alumina is the raw, unprocessed form containing impurities and residuals from the bauxite ore. It is primarily used in abrasive blasting, grinding, and other abrasive applications where cost is a significant factor. While initially cheaper, buyers must consider the potential for lower performance, increased wear on equipment, and the need for more frequent replacements.

Understanding these price variations helps international buyers from regions like Africa, South America, the Middle East, and Europe to make informed procurement decisions. For high-value, precision applications, investing in technical or calcined alumina ensures quality and performance, reducing long-term costs. Conversely, for bulk abrasive or refractory uses, refractory or brown alumina may offer the necessary cost efficiencies. Buyers should also consider supplier certifications, consistent quality, and logistical factors such as import tariffs and supply chain stability to optimize procurement strategies across diverse markets.

| Industry/Sector | Specific Application of alumina oxide price | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Refractories & Ceramics | Manufacturing of high-temperature refractory bricks and linings | Ensures thermal stability, chemical resistance, and longevity of furnace linings | Consistent alumina quality, high purity levels, reliable supply chains |

| Electronics & Semiconductors | Production of insulating substrates and electronic components | Provides excellent electrical insulation and thermal conductivity | Purity standards, traceability, compliance with industry certifications |

| Water & Waste Treatment | Filtration media and ceramic membranes for contaminant removal | Improves treatment efficiency, chemical resistance, and durability | Cost-effective sourcing, batch consistency, availability of specialized grades |

| Abrasives & Polishing | Manufacturing of abrasive powders and polishing materials | Delivers high hardness, durability, and precision finishing | Particle size control, supply stability, cost competitiveness |

| Catalyst Supports & Fillers | Production of alumina-based catalyst carriers in petrochemical processes | Enhances catalyst activity, thermal stability, and process efficiency | Particle uniformity, high surface area, compatibility with process conditions |

Alumina oxide is a core raw material in the manufacture of refractory bricks and linings used in high-temperature industrial furnaces. Its high melting point, chemical inertness, and mechanical strength make it indispensable for industries like steel, cement, and glass manufacturing. International B2B buyers from regions such as Europe and South America need consistent, high-quality alumina to ensure furnace longevity and safety. Sourcing considerations include verifying supplier certifications for purity, ensuring stable supply chains amid global logistics challenges, and negotiating prices that reflect the alumina's grade and processing standards.

In the electronics industry, alumina oxide is vital for producing insulating substrates, ceramic capacitors, and electronic components that require exceptional electrical insulation and thermal management. Buyers from Africa and the Middle East should prioritize sourcing alumina with high purity levels (99.9% or higher) and traceability to meet stringent industry standards. Ensuring reliable supply and compliance with international certifications (e.g., ISO, RoHS) helps mitigate risks of production delays and quality issues, which are critical for maintaining competitive advantage in high-tech manufacturing.

Alumina oxide serves as an essential component in filtration media and ceramic membranes used in water and wastewater treatment plants. Its chemical stability, porosity, and durability improve contaminant removal efficiency and operational lifespan. B2B buyers, especially from regions like Colombia and Poland, should focus on sourcing alumina with specific particle sizes and pore structures suited to their treatment systems. Cost-effective procurement and consistent batch quality are key to avoiding operational disruptions and ensuring regulatory compliance in water quality standards.

The abrasives industry relies on alumina oxide powders for producing cutting, grinding, and polishing materials. Its hardness and toughness enable precise finishing in manufacturing sectors such as automotive, aerospace, and jewelry. International buyers need to source alumina with controlled particle size distributions and high purity to achieve desired surface finishes. Supply stability, competitive pricing, and the ability to meet specific performance specifications are critical factors for maintaining manufacturing efficiency and product quality.

Alumina oxide is widely used as a catalyst carrier in petrochemical and refining processes due to its high surface area, thermal stability, and chemical inertness. It enhances catalyst dispersion, activity, and longevity, directly impacting process efficiency and output quality. B2B buyers from regions like Europe and the Middle East should prioritize sourcing alumina with consistent particle size and high surface area. Reliable supply chains, traceability, and competitive pricing are essential to optimize operational costs and ensure uninterrupted production cycles.

When selecting materials for applications involving alumina oxide, understanding their properties, advantages, and limitations is critical for international B2B buyers. Different industries and regions have specific standards, environmental conditions, and cost sensitivities that influence material choice. Below is an analysis of four common materials used in conjunction with alumina oxide, focusing on their suitability, performance characteristics, and considerations for buyers from Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Key Properties:

Alumina itself is a ceramic material renowned for its exceptional hardness, high-temperature stability (up to 1,700°C), excellent corrosion resistance, and electrical insulating properties. Its density and purity levels can be tailored depending on application needs, with high-grade alumina offering superior performance.

Pros & Cons:

- Pros: Highly durable, chemically inert, excellent wear resistance, and capable of withstanding extreme temperatures. It is widely accepted in industries such as electronics, aerospace, and chemical processing.

- Cons: Manufacturing can be complex and costly, especially for high-purity grades. Machining and fabrication require specialized equipment, which can add to lead times and costs.

Impact on Application:

Alumina's inertness makes it suitable for corrosive media, high-temperature environments, and electrical insulation. It is ideal for linings, crucibles, and substrates where durability and stability are paramount.

International Buyer Considerations:

Buyers from regions like Colombia or Poland need to ensure alumina products meet local standards such as ASTM or DIN. Importing high-purity alumina may involve compliance with specific certifications, and sourcing from reputable suppliers can mitigate risks related to quality and counterfeit products.

Key Properties:

Silicon carbide is a synthetic ceramic known for its excellent thermal conductivity, high thermal shock resistance, and outstanding mechanical strength at elevated temperatures. It also exhibits good chemical stability in many aggressive media.

Pros & Cons:

- Pros: Superior thermal properties enable use in high-temperature, high-pressure environments; good resistance to abrasion and corrosion.

- Cons: Manufacturing complexity leads to higher costs; machining can be challenging due to its hardness, and it may have limited electrical insulating properties compared to alumina.

Impact on Application:

Silicon carbide is often chosen for applications involving high thermal loads, such as kiln furniture, heat exchangers, or abrasive media. Its compatibility with alumina-based systems depends on specific media and operating conditions.

International Buyer Considerations:

Buyers should verify supplier certifications, especially for high-temperature applications, and ensure compliance with regional standards. In regions like the Middle East, where high-temperature processing is common, sourcing SiC from reputable manufacturers can ensure performance and safety.

Key Properties:

Zirconia offers high fracture toughness, excellent wear resistance, and stability at elevated temperatures (up to 2,700°C). It is also chemically inert and has good biocompatibility, making it suitable for specialized applications.

Pros & Cons:

- Pros: Superior toughness compared to alumina, ideal for impact-resistant components; maintains integrity in aggressive chemical environments.

- Cons: Generally more expensive; manufacturing and machining are more complex, which can increase lead times and costs.

Impact on Application:

Zirconia is often used in demanding environments such as dental implants, cutting tools, and advanced chemical reactors. Its high cost necessitates careful consideration of cost-benefit ratios, especially for large-scale or commodity applications.

International Buyer Considerations:

Buyers from Europe or South America should ensure zirconia products conform to relevant standards (e.g., ISO). Importing zirconia may involve navigating export restrictions and verifying supplier certifications to guarantee quality.

Key Properties:

Magnesia is a refractory material with high melting points (around 2,852°C), good electrical insulation, and resistance to basic (alkaline) media. It is often used in furnace linings and refractory bricks.

Pros & Cons:

- Pros: Cost-effective, readily available, and suitable for high-temperature applications involving basic slags or media.

- Cons: Less resistant to acidic corrosion; can be susceptible to thermal expansion issues, leading to cracking if not properly engineered.

Impact on Application:

Magnesia's primary use is in refractory linings for metallurgical processes, especially in basic environments. Its compatibility with alumina oxide depends on the media; it is less suitable for acidic conditions.

International Buyer Considerations:

Buyers should verify compliance with regional standards such as DIN or ASTM. Sourcing from regions with abundant magnesia supplies, like certain parts of Africa or South America, can reduce costs but requires quality assurance to prevent impurities that could compromise performance.

| Material | Typical Use Case for alumina oxide price | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alumina (Al₂O₃) | Insulating components, crucibles, wear-resistant linings | High durability, high-temperature stability, inertness | Manufacturing complexity, higher cost for high purity | Med |

| Silicon Carbide (SiC) | High-temperature kilns, heat exchangers, abrasive media | Excellent thermal conductivity, high thermal shock resistance | Costly, machining difficult, limited electrical insulation | High |

| Zirconia (ZrO₂) | Impact-resistant parts, chemical reactors, dental applications | Superior toughness, high chemical stability | Expensive, complex manufacturing | High |

| Magnesia (MgO) | Refractory linings, basic media environments | Cost-effective, high melting point | Susceptible to acidic corrosion, thermal expansion issues | Low |

For buyers across Africa, South America, the Middle East, and Europe, understanding the specific application requirements and regional standards is crucial. High-performance materials like zirconia or alumina may justify higher costs in demanding environments, but cost-sensitive projects might benefit from magnesia or lower-grade alumina. Ensuring compliance with local standards such as ASTM, DIN, or JIS, and verifying supplier certifications can mitigate risks of quality issues. Strategic sourcing, combined with a clear understanding of material properties and

The production of alumina oxide (aluminum oxide, Al₂O₃) involves several critical stages, each influencing the final product's quality, purity, and price. Understanding these stages enables B2B buyers to better assess supplier capabilities and product consistency.

1. Material Preparation and Bauxite Refining

The primary raw material is bauxite ore, which undergoes refining via the Bayer process. This involves crushing bauxite, digesting it in sodium hydroxide solution at high temperatures, and then separating alumina hydrate from residual impurities. The purity of bauxite, chemical composition, and process parameters directly impact the purity level of the resulting alumina.

2. Calcination and Alumina Production

The hydrated alumina is calcined at high temperatures (around 1100-1000°C) to remove chemically bound water, producing anhydrous alumina. Variations in calcination temperature and duration influence particle size, surface area, and phase composition, which are critical for specific applications like refractories, ceramics, or abrasives.

3. Material Forming Techniques

Depending on the end-use, alumina is processed into various forms:

- Pellets or Bricks: via pressing or extrusion for refractory applications.

- Powders: through milling and classification, tailored for ceramics or polishing.

- Sintered Blocks: via high-temperature sintering for structural uses.

4. Finishing and Surface Treatments

Post-forming, alumina products may undergo grinding, sieving, or surface treatments to achieve precise particle size distributions and surface qualities. Advanced techniques such as spray drying or granulation are employed to enhance flowability and packing density, crucial for manufacturing consistency.

Ensuring product quality involves a comprehensive QC framework aligned with international standards and industry-specific certifications. B2B buyers should scrutinize supplier QC protocols to mitigate risks associated with variability in product specifications.

1. International and Industry Standards

- ISO 9001: Most reputable alumina manufacturers adhere to ISO 9001, ensuring quality management systems are in place.

- Industry Certifications: Depending on application, suppliers might hold CE marking (Europe), API certification (oil and gas), or other relevant standards, indicating compliance with safety, performance, and environmental norms.

2. QC Checkpoints Across Production Stages

- Incoming Quality Control (IQC): Raw materials like bauxite are tested for impurity levels, chemical composition, and particle size before processing.

- In-Process Quality Control (IPQC): Monitoring during calcination, forming, and finishing stages includes temperature control, phase analysis via X-ray diffraction (XRD), particle size distribution, and surface area measurements.

- Final Quality Control (FQC): The finished alumina undergoes testing for purity (via ICP-MS or AAS), bulk density, porosity, hardness, and particle size distribution.

3. Testing Methods and Analytical Techniques

- Chemical Composition: Inductively Coupled Plasma Mass Spectrometry (ICP-MS) or Atomic Absorption Spectroscopy (AAS).

- Physical Properties: Laser diffraction for particle size, BET surface area analysis, and microscopy for surface morphology.

- Mechanical and Thermal Testing: Hardness testing, crush strength, and thermal stability assessments.

International buyers, especially from Africa, South America, the Middle East, and Europe, should adopt rigorous verification practices to ensure supplier reliability.

Third-Party Inspections and Audits: Engage accredited inspection agencies (e.g., SGS, Bureau Veritas) to conduct pre-shipment inspections, quality audits, and factory assessments. These inspections verify compliance with contractual specifications and standards.

Review of Certification Documents: Request and verify ISO certificates, test reports, and compliance certificates (CE, API, etc.). Cross-reference these documents with the supplier’s testing facilities and accreditation status.

Sample Testing and Certification: Prior to bulk orders, procure samples for independent testing at certified laboratories. This step helps confirm actual product quality aligns with specifications.

Supplier Track Record and References: Evaluate the supplier’s historical performance, delivery consistency, and client feedback, especially from buyers in your region.

Different regions may impose unique requirements or face specific challenges in quality assurance:

Africa: Variability in infrastructure may necessitate suppliers with robust QC systems and traceability. Buyers should prioritize suppliers with ISO 9001 certification and third-party audit reports.

South America (e.g., Colombia): Suppliers often compete on price but may have varying quality standards. Buyers should verify compliance with international standards and request detailed QC documentation.

Middle East: Stringent quality demands are common, especially for high-performance applications like aerospace or electronics. Certifications such as CE or API are highly valued, and onsite audits are recommended.

Europe (e.g., Poland): Regulatory compliance and environmental standards are strict. Suppliers often hold comprehensive certifications, but buyers should verify the scope and recency of these certifications.

Establish Clear Quality Specifications: Define acceptable chemical and physical parameters upfront, referencing relevant international standards.

Implement Rigorous Supplier Qualification: Use a combination of audits, certification verification, and sample testing to assess supplier quality management systems.

Prioritize Transparent QC Documentation: Require detailed test reports, certificates of analysis (COA), and traceability records for each batch.

Leverage Third-Party Inspection Services: Engage reputable inspection firms for unbiased quality verification, especially for high-volume or high-value orders.

Monitor and Audit Regularly: Maintain ongoing oversight through periodic audits and reviews, fostering continuous quality improvement.

By understanding the intricacies of manufacturing and quality assurance processes, international B2B buyers can make informed procurement decisions, mitigate risks, and ensure the consistent delivery of high-quality alumina oxide suited to their specific application needs.

For international B2B buyers, comprehending the detailed cost structure behind alumina oxide prices is essential to optimize procurement strategies. The primary cost components include raw materials, manufacturing labor, overhead expenses, tooling, quality control, logistics, and profit margins.

Materials: The core raw material—bauxite or alumina—significantly influences the base cost. Variations in raw material quality, origin, and market availability can cause price fluctuations. Higher purity alumina or specialized grades with certifications (e.g., ISO, REACH) typically command premium prices.

Labor and Manufacturing Overhead: Labor costs vary widely depending on the sourcing country. For instance, suppliers in Eastern Europe or China might offer lower manufacturing costs than those in Western Europe or North America. Overhead costs include energy, utilities, and facility expenses, which are also region-dependent.

Tooling and Quality Control: Initial tooling costs are generally amortized over large orders but can impact unit prices for smaller batches. Rigorous quality control, especially for certified grades, adds to costs but ensures compliance with international standards—crucial for industries like electronics or aerospace.

Logistics and Shipping: Transportation costs are highly variable based on distance, mode (sea, air, land), and port fees. Buyers from Africa, South America, or the Middle East should consider proximity to supplier hubs and potential customs duties, which can substantially affect total landed costs.

Margins: Suppliers factor in profit margins based on market competitiveness, order volume, and relationship strength. Larger, long-term contracts often enable better pricing leverage for buyers.

Several factors influence alumina oxide pricing beyond the base cost:

Order Volume and MOQ: Larger orders typically benefit from volume discounts. Establishing a consistent order schedule can provide bargaining power and reduce per-unit costs.

Specifications and Customization: Custom grades or specific certifications (e.g., low-alkali, high-purity) increase costs due to additional processing or testing. Clear specifications upfront help prevent unexpected expenses.

Material Quality and Certifications: Higher-grade alumina with certifications ensures compliance but adds to the price. For critical applications, investing in certified material can reduce downstream risks and costs.

Supplier Factors: Supplier reputation, reliability, and financial stability influence pricing. Established suppliers with proven quality records may command slightly higher prices but offer more security and consistency.

Incoterms and Delivery Terms: The choice of Incoterms (e.g., FOB, CIF, DDP) impacts who bears transportation and customs costs. Buyers should evaluate these terms carefully to accurately calculate landed costs and avoid surprises.

Negotiate Effectively: Leverage your purchase volume and long-term commitment potential to negotiate better prices and favorable terms. Discuss payment terms, discounts for early payment, and flexible delivery schedules.

Focus on Total Cost of Ownership (TCO): Consider all costs involved—not just the unit price. This includes customs duties, taxes, warehousing, and potential costs associated with quality issues or delays.

Optimize Logistics: For buyers in Africa, South America, or Europe, regional sourcing may reduce shipping time and costs. Working with suppliers close to your market or those with established logistics networks can improve supply chain resilience.

Price Monitoring and Market Trends: Alumina prices fluctuate based on global bauxite markets, energy prices, and geopolitical factors. Regularly monitor industry reports and market indices to anticipate price movements and plan procurement accordingly.

Customization and Certification Costs: Be transparent about specifications early in negotiations. While standard grades are less expensive, specialized needs may justify premium pricing—assess whether these are necessary for your application.

Prices for alumina oxide are highly variable and subject to market fluctuations, geopolitical influences, and supplier-specific factors. As such, the following indicative ranges are provided for reference purposes only:

Always conduct direct supplier inquiries and negotiate based on your specific requirements and volumes to obtain accurate, current pricing tailored to your procurement needs.

1. Material Grade

Alumina oxide (aluminum oxide or alumina) is classified into various grades based on purity, particle size, and intended application. Common grades include technical, ceramic, and pharmaceutical grades. For B2B buyers, understanding the grade is crucial because higher purity grades (e.g., 99.99%) typically command premium prices due to their suitability for high-performance applications like electronics or aerospace. Selecting the appropriate grade ensures that the product meets technical specifications without overspending.

2. Purity Level

Purity percentage indicates the proportion of alumina in the material. Higher purity levels (above 99%) reduce impurities that can affect product performance, especially in electronics, ceramics, or medical uses. Purity directly influences the price—higher purity alumina generally costs more, but it guarantees better quality and performance. Buyers must specify minimum purity levels to obtain accurate quotes and avoid unforeseen costs.

3. Particle Size and Distribution

Alumina powders are available in various particle sizes, from fine powders (<1 micron) to coarse granules. Uniform particle size distribution enhances processing efficiency and product consistency. Smaller or more precisely controlled particle sizes tend to be more expensive due to increased manufacturing complexity. Clarifying these specifications helps in negotiating fair prices and ensuring compatibility with manufacturing processes.

4. Tolerance and Impurities

Tolerance refers to the allowable variation in physical or chemical properties, such as particle size or purity. Lower tolerances require stricter quality control, increasing costs. Additionally, impurity levels (e.g., silica, iron oxide) can impact the material's performance and are often regulated. Buyers should specify acceptable impurity levels to prevent unexpected charges or rejections.

5. Form and Packaging

Alumina oxide is supplied in various forms—powder, granules, or blocks—and packaging can range from bulk containers to small drums. The form and packaging influence transportation costs, handling, and storage requirements. For international buyers, understanding these properties ensures compatibility with existing processing lines and helps accurately estimate total landed costs.

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce alumina oxide specifically tailored for their manufacturing processes. OEM agreements often involve bulk purchasing and customized specifications. Recognizing OEM relationships can help buyers negotiate better pricing or secure priority supply, especially for large or ongoing projects.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in a single order. MOQs can significantly impact initial procurement costs, particularly for small or new buyers. Understanding MOQs helps in planning inventory levels and negotiating better terms, especially when entering new markets or dealing with niche grades.

3. RFQ (Request for Quotation)

A formal process where buyers solicit price quotes, specifications, and delivery terms from multiple suppliers. RFQs are essential for comparing offers, ensuring transparency, and obtaining competitive pricing. Crafting clear RFQs with precise technical specs increases the likelihood of accurate quotes and better market insights.

4. Incoterms (International Commercial Terms)

Standardized trade terms defined by the International Chamber of Commerce that specify responsibilities, risks, and costs associated with shipping and delivery. Common Incoterms like FOB (Free On Board) or CIF (Cost, Insurance, and Freight) determine who bears shipping costs and risks at each stage. Familiarity with Incoterms helps buyers optimize logistics and budget accurately for landed costs.

5. CIF and FOB Pricing Models

These are common pricing structures in international trade. FOB indicates the price includes only the product and loading costs at the port of origin, with buyers responsible for shipping. CIF includes costs, insurance, and freight up to the destination port, often simplifying budgeting. Understanding these models allows buyers to compare offers effectively and select the most cost-efficient options.

6. Certification and Compliance Terms

Many buyers require certifications such as ISO, RoHS, or REACH to ensure compliance with international standards. These certifications can influence pricing, as certified products often undergo additional testing and quality assurance. Clarifying certification requirements upfront avoids delays and additional costs during procurement.

By mastering these technical properties and trade terms, international B2B buyers from Africa, South America, the Middle East, and Europe can make more informed purchasing decisions, negotiate better prices, and establish reliable supply chains for alumina oxide.

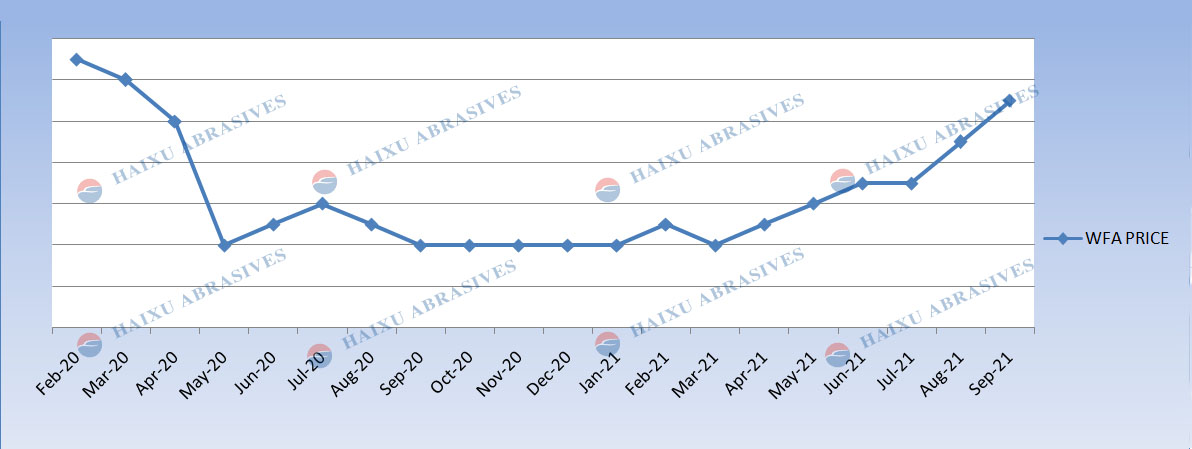

The global alumina oxide market is predominantly driven by the expanding aluminum industry, which accounts for over 90% of alumina consumption. Emerging markets, particularly in Africa, South America, the Middle East, and parts of Europe such as Poland and Colombia, are increasingly vital players due to growing industrialization and infrastructure development. Price fluctuations are often influenced by supply-demand imbalances, geopolitical tensions, and major production shifts in key regions like Australia, Brazil, and the Middle East.

Illustrative Image (Source: Google Search)

Current sourcing trends highlight a shift toward diversified supply chains, with B2B buyers seeking alternatives amid geopolitical risks and trade uncertainties. For instance, African countries like Guinea and Mozambique are gaining prominence as new sources of bauxite, the raw material for alumina, offering potential cost advantages and reduced dependency on traditional suppliers. South American nations, especially Brazil, continue to be significant players, benefiting from established mining infrastructure and stable supply chains.

Technological advancements such as online procurement platforms and real-time market analytics are transforming sourcing strategies. These tools enable buyers from Europe, Colombia, and Poland to monitor price movements, assess supplier reliability, and optimize inventory management more effectively. Additionally, sustainability considerations are increasingly influencing sourcing decisions, prompting buyers to evaluate not only cost but also environmental compliance and ethical practices.

Market dynamics are also shaped by environmental regulations, especially in Europe, where stricter emissions standards and carbon footprint reduction initiatives are compelling suppliers to adopt cleaner production methods. For African and South American buyers, understanding these trends is crucial to negotiate favorable terms and ensure supply chain resilience amid fluctuating prices and geopolitical complexities.

Sustainability has become a central pillar in the alumina oxide supply chain, driven by mounting environmental concerns and consumer demand for ethically sourced materials. The extraction and processing of alumina are energy-intensive, contributing to significant carbon emissions and environmental degradation if not managed responsibly. As a result, international buyers from Europe, South America, Africa, and the Middle East are increasingly prioritizing suppliers with strong environmental credentials.

Certifications such as ISO 14001 (Environmental Management) and the Aluminum Stewardship Initiative (ASI) certification are gaining prominence, signaling adherence to sustainable practices. These certifications ensure that suppliers are committed to reducing their carbon footprint, managing waste responsibly, and maintaining social responsibility standards. For B2B buyers, sourcing from certified suppliers not only mitigates reputational risks but also aligns with corporate sustainability goals and regulatory compliance.

Ethical sourcing extends beyond environmental impact to encompass labor practices and community engagement. Buyers in Colombia, Poland, and across Africa are scrutinizing supply chains to prevent child labor, ensure fair wages, and support local communities. Transparent supply chains, traceability, and third-party audits are essential tools for verifying compliance.

Investing in 'green' alumina—produced using renewable energy sources and innovative processes—can also offer competitive advantages. Such materials often command premium pricing but can significantly enhance a company's sustainability profile and appeal to environmentally conscious clients. Overall, integrating sustainability and ethical sourcing into procurement strategies is not only responsible but also strategic, helping buyers secure reliable, future-proof supply chains amid evolving regulations and market expectations.

Understanding the historical development of the alumina market provides valuable context for B2B buyers. Traditionally, alumina sourcing was dominated by a few large producers in Australia, Brazil, and the Middle East, with prices largely influenced by long-term supply contracts and commodity cycles. Over the past two decades, market liberalization, technological advancements, and increased environmental awareness have reshaped the landscape.

The emergence of new sources from Africa and South America has diversified supply options, reducing reliance on traditional regions and fostering competitive pricing. Additionally, the global push toward sustainability has prompted industry-wide investments in cleaner extraction and processing technologies, gradually shifting market standards. These historical shifts underscore the importance of agility and informed decision-making in sourcing strategies, especially for buyers in emerging markets like Colombia and Poland who seek to balance cost, reliability, and sustainability.

By understanding these evolutions, B2B buyers can better anticipate future market trends, leverage new sourcing opportunities, and align their procurement practices with global standards for environmental and social responsibility.

How can I verify the credibility of alumina oxide suppliers internationally?

To ensure supplier credibility, conduct thorough due diligence by checking their business licenses, certifications (ISO, SGS, etc.), and references from previous clients. Use third-party verification platforms like Alibaba’s Gold Supplier status or global trade directories. Request detailed product samples and inspection reports before committing. Additionally, consider engaging third-party inspection services for on-site audits or quality assessments, especially when dealing with overseas suppliers. Building relationships through transparent communication and requesting comprehensive documentation reduces risks associated with counterfeit or unreliable sources.

What are the key factors to consider when customizing alumina oxide specifications for my industry?

Identify your specific application needs—purity levels, particle size, shape, and chemical composition—then communicate these clearly with suppliers. Many suppliers offer customization options, but ensure they have the technical capacity and experience to meet your specifications. Request detailed technical datasheets and samples for testing. Clarify whether customization impacts lead times or costs, and negotiate terms upfront. Working with suppliers familiar with your industry’s standards (e.g., ceramics, refractories, electronics) ensures the product aligns with your operational requirements.

What is the typical minimum order quantity (MOQ) and lead time for alumina oxide? How can I optimize procurement?

MOQs vary widely—small orders may start at 1-5 metric tons, while larger contracts could involve 50+ tons. Lead times depend on supplier location, production capacity, and inventory levels, ranging from a few weeks to several months. To optimize procurement, establish long-term relationships with reliable suppliers, which often offers better terms and flexibility. Consolidate orders to meet MOQ thresholds and plan ahead to accommodate production schedules. Regular communication and forecast sharing can help suppliers better align their production timelines with your needs, reducing delays.

What are the common payment terms accepted in international alumina oxide trade, and how can I negotiate favorable terms?

Common payment methods include letters of credit (LC), telegraphic transfers (T/T), and open account terms for trusted partners. Negotiating favorable terms involves demonstrating your creditworthiness through references or prior transactions. For new suppliers, consider partial payments or escrow arrangements to mitigate risks. Establish clear payment schedules aligned with shipment milestones or quality inspections. Building trust through transparent communication and prompt payments can improve your bargaining power for better terms, such as reduced upfront deposits or extended payment periods.

What certifications and quality assurance documents should I request from alumina oxide suppliers?

Require suppliers to provide certifications such as ISO 9001 (quality management), SGS or BV inspection reports, and material safety data sheets (MSDS). For industry-specific standards, check if they hold certifications relevant to your application, such as ASTM or REACH compliance. Insist on third-party testing reports verifying purity, chemical composition, and particle size. Quality assurance processes like batch testing, stability reports, and traceability documentation help ensure consistent product quality, minimizing operational risks and ensuring compliance with your industry standards.

How can I effectively manage logistics and shipping costs for alumina oxide across different regions?

Partner with experienced freight forwarders familiar with your import/export regions to optimize shipping routes and costs. Consider multimodal transportation (sea, rail, air) based on urgency and budget. Negotiate bulk shipping discounts and request all-inclusive quotes covering customs clearance, duties, and inland transportation. Implement tracking systems to monitor shipments and proactively address delays. Establish clear Incoterms (e.g., FOB, CIF) to delineate responsibilities and costs. Proper planning and supplier coordination help minimize logistics disruptions and reduce total landed costs.

Illustrative Image (Source: Google Search)

What strategies should I adopt to resolve disputes related to alumina oxide quality or delivery?

First, maintain detailed documentation of all communications, contracts, inspection reports, and shipment records. When issues arise, communicate promptly with suppliers, referencing contractual obligations and quality standards. Use third-party inspection agencies to verify claims objectively. If disagreements persist, consider mediation or arbitration clauses outlined in your contract, preferably under internationally recognized frameworks like ICC or LCIA. Building strong supplier relationships based on transparency and mutual respect often results in amicable resolutions, but having clear contractual dispute mechanisms is essential for enforceability.

How can I stay updated on alumina oxide market trends and price fluctuations to make informed purchasing decisions?

Subscribe to industry reports, trade publications, and market analytics platforms specializing in raw materials. Join industry associations or regional trade chambers that offer market insights and networking opportunities. Engage with supplier newsletters and participate in international trade fairs or webinars to gauge supply-demand dynamics. Monitoring global economic indicators, production capacities, and geopolitical developments can help anticipate price shifts. Developing a flexible procurement strategy that incorporates market intelligence enables proactive purchasing, securing favorable prices and maintaining supply continuity.

In an evolving global market, proactive and strategic sourcing is essential for international B2B buyers aiming to optimize costs and mitigate risks associated with alumina oxide procurement. Understanding regional supply dynamics, geopolitical influences, and market volatility allows buyers from Africa, South America, the Middle East, and Europe—such as Colombia and Poland—to make informed decisions that enhance supply chain resilience.

Key takeaways include the importance of diversifying sourcing channels, leveraging long-term contracts, and maintaining close supplier relationships to navigate fluctuating prices. Staying attuned to market trends, such as shifts in demand from key industries like aluminum production and ceramics, will enable buyers to anticipate price movements and capitalize on emerging opportunities.

Looking ahead, the alumina oxide market is likely to experience continued price variability driven by global economic shifts and supply chain adjustments. Buyers should prioritize strategic sourcing initiatives now to build flexibility and cost stability for the future. By adopting a proactive, data-driven approach, international buyers can secure competitive advantages and ensure sustained growth in an increasingly complex market landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina