In today’s interconnected economy, sourcing sisic effectively on the global stage is crucial for businesses aiming to maintain competitive advantage and operational excellence. As demand surges across regions like Africa, South America, the Middle East, and Europe, understanding the complexities of sisic—from its diverse types and material compositions to manufacturing and quality control standards—becomes indispensable for international B2B buyers.

This comprehensive guide serves as an authoritative resource, offering an in-depth exploration of the sisic market tailored specifically for buyers in emerging and established markets such as Argentina and Indonesia. It covers critical aspects including:

By equipping buyers with actionable intelligence and practical sourcing strategies, this guide empowers businesses to navigate regulatory challenges, cultural nuances, and logistical hurdles inherent in international trade. Whether you are establishing new supplier relationships or optimizing existing ones, mastering these elements will enable you to secure high-quality sisic solutions that align with your operational goals and market demands.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Sisic Standard | Basic configuration, widely compatible, cost-effective | General industrial use, manufacturing lines | + Affordable – Limited customization options |

| Sisic Advanced | Enhanced performance, integrated analytics, modular design | High-tech manufacturing, automation | + Greater efficiency – Higher upfront investment |

| Sisic Compact | Smaller footprint, energy-efficient, simplified interface | SMEs, mobile or remote operations | + Space-saving – Reduced scalability |

| Sisic Customizable | Tailored features, scalable modules, adaptable to niche needs | Specialized industries, bespoke solutions | + Highly flexible – Longer lead times and higher costs |

| Sisic Cloud-Enabled | Cloud integration, remote monitoring, IoT compatibility | Digital transformation projects, logistics | + Real-time data access – Dependence on internet connectivity |

Sisic Standard

This type represents the foundational sisic model, favored for its broad compatibility and cost-effectiveness. It suits general industrial applications where basic functionality is sufficient. For B2B buyers, especially in emerging markets like Africa and South America, the Standard type offers a reliable entry point with manageable costs. However, it may lack advanced features required for highly specialized or automated environments.

Sisic Advanced

Designed for industries demanding high performance and smart integration, Sisic Advanced incorporates analytics and modularity. This makes it ideal for automation-heavy sectors and technology-driven manufacturing hubs in Europe and the Middle East. Buyers should weigh the higher initial expenditure against long-term gains in efficiency and process optimization.

Sisic Compact

With a focus on minimal space usage and energy efficiency, the Compact variant is tailored for small to medium enterprises and operations with limited physical infrastructure. Its simplified interface supports ease of use, making it attractive for businesses in constrained environments, such as remote facilities in Indonesia or Argentina. The trade-off lies in its limited scalability for future expansion.

Sisic Customizable

Offering bespoke configurations, this type is suited for companies with unique operational requirements or niche markets. Its scalability and adaptability appeal to specialized industries across all targeted regions. Procurement involves longer timelines and higher costs, but the investment ensures a solution closely aligned with business needs and growth plans.

Sisic Cloud-Enabled

This modern variation integrates cloud technologies for real-time monitoring and IoT connectivity, supporting digital transformation initiatives. It is particularly relevant for logistics and supply chain businesses aiming to leverage data-driven decision-making. Buyers must consider the reliability of internet infrastructure and cybersecurity when adopting this type, especially in regions with variable connectivity.

Related Video: Sicilian Defense ALL Variations Explained [Chess Opening Crash Course]

| Industry/Sector | Specific Application of sisic | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

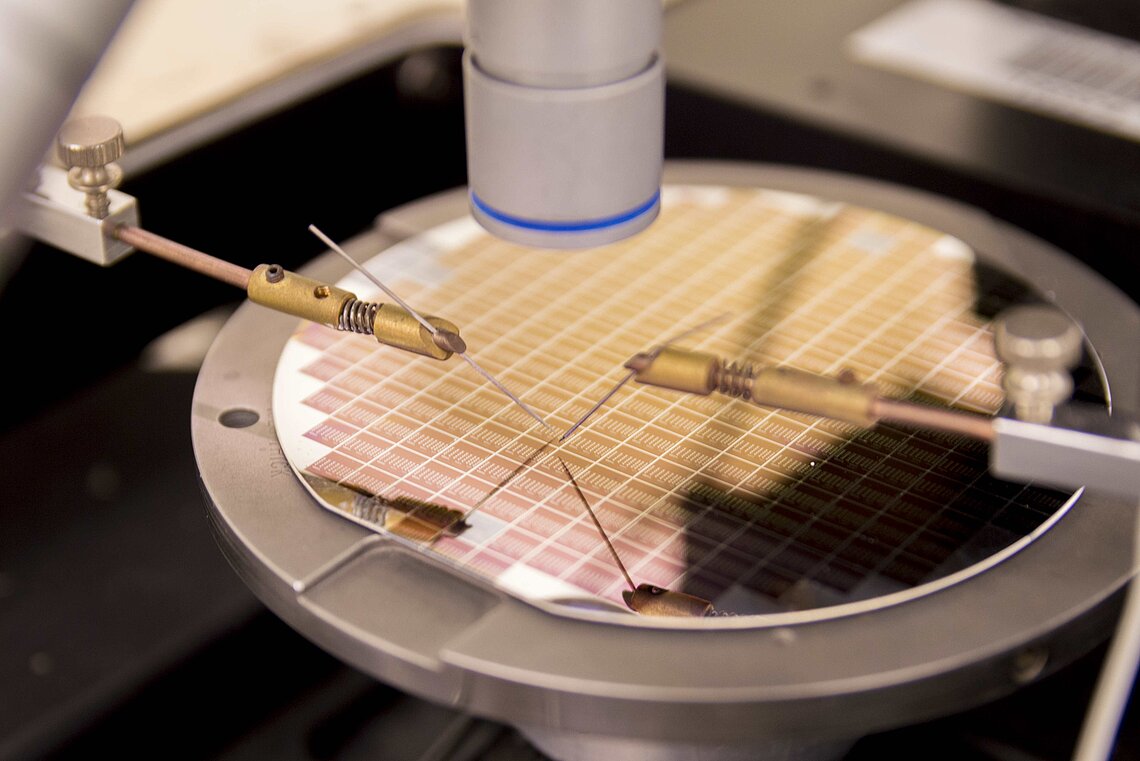

| Semiconductor Industry | High-temperature semiconductor substrates and wafers | Enhanced thermal stability and electrical performance leading to higher yield and device reliability | Purity levels, crystallographic quality, supplier certifications, and compliance with international standards |

| Aerospace & Defense | High-performance components for turbine engines and heat shields | Superior thermal shock resistance and oxidation stability, reducing maintenance costs and improving safety | Material traceability, batch consistency, and adherence to aerospace quality standards (e.g., AS9100) |

| Automotive Manufacturing | Engine components and exhaust systems exposed to extreme conditions | Increased durability and efficiency under high thermal and mechanical stress | Proven supplier track record, material certifications, and logistics capabilities for timely delivery |

| Chemical Processing | Corrosion-resistant reactor linings and heat exchangers | Prolonged equipment lifespan and reduced downtime due to chemical inertness | Chemical compatibility data, availability of custom shapes/sizes, and regional supplier support |

| Electronics & Optoelectronics | Substrates for LEDs, sensors, and high-frequency devices | Improved signal integrity and device longevity in harsh environments | Supplier expertise in precision manufacturing and quality control, along with export compliance documentation |

Semiconductor Industry

In semiconductor manufacturing, sisic is prized for its exceptional thermal conductivity and electrical insulation properties. It serves as a substrate material for high-temperature semiconductor wafers, enabling devices to operate reliably under extreme thermal conditions. For B2B buyers in regions like South America and Europe, sourcing high-purity sisic with consistent crystallographic orientation is critical to ensure wafer uniformity and yield. Buyers should prioritize suppliers with stringent quality certifications and the capability to provide detailed material analysis reports.

Aerospace & Defense

Sisic’s outstanding resistance to thermal shock and oxidation makes it ideal for aerospace applications such as turbine engine components and heat shields. These components endure extreme temperatures and mechanical stresses, demanding materials that maintain integrity over long periods. For international buyers, especially from the Middle East and Africa, ensuring material traceability and compliance with aerospace standards such as AS9100 is essential. Reliable supply chains and quality assurance processes are key to mitigating risk in this high-stakes sector.

Automotive Manufacturing

In the automotive sector, sisic is used for parts like engine components and exhaust systems that operate under high thermal and mechanical stress. Its durability enhances vehicle performance and longevity, reducing warranty claims and maintenance costs. Buyers from emerging markets such as Indonesia and Argentina must consider suppliers with a proven track record and the ability to meet automotive industry certifications. Logistics capabilities to support just-in-time manufacturing processes are also critical.

Chemical Processing

Sisic’s chemical inertness and corrosion resistance make it a preferred material for reactor linings, heat exchangers, and other equipment exposed to aggressive chemicals. This results in longer equipment life and less downtime. International buyers should evaluate suppliers based on their ability to provide customized shapes and sizes to fit specific reactor designs, as well as comprehensive chemical compatibility data. Regional support and after-sales service are important for maintaining continuous operations.

Electronics & Optoelectronics

Sisic substrates are widely used in LEDs, sensors, and high-frequency electronic devices due to their excellent electrical insulation and thermal management capabilities. These properties enhance device performance and reliability, especially in harsh environmental conditions. For B2B buyers in Europe and South America, sourcing from suppliers with expertise in precision manufacturing and stringent quality control ensures product consistency. Compliance with export regulations and availability of technical support are also vital considerations.

Related Video: Uses of Radioisotope in Industry | Nuclear Energy | Science

Siliconized silicon carbide (SiSiC) is a composite ceramic material widely used in industrial applications requiring exceptional hardness, thermal stability, and corrosion resistance. For international B2B buyers, especially in regions such as Africa, South America, the Middle East, and Europe, understanding the nuances of SiSiC material variants is crucial for optimal procurement and application performance.

Key Properties:

RB-SiSiC is produced by infiltrating porous silicon carbide with molten silicon, resulting in a dense, hard material with excellent thermal conductivity and high-temperature resistance (up to ~1400°C). It offers good corrosion resistance against oxidizing environments and moderate chemical attack.

Pros & Cons:

- Pros: Lower manufacturing cost compared to other SiSiC types, good machinability, and excellent wear resistance.

- Cons: Slightly lower mechanical strength and fracture toughness than sintered SiSiC; residual free silicon can reduce corrosion resistance in highly acidic or alkaline environments.

Impact on Application:

Ideal for components exposed to moderate thermal and chemical stresses such as mechanical seals, pump components, and kiln furniture. Its free silicon content makes it less suitable for highly corrosive media like strong acids or alkalis.

International Buyer Considerations:

Buyers in regions with stringent standards (e.g., Europe’s EN or DIN standards) should verify RB-SiSiC compliance, especially regarding silicon content and porosity. In markets like South America and Africa, cost-effectiveness often drives preference for RB-SiSiC, but buyers must assess local chemical exposure to ensure longevity.

Key Properties:

SSiC is made by sintering silicon carbide powders at high temperatures without free silicon, resulting in a very dense, strong, and hard ceramic with excellent thermal shock resistance and chemical inertness. It withstands temperatures up to 1600°C and aggressive chemical environments.

Pros & Cons:

- Pros: Superior mechanical strength, high corrosion resistance including against strong acids and alkalis, and excellent wear resistance.

- Cons: Higher manufacturing cost and more complex machining process compared to RB-SiSiC.

Impact on Application:

Best suited for harsh environments such as chemical processing, semiconductor manufacturing, and high-performance mechanical seals. Its chemical inertness makes it ideal for handling aggressive media.

International Buyer Considerations:

European and Middle Eastern buyers often require compliance with ASTM C1462 or ISO standards for sintered SiC. In Africa and South America, the higher cost may limit use to critical applications. Importers should verify certification and traceability to avoid substandard products.

Key Properties:

CVD-SiSiC is produced by depositing silicon carbide layers from gaseous precursors onto substrates, creating a nearly pure, dense, and uniform coating with exceptional hardness and chemical resistance. It can operate at temperatures above 1700°C and resists oxidation and corrosion.

Pros & Cons:

- Pros: Outstanding surface finish, extreme chemical and thermal resistance, and low porosity.

- Cons: Very high cost and limited to coating applications rather than bulk material use; complex manufacturing requiring specialized equipment.

Impact on Application:

Used primarily for protective coatings on mechanical parts, semiconductor wafers, and high-precision components where surface integrity is critical. Not typically used for structural parts due to cost and thickness limitations.

International Buyer Considerations:

CVD-SiSiC is favored in high-tech industries in Europe and the Middle East, where performance justifies cost. Buyers in emerging markets like Africa and South America should carefully evaluate ROI and consider local technical support for integration.

Key Properties:

PL-SiSiC is sintered without external pressure, resulting in a material with good density and mechanical properties, though slightly inferior to hot-pressed SiSiC. It offers good thermal stability and corrosion resistance up to 1500°C.

Pros & Cons:

- Pros: Lower cost than hot-pressed variants, good chemical resistance, and suitable for complex shapes.

- Cons: Slightly lower strength and fracture toughness; may have minor porosity affecting performance in highly corrosive environments.

Impact on Application:

Suitable for industrial components like valve parts, heat exchangers, and wear-resistant linings where moderate mechanical strength is adequate.

International Buyer Considerations:

Buyers in regions with cost-sensitive markets (e.g., parts of South America and Africa) may prefer PL-SiSiC for balance between performance and price. Compliance with JIS or ASTM standards should be confirmed, especially for export to Europe or the Middle East.

| Material | Typical Use Case for sisic | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Reaction-Bonded SiSiC (RB) | Mechanical seals, kiln furniture, pump parts | Cost-effective, good wear resistance | Lower corrosion resistance due to free silicon | Low |

| Sintered SiSiC (SSiC) | Chemical processing, semiconductor components | High strength and chemical inertness | High cost, complex machining | High |

| Chemical Vapor Deposited SiSiC (CVD) | Protective coatings, high-precision parts | Exceptional surface quality and chemical resistance | Very expensive, limited to coatings | High |

| Pressureless Sintered SiSiC (PL) | Valves, heat exchangers, wear linings | Balanced cost and performance, good shape complexity | Slightly lower strength and porosity concerns | Medium |

This guide equips international B2B buyers with critical insights into selecting the appropriate SiSiC material variant based on application demands, regional standards, and cost considerations, ensuring optimized procurement decisions across diverse industrial sectors.

Illustrative Image (Source: Google Search)

Silicon Silicon Carbide (SiSiC) is a high-performance ceramic material prized for its exceptional hardness, thermal conductivity, and chemical inertness. For international B2B buyers, especially those from regions such as Africa, South America, the Middle East, and Europe, understanding the manufacturing stages and quality assurance protocols of SiSiC is critical to sourcing reliable, high-quality components.

The manufacturing journey begins with raw material preparation. High-purity silicon carbide powders and silicon metal are the primary raw materials. These powders undergo:

For buyers, sourcing suppliers that use certified raw materials with traceability documentation reduces the risk of material inconsistencies.

Forming SiSiC components involves shaping the prepared powders into desired geometries before sintering. Common forming methods include:

Each method impacts the microstructure and mechanical properties, so buyers should clarify forming techniques with suppliers, ensuring alignment with intended applications.

This stage is the hallmark of SiSiC production:

The infiltration process requires precise temperature control and timing to avoid defects like residual silicon pools or incomplete infiltration.

Post-sintering, components may undergo:

Buyers should verify the supplier’s capability to deliver finished parts matching required specifications, as machining SiSiC demands specialized equipment.

Robust quality control is indispensable in the SiSiC supply chain. International B2B buyers must understand typical QC protocols, certifications, and inspection methods to mitigate risks and ensure compliance.

Buyers should request evidence of these certifications during supplier evaluation and periodically thereafter.

Quality control in SiSiC manufacturing typically follows these stages:

Each checkpoint reduces defects and ensures that components meet stringent performance requirements.

Buyers should request detailed QC test reports and, where possible, participate in witnessing tests or audits.

Ensuring supplier compliance with QC standards is crucial, especially for international buyers who may face logistical and regulatory complexities.

Buyers from Africa, South America, the Middle East, and Europe should consider third-party audit firms experienced in cross-border quality verification to overcome language and cultural barriers.

Demanding complete documentation protects buyers from receiving substandard products.

Independent inspection agencies can provide unbiased verification of product quality before shipment. This is particularly valuable for buyers in regions like Argentina or Indonesia, where local testing facilities may be limited or regulatory requirements demand external certification.

Understanding supplier practices and expectations can facilitate smoother negotiations and QC enforcement, especially when dealing with diverse regions.

For international B2B buyers sourcing SiSiC components, a deep understanding of manufacturing processes and quality assurance practices is vital. From raw material preparation through advanced sintering techniques to rigorous multi-level quality controls, each step influences the final product’s reliability and performance. By insisting on recognized certifications, demanding transparent QC documentation, conducting audits, and leveraging third-party inspections, buyers across Africa, South America, the Middle East, and Europe can confidently integrate SiSiC products into their supply chains, ensuring superior quality and compliance with regional standards.

Understanding the cost structure and pricing dynamics of sisic sourcing is crucial for international B2B buyers aiming to optimize procurement and achieve competitive advantage. This analysis breaks down key cost components, price influencers, and practical buyer strategies tailored to diverse markets such as Africa, South America, the Middle East, and Europe.

Materials

Raw materials constitute the foundational cost, influenced heavily by the grade and source of silicon carbide (SiSiC). Premium materials meeting stringent industry standards increase costs but deliver superior performance and durability.

Labor

Skilled labor costs vary by region, impacting manufacturing expenses. Facilities with advanced automation may lower labor costs but require significant upfront investment.

Manufacturing Overhead

This includes utilities, equipment depreciation, and factory maintenance. Overhead allocation depends on production scale and efficiency, affecting unit costs.

Tooling and Setup

Custom tooling for specialized SiSiC components can be a substantial upfront expense, especially for low-volume or customized orders. Amortization of tooling costs over larger volumes reduces per-unit costs.

Quality Control (QC)

Rigorous QC processes ensure compliance with certifications such as ISO, ASTM, or customer-specific standards. Enhanced QC adds to cost but minimizes defects and returns.

Logistics and Freight

International shipping, customs duties, and handling fees vary by destination. For buyers in Africa, South America, the Middle East, and Europe, these costs are influenced by port accessibility, trade agreements, and Incoterms.

Supplier Margin

Supplier profit margins depend on market competition, product exclusivity, and service levels. Transparent negotiation can optimize this component.

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes typically benefit from economies of scale, lowering unit prices. Buyers from emerging markets should assess MOQ thresholds carefully to balance inventory costs and price benefits.

Specifications and Customization

Tailored SiSiC products with unique dimensions, tolerances, or composite features command premium pricing due to increased complexity.

Material Quality and Certifications

Higher-grade SiSiC with certifications ensuring performance in demanding applications (e.g., automotive, aerospace) will cost more but reduce risk.

Supplier Reputation and Location

Established suppliers with proven track records may charge a premium but offer reliability and after-sales support. Regional proximity can reduce logistics costs and lead times.

Incoterms Selection

Terms like FOB, CIF, or DDP significantly affect the final landed cost. Buyers should understand responsibilities under each term to avoid unexpected expenses.

Negotiate Beyond Price

Engage suppliers on payment terms, lead times, and bundled services such as technical support or quality guarantees to maximize value.

Calculate Total Cost of Ownership (TCO)

Consider not just the unit price but also shipping, import duties, inventory carrying costs, and potential downtime due to quality issues. This holistic view is especially critical for buyers in regions with complex logistics.

Leverage Volume Consolidation

Pooling orders with other divisions or partners can help meet MOQ requirements and unlock better pricing tiers.

Validate Supplier Certifications

For markets with strict regulatory environments (e.g., Europe), insist on documented quality certifications to avoid compliance risks.

Plan for Currency Fluctuations and Payment Risks

Use forward contracts or letters of credit to mitigate foreign exchange volatility, which can impact final costs.

Understand Regional Logistics Nuances

For buyers in Africa and South America, port congestion and inland transportation challenges may add hidden costs. Collaborate with freight forwarders experienced in these regions.

Pricing for sisic sourcing varies significantly based on order specifics, supplier terms, and market conditions. The figures discussed are indicative and should be validated through direct supplier engagement and up-to-date market research to ensure accuracy.

By dissecting the cost drivers and pricing influencers while adopting strategic procurement practices, international B2B buyers can enhance cost-efficiency and secure high-quality sisic products tailored to their operational needs.

1. Material Grade

SiSiC (Silicon-infiltrated Silicon Carbide) comes in various grades defined by purity, density, and mechanical strength. Higher-grade SiSiC offers superior thermal conductivity and mechanical durability, essential for demanding industrial applications such as semiconductor manufacturing and automotive components. B2B buyers should specify the grade to ensure compatibility with their operational requirements and longevity expectations.

2. Density and Porosity

This property measures the compactness of the SiSiC material. Low porosity and high density translate to better mechanical strength and chemical resistance. For international buyers, especially in sectors like chemical processing or aerospace, understanding density ensures the product withstands harsh environments and reduces maintenance costs.

3. Thermal Conductivity

SiSiC is valued for its excellent heat transfer capabilities. Thermal conductivity is critical in applications requiring rapid heat dissipation or thermal shock resistance, such as heat exchangers and engine parts. Buyers should assess this property to optimize performance and energy efficiency in their systems.

4. Dimensional Tolerance

Tolerance defines the allowable deviation in the physical dimensions of SiSiC components. Tight tolerances are crucial for precision parts in high-tech industries to ensure seamless assembly and function. Buyers must clarify tolerance levels to avoid costly reworks and ensure interoperability with existing equipment.

5. Mechanical Strength (Flexural and Compressive)

SiSiC exhibits high flexural and compressive strength, making it suitable for structural components under high stress. Understanding these strength metrics helps buyers evaluate the material’s suitability for load-bearing applications and ensures safety compliance.

6. Chemical Resistance

SiSiC resists corrosion from acids, alkalis, and oxidizing agents. This property is vital for buyers in chemical processing, where material degradation can lead to failures. Specifying chemical resistance requirements protects investments and enhances operational reliability.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or components used in another company’s end products. For B2B buyers, working with OEMs ensures high-quality, application-specific SiSiC components tailored to original design specifications, reducing compatibility risks.

MOQ (Minimum Order Quantity)

This is the smallest quantity a supplier is willing to sell. Understanding MOQ helps buyers from emerging markets like Africa or South America plan inventory and cash flow efficiently. Negotiating MOQ terms can lead to cost savings and optimized supply chain management.

RFQ (Request for Quotation)

An RFQ is a formal document sent to suppliers to obtain pricing, delivery, and terms for SiSiC products. Clear and detailed RFQs speed up procurement, minimize misunderstandings, and facilitate competitive bidding, especially important for international buyers managing multiple suppliers.

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities between buyers and sellers regarding shipping, insurance, and customs. Familiarity with Incoterms like FOB, CIF, or DDP is critical for buyers to control costs, risks, and logistics efficiently when importing SiSiC.

Lead Time

The period between placing an order and receiving the product. Lead time impacts production schedules and project timelines. Buyers should clarify lead times upfront to align procurement with operational demands, avoiding delays especially in time-sensitive industries.

Certification and Compliance

Includes industry standards and certifications such as ISO, RoHS, or REACH that SiSiC products must meet. Buyers should verify these certifications to ensure legal compliance, quality assurance, and market acceptance across regions like Europe and the Middle East.

Understanding these technical properties and trade terms enables international B2B buyers to make informed decisions, ensuring the SiSiC products they procure meet performance expectations and align with their commercial strategies. Clear communication on specifications and contract terms can significantly enhance supplier relationships and reduce procurement risks.

The sisic sector is experiencing significant transformation driven by globalization, technological innovation, and shifting buyer expectations. For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, understanding these dynamics is crucial to securing competitive advantage and long-term partnerships.

Global Drivers:

- Increasing demand for advanced, customized sisic products in emerging markets such as Argentina and Indonesia is fueling growth. These regions are investing in infrastructure and industrial upgrades, creating new sourcing opportunities.

- The rise of digital procurement platforms and AI-driven supply chain analytics is enhancing transparency and efficiency, enabling buyers to make data-backed decisions.

- Geopolitical factors and trade policies continue to influence sourcing routes, with buyers diversifying suppliers to mitigate risks related to tariffs and regional instabilities.

Current & Emerging Sourcing Trends:

- Localization and Nearshoring: Buyers are prioritizing suppliers closer to their operational hubs to reduce lead times and logistics costs, a trend particularly notable in Europe and the Middle East.

- Integrated Supply Chains: Companies are seeking integrated partnerships that offer end-to-end solutions, combining manufacturing, quality control, and logistics under one umbrella.

- Technology Adoption: The incorporation of Industry 4.0 technologies—such as IoT-enabled equipment and blockchain for traceability—is redefining supplier capabilities and quality assurance.

- Flexible Contracting: With market volatility, flexible sourcing agreements that allow volume adjustments and rapid response to demand fluctuations are increasingly preferred.

Market Dynamics:

- Buyers from Africa and South America often face challenges related to infrastructure and regulatory compliance but benefit from growing regional trade agreements that facilitate cross-border commerce.

- Europe’s mature markets emphasize compliance, quality certifications, and sustainability, driving suppliers to meet stringent standards.

- The Middle East’s strategic location offers logistical advantages, making it a hub for distribution and re-export, while also pushing suppliers to innovate in energy efficiency and product customization.

Sustainability is no longer optional in the sisic sector; it is a strategic imperative for international buyers committed to responsible sourcing and long-term value creation.

Environmental Impact:

- The sisic industry’s environmental footprint—ranging from raw material extraction to manufacturing emissions—necessitates adopting cleaner technologies and waste reduction practices.

- Buyers increasingly demand suppliers to demonstrate measurable improvements in energy consumption, water use, and carbon emissions.

Ethical Supply Chains:

- Transparency in labor practices and fair trade policies is critical. Buyers from regions with robust regulatory environments (e.g., Europe) often require adherence to international labor standards and social compliance audits.

- Ethical sourcing mitigates reputational risks and aligns with corporate social responsibility (CSR) goals, a priority for B2B buyers aiming to satisfy ESG (Environmental, Social, and Governance) criteria.

Green Certifications and Materials:

- Certifications such as ISO 14001 (Environmental Management), FSC (Forest Stewardship Council), and LEED (Leadership in Energy and Environmental Design) are increasingly demanded in procurement contracts.

- The shift toward bio-based, recycled, and low-impact sisic materials supports circular economy initiatives and appeals to buyers targeting sustainability benchmarks.

- Collaborative initiatives between suppliers and buyers to innovate sustainable product designs and packaging are gaining traction, driving market differentiation.

The sisic sector has evolved from traditional manufacturing practices to a sophisticated, technology-driven industry shaped by globalization and innovation. Historically dominated by localized production, the sector expanded rapidly in the late 20th century due to advances in automation and global trade liberalization.

For B2B buyers, this evolution means access to a broader supplier base with enhanced capabilities but also requires deeper due diligence to navigate complex supply networks. Understanding the sector’s history helps buyers appreciate the current emphasis on quality standards, digital integration, and sustainability practices that define modern sisic sourcing strategies.

By leveraging insights into market trends, sustainability imperatives, and sector evolution, international B2B buyers from diverse regions can optimize their sourcing strategies in the sisic sector to achieve resilience, compliance, and competitive advantage.

How can I effectively vet sisic suppliers to ensure reliability and quality?

To vet sisic suppliers, start by verifying their business licenses, certifications, and export history. Request detailed product specifications, quality assurance processes, and client references, particularly from your region or industry. Use third-party inspection services or request samples for quality checks. Engage in direct communication to assess responsiveness and transparency. Checking trade platforms and global B2B directories for verified supplier badges can also reduce risks. Prioritize suppliers with demonstrated experience serving markets similar to Africa, South America, the Middle East, or Europe, ensuring their compliance with regional standards.

Is customization available for sisic products, and how should I approach it?

Many sisic suppliers offer customization to meet specific technical or dimensional requirements. Clearly define your specifications early, including size, purity, and packaging needs. Discuss customization capabilities upfront to understand potential costs, lead times, and minimum order quantities (MOQ). Request prototypes or samples before bulk production to verify specifications. Ensure that custom orders comply with your country's import regulations and industry standards. Effective communication and documented agreements on customization parameters are critical to avoid misunderstandings and ensure a smooth supply chain.

What are typical minimum order quantities (MOQ), lead times, and payment terms for sisic purchases?

MOQs for sisic vary by supplier but often range from small batch orders for testing (e.g., 100 kg) to larger volumes for industrial use. Lead times typically span 2-6 weeks depending on order size, customization, and shipping logistics. Payment terms generally include 30-50% upfront deposit with the balance paid upon shipment or delivery. For new buyers, suppliers may request Letters of Credit (LC) or escrow services for added security. Negotiating flexible terms is possible, especially when establishing long-term partnerships or larger orders.

What quality assurance measures and certifications should I expect from sisic suppliers?

Reputable sisic suppliers maintain strict quality control aligned with international standards such as ISO 9001 for quality management and may hold industry-specific certifications depending on the application (e.g., RoHS, REACH compliance). Request detailed Certificates of Analysis (CoA) and Material Safety Data Sheets (MSDS) to verify product composition and safety. Regular third-party audits and batch testing reports enhance trust. Ensure suppliers can provide traceability documentation and comply with your local regulatory requirements to guarantee product safety and performance.

How do I navigate logistics and shipping challenges for sisic imports to regions like Africa, South America, or the Middle East?

Logistics for sisic imports require careful planning due to potential customs delays, varying import duties, and transportation infrastructure differences. Partner with freight forwarders experienced in your target region who can advise on optimal shipping modes—sea freight for cost-efficiency or air freight for urgent deliveries. Ensure all documentation, including commercial invoices, packing lists, and certificates of origin, are accurate and comply with local customs regulations. Consider insurance to protect against transit damage or loss, and track shipments proactively to mitigate delays.

What steps should I take if there is a dispute with a sisic supplier regarding product quality or delivery?

First, document all communications, contracts, and evidence such as photos or inspection reports. Raise the issue promptly with the supplier, seeking an amicable resolution such as replacement, refund, or discount. If unresolved, escalate through formal dispute resolution mechanisms outlined in your contract, such as mediation or arbitration. For cross-border disputes, understanding applicable international trade laws (e.g., Incoterms) and engaging legal counsel familiar with your supplier’s jurisdiction is crucial. Using escrow services or payment through trusted platforms can reduce financial risks.

Are there specific regulatory or compliance considerations when importing sisic into my country?

Yes, importing sisic often involves compliance with chemical safety regulations, import permits, and environmental standards. Check your country’s customs regulations for restricted substances and required documentation. Some regions require product registration or testing before market entry. Additionally, ensure compliance with international agreements like the Basel Convention if shipping hazardous waste byproducts. Working with customs brokers and legal advisors familiar with your local regulatory landscape can streamline clearance and avoid costly penalties or shipment delays.

How can I build a sustainable long-term relationship with sisic suppliers across different regions?

Building sustainable partnerships involves transparent communication, timely payments, and mutual understanding of market needs. Invest time in learning your supplier’s production capabilities and constraints, and share your demand forecasts to enable better planning. Regularly review contract terms and quality metrics together to foster continuous improvement. Cultural sensitivity and respect for local business practices in Africa, South America, the Middle East, and Europe will enhance trust. Consider joint initiatives like co-development or volume-based incentives to strengthen collaboration and ensure supply chain resilience.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The strategic sourcing of sisic presents a compelling opportunity for international B2B buyers aiming to optimize supply chains and enhance competitive advantage. Key takeaways include the importance of rigorous supplier evaluation, leveraging regional insights, and fostering collaborative partnerships to ensure quality, cost-effectiveness, and reliability. For buyers in Africa, South America, the Middle East, and Europe, understanding local market dynamics and regulatory environments is essential to navigate complexities and unlock value.

Illustrative Image (Source: Google Search)

Strategic sourcing empowers businesses to:

Looking ahead, the evolving global trade landscape demands agility and proactive sourcing strategies. Buyers are encouraged to invest in digital tools, deepen market intelligence, and cultivate long-term supplier relationships. By doing so, companies in emerging and established markets alike can harness sisic’s potential to drive growth and resilience.

Take action now: Embrace strategic sourcing as a cornerstone of your procurement strategy to capitalize on sisic’s benefits, ensuring your business stays ahead in a competitive and interconnected global marketplace.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina