Guide to Substrate Electronics

In today’s interconnected electronics landscape, substrate electronics serve as the foundational backbone for advanced devices ranging from consumer gadgets to critical industrial systems. Their significance extends beyond simple connectivity, directly impacting device performance, reliability, and miniaturization—key factors in a competitive global market. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, understanding the nuances of substrate electronics is essential to making informed sourcing decisions that optimize quality, cost, and supply chain resilience.

This comprehensive guide offers an in-depth exploration of the substrate electronics ecosystem, covering critical topics such as types of substrates, material options, manufacturing processes, quality control standards, and leading suppliers worldwide. It also provides actionable insights into cost considerations, market trends, and common challenges faced by buyers across diverse regions. Whether sourcing from established hubs like Germany or emerging markets in Nigeria or South America, this guide equips you with the knowledge to navigate complex global markets confidently.

Illustrative Image (Source: Google Search)

By leveraging this resource, international B2B buyers can identify reliable suppliers, assess quality benchmarks, and optimize procurement strategies tailored to regional and industry-specific needs. In an era where supply chain agility and technological excellence are paramount, mastering the fundamentals of substrate electronics ensures your business remains competitive and future-ready in the global electronics arena.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Rigid Substrates | Made from stiff materials like glass or ceramic; non-flexible | High-density PCBs, aerospace, automotive electronics | Pros: Excellent thermal stability, high precision manufacturing. Cons: Less adaptable to complex geometries, potentially higher costs. |

| Flexible Substrates | Composed of pliable materials such as polyimide or polyester | Wearable tech, flexible displays, IoT devices | Pros: Enables compact, lightweight designs, ideal for dynamic applications. Cons: Generally higher material costs, potentially lower thermal performance. |

| Hybrid Substrates | Combine rigid and flexible layers for tailored functionality | Advanced consumer electronics, medical devices, aerospace | Pros: Customizable for specific needs, balancing rigidity and flexibility. Cons: More complex manufacturing process, potentially longer lead times. |

| Embossed or Patterned Substrates | Feature micro-patterns or surface modifications for specific functions | Sensors, RF applications, microfluidics | Pros: Enhanced performance for specialized applications, improved signal integrity. Cons: Higher fabrication costs, requires specialized equipment. |

| High-Temperature Substrates | Designed to withstand elevated operating temperatures | Power electronics, industrial controls, automotive | Pros: Durable under extreme conditions, suitable for high-power applications. Cons: Typically more expensive, limited flexibility in design. |

Rigid Substrates are the most traditional, offering exceptional stability and precision, making them ideal for high-performance electronic assemblies. They are suitable for applications requiring exact tolerances, such as aerospace and automotive electronics. B2B buyers should consider supplier certifications, material quality, and compatibility with existing manufacturing processes, especially when sourcing from regions with varying standards like Nigeria or Eastern Europe.

Flexible Substrates provide unique advantages in applications demanding lightweight and conformal designs, such as wearable tech and IoT devices. They are well-suited for products that need to bend or flex during operation. Buyers must evaluate supplier capabilities for large-scale roll-to-roll manufacturing, material consistency, and cost implications, especially for bulk orders from emerging markets where cost efficiency is critical.

Hybrid Substrates offer a customizable approach, combining the strengths of rigid and flexible layers. They are particularly relevant for complex, multi-functional devices in medical or aerospace sectors. B2B purchasers should prioritize suppliers with advanced R&D capabilities and proven track records in producing tailored substrates to ensure quality and timely delivery, which is vital for project planning in regions like South America or the Middle East.

Embossed or Patterned Substrates are specialized for high-performance applications such as RF and sensor technologies. These substrates often require advanced fabrication techniques and are thus suited for high-end or niche markets. Buyers should verify the technological expertise of suppliers and consider lead times and costs associated with bespoke patterning, especially when sourcing from regions with limited advanced manufacturing infrastructure.

High-Temperature Substrates are essential for power electronics and industrial applications where thermal endurance is critical. They are typically more expensive but necessary for durability and reliability in harsh environments. B2B buyers should assess supplier certifications for industrial standards, availability of technical support, and compatibility with existing systems, especially when importing from regions with varying manufacturing standards like Europe or Asia.

| Industry/Sector | Specific Application of substrate electronics | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Advanced driver-assistance systems (ADAS) and electric vehicle (EV) power modules | Enhances safety, efficiency, and reliability of vehicles; supports EV market growth | High thermal management performance, automotive-grade standards, supply chain resilience |

| Renewable Energy | Power conversion and control systems in solar inverters and wind turbines | Improves efficiency, durability, and miniaturization of renewable energy systems | Corrosion resistance, high voltage handling, long-term stability |

| Healthcare & Medical Devices | Compact imaging equipment and wearable health monitors | Enables miniaturization, improves device performance, and ensures reliability | Biocompatibility, precision fabrication, compliance with medical standards |

| Industrial Automation | Robotics, sensors, and control units in manufacturing plants | Increases operational precision, reduces downtime, and supports Industry 4.0 initiatives | Robustness in harsh environments, scalability, supply chain flexibility |

| Telecommunications | High-frequency RF modules and data processing components for 5G infrastructure | Facilitates high-speed connectivity, reduces latency, and enhances network capacity | RF performance, electromagnetic shielding, compatibility with telecom standards |

Substrate electronics are integral to modern automotive systems, especially in ADAS and EV power modules. They enable high-density integration of sensors, microcontrollers, and power components, which are essential for vehicle safety and efficiency. For international B2B buyers from regions like Nigeria or Germany, sourcing substrates that meet automotive-grade standards, including thermal management and vibration resistance, is critical. Reliable supply chains and compliance with automotive certifications ensure seamless integration into complex vehicle architectures, supporting the rapid expansion of electric and autonomous vehicles globally.

In renewable energy sectors, substrate electronics are used within solar inverters, wind turbine controllers, and energy storage systems. These substrates facilitate the miniaturization of power electronics, improving system efficiency and longevity under harsh environmental conditions. For buyers in South America or the Middle East, where solar and wind projects are burgeoning, sourcing substrates with high corrosion resistance, high-voltage handling, and proven long-term stability is vital. Ensuring quality and durability reduces maintenance costs and enhances overall project ROI, especially in remote or extreme climates.

Medical devices such as imaging equipment, portable diagnostics, and wearable health monitors rely heavily on substrate electronics for compactness and reliability. These substrates support high-precision circuits, biocompatibility, and sterilization requirements. For international buyers from Europe or Africa, sourcing substrates that comply with stringent medical standards and offer consistent performance is essential. This ensures device reliability, patient safety, and regulatory compliance, which are critical for market acceptance and clinical efficacy.

Substrate electronics are foundational in robotics, sensors, and control systems used in manufacturing. They enable the integration of complex control algorithms within compact, robust modules suitable for harsh industrial environments. For B2B buyers in regions like Europe or South America, sourcing substrates that offer durability, scalability, and supply chain flexibility supports Industry 4.0 initiatives. These substrates help reduce operational downtime and improve automation precision, leading to increased productivity and competitiveness.

In the fast-evolving 5G landscape, substrate electronics are used in RF modules, data processing units, and high-frequency components. They enable high-speed data transfer, low latency, and compact form factors necessary for modern telecom infrastructure. For international buyers from the Middle East or Europe, sourcing substrates with excellent RF performance, electromagnetic shielding, and compliance with telecom standards ensures reliable network deployment. This is crucial for expanding connectivity and supporting digital transformation initiatives across diverse regions.

1. FR-4 (Epoxy Glass Composite)

FR-4 is the most widely used substrate material in electronic manufacturing, especially for printed circuit boards (PCBs). It offers excellent electrical insulation, mechanical strength, and ease of fabrication. Its high glass transition temperature (typically around 130°C to 140°C) ensures stability under moderate thermal stress, making it suitable for a broad range of applications. However, FR-4's moisture absorption can impact performance in humid environments, which is a critical consideration for regions with high humidity such as Nigeria or parts of South America.

Pros & Cons:

Pros: Cost-effective, readily available globally, compatible with standard manufacturing processes, good mechanical and electrical properties.

Cons:* Limited high-temperature performance (not suitable for extreme thermal conditions), moisture absorption issues, and relatively lower chemical resistance.

Impact on Application:*

Ideal for general-purpose electronics, consumer devices, and industrial applications where moderate environmental conditions prevail. Not recommended for highly corrosive or extreme temperature environments.

International Buyer Considerations:*

Compliance with standards such as IEC, UL, and RoHS is common. Buyers from Europe and Germany often prefer environmentally friendly formulations, while African and Middle Eastern markets may prioritize cost and availability. Ensuring supplier adherence to regional standards and certifications can mitigate compliance risks.

2. Polyimide Films (e.g., Kapton)

Polyimide substrates are renowned for their exceptional thermal stability, chemical resistance, and flexibility. They can withstand temperatures up to 400°C or higher, making them suitable for high-performance applications such as aerospace, military, and advanced industrial electronics. Their flexibility also enables use in conformal or wearable electronics.

Pros & Cons:

Pros: High temperature tolerance, excellent chemical and radiation resistance, flexible and lightweight.

Cons:* Higher material and manufacturing costs, more complex fabrication processes, limited availability in some regions.

Impact on Application:*

Best suited for high-reliability, high-temperature environments, or flexible electronics. They perform well in corrosive media and extreme conditions, making them ideal for specialized markets.

International Buyer Considerations:*

Compliance with international standards like ASTM D4565 and REACH is vital. Buyers from Europe and Germany often favor polyimide's environmental certifications, while buyers from Africa and the Middle East should consider supply chain reliability due to higher costs and limited local manufacturing.

3. Ceramic-Based Substrates (e.g., Aluminum Nitride, Alumina)

Ceramic substrates are characterized by their outstanding thermal conductivity, electrical insulation, and mechanical robustness. Alumina (Al₂O₃) is the most common, offering good thermal stability and electrical properties at a relatively moderate cost, whereas aluminum nitride (AlN) provides superior thermal management but at a higher price point.

Pros & Cons:

Pros: Excellent heat dissipation, high dielectric strength, corrosion resistance, and durability.

Cons:* Fragility during manufacturing, higher cost especially for AlN, and more complex processing requirements.

Impact on Application:*

Ideal for high-power, high-frequency applications such as RF modules, power electronics, and advanced computing hardware. Their robustness makes them suitable for harsh environments, including industrial and outdoor settings.

International Buyer Considerations:*

Standards like ASTM C1167 and IEC 60664 are relevant. Buyers in Europe and Germany often prefer high-quality, certified ceramic substrates, while African and Middle Eastern markets may focus on cost-effective options with reliable supply chains. Importers should verify supplier certifications for quality assurance.

4. Flexible Polyester Films (e.g., PET, PEN)

Polyester films are a cost-effective choice for flexible substrate electronics, especially in applications requiring lightweight and conformal designs. They offer moderate thermal stability (up to about 150°C) and good electrical insulation properties.

Pros & Cons:

Pros: Low cost, ease of processing, flexibility, and good electrical insulation.

Cons:* Limited thermal and chemical resistance, lower mechanical strength compared to ceramics or polyimides.

Impact on Application:*

Suitable for low-power, flexible, or wearable electronics, as well as in consumer devices where cost and flexibility are prioritized over high-temperature performance.

International Buyer Considerations:*

Standards compliance, such as UL 94 for flammability and IEC standards for electrical safety, is crucial. Buyers from Europe and Germany often prefer environmentally certified materials, while African and Middle Eastern buyers should consider local availability and supply chain stability.

| Material | Typical Use Case for substrate electronics | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| FR-4 (Epoxy Glass Composite) | General PCB applications, consumer electronics, industrial | Cost-effective, widely available, easy to manufacture | Limited high-temp performance, moisture absorption | Low |

| Polyimide Films (Kapton) | High-temp, flexible, aerospace, military applications | High thermal stability, chemical resistance, flexibility | Higher cost, complex fabrication | High |

| Ceramic-Based (Alumina, AlN) | RF modules, power electronics, high-power applications | Excellent heat dissipation, durability, electrical insulation | Fragility during manufacturing, higher cost | Med-High |

| Flexible Polyester Films (PET, PEN) | Wearables, low-power flexible electronics | Cost-effective, flexible, lightweight | Limited thermal and chemical resistance | Low |

This comprehensive analysis provides international B2B buyers with actionable insights into selecting the most appropriate substrate materials based on application requirements, regional standards, and supply chain considerations.

The production of substrate electronics involves a complex series of meticulously controlled stages, each crucial to ensuring product integrity, performance, and compliance with international standards.

1. Material Preparation:

The process begins with sourcing high-quality base materials, typically ceramic (e.g., alumina, aluminum nitride) or composite substrates. Material selection depends on the application, thermal management needs, and electrical properties. Suppliers must adhere to strict material specifications, often verified through certifications like ISO 9001 and material testing reports. For B2B buyers, verifying supplier certifications and material traceability is essential, especially when sourcing from regions with varying regulatory standards.

2. Forming and Patterning:

Next, the substrates undergo forming processes such as lamination, cutting, and shaping. Advanced techniques like laser ablation, photolithography, and chemical etching are employed to define precise circuit patterns and vias. These steps demand high precision equipment and cleanroom environments to prevent contamination and ensure dimensional accuracy. Proper process control minimizes defects such as warping or pattern misalignment, which can compromise device performance.

3. Assembly and Metallization:

The core assembly involves metallization—applying conductive layers (copper, gold, or other alloys)—using processes like sputtering, electroplating, or screen printing. This stage also includes attaching electronic components, such as passive devices or connectors, through bonding or soldering. Automation and real-time inspection are vital here to maintain consistency and prevent issues like shorts or open circuits. For international buyers, understanding the supplier’s assembly protocols and equipment quality is critical to ensure reliability.

4. Finishing and Testing:

Final steps involve surface finishing (e.g., coating, sealing), cleaning, and final inspection. Advanced testing methods such as Automated Optical Inspection (AOI), X-ray inspection, and electrical testing are employed to verify circuit integrity, connectivity, and adherence to specifications. Post-manufacturing, substrates are subjected to environmental stress testing—thermal cycling, humidity exposure—to confirm durability.

Quality assurance is integral to substrate electronics manufacturing, especially for B2B buyers operating in diverse regulatory landscapes.

International Standards:

- ISO 9001: The foundation for quality management systems, ensuring consistent process control and continuous improvement. Reputable suppliers often hold ISO 9001 certification, demonstrating commitment to quality.

- ISO 14001: Focuses on environmental management, relevant for suppliers emphasizing sustainable practices.

- Industry-specific certifications:

- CE Marking (Europe): Indicates compliance with EU safety and environmental standards, crucial for electronic products sold in European markets.

- API Standards (Oil & Gas): For substrates used in harsh environments, adherence to API standards ensures reliability under extreme conditions.

- UL Certification (North America): Confirms safety standards for electronic components.

QC Checkpoints and Methods:

- Incoming Quality Control (IQC): Verifies raw materials and components upon receipt, including material composition, dimensions, and initial defect screening.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing—dimensional checks, process parameter verification, and defect detection—using techniques like AOI, laser measurement, and electrical testing.

- Final Quality Control (FQC): Comprehensive inspection before shipment, including functional testing, environmental stress testing, and final visual inspection.

Common Testing Techniques:

- Electrical Testing: Ensures circuit continuity, insulation resistance, and impedance matching.

- X-ray Inspection: Detects internal defects such as voids or misaligned vias.

- Thermal Cycling & Humidity Tests: Assess product robustness under operational conditions, critical for high-reliability applications.

- Mechanical Tests: Verify adhesion strength, flexural resistance, and surface durability.

For buyers from Africa, South America, the Middle East, and Europe, verifying manufacturing quality is vital to mitigate risks and ensure product compliance.

Supplier Audits:

- Conduct on-site audits to assess manufacturing facilities, process controls, and quality management systems.

- Use third-party inspection agencies with expertise in electronics manufacturing to evaluate compliance with industry standards and regional regulations.

Documentation and Certification Checks:

- Review certifications such as ISO 9001, ISO 14001, CE, UL, or API to confirm adherence to international standards.

- Request detailed test reports, material certificates, and process documentation for traceability.

Sample Testing and Third-party Inspection:

- Arrange for independent testing of samples to verify quality claims.

- Use third-party inspection services to perform random sampling, process verification, and final inspection reports, especially when dealing with suppliers from regions with variable quality assurance practices.

Ongoing Quality Monitoring:

- Establish key performance indicators (KPIs) such as defect rates, lead times, and compliance scores.

- Implement supplier scorecards and periodic reviews to ensure sustained quality levels.

For B2B buyers seeking reliable substrate electronics, understanding the detailed manufacturing processes and rigorous quality assurance practices is essential. By establishing robust supplier verification protocols, leveraging international standards, and demanding transparency, buyers from Africa, South America, the Middle East, and Europe can secure high-quality products that meet their specific operational and regulatory needs. This proactive approach minimizes risks, enhances product reliability, and fosters long-term supplier relationships in the global electronics supply chain.

A thorough grasp of the cost structure is essential for effective pricing and negotiation. The primary cost components include:

Several key factors shape substrate electronics pricing for international buyers:

While specific prices vary widely, as a rough guide:

Disclaimer: These prices are indicative and subject to market fluctuations, supplier capabilities, and specific project requirements. Buyers should obtain detailed quotes and conduct due diligence before committing.

By understanding these cost drivers and pricing influencers, international B2B buyers can strategically negotiate, optimize their procurement processes, and achieve better value in sourcing substrate electronics.

Understanding key technical specifications is vital for international B2B buyers to ensure compatibility, quality, and cost-effectiveness when sourcing substrate electronics. Here are the most essential properties:

1. Material Grade

The substrate material’s grade defines its purity, durability, and performance characteristics. Common materials include high-grade ceramics, glass-ceramics, and specialized polymers. Higher-grade materials generally offer better thermal stability, electrical insulation, and mechanical strength, which are crucial for high-reliability applications like aerospace or medical devices. Buyers should specify material grades aligned with their end-use requirements to prevent costly rework or failures.

2. Dielectric Constant (Dk) and Loss Tangent

These electrical properties influence signal integrity and power efficiency. The dielectric constant (Dk) measures how well the substrate insulates and propagates electromagnetic signals, while the loss tangent indicates energy dissipation. Precise control over these parameters ensures optimal performance in high-frequency applications such as RF and microwave systems. When sourcing, verify the Dk and loss tangent tolerances to match your technical specifications.

3. Tolerance and Dimensional Accuracy

Dimensional tolerances specify the allowable deviation from the nominal size of the substrate. Tight tolerances are essential for ensuring proper component fit and reliable electrical connections, especially in miniaturized or high-density assemblies. Confirm the tolerance levels during procurement to avoid issues during assembly and to reduce rework costs.

4. Thermal Conductivity and Coefficient of Thermal Expansion (CTE)

These properties determine how the substrate manages heat. High thermal conductivity facilitates efficient heat dissipation, preventing overheating. A matched CTE with other components minimizes mechanical stress during temperature fluctuations, enhancing product longevity. For high-power applications, specify these properties clearly to select suitable substrates.

5. Surface Finish and Coating

Surface quality affects solderability, adhesion, and overall reliability. Common finishes include gold, silver, or tin plating, each with specific advantages. High-quality finishes reduce the risk of corrosion and improve electrical contact stability. When purchasing, ensure the surface finish meets your assembly process requirements and environmental conditions.

Familiarity with industry jargon helps streamline communication and negotiations between buyers and suppliers globally:

1. OEM (Original Equipment Manufacturer)

An OEM produces components or products that are integrated into a final system sold under a different brand. Understanding whether a supplier is an OEM helps determine the level of customization, volume, and pricing expectations. OEM relationships often imply large order volumes and long-term partnerships.

2. MOQ (Minimum Order Quantity)

This is the smallest quantity a supplier is willing to produce or sell per order. For substrate electronics, MOQs can vary widely depending on the complexity and cost of manufacturing. Knowing the MOQ upfront helps buyers plan procurement budgets and production schedules efficiently.

3. RFQ (Request for Quotation)

An RFQ is a formal request sent to suppliers seeking detailed pricing, lead times, and technical compliance information. Effectively managing RFQs ensures competitive pricing and timely responses, especially important when sourcing from different regions with varying manufacturing capacities.

4. Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms like FOB (Free On Board) or CIF (Cost, Insurance, and Freight) influence cost calculations and risk management. Clear understanding of Incoterms is crucial for international logistics planning.

5. Lead Time

The period from order placement to delivery. Longer lead times may impact project timelines, so it’s critical to confirm and plan accordingly, especially when sourcing from overseas suppliers in regions with variable logistics infrastructure.

6. Quality Certification

Standards such as ISO 9001 or IPC-A-610 indicate compliance with quality management systems and industry-specific standards. Verified certifications assure buyers of consistent quality and facilitate smoother customs clearance and regulatory approval processes.

Summary:

For international B2B buyers, especially from diverse regions like Africa, South America, the Middle East, and Europe, understanding these technical properties and trade terms is essential. Precise specification of material properties ensures product performance and reliability, while familiarity with trade terminology streamlines negotiations, logistics, and compliance. This knowledge empowers buyers to make informed decisions, negotiate effectively, and establish long-term, successful supplier relationships in the substrate electronics market.

The substrate electronics sector is integral to the global electronics supply chain, underpinning advancements in high-performance computing, 5G infrastructure, IoT devices, and electric vehicles. Driven by technological innovation, increased demand for miniaturization, and the need for high-speed data transfer, this market is experiencing rapid growth. For international B2B buyers from regions like Africa, South America, the Middle East, and Europe, understanding current trends is vital for strategic sourcing.

Emerging sourcing trends include a shift toward localized manufacturing and diversified supply chains to mitigate risks associated with geopolitical tensions and pandemic disruptions. European buyers, particularly in Germany, are increasingly investing in high-quality, precision-engineered substrates, emphasizing reliability and technological compatibility. Conversely, buyers from Africa and South America often seek cost-effective solutions, prompting a focus on regions with emerging manufacturing hubs in Asia and the Middle East.

Illustrative Image (Source: Google Search)

Market dynamics are also influenced by material innovations such as flexible substrates, ceramic-based components, and advancements in dielectric materials that enhance performance in high-frequency applications. Additionally, the rise of additive manufacturing techniques offers new avenues for customization and rapid prototyping, appealing to B2B buyers seeking agility.

Global drivers such as the expansion of 5G networks, electric vehicle adoption, and the growth of data centers are fueling demand for advanced substrate materials. However, supply chain complexities—including raw material shortages (e.g., rare metals), geopolitical tensions, and trade policies—pose challenges. Strategic sourcing, diversification, and investing in supplier relationships are essential for B2B buyers aiming to secure stable supply chains.

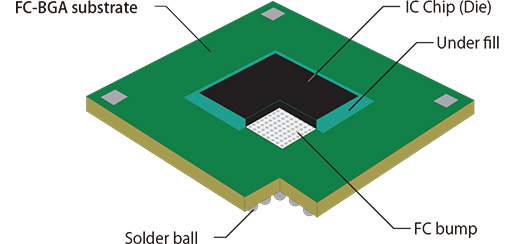

Illustrative Image (Source: Google Search)

Understanding regional market nuances—such as Europe's focus on quality and innovation, Africa’s demand for cost-effective solutions, and South America's growing electronics manufacturing—enables buyers to tailor procurement strategies effectively. Navigating these dynamics requires staying informed on technological trends, geopolitical developments, and regional market conditions to optimize sourcing and maintain a competitive edge.

Sustainability is increasingly shaping procurement decisions within the substrate electronics sector. Environmental concerns stem from the mining and processing of raw materials like gallium, indium, and rare earth elements, which have significant ecological footprints. B2B buyers from Africa, South America, the Middle East, and Europe are recognizing the importance of integrating sustainable practices to reduce environmental impact and ensure long-term supply chain resilience.

Ethical sourcing involves verifying that raw materials are obtained responsibly, respecting labor rights, and avoiding conflict minerals. Certification schemes such as Responsible Minerals Initiative (RMI), Conflict-Free Smelter Program, and ISO standards are becoming benchmarks for suppliers. For European buyers, compliance with stringent environmental regulations and sustainability standards is often mandatory, influencing supplier selection and contractual terms.

In terms of materials, there is a rising preference for 'green' substrates—those produced with environmentally friendly processes, using recyclable or biodegradable materials where possible. The adoption of low-impact manufacturing techniques, such as additive manufacturing and green chemistry, further supports sustainability goals. Additionally, many companies are pursuing certifications like LEED, ISO 14001, and EPEAT to demonstrate their environmental commitments.

For B2B buyers, fostering transparent supply chains and engaging with suppliers committed to sustainability not only mitigates risks but also enhances brand reputation and customer trust. Incorporating sustainability clauses into procurement agreements, conducting regular audits, and prioritizing suppliers with verifiable ethical practices are actionable strategies. Ultimately, aligning sourcing practices with environmental and social responsibility standards is vital for future-proofing operations and meeting evolving regulatory and market expectations.

The substrate electronics market has evolved from simple conductive layers to highly sophisticated materials designed for high-frequency, high-density applications. Initially dominated by glass-ceramic and basic epoxy substrates, the industry has shifted toward advanced composites, flexible substrates, and multilayer configurations to meet the demands of miniaturization and performance. This evolution reflects technological advancements in materials science, manufacturing precision, and integration capabilities.

For B2B buyers, understanding this progression highlights the importance of sourcing from suppliers with a proven track record of innovation and quality. It also underscores the need for ongoing collaboration with manufacturers to adapt to evolving technological standards, ensuring compatibility and future-proofing investments. Recognizing the historical context helps buyers appreciate the sector’s trajectory and anticipate future trends, such as increased adoption of flexible and environmentally sustainable substrates, which are poised to define the next phase of development.

Effective vetting begins with comprehensive due diligence. Start by requesting detailed certifications such as ISO 9001, RoHS, and industry-specific quality standards. Review supplier references and seek feedback from their existing clients, especially those in similar markets. Evaluate their manufacturing facilities via virtual tours or third-party audits when possible. Assess their compliance with international trade regulations and export licenses. Additionally, request samples to verify product quality firsthand. Establish clear communication channels and inquire about their quality control processes, lead times, and after-sales support to ensure they can meet your specific requirements reliably.

Most reputable suppliers offer customization in terms of substrate size, shape, material composition, and electrical specifications. Clearly define your technical requirements, including conductivity, thermal management, and environmental resistance. Engage suppliers early in the process to discuss design prototypes, and request detailed technical datasheets. Use visual aids like CAD drawings to convey complex specifications. Be aware that customization may impact lead times and costs; negotiate these upfront. Establish a detailed scope of work and validation process to ensure the final product aligns with your application’s needs, especially for specialized markets like aerospace or medical devices.

MOQs vary widely depending on supplier size and complexity but generally range from 50 to 500 units for standard products. Custom or specialized substrates tend to have higher MOQs, often exceeding 1,000 units. Lead times typically span from 4 to 12 weeks, influenced by order complexity and manufacturing capacity. Payment terms are usually 30% upfront, with the balance payable before shipment, but flexible terms can be negotiated, especially for large or repeat orders. International buyers should consider establishing Letters of Credit or escrow arrangements to mitigate payment risks and ensure timely delivery.

Key certifications include ISO 9001 for quality management, RoHS compliance for hazardous substances, and industry-specific standards like UL, CE, or IPC certifications. Ask for detailed QA documentation such as test reports, process control records, and inspection certificates. Suppliers should also provide material traceability records and environmental compliance certificates. For critical applications, consider requesting third-party lab test results or certification of conformance (CoC). Verifying these documents ensures the supplier adheres to international standards, reduces the risk of non-compliance, and guarantees product reliability across diverse markets.

Start by selecting suppliers experienced in international shipping and familiar with your target markets’ import regulations. Opt for Incoterms like FOB or CIF to clarify responsibilities and costs. Use reputable freight forwarders with expertise in electronics logistics to handle customs clearance, packaging, and insurance. Ensure proper packaging to prevent damage during transit, especially for delicate substrates. Track shipments actively and maintain open communication with logistics providers. Additionally, be aware of import duties, taxes, and local compliance requirements to avoid delays or additional costs, particularly when sourcing from regions with complex customs procedures like Nigeria or Brazil.

Disputes often arise around quality issues, delivery delays, or payment conflicts. To mitigate risks, include clear contractual clauses specifying dispute resolution methods, such as arbitration under internationally recognized rules (e.g., ICC or UNCITRAL). Preferably, select arbitration venues in neutral locations to ensure fairness. Maintain detailed records of all communications, quality checks, and shipping documents to support claims if disputes occur. Building strong relationships and setting clear expectations upfront can prevent many issues. For ongoing partnerships, consider establishing escalation procedures and regular review meetings to address concerns proactively.

Geopolitical tensions can affect trade policies, tariffs, and import/export restrictions, potentially disrupting supply chains. Keep abreast of current geopolitical developments and regional trade agreements that may influence sourcing options. Currency fluctuations impact overall costs; for example, a weaker local currency can increase import expenses. To mitigate this, consider locking in prices via forward contracts or negotiating pricing in stable currencies like USD or EUR. Diversify your supplier base across multiple regions to reduce dependency on a single source. Regularly review and adjust your procurement strategies to adapt to changing economic and political landscapes.

Immediately document the issue with detailed photographs, inspection reports, and communication records. Notify your supplier promptly, referencing contractual agreements and quality standards. Engage in collaborative problem-solving to identify root causes—whether material defects, process errors, or logistical delays. Request corrective and preventive action plans, including rework, replacements, or process adjustments. If resolution stalls, consider involving third-party inspectors or mediators. Maintain a contingency plan by sourcing alternative suppliers or holding safety stock. Establish ongoing quality audits and performance reviews to prevent recurrence, and build strong supplier relationships to facilitate smoother resolution in future transactions.

Effective strategic sourcing in substrate electronics is essential for international B2B buyers aiming to optimize supply chain resilience, cost efficiency, and technological competitiveness. Key takeaways include the importance of diversifying sourcing regions, fostering strong supplier relationships, and prioritizing quality and innovation to meet evolving industry standards. As the demand for advanced substrates grows, particularly in sectors like telecommunications, automotive, and consumer electronics, proactive sourcing strategies will be critical to maintaining a competitive edge.

Looking ahead, global geopolitical shifts, technological advancements, and supply chain disruptions will continue to influence sourcing decisions. Buyers from Africa, South America, the Middle East, and Europe should capitalize on emerging markets and regional strengths—such as Africa’s growing manufacturing hubs or Europe’s focus on sustainability—to build more resilient and sustainable supply networks.

Actionable Insight: Stay informed about industry trends, leverage local partnerships, and invest in supply chain agility. By doing so, international buyers can secure a strategic advantage in the evolving substrate electronics landscape—positioning themselves for long-term success in a highly competitive global market.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina