Sintered silicon carbide (SiC) stands at the forefront of advanced material solutions, prized for its exceptional hardness, thermal conductivity, and chemical resistance. For international B2B buyers, particularly those operating in dynamic markets across Africa, South America, the Middle East, and Europe, understanding the nuances of sintered SiC is critical to securing high-performance components that drive operational excellence and innovation.

This guide delivers a comprehensive roadmap to the sintered SiC landscape, addressing every pivotal aspect—from the diversity of material grades and manufacturing processes to rigorous quality control standards. It explores the global supplier ecosystem, offering insights into regional sourcing advantages and cost considerations that influence procurement strategies. Whether you are based in the UK, Argentina, or emerging industrial hubs, this resource equips you with actionable intelligence to evaluate potential partners and optimize your supply chain.

Key areas covered include:

- Types and grades of sintered SiC tailored for different industrial applications

- Material properties and performance benchmarks critical for engineering decisions

- Manufacturing techniques and quality assurance practices ensuring product reliability

- Global supplier profiles and sourcing strategies aligned with market realities

- Cost analysis and market trends to anticipate pricing dynamics

- Frequently asked questions addressing common buyer challenges

By synthesizing technical depth with market insights, this guide empowers international B2B buyers to make informed, strategic sourcing decisions that enhance competitiveness and long-term value in the sintered SiC market.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Alpha-Phase Sintered SiC | High purity α-SiC, hexagonal crystal structure, excellent thermal conductivity | High-temperature components, heat exchangers, semiconductor manufacturing | Pros: Superior thermal stability, excellent wear resistance. Cons: Higher cost, limited machinability. |

| Beta-Phase Sintered SiC | Cubic crystal structure β-SiC, typically finer grain size, slightly lower density | Abrasives, cutting tools, mechanical seals | Pros: Better machinability, cost-effective. Cons: Lower thermal stability, moderate strength. |

| Reaction-Bonded SiC (RBSiC) | Formed by silicon infiltration into porous carbon preforms, lower density | Furnace components, chemical processing, automotive parts | Pros: Cost-efficient, good corrosion resistance. Cons: Porosity can reduce mechanical strength. |

| Liquid-Phase Sintered SiC | Contains additives (e.g., Al, B) to promote densification, high density and strength | Mechanical seals, wear parts, aerospace components | Pros: High mechanical strength, excellent wear resistance. Cons: Additives may affect thermal properties. |

| Nano-Structured Sintered SiC | Incorporates nano-sized SiC particles for enhanced mechanical properties | Advanced electronics, aerospace, high-performance cutting tools | Pros: Exceptional hardness and strength, enhanced toughness. Cons: Premium pricing, limited availability. |

Alpha-Phase Sintered SiC

This type features a high-purity hexagonal crystal structure, offering excellent thermal conductivity and chemical stability. It is ideal for applications requiring high-temperature endurance such as semiconductor manufacturing and heat exchangers. B2B buyers should consider its superior wear resistance and thermal stability, balanced against higher costs and limited machinability. This makes it suitable for industries in Europe and the Middle East where performance outweighs initial investment.

Beta-Phase Sintered SiC

Beta-phase SiC has a cubic crystal structure with finer grains, providing better machinability and cost efficiency. It is commonly used in abrasives, cutting tools, and mechanical seals where moderate thermal and mechanical performance is acceptable. For buyers in South America and Africa, this type offers a practical balance between performance and budget, especially for tooling and wear-resistant parts.

Reaction-Bonded SiC (RBSiC)

RBSiC is produced by infiltrating molten silicon into porous carbon, resulting in a lower-density material with good corrosion resistance. It is widely used in furnace components and chemical processing equipment. Buyers should note its cost-efficiency and corrosion resistance but also consider the potential trade-off in mechanical strength due to porosity. This type suits industries prioritizing chemical resistance over maximum strength.

Liquid-Phase Sintered SiC

This variant incorporates additives to achieve high density and mechanical strength, making it well-suited for demanding wear parts and aerospace components. Buyers should evaluate the enhanced wear resistance and strength against possible compromises in thermal properties caused by additives. This type is favored in markets such as Europe and the Middle East where high-performance mechanical parts are critical.

Nano-Structured Sintered SiC

Nano-structured SiC leverages nano-sized particles to dramatically improve hardness, toughness, and strength. It serves advanced electronics, aerospace, and high-performance cutting tool sectors. While offering exceptional material properties, it commands premium pricing and may have limited availability. B2B buyers targeting cutting-edge applications should weigh the benefits of superior performance against cost and supply considerations.

Related Video: Power Cycling on sintered SiC modules

| Industry/Sector | Specific Application of sintered sic | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | High-performance brake discs and clutches | Enhanced wear resistance and thermal stability, leading to longer service life and improved safety | Consistent quality certifications, supply chain reliability, and compliance with regional automotive standards |

| Aerospace | Wear-resistant components in turbine engines | Reduced maintenance downtime and improved fuel efficiency due to high-temperature durability | Supplier capability for precision manufacturing and adherence to aerospace material standards |

| Electronics & Semiconductors | Substrates and heat sinks for high-power devices | Superior thermal conductivity and electrical insulation improve device performance and longevity | Availability of high-purity sintered SiC and customization options for thermal management |

| Chemical Processing | Corrosion-resistant pump seals and valve components | Increased operational uptime and reduced replacement frequency in aggressive chemical environments | Proven material performance under corrosive conditions and certifications for chemical industry use |

| Renewable Energy | Components in wind turbine bearings and solar inverters | Improved mechanical strength and resistance to environmental degradation, enhancing system reliability | Supplier experience with renewable energy sector and ability to meet large-scale order demands |

Automotive Industry Applications

Sintered silicon carbide (SiC) is widely used in automotive brake discs and clutch systems where extreme wear resistance and thermal stability are critical. Its ability to withstand high friction and heat ensures longer component life and enhanced safety, which is vital for vehicle manufacturers targeting markets with diverse climatic conditions, such as Africa and South America. Buyers should prioritize suppliers offering consistent quality and compliance with local automotive regulations to ensure seamless integration into production lines.

Aerospace Sector Uses

In aerospace, sintered SiC components are integral to turbine engines due to their exceptional wear resistance and ability to maintain integrity at elevated temperatures. These properties contribute to reduced maintenance cycles and improved fuel efficiency, crucial for airlines and manufacturers across Europe and the Middle East aiming to optimize operational costs. For international buyers, sourcing from suppliers with rigorous aerospace certification and precise manufacturing capabilities is essential to meet stringent industry standards.

Electronics and Semiconductor Applications

Sintered SiC serves as a substrate and heat sink material in high-power electronic devices, providing excellent thermal conductivity and electrical insulation. This enhances device performance and durability, a significant advantage for manufacturers in technologically advanced markets like the UK and parts of Europe. Buyers should focus on high-purity materials and customization options to meet specific thermal management requirements, ensuring compatibility with their electronic components.

Chemical Processing Industry

The chemical sector benefits from sintered SiC’s corrosion resistance in pump seals and valve components, which operate in aggressive environments. This reduces downtime and maintenance costs, a priority for industrial plants in regions such as the Middle East and South America where chemical processing is a key economic activity. Buyers must verify material performance through certifications and proven field applications to guarantee reliability under harsh conditions.

Renewable Energy Sector

Sintered SiC is increasingly used in wind turbine bearings and solar inverter components due to its mechanical strength and environmental resilience. These qualities help improve the longevity and reliability of renewable energy systems, supporting sustainability goals in Europe and Africa. When sourcing, businesses should consider suppliers experienced in the renewable energy market and capable of fulfilling large-scale, consistent orders to support long-term projects.

When selecting sintered silicon carbide (SiC) materials for industrial applications, understanding the distinct types and their properties is crucial for international B2B buyers. This is especially important for markets in Africa, South America, the Middle East, and Europe, where operational environments, regulatory standards, and cost sensitivities vary widely.

Key Properties:

RB-SiC typically offers excellent thermal conductivity and good corrosion resistance. It can withstand temperatures up to 1400°C and exhibits moderate mechanical strength. Its porosity is relatively higher than fully sintered SiC, which can affect chemical resistance in aggressive environments.

Pros & Cons:

- Pros: Lower manufacturing cost due to reaction bonding process; good machinability; suitable for complex shapes.

- Cons: Higher porosity leads to lower corrosion resistance; less suitable for highly acidic or alkaline media; moderate mechanical strength compared to fully sintered SiC.

Impact on Application:

RB-SiC is ideal for applications involving moderate chemical exposure and where thermal shock resistance is important, such as pump components and kiln furniture. It is less suitable for highly corrosive chemical processing.

International Buyer Considerations:

Buyers in regions like South America and Africa may prefer RB-SiC due to its cost-effectiveness and ease of customization. Compliance with ASTM C-799 and DIN EN 60672 standards is common. However, buyers in Europe and the Middle East should verify chemical compatibility and porosity levels for their specific applications, especially in stringent chemical processing sectors.

Key Properties:

SSiC is fully dense with superior mechanical strength, hardness, and excellent corrosion resistance. It withstands temperatures up to 1600°C and has very low porosity, making it highly resistant to chemical attack and abrasion.

Pros & Cons:

- Pros: Outstanding durability and wear resistance; excellent for harsh chemical environments; high thermal stability.

- Cons: Higher cost due to complex manufacturing; limited machinability; longer lead times.

Impact on Application:

SSiC is preferred for highly demanding environments such as chemical reactors, heat exchangers, and semiconductor manufacturing components. Its resistance to aggressive acids and alkalis makes it suitable for media like sulfuric acid and hydrochloric acid.

International Buyer Considerations:

European and Middle Eastern buyers often require SSiC to meet stringent ASTM C-714 or DIN EN 60672 standards for chemical resistance and mechanical performance. Buyers from Africa and South America should weigh the higher cost against longer service life and reduced maintenance, especially for critical applications.

Key Properties:

HPSiC combines high density with enhanced fracture toughness and thermal shock resistance. It typically operates effectively at temperatures up to 1500°C and offers excellent abrasion resistance.

Pros & Cons:

- Pros: Superior mechanical toughness; good thermal shock resistance; excellent wear resistance.

- Cons: Manufacturing complexity leads to higher costs; limited availability in some regions; machining challenges.

Impact on Application:

HPSiC is well-suited for mechanical seals, valve components, and wear parts in abrasive slurry environments. It balances toughness and hardness, making it ideal for dynamic applications with mechanical stress.

International Buyer Considerations:

Buyers in Europe and the Middle East often prioritize HPSiC for heavy-duty industrial machinery due to its toughness. In Africa and South America, cost and supply chain considerations may limit its use to high-value applications. Compliance with JIS and ASTM standards should be verified.

Key Properties:

PSSiC offers near-full density with excellent chemical and thermal resistance. It can tolerate temperatures up to 1700°C and has very low porosity, providing outstanding corrosion resistance.

Pros & Cons:

- Pros: Exceptional chemical inertness; high temperature tolerance; excellent wear resistance.

- Cons: Very high production cost; limited availability; complex quality control requirements.

Impact on Application:

PSSiC is ideal for ultra-high purity applications such as semiconductor wafer processing and advanced chemical reactors where contamination must be minimized.

International Buyer Considerations:

European and Middle Eastern buyers often require PSSiC for cutting-edge industries and must ensure compliance with strict ASTM and ISO standards. For buyers in Africa and South America, the high cost and supply chain complexity may restrict usage to niche, high-tech sectors.

| Material | Typical Use Case for sintered sic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Reaction Bonded SiC (RB-SiC) | Moderate chemical exposure, kiln furniture, pump parts | Cost-effective, good machinability | Higher porosity, lower chemical resistance | Low |

| Sintered SiC (SSiC) | Harsh chemical environments, heat exchangers | Superior corrosion resistance and durability | High cost, limited machinability | High |

| Hot Pressed SiC (HPSiC) | Mechanical seals, valve components, abrasive wear parts | High fracture toughness and thermal shock resistance | Expensive, complex manufacturing | High |

| Pressureless Sintered SiC (PSSiC) | Ultra-pure semiconductor and chemical processing | Exceptional chemical inertness and purity | Very high cost, limited availability | High |

This guide aims to empower international B2B buyers with a clear understanding of sintered SiC material options, enabling informed decisions tailored to regional standards, cost constraints, and application demands.

Sintered silicon carbide (SiC) is a high-performance ceramic widely used in demanding industrial applications due to its exceptional hardness, thermal stability, and corrosion resistance. Understanding the typical manufacturing process is crucial for B2B buyers to evaluate suppliers effectively and ensure product consistency.

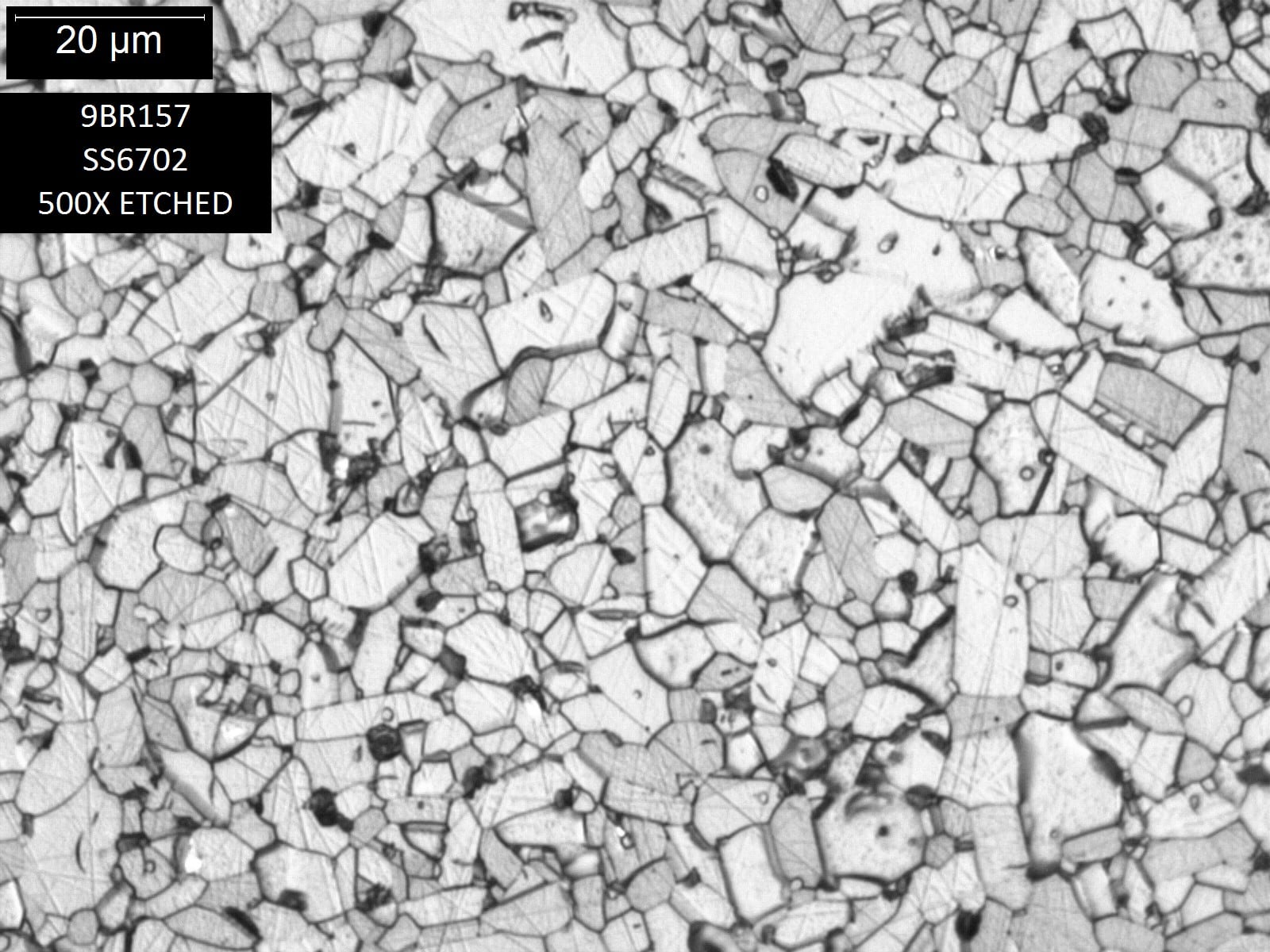

The process begins with selecting high-purity silicon carbide powders, often combined with sintering aids such as boron or carbon to enhance densification. The raw materials undergo thorough mixing and milling to achieve a uniform particle size distribution and composition. This step is critical as it directly affects the final mechanical properties and microstructure of the sintered SiC.

Once the powder blend is ready, it is shaped into the desired form using techniques such as:

This stage requires strict control to avoid defects like cracks or density variations.

The green bodies are then sintered at very high temperatures (typically 2000°C or higher) in inert or vacuum atmospheres. Sintering densifies the material by bonding SiC grains together, eliminating porosity and enhancing strength and wear resistance. The sintering process parameters—temperature, time, and atmosphere—are optimized based on the part’s application.

Post-sintering, SiC parts often require precision machining to meet exact dimensional and surface finish specifications. Techniques include grinding, laser machining, or diamond wheel cutting due to SiC’s extreme hardness. Final finishing may also involve surface treatments to improve performance characteristics such as oxidation resistance or reduce friction.

For international B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, ensuring the quality and reliability of sintered SiC components is paramount. Robust QA/QC processes minimize risks related to product failure and supply chain disruptions.

Buyers should verify that suppliers hold certifications aligned with their industry and regional regulatory requirements.

For buyers across Africa, South America, the Middle East, and Europe, due diligence in supplier evaluation is essential to mitigate risks.

Suppliers should provide QC documentation in English or the buyer’s preferred language to avoid misinterpretation. Clear, detailed reports support smoother customs clearance and internal compliance audits.

International buyers must consider the impact of shipping times on batch consistency. Regular communication with suppliers about production scheduling and QC results ensures product uniformity across multiple shipments.

By focusing on these aspects, international B2B buyers can secure high-quality sintered SiC components that meet stringent performance and regulatory requirements, supporting long-term operational success.

Understanding the cost and pricing dynamics of sintered silicon carbide (SiC) is crucial for international B2B buyers aiming to optimize procurement strategies. The pricing landscape is shaped by multiple interconnected factors that influence the final purchase cost and total cost of ownership (TCO).

Raw Materials

The primary cost driver is the quality and source of raw silicon carbide powders and sintering additives. High-purity materials command premium prices but deliver superior performance and longevity. Fluctuations in raw material availability and global commodity prices can impact costs, especially for buyers in regions with limited local supply chains.

Labor and Manufacturing Overhead

Skilled labor for precision sintering, machining, and finishing adds to the cost base. Manufacturing overhead includes energy consumption (high-temperature sintering requires significant power), equipment depreciation, and factory overheads. Regions with higher labor costs (e.g., Europe) typically see elevated pricing compared to emerging markets.

Tooling and Equipment

Specialized tooling for shaping and finishing sintered SiC components contributes to upfront and ongoing expenses. Complex or custom tooling requirements increase the per-unit cost, particularly for low-volume orders.

Quality Control (QC)

Rigorous QC processes, including dimensional inspections, density testing, and certification compliance (e.g., ISO standards), ensure product reliability but add cost layers. Buyers prioritizing certified quality and traceability should anticipate premium pricing.

Logistics and Supply Chain

International shipping, customs duties, and insurance influence landed costs. For buyers in Africa, South America, and the Middle East, longer transit times and multiple handling points can escalate costs and risks. Efficient logistics planning and choosing optimal Incoterms (e.g., DAP, FOB) are essential to control expenses.

Supplier Margin

Profit margins vary based on supplier scale, market positioning, and competitive dynamics. Established suppliers with extensive certifications may charge higher margins, reflecting added value and reliability.

Order Volume and Minimum Order Quantities (MOQs): Larger volumes typically yield volume discounts and lower unit costs. Buyers from smaller markets should consider consolidating orders or partnering with distributors to meet MOQs economically.

Specification Complexity and Customization: Tailored shapes, tight tolerances, or specialized grades increase production complexity and costs. Standardized products are generally more cost-effective.

Material Grades and Certifications: Higher-grade sintered SiC with enhanced mechanical or thermal properties commands higher prices. Certifications relevant to specific industries (e.g., automotive, aerospace) can add to costs but reduce operational risks.

Supplier Location and Reputation: Proximity to manufacturing hubs reduces freight costs and lead times. Established suppliers with robust quality systems often justify premium pricing through reliability and reduced defects.

Incoterms Impact: The chosen Incoterms define responsibility for freight, insurance, and customs, influencing total buyer costs. For example, CIF terms include shipping and insurance but may limit buyer control over logistics.

Negotiate Beyond Price: Engage suppliers on payment terms, lead times, and after-sales support. Bulk purchasing and long-term contracts can unlock better pricing and priority production slots.

Evaluate Total Cost of Ownership: Consider installation, maintenance, lifespan, and failure risks. Investing in higher-quality sintered SiC may reduce downtime and replacement costs, offering superior ROI.

Leverage Regional Trade Agreements: Buyers in Africa, South America, and the Middle East should explore trade agreements and tariff exemptions to lower import duties.

Optimize Logistics: Collaborate with freight forwarders familiar with sintered SiC handling. Consolidate shipments to reduce per-unit logistics costs and minimize damage risks.

Understand Pricing Nuances by Region: For example, UK buyers may face higher labor-driven prices but benefit from stricter quality and environmental standards. South American buyers should factor in currency volatility and import tariffs. Middle Eastern buyers might prioritize suppliers with regional warehouses to reduce lead times.

Due to market volatility, raw material costs, and regional economic factors, pricing for sintered SiC products can vary widely. All price indications should be verified directly with suppliers based on current market conditions, order specifics, and negotiated terms.

By thoroughly analyzing these cost components and pricing influencers, international B2B buyers can make informed sourcing decisions that balance cost-efficiency with product performance and supply reliability.

For international B2B buyers evaluating sintered silicon carbide (SiC), understanding key material specifications is essential to ensure product performance and supply chain efficiency. Here are the most important technical properties to consider:

Material Grade

Sintered SiC comes in various grades depending on purity, density, and microstructure. Higher-grade SiC typically offers better thermal conductivity and mechanical strength. For buyers, selecting the appropriate grade impacts product durability and cost-effectiveness, especially in high-temperature or abrasive environments.

Density

This measures how compact the sintered SiC is, usually expressed in grams per cubic centimeter (g/cm³). Higher density indicates fewer pores, leading to improved mechanical strength and chemical resistance. Buyers should specify density requirements to avoid premature wear or failure in demanding industrial applications.

Hardness

Measured by the Mohs scale or Vickers hardness test, hardness reflects resistance to surface deformation. Sintered SiC is known for exceptional hardness, often exceeding 9 on the Mohs scale. This property is critical for components subject to abrasion, such as seals, nozzles, or cutting tools.

Thermal Conductivity

This indicates the material’s ability to conduct heat, typically measured in W/m·K. High thermal conductivity is beneficial in applications requiring rapid heat dissipation, such as heat exchangers or semiconductor manufacturing. Buyers should align thermal specs with operational temperature ranges.

Dimensional Tolerance

Tolerance defines acceptable deviation in size and shape, often expressed in micrometers (µm). Tight tolerances ensure parts fit precisely in assemblies, reducing rework and enhancing performance. For B2B buyers, specifying tolerance levels upfront helps avoid costly manufacturing delays.

Chemical Resistance

Sintered SiC resists corrosion from acids, alkalis, and oxidizing agents. Understanding its chemical resistance is vital for buyers in chemical processing or harsh environmental sectors, ensuring longevity and reducing maintenance costs.

Navigating international procurement of sintered SiC requires familiarity with common industry jargon. Clear understanding of these terms aids smoother negotiations and contract management:

OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products that are used in another company’s end product. Buyers often source sintered SiC parts directly from OEMs for assured quality and compatibility with their machinery.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs can vary widely, impacting inventory and cash flow. Buyers should negotiate MOQs that align with their project scale, especially when ordering from overseas suppliers.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for price, lead time, and terms for a specified quantity and specification of sintered SiC. Effective RFQs include detailed technical requirements to ensure accurate and comparable offers.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyer and seller. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Selecting the right Incoterm clarifies logistics costs and risks, critical for cross-border transactions.

Lead Time

The total time from order placement to delivery. Lead times for sintered SiC can vary based on supplier capacity and customization requirements. Buyers should factor lead time into project timelines and negotiate realistic expectations.

Batch Traceability

The ability to track production batches for quality control and regulatory compliance. For buyers in regulated industries, insisting on batch traceability ensures accountability and facilitates problem resolution if defects occur.

Understanding these technical properties and trade terms empowers B2B buyers across Africa, South America, the Middle East, and Europe to make informed decisions, optimize procurement processes, and mitigate risks in sourcing sintered SiC. Clear communication of specifications and trade conditions upfront leads to stronger supplier partnerships and better end-product performance.

The sintered silicon carbide (SiC) sector is experiencing robust growth driven by increasing demand from diverse industrial applications, including automotive, aerospace, electronics, and energy. For B2B buyers in Africa, South America, the Middle East, and Europe, understanding these dynamics is critical to making informed sourcing decisions. Globally, sintered SiC’s superior properties—such as high thermal conductivity, exceptional hardness, and chemical stability—are fueling its adoption in high-performance components like mechanical seals, wear parts, and semiconductor substrates.

Illustrative Image (Source: Google Search)

Key market drivers include the rising electrification of vehicles, which requires SiC-based power electronics for improved efficiency, and the expansion of renewable energy infrastructures, where SiC components enhance inverter performance. Additionally, sectors such as petrochemical and mining in regions like the Middle East and Africa are increasingly utilizing sintered SiC for its wear resistance and corrosion durability.

From a sourcing perspective, buyers should note the trend toward customized SiC solutions tailored to specific industrial requirements, which demands closer collaboration with manufacturers. Digitalization and Industry 4.0 technologies are also shaping the supply chain by enabling better quality control, traceability, and faster lead times. For example, European buyers benefit from advanced manufacturing ecosystems that integrate automated sintering and precision machining, while South American and African markets are progressively improving access to these technologies through partnerships and joint ventures.

Emerging trends include a push for smaller, more energy-efficient SiC components and innovations in binder systems to improve mechanical properties without compromising sustainability. International buyers must stay vigilant about geopolitical factors affecting raw material availability—such as silicon carbide powder sourcing—and global logistics challenges that may impact lead times and costs.

Sustainability is increasingly central in the sintered SiC supply chain, driven by both regulatory pressures and buyer demand for environmentally responsible materials. The production of sintered SiC involves energy-intensive processes, including high-temperature sintering, which contributes significantly to its carbon footprint. For B2B buyers, especially in Europe and the Middle East where environmental regulations are stringent, prioritizing suppliers with green manufacturing certifications (e.g., ISO 14001) can mitigate risks associated with non-compliance and reputational damage.

Ethical sourcing extends beyond environmental impact to encompass labor practices and transparent supply chains. Buyers from regions like the UK and Argentina should ensure that their SiC suppliers adhere to responsible sourcing frameworks, which verify that raw materials—such as silicon carbide powders—are procured without contributing to conflict zones or exploitative labor.

Illustrative Image (Source: Google Search)

Material innovation is also playing a role in sustainability. The development of eco-friendly binders and the use of recycled SiC feedstock are gaining traction, helping reduce waste and energy consumption. Some suppliers offer life-cycle assessments (LCA) to quantify environmental impacts, enabling B2B purchasers to make data-driven decisions aligned with corporate sustainability goals.

Ultimately, integrating sustainability criteria into procurement processes not only supports global environmental objectives but also enhances supply chain resilience and fosters long-term partnerships with forward-thinking manufacturers.

The evolution of sintered silicon carbide dates back to the early 20th century, with significant technological advancements occurring post-World War II as industrial demand for high-performance ceramics surged. Initially developed as a refractory material, sintered SiC quickly found applications in harsh environments due to its exceptional hardness and thermal stability.

Over the decades, improvements in sintering techniques—such as pressureless sintering and hot pressing—have enabled the production of denser, more uniform SiC components with enhanced mechanical properties. This evolution has been critical for expanding SiC’s applicability into precision engineering fields.

For international B2B buyers, understanding this historical context highlights why today’s sintered SiC products offer unparalleled performance and reliability, making them indispensable in cutting-edge industrial applications. It also underscores the importance of partnering with suppliers who leverage the latest sintering technologies to meet increasingly stringent quality and performance standards.

How can I effectively vet sintered SiC suppliers from different regions like Africa, South America, the Middle East, and Europe?

Effective supplier vetting starts with verifying certifications such as ISO 9001 and industry-specific quality standards. Request detailed product datasheets and samples to assess material consistency and performance. Conduct background checks on the supplier’s financial stability and track record of international shipments. Engage with local trade chambers or B2B platforms relevant to each region for verified supplier listings. Additionally, consider site visits or third-party audits to ensure manufacturing capabilities meet your technical requirements and compliance standards.

What customization options are typically available for sintered SiC products, and how should I communicate these needs to suppliers?

Sintered SiC can be customized in terms of grain size, density, shape, and surface finish to suit specific industrial applications. Clearly define your technical specifications, including mechanical and thermal properties, alongside dimensional tolerances. Provide detailed engineering drawings or prototypes where possible. Early-stage communication should include discussions on feasibility, minimum order quantities (MOQs), and any additional costs for customization. Using standardized technical language and referencing industry norms helps avoid misunderstandings.

What are common MOQs and lead times for sintered SiC orders, and how can buyers from emerging markets negotiate favorable terms?

MOQs vary widely depending on supplier capacity and customization levels but typically range from a few hundred to several thousand units. Lead times often span 4 to 12 weeks, influenced by production complexity and logistics. Buyers from emerging markets should build relationships by demonstrating long-term purchase potential and consider consolidating orders to meet MOQ thresholds. Negotiating flexible payment terms or phased deliveries can help manage cash flow and reduce inventory risk.

Which quality assurance certifications should I prioritize when selecting sintered SiC suppliers for industrial use?

Prioritize suppliers holding ISO 9001 for quality management systems and ISO 14001 for environmental management. For specific applications, certifications like RoHS compliance and REACH registration are critical to ensure chemical safety and environmental standards. Material test reports (MTRs) and third-party lab certifications validating hardness, density, and thermal conductivity provide additional assurance. Always request batch traceability documentation to support quality consistency and regulatory compliance.

What are the best practices for managing international logistics and customs clearance for sintered SiC shipments?

Work with freight forwarders experienced in handling ceramic materials and cross-border shipments to minimize transit damage. Clarify Incoterms (e.g., FOB, CIF) upfront to allocate responsibilities and costs clearly. Prepare all necessary customs documentation, including commercial invoices, certificates of origin, and compliance certificates, to expedite clearance. Buyers should monitor shipment tracking closely and have contingency plans for delays, especially when importing into countries with complex import regulations or infrastructure constraints.

How can B2B buyers in regions like the Middle East and South America mitigate risks related to payment and currency fluctuations when sourcing sintered SiC?

Utilize secure payment methods such as letters of credit or escrow services to protect transactions. Negotiate payment terms that balance supplier confidence with buyer cash flow, like partial upfront payment and balance on delivery. Consider invoicing in stable currencies like USD or EUR to reduce exposure to local currency volatility. Hedging instruments or working with banks offering foreign exchange risk management can further safeguard against adverse currency movements.

What dispute resolution mechanisms are advisable for international contracts involving sintered SiC suppliers?

Include clear dispute resolution clauses in contracts specifying jurisdiction, governing law, and arbitration procedures (e.g., ICC or UNCITRAL arbitration). Mediation is often a first step before arbitration or litigation, offering a cost-effective path to settlement. Ensure contracts outline quality benchmarks, inspection rights, and remedies for non-compliance or delayed delivery. Maintaining open communication channels and documenting all agreements and changes reduces the likelihood of disputes escalating.

How important is supplier transparency regarding production processes and raw material sourcing for sintered SiC, especially for environmentally conscious buyers?

Transparency is increasingly critical as buyers prioritize sustainability and ethical sourcing. Understanding raw material origins and production methods helps assess environmental impact and compliance with international standards. Suppliers willing to share process details and environmental certifications demonstrate commitment to responsible manufacturing. This transparency supports buyers’ own ESG (Environmental, Social, Governance) reporting and can be a differentiator in competitive markets focused on green procurement.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Sintered silicon carbide (SiC) presents a compelling opportunity for international B2B buyers seeking high-performance ceramic solutions. Key takeaways emphasize the importance of evaluating suppliers not only on cost but on quality consistency, technological expertise, and supply chain resilience—critical factors for industries ranging from aerospace to electronics. For buyers in Africa, South America, the Middle East, and Europe, understanding regional market dynamics and logistics complexities will be essential to optimize sourcing strategies.

Illustrative Image (Source: Google Search)

Strategic sourcing of sintered SiC demands a proactive approach: building strong supplier relationships, leveraging multi-sourcing to mitigate risks, and prioritizing partners who invest in innovation and sustainable practices. This ensures access to advanced materials that meet stringent technical specifications while supporting long-term business continuity.

Looking ahead, the sintered SiC market is poised for growth fueled by expanding applications and evolving manufacturing technologies. Buyers who act decisively today to align with forward-thinking suppliers will gain a competitive edge. International buyers are encouraged to engage early with industry experts, explore collaborative sourcing models, and invest in supply chain transparency to unlock the full potential of sintered SiC in their operations. Embracing these strategies will position businesses to thrive amid global market shifts and technological advancements.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina