In today’s interconnected global economy, understanding the nuances of sic structure is essential for B2B buyers seeking competitive advantage and operational excellence. Whether you are sourcing for manufacturing, construction, or specialized industrial applications, the right sic structure can dramatically influence product quality, cost efficiency, and supply chain resilience. For businesses across Africa, South America, the Middle East, and Europe — including industrial hubs in Germany and Italy — mastering this complex landscape is critical to securing reliable partnerships and optimizing procurement strategies.

This comprehensive guide is designed to empower international buyers with actionable insights into the full spectrum of sic structure considerations. You will explore a detailed overview of various types and material compositions, offering clarity on their performance characteristics and suitability for diverse applications. Additionally, the guide covers manufacturing processes and quality control standards that ensure consistency and compliance with international benchmarks.

Understanding the supplier ecosystem is equally vital. We provide an in-depth analysis of global and regional suppliers, highlighting key players and sourcing tips tailored to your market’s unique dynamics. Cost structures and pricing trends are unpacked to help you budget effectively and negotiate with confidence.

Finally, an extensive FAQ section addresses common challenges and practical solutions, enabling you to make well-informed decisions with reduced risk. By leveraging this guide, B2B buyers from emerging and established markets alike will gain a strategic edge in navigating the complexities of sic structure sourcing — transforming challenges into opportunities for growth and innovation.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Hierarchical SIC Structure | Organized in multi-level categories from broad sectors to specific industries | Market segmentation, supplier classification, regulatory compliance | + Clear categorization aids targeted sourcing – Complexity may require detailed understanding |

| Sector-Based SIC Structure | Grouped by broad economic sectors such as manufacturing, services, agriculture | Industry benchmarking, sector-specific procurement | + Simplifies industry-wide analysis – Less granularity for niche product sourcing |

| Regional SIC Variations | Adjustments of SIC codes reflecting local economic activities and regulations | Local market entry, regional supplier evaluation | + Tailored to local business environments – Variations complicate cross-border comparisons |

| Product/Service-Oriented SIC | Classification based on primary products or services offered by businesses | Product-specific sourcing, supply chain optimization | + Focused on procurement needs – May overlook broader company capabilities |

| Hybrid SIC Models | Combination of hierarchical and product-based classifications for comprehensive analysis | Complex supply chain management, multi-sector sourcing | + Versatile and detailed – Can be resource-intensive to implement and maintain |

This structure organizes industries into broad categories that branch into more specific subcategories, enabling detailed classification. For B2B buyers, especially those managing large portfolios or regulatory compliance, this model facilitates precise market segmentation and supplier identification. However, its complexity requires buyers to invest in understanding the classification depth to leverage it effectively. Ideal for multinational buyers needing granular insight into industry specifics.

Grouping businesses by broad economic sectors such as manufacturing or services, this structure supports high-level industry benchmarking and sector-focused procurement strategies. It suits buyers seeking to evaluate market trends or source suppliers within distinct economic segments. While it simplifies analysis, buyers may find it insufficient for niche product sourcing, necessitating complementary classification tools for detailed procurement.

SIC codes adapted to reflect local economic conditions and regulatory environments are crucial for buyers entering new geographic markets, particularly in Africa, South America, the Middle East, and Europe. These variations enable accurate evaluation of local suppliers and compliance with regional standards. However, they pose challenges for cross-border comparison, requiring buyers to harmonize data or use mapping tools for effective international sourcing.

Classifying businesses primarily by their core products or services helps buyers focus procurement efforts on specific goods or service categories. This approach is advantageous for supply chain optimization and product-specific sourcing strategies. Buyers should note that this focus might overlook a supplier’s broader capabilities or diversification, which could be relevant for future business opportunities or risk mitigation.

Combining hierarchical and product/service classifications, hybrid models offer a comprehensive view of industries and products. This detailed approach benefits buyers managing complex supply chains across multiple sectors, allowing for nuanced supplier evaluation and strategic sourcing. The trade-off is the increased resource demand to implement and maintain such systems, making it more suitable for organizations with advanced procurement capabilities and diverse supplier bases.

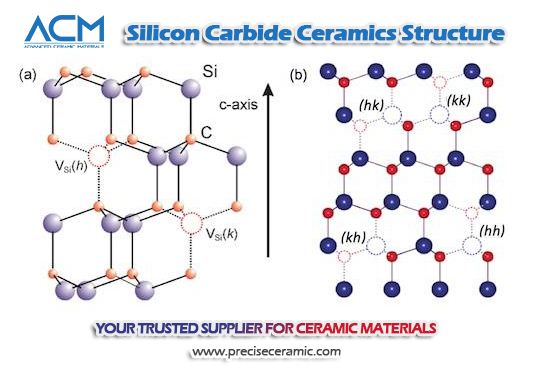

Related Video: SiC Crystal Structure setup

| Industry/Sector | Specific Application of sic structure | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-voltage, high-frequency power devices | Increased efficiency, reduced energy loss, smaller device size | Quality certification, thermal management capability, supplier reliability |

| Automotive & EVs | SiC-based power modules for electric vehicles | Enhanced battery life, faster charging, improved thermal performance | Compliance with automotive standards, scalability, cost-effectiveness |

| Renewable Energy Systems | SiC inverters for solar and wind power conversion | Higher efficiency, longer operational life, reduced maintenance | Longevity, environmental certifications, compatibility with existing infrastructure |

| Industrial Automation | High-speed switching devices and motor drives | Improved system responsiveness, energy savings, durability | Customization options, technical support, lead times |

| Telecommunications | High-frequency RF components and power amplifiers | Better signal integrity, lower noise, enhanced bandwidth | Frequency range support, integration flexibility, supplier innovation capability |

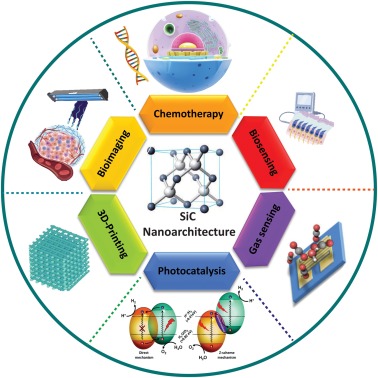

Silicon carbide (SiC) structures have become pivotal in power electronics, where they enable the design of high-voltage and high-frequency devices. For international B2B buyers, especially in Europe and the Middle East, sourcing SiC components with certified quality and proven thermal management is critical to ensure device longevity and energy efficiency. The ability of SiC to operate at higher temperatures and voltages reduces system size and energy losses, making it ideal for power converters and industrial power supplies.

In the automotive sector, particularly for electric vehicles (EVs), SiC structures are used in power modules to enhance battery performance and enable faster charging cycles. Buyers from South America and Africa should prioritize suppliers who comply with stringent automotive standards and can provide scalable solutions to meet growing EV markets. The superior thermal conductivity of SiC helps maintain optimal operating temperatures, which is essential for vehicle reliability and safety.

For renewable energy systems, SiC-based inverters convert DC power from solar panels or wind turbines into AC power more efficiently than traditional silicon devices. This leads to longer operational lifespans and lower maintenance costs—critical factors for B2B buyers in regions investing heavily in sustainable energy, such as Europe and the Middle East. Ensuring compatibility with existing grid infrastructure and verifying environmental certifications are key procurement considerations.

In industrial automation, SiC structures enable high-speed switching devices and motor drives that improve system responsiveness and reduce energy consumption. International buyers should look for suppliers offering customization and robust technical support to tailor solutions for diverse industrial processes. The durability of SiC components supports continuous operation in harsh environments, a valuable benefit for manufacturing sectors in Africa and South America.

Finally, in telecommunications, SiC is integral to high-frequency RF components and power amplifiers, facilitating better signal integrity and enhanced bandwidth. Buyers in technologically advanced markets like Germany and Italy benefit from sourcing SiC devices that support wide frequency ranges and offer integration flexibility. Partnering with innovative suppliers ensures access to cutting-edge components that keep pace with evolving network demands.

Related Video: Silicon Carbide Explained - SiC Basics

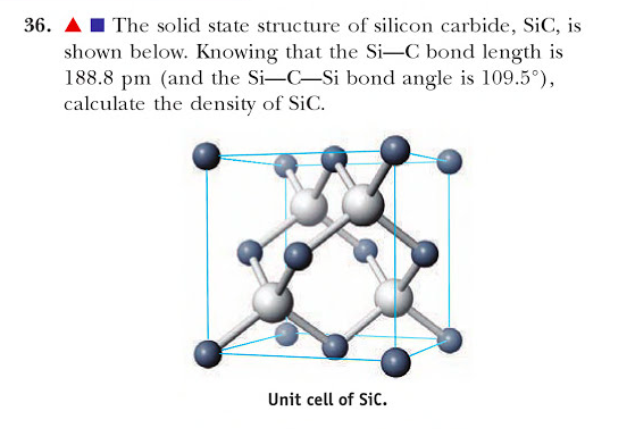

Silicon carbide (SiC) structures are widely used in demanding industrial applications due to their exceptional mechanical, thermal, and chemical properties. Selecting the appropriate material variant for SiC structures is critical for optimizing performance and cost-efficiency, especially in international B2B contexts where compliance with regional standards and application-specific requirements vary. Below is a detailed analysis of common SiC materials and their strategic considerations for buyers across Africa, South America, the Middle East, and Europe.

Key Properties: RB-SiC offers good thermal conductivity (~120 W/m·K) and a moderate flexural strength (around 300 MPa). It can withstand temperatures up to 1400°C and exhibits excellent corrosion resistance against oxidizing and acidic environments.

Pros & Cons: RB-SiC is relatively cost-effective compared to other SiC variants due to its simpler manufacturing process, which involves infiltrating porous carbon preforms with molten silicon. However, it has a slightly lower mechanical strength and hardness than sintered SiC. Its porosity can also lead to reduced wear resistance in highly abrasive applications.

Impact on Application: RB-SiC is suitable for chemical processing equipment, kiln furniture, and heat exchangers where moderate mechanical stress and high corrosion resistance are required. It performs well with acidic and oxidizing media but is less ideal for highly abrasive or high-pressure environments.

International Considerations: European buyers, particularly in Germany and Italy, often require compliance with DIN EN standards and certifications for chemical resistance. In the Middle East and Africa, RB-SiC's cost-effectiveness and corrosion resistance make it attractive for petrochemical and desalination industries. South American buyers should verify ASTM standards compliance and consider local supplier capabilities for consistent quality.

Key Properties: SSiC boasts superior mechanical strength (up to 600 MPa), high hardness (Mohs ~9), and excellent thermal shock resistance. It can operate continuously at temperatures exceeding 1600°C and withstands aggressive chemical environments, including strong alkalis and acids.

Pros & Cons: The sintering process produces a dense, non-porous material with outstanding wear resistance and durability. The downside is a higher production cost and more complex manufacturing, which can lead to longer lead times and higher minimum order quantities.

Impact on Application: Ideal for high-wear, high-temperature applications such as pump seals, valve components, and mechanical seals in aggressive media. Its robustness makes it suitable for industries requiring long service life under severe conditions.

International Considerations: European buyers prioritize SSiC for high-end industrial uses, often requiring compliance with ISO and DIN standards. In the Middle East and South America, where oil and gas industries dominate, SSiC’s durability justifies its premium cost. African markets may face supply chain challenges; thus, buyers should engage suppliers with proven export logistics and quality assurance.

Key Properties: PLSSiC is a variant of sintered SiC produced without applied pressure, resulting in slightly lower density but maintaining excellent thermal and chemical resistance. It withstands temperatures up to 1700°C and has good oxidation resistance.

Pros & Cons: PLSSiC offers a balance between cost and performance, with better machinability than fully sintered SiC. However, its mechanical strength is somewhat lower than SSiC, and it may not be suitable for extremely high-stress applications.

Impact on Application: Commonly used in kiln furniture, burner nozzles, and components exposed to thermal cycling and corrosive gases. Its machinability allows for complex shapes and custom designs, beneficial in specialized industrial equipment.

International Considerations: Buyers in Europe appreciate PLSSiC for applications requiring intricate geometries and moderate mechanical demands. In emerging markets like Africa and South America, PLSSiC’s cost-performance ratio is attractive, but buyers should ensure suppliers meet ASTM or JIS standards to guarantee material consistency.

Key Properties: CVD-SiC is a dense, pure form of silicon carbide deposited as a thin layer with exceptional hardness, chemical inertness, and thermal stability up to 2000°C. It has excellent resistance to oxidation and corrosion.

Pros & Cons: The CVD process yields near-perfect crystalline structures with superior surface finish and minimal defects. However, it is the most expensive SiC variant and typically used as a coating rather than bulk material, limiting its use to specialized applications.

Impact on Application: Ideal for protective coatings on mechanical seals, turbine components, and semiconductor devices where surface integrity and chemical resistance are paramount. It enhances the lifespan of base materials exposed to extreme environments.

International Considerations: European manufacturers often specify CVD-SiC coatings for high-precision applications, adhering to stringent ISO and DIN standards. Middle Eastern and South American industries may adopt CVD-SiC for advanced petrochemical processes, but cost and availability remain limiting factors. African buyers should assess the cost-benefit ratio carefully and consider partnerships with suppliers offering technical support.

| Material | Typical Use Case for sic structure | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Reaction-Bonded SiC (RB-SiC) | Chemical processing equipment, kiln furniture | Cost-effective, good corrosion resistance | Lower mechanical strength, porous structure | Low |

| Sintered SiC (SSiC) | Pump seals, valve components, high-wear parts | High strength, excellent wear and thermal resistance | Higher cost, complex manufacturing | High |

| Pressureless Sintered SiC (PLSSiC) | Kiln furniture, burner nozzles, thermal cycling parts | Good machinability, balanced cost-performance | Slightly lower strength than fully sintered SiC | Medium |

| Chemical Vapor Deposition SiC (CVD-SiC) | Protective coatings on seals, turbine parts | Exceptional surface finish and chemical inertness | Very high cost, limited to coating applications | High |

This guide equips international B2B buyers with a clear understanding of the trade-offs and strategic considerations when selecting SiC materials. Buyers should align material choice with application demands, regional compliance standards, and supply chain capabilities to maximize operational efficiency and return on investment.

Manufacturing and quality assurance of SiC (Silicon Carbide) structures are critical to ensuring high-performance, durability, and reliability, particularly for industrial applications ranging from semiconductors to power electronics. International B2B buyers from diverse regions such as Africa, South America, the Middle East, and Europe require a clear understanding of these processes to select suppliers that meet stringent global standards and local market requirements.

The manufacturing of SiC structures involves several well-defined stages, each requiring precision and control due to the material’s hardness and thermal properties.

Quality assurance in SiC structure manufacturing is multilayered, encompassing international standards compliance, systematic testing, and supplier transparency.

For international buyers, especially from Africa, South America, the Middle East, and Europe, verifying the supplier’s quality control system is essential to mitigate risk and ensure product compliance.

Illustrative Image (Source: Google Search)

Understanding the manufacturing processes and rigorous quality assurance protocols behind SiC structures empowers international B2B buyers to make informed sourcing decisions. By focusing on critical manufacturing stages, compliance with global and industry-specific standards, and robust QC verification methods, buyers from Africa, South America, the Middle East, and Europe can secure high-quality SiC products that meet their technical and regulatory demands. Establishing strong partnerships with suppliers who demonstrate transparent and certified quality management systems is key to long-term success in this sophisticated market segment.

Understanding the cost and pricing dynamics behind sourcing sic structures is crucial for international B2B buyers aiming to optimize procurement strategies and total cost of ownership. This analysis breaks down the essential cost components, key pricing influencers, and actionable tips for buyers from Africa, South America, the Middle East, and Europe.

Materials

The primary cost driver is the raw materials used in sic structures, typically silicon carbide ceramics or composites. Material quality, purity, and source origin significantly affect costs. For instance, high-purity or specialized grades command premium prices but ensure superior performance and longevity.

Labor

Skilled labor required for precision manufacturing and assembly contributes to costs. Labor rates vary widely by region, with European suppliers generally having higher labor costs compared to counterparts in emerging markets. However, labor quality and expertise are critical for defect-free production.

Manufacturing Overhead

Includes factory utilities, equipment depreciation, and indirect labor. Advanced manufacturing processes for sic structures—such as sintering, machining, and finishing—require sophisticated equipment, influencing overhead expenses.

Tooling and Setup

Initial tooling costs for molds, dies, or custom fixtures can be substantial, especially for bespoke designs or low-volume orders. These are often amortized over production runs, so larger volumes reduce per-unit tooling cost.

Illustrative Image (Source: Google Search)

Quality Control (QC)

Rigorous QC is necessary due to the technical nature of sic structures. Costs cover inspection equipment, testing protocols, certifications, and potential rework. High-quality assurance adds to pricing but mitigates risks of failure downstream.

Logistics and Freight

Given the fragile nature and sometimes bulky size of sic components, specialized packaging and shipping are required. International freight costs fluctuate based on distance, mode (air, sea, road), and geopolitical factors. Customs duties and import taxes also add to landed cost.

Supplier Margin

Suppliers incorporate profit margins reflecting market demand, competition, and value-added services such as engineering support or after-sales service.

Order Volume and Minimum Order Quantity (MOQ)

Larger orders typically unlock volume discounts and reduce per-unit costs by spreading fixed expenses. Buyers should negotiate MOQs aligned with their consumption to avoid overstocking or premium small-batch pricing.

Technical Specifications and Customization

Complex designs, tighter tolerances, or unique material blends increase costs. Customization often requires additional tooling and QC, impacting pricing.

Material Grade and Certification Requirements

Compliance with international standards (e.g., ISO, RoHS) or industry-specific certifications can elevate costs but are essential for regulated markets in Europe and the Middle East.

Supplier Location and Capabilities

Proximity to the buyer can reduce logistics costs and lead times. Suppliers with advanced technology and strong quality records may justify higher pricing due to reliability and reduced risk.

Incoterms and Payment Terms

The agreed Incoterms (e.g., FOB, CIF, DDP) influence who bears logistics and customs costs. Buyers should clearly understand these terms to avoid unexpected expenses.

Negotiate Beyond Price:

Engage suppliers in discussions about lead times, payment terms, warranties, and after-sales support to secure comprehensive value, not just the lowest price.

Evaluate Total Cost of Ownership (TCO):

Consider hidden costs such as inventory holding, quality failures, and logistics delays. A slightly higher unit price may yield savings by reducing defects or improving supply chain reliability.

Leverage Regional Trade Agreements:

Buyers in Africa, South America, and the Middle East should explore regional trade agreements and customs unions that may reduce tariffs or simplify import procedures for sic structures sourced from Europe or Asia.

Assess Supplier Financial Stability:

Long-term partnerships require supplier solvency to avoid disruptions. Request financial disclosures or references, especially when engaging new or overseas suppliers.

Plan for Currency and Inflation Risks:

International buyers must hedge against exchange rate volatility and inflation in supplier countries, which can affect pricing over contract durations.

Request Detailed Cost Breakdowns:

Insist on transparent quotations that itemize costs. This enables targeted negotiations on specific cost drivers, such as tooling or logistics.

Test Small Batches First:

When possible, order samples or small pilot runs to validate quality and supplier responsiveness before committing to large volumes.

All price indications for sic structures are inherently variable and dependent on specific technical requirements, order volumes, supplier capabilities, and current market conditions. Buyers should treat quoted prices as indicative and conduct thorough due diligence, including multiple supplier comparisons and market research, to inform purchasing decisions.

By carefully analyzing these cost components and price influencers, international B2B buyers can strategically navigate the complex pricing landscape of sic structure sourcing. This approach enhances procurement efficiency, mitigates risks, and supports sustainable supplier relationships across diverse global markets.

Material Grade

The material grade of a Sic (silicon carbide) structure defines its purity, crystalline form, and performance characteristics such as thermal conductivity and hardness. For B2B buyers, understanding the grade ensures the product meets industry standards and application requirements, especially in high-temperature or abrasive environments typical in manufacturing or electronics.

Dimensional Tolerance

Dimensional tolerance specifies the allowable deviation from the specified dimensions of the Sic structure. Tight tolerances are crucial for components requiring precise fits, such as semiconductor substrates or mechanical parts. Buyers must assess tolerance levels to guarantee compatibility with their existing systems and avoid costly rework or product failure.

Thermal Stability

Thermal stability refers to the structure’s ability to maintain its properties under high temperatures. Sic structures are prized for their excellent thermal resistance, making this parameter vital for applications in power electronics and automotive industries. Buyers should verify thermal stability to ensure long-term performance and reliability under operational stresses.

Mechanical Strength

This property measures the Sic structure's resistance to mechanical forces, including compression, tension, and impact. High mechanical strength is essential for durability in harsh industrial environments. For international buyers, confirming mechanical strength helps in selecting Sic structures that withstand transport and operational demands.

Illustrative Image (Source: Google Search)

Surface Finish

Surface finish affects the interaction of the Sic structure with other components, influencing assembly and performance. A smooth, defect-free finish is often required for optical or electronic applications. Buyers should specify surface finish requirements clearly to suppliers to meet functional and aesthetic needs.

Electrical Resistivity

Electrical resistivity defines how well the Sic structure resists electrical current. This is critical in electronic components and sensors where insulation or controlled conductivity is required. Buyers must consider resistivity levels aligned with their application to avoid malfunction or safety issues.

OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts or equipment used in another company’s end product. For buyers, sourcing Sic structures from OEMs often guarantees compliance with original design specifications and quality assurance.

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier is willing to sell. Understanding MOQ helps buyers, particularly SMEs or startups, plan procurement budgets and inventory without overcommitting financially or risking shortages.

RFQ (Request for Quotation)

RFQ is a formal process where buyers solicit detailed pricing and terms from suppliers. It enables international B2B buyers to compare offers transparently and negotiate better terms for Sic structures tailored to their technical and commercial needs.

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Familiarity with Incoterms (such as FOB, CIF, DDP) is essential for buyers across Africa, South America, the Middle East, and Europe to minimize logistics risks and costs.

Lead Time

Lead time is the period between placing an order and receiving the goods. For Sic structures, knowing lead time helps buyers align procurement with production schedules and market demands, avoiding downtime or delayed deliveries.

Certification and Compliance

Certifications (e.g., ISO, RoHS) confirm that Sic structures meet international quality and environmental standards. Buyers should request these certifications to ensure compliance with local regulations and industry benchmarks, facilitating smoother market entry and acceptance.

Understanding these technical properties and trade terms empowers B2B buyers to make informed decisions, optimize procurement processes, and establish reliable supplier partnerships in the global Sic structure market.

The global market for sic structure is shaped by rapid technological advancements, evolving regulatory frameworks, and shifting demand patterns across diverse regions. For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding these dynamics is crucial to optimize sourcing strategies and maintain competitive advantage.

Key Market Drivers include urbanization, infrastructure development, and the increasing need for resilient, adaptable structural solutions. Emerging economies in Africa and South America are investing heavily in infrastructure, creating significant demand for innovative sic structure products that combine durability with cost-effectiveness. Meanwhile, European buyers, especially in Germany and Italy, focus on precision engineering, quality standards, and integration with smart building technologies.

Sourcing Trends are increasingly influenced by digital transformation. Buyers are leveraging Industry 4.0 technologies such as IoT-enabled monitoring, BIM (Building Information Modeling), and AI-driven supply chain management to enhance transparency and efficiency. This trend facilitates just-in-time procurement, reduces lead times, and improves supplier collaboration across continents.

Market Dynamics also reflect a growing preference for modular and prefabricated sic structure components, enabling faster construction cycles and scalability. In the Middle East, where large-scale projects demand high customization, suppliers are adopting flexible manufacturing processes and advanced materials to meet these needs.

For B2B buyers, strategic partnerships with regional manufacturers and distributors are essential to navigate tariffs, logistics complexities, and compliance with local standards. Understanding regional certification requirements and fostering long-term supplier relationships can mitigate risks and ensure consistent quality delivery.

Sustainability has become a non-negotiable criterion in the sic structure sector, driven by global climate commitments and stakeholder expectations. International buyers must prioritize environmentally responsible sourcing to reduce carbon footprints and align with evolving regulatory landscapes.

The production of sic structures often involves energy-intensive processes and raw materials with significant environmental impacts. Therefore, buyers should seek suppliers who demonstrate transparent environmental management systems and utilize renewable energy sources or recycled materials. Certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and ISO 14001 provide credible assurance of sustainable practices.

Ethical supply chains are equally critical. Buyers should conduct thorough due diligence to ensure compliance with labor standards, fair wages, and safe working conditions throughout the supply network. This is particularly relevant when sourcing from regions with emerging regulatory frameworks.

Incorporating green materials—such as low-carbon concrete alternatives, sustainably harvested timber, and recycled steel—can significantly enhance the environmental profile of sic structure projects. Additionally, suppliers adopting circular economy principles, including waste reduction and material reuse, offer long-term value and risk mitigation.

By embedding sustainability criteria into procurement policies, B2B buyers not only contribute to global environmental goals but also enhance brand reputation and meet increasing demands from investors and clients for responsible sourcing.

The sic structure sector has evolved from traditional, labor-intensive construction methods to highly engineered, technology-driven processes. Historically dominated by local craftsmanship and raw material availability, the industry has progressively embraced mechanization and standardized production since the mid-20th century.

In Europe, countries like Germany and Italy have been pioneers in integrating precision engineering and quality assurance into sic structure manufacturing, setting global benchmarks. Meanwhile, emerging markets in Africa and South America are rapidly adopting these innovations to meet growing infrastructure needs, often leapfrogging legacy methods through modular and prefabricated solutions.

This evolution reflects a broader trend toward globalization and digitalization, enabling more efficient cross-border collaboration and knowledge transfer. For B2B buyers, appreciating this historical trajectory is important to understand current capabilities and anticipate future innovations in the sic structure marketplace.

How can I effectively vet suppliers of sic structure for international B2B procurement?

To ensure reliability, start by verifying the supplier’s business licenses, certifications, and financial stability. Request references and case studies from previous international clients, especially those within your region (Africa, South America, Middle East, Europe). Utilize third-party audits or inspection services to validate factory capabilities and compliance with industry standards. Engage in direct communication to assess responsiveness and transparency. Additionally, check for adherence to export regulations and the supplier’s experience handling cross-border transactions to minimize risks.

Is customization of sic structure feasible, and how should I approach it with suppliers?

Yes, many suppliers offer customization to meet specific technical or regulatory requirements. Clearly define your specifications, including materials, dimensions, and performance criteria before negotiation. Request prototypes or samples to evaluate quality and fit. Discuss the customization process timeline and any additional costs upfront. Ensure that customization does not compromise compliance with your country’s standards. Maintaining detailed documentation and a signed agreement on specifications helps avoid misunderstandings during production.

What are typical minimum order quantities (MOQs), lead times, and payment terms for sic structure in international trade?

MOQs vary widely depending on supplier scale and product complexity but typically range from small batches (10-50 units) to larger volumes for cost efficiency. Lead times can span from 4 to 12 weeks, factoring in production and shipping. Payment terms often include an upfront deposit (30-50%), with the balance paid upon inspection or before shipment. Use secure payment methods like letters of credit or escrow services to protect your investment. Negotiate terms that balance cash flow needs with supplier confidence.

What quality assurance (QA) measures and certifications should I expect from sic structure suppliers?

Suppliers should provide QA protocols aligned with international standards such as ISO 9001 for quality management and, if applicable, industry-specific certifications (e.g., CE marking in Europe). Insist on detailed inspection reports, including raw material testing, in-process checks, and final product verification. Third-party testing agencies can validate compliance with mechanical and safety standards. Establish clear acceptance criteria and consider including warranty clauses in contracts to safeguard against defects and ensure long-term reliability.

How can I optimize logistics and shipping for sic structure imports across different continents?

Work with logistics partners experienced in heavy or oversized cargo typical of structural components. Choose shipping modes (sea, air, or multimodal) based on cost, urgency, and destination infrastructure. Coordinate closely with suppliers on packaging standards to prevent damage during transit. Plan customs clearance by preparing complete documentation, including commercial invoices, packing lists, and certificates of origin. Consider Incoterms carefully to define responsibility for freight, insurance, and duties, reducing ambiguity and delays.

What strategies can help resolve disputes or quality issues with sic structure suppliers internationally?

Establish clear contractual terms specifying dispute resolution mechanisms such as mediation or arbitration in a mutually agreeable jurisdiction. Maintain thorough documentation of communications, specifications, and quality inspections. For quality issues, initiate prompt negotiations for corrective actions, replacements, or refunds. Engage local legal counsel familiar with international trade laws if disputes escalate. Building strong relationships and open communication channels with suppliers can often prevent conflicts and foster collaborative problem-solving.

Are there regional considerations for sourcing sic structure from suppliers in Africa, South America, the Middle East, or Europe?

Yes, regional factors like local manufacturing capabilities, regulatory environments, and logistical infrastructure impact sourcing decisions. For example, European suppliers often provide advanced certifications and shorter lead times but at higher costs. Suppliers in Africa or South America may offer competitive pricing but require thorough vetting and longer shipping durations. Understand regional trade agreements, tariffs, and import restrictions that affect cost and delivery. Leveraging local agents or representatives can improve communication and compliance in specific regions.

How can I ensure compliance with environmental and safety standards when purchasing sic structure internationally?

Require suppliers to comply with international environmental regulations such as REACH in Europe or local standards in your market. Verify the use of sustainable materials and responsible manufacturing processes through certifications like ISO 14001. Safety compliance should include adherence to structural integrity standards and safe handling guidelines. Request documentation proving conformity and conduct periodic audits or inspections. Incorporating compliance clauses in contracts and working with suppliers committed to sustainability mitigates regulatory risks and supports corporate social responsibility goals.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic sourcing of SIC structure components demands a nuanced understanding of market dynamics, supplier capabilities, and regional specificities. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—leveraging a well-defined sourcing strategy can significantly enhance supply chain resilience, cost efficiency, and product quality. Prioritizing suppliers with proven expertise in SIC structure manufacturing and those who demonstrate compliance with international standards is critical to mitigating risks and ensuring long-term value.

Key takeaways include the importance of thorough supplier evaluation, embracing technology-driven procurement processes, and fostering collaborative partnerships that enable innovation and agility. Buyers should also consider geopolitical factors and logistic frameworks unique to their regions to optimize sourcing decisions.

Looking ahead, the SIC structure market is poised for growth fueled by increasing infrastructure demands and technological advancements. International buyers are encouraged to adopt a proactive sourcing approach—integrating sustainability criteria and digital tools—to stay ahead in a competitive global marketplace. By doing so, they will not only secure superior products but also contribute to building more sustainable and efficient supply networks across continents.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina