The global landscape for silicon carbide (SiC) crystal structures is rapidly evolving, driven by increasing demand across high-performance electronics, automotive, aerospace, and energy sectors. For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe—including key markets such as the UK and Indonesia—understanding the nuances of SiC crystal structure is essential for securing reliable supply chains and competitive pricing.

SiC’s exceptional properties, including high thermal conductivity, chemical stability, and wide bandgap, make it a critical material for advanced semiconductor devices and power electronics. However, the complexity of its crystal growth, diverse polytypes, and stringent manufacturing quality controls present unique sourcing challenges. Navigating these requires deep technical insight coupled with strategic market awareness.

This comprehensive guide offers a detailed exploration of SiC crystal structures, covering:

By consolidating technical expertise and market intelligence, this guide equips B2B buyers with actionable insights to make informed decisions, mitigate risks, and identify optimal sourcing opportunities. Whether you are entering new markets or strengthening existing partnerships, this resource empowers your procurement strategy to leverage the full potential of SiC crystal technology on a global scale.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

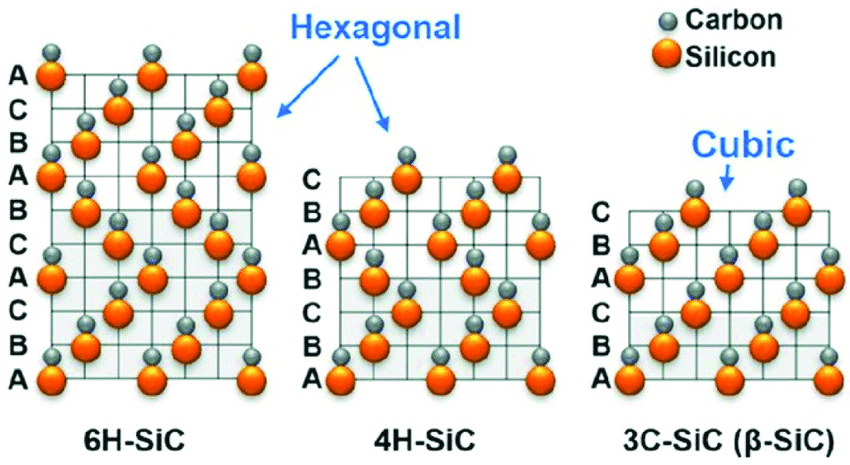

| 3C-SiC (Cubic) | Zinc blende cubic crystal structure, isotropic | Power electronics, high-frequency devices | Pros: High electron mobility, isotropic properties; Cons: Lower thermal conductivity than hexagonal types |

| 4H-SiC (Hexagonal) | Hexagonal structure with longer stacking sequence | High-power, high-temperature electronics | Pros: Excellent thermal conductivity, high breakdown voltage; Cons: More complex growth process |

| 6H-SiC (Hexagonal) | Hexagonal with different stacking order than 4H | LEDs, high-voltage devices | Pros: Good electrical properties; Cons: Lower electron mobility compared to 4H-SiC |

| 15R-SiC (Rhombohedral) | Rhombohedral polytype, less common | Specialized semiconductor applications | Pros: Unique electronic properties; Cons: Limited availability, higher cost |

3C-SiC (Cubic Silicon Carbide)

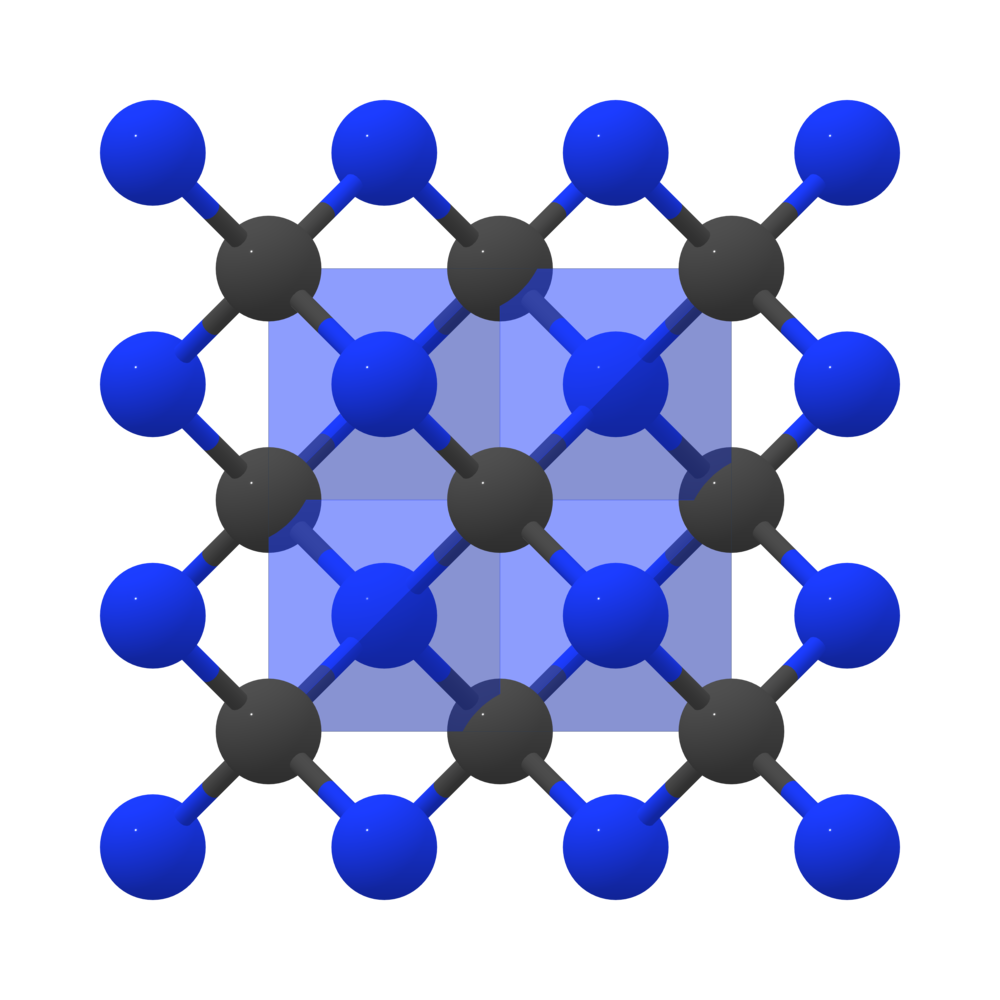

3C-SiC features a cubic zinc blende crystal structure, offering isotropic electrical and mechanical properties. It is favored for applications requiring high electron mobility and uniform performance in all directions, such as in high-frequency and power electronic devices. For B2B buyers, 3C-SiC provides cost advantages due to simpler growth but may fall short in thermal management compared to hexagonal polytypes. Buyers should consider device thermal requirements and production scalability when selecting 3C-SiC.

4H-SiC (Hexagonal Silicon Carbide)

4H-SiC is the most widely used hexagonal polytype, characterized by a longer stacking sequence that enhances its electrical and thermal properties. It excels in high-power and high-temperature electronics, offering superior thermal conductivity and breakdown voltage. This makes it ideal for demanding industrial applications, including electric vehicles and power inverters. However, its growth process is more complex and costly, so buyers must weigh performance benefits against procurement budgets.

6H-SiC (Hexagonal Silicon Carbide)

6H-SiC has a hexagonal structure with a distinct stacking order different from 4H-SiC. It is commonly used in light-emitting diodes (LEDs) and high-voltage devices due to its stable electrical characteristics. While it offers good performance, its electron mobility is lower than 4H-SiC, potentially affecting device speed. B2B buyers should evaluate their application’s speed versus cost trade-offs and consider 6H-SiC for cost-effective, reliable semiconductor solutions.

15R-SiC (Rhombohedral Silicon Carbide)

The 15R-SiC polytype exhibits a rhombohedral crystal structure and is less prevalent than cubic or hexagonal types. Its unique electronic properties make it suitable for niche semiconductor applications requiring specialized performance. However, limited availability and higher production costs can pose challenges for buyers. Companies looking for tailored semiconductor characteristics may find 15R-SiC valuable, but should carefully assess supply chain reliability and cost implications.

Related Video: SiC Crystal Structure setup

| Industry/Sector | Specific Application of sic crystal structure | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Power Electronics | High-voltage, high-temperature semiconductor devices | Increased efficiency, reduced energy loss, enhanced durability | Supplier quality certifications, thermal management capabilities, compliance with international standards |

| Automotive | Electric vehicle (EV) power modules and inverters | Improved power density, reliability under harsh conditions | Proven track record in automotive-grade materials, scalability, supply chain resilience |

| Renewable Energy | Silicon carbide-based photovoltaic (PV) inverters and converters | Higher conversion efficiency, longer lifespan, reduced cooling requirements | Compatibility with existing systems, warranty terms, local technical support availability |

| Aerospace & Defense | High-frequency, high-power RF components and sensors | Superior performance in extreme environments, miniaturization | Compliance with aerospace standards, traceability, strict quality control |

| Industrial Manufacturing | Harsh environment sensors and high-temperature electronics | Enhanced operational stability, reduced downtime | Customization options, durability testing, logistics for international delivery |

Silicon carbide (SiC) crystal structures form the backbone of power electronics devices, where their ability to operate at high voltages and temperatures offers substantial improvements over traditional silicon. For international buyers, especially in regions with growing industrial infrastructure like Africa and South America, sourcing SiC devices requires verifying supplier certifications and ensuring thermal management compatibility to maximize efficiency and device longevity.

In the automotive sector, SiC crystals are critical in electric vehicle power modules and inverters. Their robustness under thermal stress and higher power density enable lighter, more efficient EV powertrains. Buyers from Europe and the Middle East must prioritize suppliers with automotive-grade certifications and scalable production to meet evolving regulatory and market demands.

The renewable energy industry leverages SiC in photovoltaic inverter systems, achieving higher energy conversion rates and reducing cooling infrastructure costs. For B2B buyers in emerging markets such as Indonesia and South America, it is vital to assess the compatibility of SiC components with existing grid systems and ensure strong after-sales support to facilitate smooth integration.

In aerospace and defense, the SiC crystal structure enables high-frequency RF components that perform reliably in extreme conditions. International buyers should focus on suppliers adhering to aerospace quality standards and offering full traceability to meet stringent contract requirements and operational reliability.

Lastly, in industrial manufacturing, SiC-based sensors and electronics withstand harsh environments, minimizing downtime and maintenance costs. Buyers across all targeted regions should seek suppliers offering customization and rigorous durability testing, along with efficient international logistics to ensure timely delivery and operational continuity.

Related Video: Spotlight on Silicon Carbide (SiC) crystal growth

Silicon Carbide (SiC) crystal structures are widely recognized for their exceptional mechanical, thermal, and chemical properties, making them a preferred choice in various industrial applications. Selecting the appropriate SiC material variant requires a strategic evaluation of performance characteristics, manufacturing considerations, and regional compliance standards. Below is an analysis of four common SiC materials relevant to international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe.

Key Properties:

Alpha SiC is the most common polytype, characterized by a hexagonal crystal structure. It offers high hardness, excellent thermal conductivity (up to 120 W/mK), and outstanding chemical inertness. It withstands temperatures up to 1600°C and has good corrosion resistance in acidic and oxidizing environments.

Pros & Cons:

Alpha SiC is highly durable and wear-resistant, ideal for abrasive environments. It is relatively easier to manufacture compared to other polytypes, reducing production lead times. However, it is brittle and can be costly when produced in large, defect-free crystals.

Impact on Application:

Its chemical stability suits applications involving corrosive media such as acids and oxidizers, common in chemical processing industries. The high thermal conductivity benefits power electronics and heat exchanger components.

Regional Considerations:

Buyers in Europe and the Middle East should verify compliance with ASTM C799 and DIN EN standards for SiC ceramics. African and South American markets may prioritize cost-effective sourcing, so suppliers offering alpha SiC with consistent quality and certification are preferred. The UK market often demands traceability and adherence to ISO 9001 quality management systems.

Key Properties:

Beta SiC has a cubic crystal structure and is typically synthesized via chemical vapor deposition (CVD). It exhibits superior mechanical strength and fracture toughness compared to alpha SiC, with excellent thermal shock resistance.

Pros & Cons:

Beta SiC is less brittle, making it suitable for complex shapes and thin-walled components. Its manufacturing via CVD allows for high purity and controlled microstructure but increases production complexity and cost.

Impact on Application:

Ideal for semiconductor devices, high-temperature sensors, and precision mechanical parts. Its resistance to thermal shock makes it suitable for aerospace and automotive applications where rapid temperature changes occur.

Regional Considerations:

In South America and Africa, where infrastructure for high-precision manufacturing is developing, sourcing beta SiC may require partnerships with specialized suppliers. Europe and the Middle East buyers should ensure materials meet JIS C 1601 standards for semiconductor-grade SiC. Import regulations and tariffs may affect pricing in Indonesia and other Asian markets.

Key Properties:

SSiC is produced by sintering SiC powder with additives, resulting in a dense, polycrystalline material. It offers excellent corrosion resistance, high hardness, and can operate continuously at temperatures up to 1400°C.

Pros & Cons:

SSiC is cost-effective for bulk applications and provides good mechanical strength. However, its grain boundaries can be susceptible to oxidation at very high temperatures, limiting its use in extreme environments.

Impact on Application:

Commonly used in pump seals, valve components, and kiln furniture where chemical resistance and mechanical durability are critical. Its robustness suits harsh industrial environments such as mining and chemical processing.

Regional Considerations:

Buyers in the Middle East and Africa often require materials that withstand abrasive slurries and corrosive fluids, making SSiC a preferred choice. Compliance with ASTM C663 and ISO 9001 is important for quality assurance. European buyers may demand environmental certifications related to manufacturing processes.

Key Properties:

RBSC is manufactured by infiltrating porous carbon preforms with molten silicon, forming a composite of SiC and residual silicon. It exhibits good thermal conductivity and moderate corrosion resistance but lower hardness than sintered SiC.

Pros & Cons:

RBSC offers cost advantages due to lower sintering temperatures and simpler processing. However, the presence of free silicon reduces chemical resistance, limiting its use in highly acidic or oxidizing conditions.

Impact on Application:

Suitable for mechanical components where moderate corrosion resistance and thermal properties suffice, such as heat exchangers and mechanical seals in less aggressive environments.

Regional Considerations:

For buyers in South America and Africa, RBSC provides an economical option for industrial parts. European and Middle Eastern buyers should assess the suitability based on chemical exposure and may require additional coatings or treatments. Compliance with ASTM C795 is recommended for RBSC products.

| Material | Typical Use Case for sic crystal structure | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alpha (α) Silicon Carbide | Chemical processing components, power electronics | High thermal conductivity and chemical stability | Brittle nature and higher cost for large crystals | Medium |

| Beta (β) Silicon Carbide | Semiconductor devices, aerospace components | Superior fracture toughness and thermal shock resistance | Complex and costly manufacturing process | High |

| Sintered Silicon Carbide | Pump seals, valve parts, kiln furniture | Excellent corrosion resistance and mechanical strength | Susceptible to oxidation at very high temperatures | Medium |

| Reaction Bonded Silicon Carbide | Heat exchangers, mechanical seals in moderate environments | Cost-effective with good thermal conductivity | Lower chemical resistance due to free silicon | Low |

This guide aims to assist international B2B buyers in making informed decisions tailored to their operational environments and regional compliance needs, ensuring optimal performance and cost-efficiency in their SiC-based product applications.

Illustrative Image (Source: Google Search)

The production of silicon carbide (SiC) crystal structures involves highly specialized processes designed to achieve precise structural and material properties essential for advanced industrial applications. Understanding the typical manufacturing stages and techniques is crucial for B2B buyers aiming to source high-quality SiC crystals reliably.

The process begins with high-purity raw materials, primarily silicon and carbon sources, which must meet stringent purity standards to avoid defects in the crystal lattice. Suppliers typically use synthetic silicon carbide powders or prepare polycrystalline SiC substrates as feedstock. The purity and particle size distribution are critical parameters controlled during this stage to ensure uniformity and optimal reaction kinetics.

The core of SiC crystal manufacturing is the crystal growth phase, where techniques such as the Physical Vapor Transport (PVT) method dominate. PVT involves sublimating SiC powder at high temperatures (~2500°C) in a controlled environment to deposit single crystals on seed crystals. This method allows for controlled growth of large, defect-minimized crystals with specific polytypes (e.g., 4H-SiC, 6H-SiC) depending on the application.

Alternative forming methods, though less common, include chemical vapor deposition (CVD) for thin films or epitaxial layers, which are critical for semiconductor device fabrication.

Post-growth, the SiC crystals undergo precision machining to shape wafers or components. This includes slicing, grinding, and polishing under cleanroom conditions to achieve the necessary surface finish and dimensional tolerances. Because SiC is extremely hard, diamond tools and advanced CNC machinery are employed.

Assembly may also involve bonding SiC components with other materials, requiring expertise in thermal expansion matching and surface treatment to maintain structural integrity.

Finishing processes focus on defect inspection, surface passivation, and coating (if applicable) to enhance performance characteristics such as oxidation resistance. Packaging is designed to protect the crystal structure from contamination and mechanical damage during transit, often incorporating moisture control and anti-static materials.

Given the technical complexity and critical application of SiC crystals, rigorous quality assurance protocols are indispensable. International B2B buyers should look for suppliers adhering to recognized standards and comprehensive QC checkpoints.

For buyers sourcing SiC crystals internationally, especially from diverse markets such as Africa, South America, the Middle East, and Europe (including the UK and Indonesia), verifying supplier quality is paramount.

Conducting on-site audits or commissioning third-party inspections helps validate manufacturing capabilities, QC processes, and compliance with certifications. Buyers should focus on the supplier’s adherence to ISO 9001 systems, equipment calibration, and staff expertise.

Request comprehensive quality documentation including:

- Material certificates (e.g., Certificate of Analysis for raw materials).

- Process control records.

- Inspection and test reports for each batch.

- Traceability logs linking raw materials to finished products.

Engaging independent testing laboratories for sample verification ensures unbiased quality assessment. This is especially important for new suppliers or when entering new markets with differing QC expectations.

By understanding these manufacturing and quality assurance fundamentals, international B2B buyers can make informed decisions, reducing supply risks and ensuring access to SiC crystal structures that meet their technical and commercial requirements.

When sourcing silicon carbide (SiC) crystal structures, understanding the detailed cost components is essential for international B2B buyers aiming to optimize procurement. The main cost elements typically include:

Several factors influence the final pricing of SiC crystal structures, especially in cross-border B2B transactions:

For buyers from Africa, South America, the Middle East, and Europe, navigating the complexities of SiC crystal structure sourcing requires strategic considerations:

Due to the variability of raw material costs, manufacturing complexity, supplier capabilities, and geopolitical factors, pricing for SiC crystal structures can fluctuate significantly. The figures and strategies outlined here are indicative to guide buyer decisions and should be validated through direct supplier engagement and market analysis.

Understanding the key technical specifications of silicon carbide (SiC) crystal structures is essential for B2B buyers to ensure compatibility with their applications and optimize procurement decisions.

Polytype and Crystal Grade

SiC exists in multiple polytypes, such as 4H-SiC and 6H-SiC, which differ in their atomic stacking sequences. The polytype directly affects electrical properties like bandgap and carrier mobility. Crystal grade refers to the purity and defect density; high-grade SiC crystals have fewer dislocations and impurities. For buyers, specifying the correct polytype and grade is crucial to meet performance and reliability standards in sectors like power electronics or semiconductor devices.

Wafer Diameter and Thickness

SiC wafers are manufactured in various diameters (e.g., 100mm, 150mm) and thicknesses. Larger diameters enable higher production volumes but may come at a premium cost. Thickness impacts mechanical strength and device fabrication processes. Buyers must balance production needs with cost and equipment compatibility when selecting wafer dimensions.

Surface Finish and Flatness Tolerance

Surface finish relates to the smoothness of the wafer’s surface, impacting device fabrication yield. Flatness tolerance defines the allowable deviation from a perfectly flat surface, critical for lithography and bonding processes. High-precision applications require tighter tolerances, influencing price and supplier selection.

Doping Concentration and Uniformity

SiC crystals can be doped with elements like nitrogen or aluminum to tailor electrical conductivity. The concentration and uniformity of doping affect device characteristics such as resistivity and switching speed. Buyers should specify doping parameters precisely to ensure product consistency and performance.

Defect Density (Dislocations and Micropipes)

Defects like dislocations and micropipes can degrade device performance and yield. Low defect density is a hallmark of premium SiC crystals. For mission-critical applications, insisting on defect density specifications helps avoid costly failures and production downtime.

Navigating international B2B transactions for SiC materials involves understanding key trade terms that streamline communication and set clear expectations.

OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or products used in another company’s final product. For SiC buyers, OEM relationships often mean tailored crystal specifications and consistent supply agreements critical for manufacturing high-value electronic components.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. MOQs affect purchasing decisions, especially for buyers in emerging markets or smaller enterprises who may seek flexible quantities to manage inventory and cash flow.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain price and delivery terms based on specified requirements. An effective RFQ includes detailed crystal specifications, enabling suppliers to provide accurate and comparable offers.

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) defining the responsibilities of buyers and sellers for shipping, insurance, and customs clearance. Familiarity with Incoterms helps buyers manage logistics costs and risks, especially when importing SiC crystals across continents.

Lead Time

The period between placing an order and receiving the goods. SiC crystal manufacturing is complex and can involve long lead times; understanding this helps buyers plan production schedules and inventory.

Batch Traceability

The ability to track a specific batch of SiC crystals through production and delivery stages. Traceability is vital for quality assurance, particularly in regulated industries like automotive or aerospace, ensuring any defects can be traced and managed efficiently.

By mastering these technical properties and trade terms, international buyers from regions such as Africa, South America, the Middle East, and Europe can make informed procurement decisions, negotiate effectively, and establish robust supply chains for silicon carbide crystal structures.

The silicon carbide (SiC) crystal structure sector is experiencing robust growth driven by its critical role in high-performance electronics, electric vehicles (EVs), renewable energy systems, and industrial applications. Globally, demand for SiC wafers and components is surging as manufacturers seek materials capable of withstanding high voltages, temperatures, and switching frequencies. This trend is particularly pronounced in regions like Europe and the Middle East, where EV adoption and renewable infrastructure investments are accelerating, and in emerging markets such as Africa and South America, where industrial modernization is underway.

Key market dynamics include:

Technological Advancements: Innovations in SiC crystal growth techniques, such as physical vapor transport (PVT) and chemical vapor deposition (CVD), are improving wafer quality and reducing production costs. This advances the feasibility of large-scale adoption in power electronics and semiconductors.

Supply Chain Diversification: Buyers from Africa, South America, the Middle East, and Europe increasingly prioritize suppliers with diversified sourcing to mitigate geopolitical risks and supply disruptions. Strategic partnerships with manufacturers in Asia and North America are common.

Customization and Vertical Integration: Leading SiC producers offer tailored crystal structures to meet specific device requirements, fostering closer B2B collaboration. Vertical integration, from raw material sourcing to wafer fabrication, is becoming a competitive advantage.

Emerging Sourcing Trends: There is a growing preference for suppliers who provide traceability and quality certifications, such as ISO 9001 and IATF 16949, which assure compliance with industry standards. Additionally, digital platforms and e-procurement tools are streamlining international transactions, benefiting buyers from diverse regions.

For international B2B buyers, especially in markets like the UK and Indonesia, understanding these trends helps optimize procurement strategies and align with suppliers capable of delivering innovation, quality, and supply reliability.

Sustainability is increasingly integral to the SiC crystal structure supply chain. The production of SiC involves energy-intensive processes, including high-temperature crystal growth and wafer slicing, which contribute to environmental footprints. Consequently, international buyers are prioritizing suppliers committed to reducing carbon emissions, waste, and water usage.

Key considerations for B2B buyers:

Environmental Impact Mitigation: Leading SiC manufacturers invest in energy-efficient furnaces, renewable energy integration, and recycling of by-products. These initiatives not only lower operational costs but also align with global environmental targets.

Ethical Supply Chains: Transparency and accountability in sourcing raw materials are critical. Buyers from Africa, South America, and the Middle East often seek suppliers who adhere to responsible mining and labor practices, minimizing risks associated with conflict minerals and labor rights violations.

Green Certifications: Certifications such as ISO 14001 (Environmental Management) and adherence to the Responsible Minerals Initiative (RMI) offer assurance of sustainable practices. Some suppliers also pursue product-specific eco-labels indicating lower environmental impacts across the product lifecycle.

Circular Economy Approaches: The sector is exploring circularity through wafer reuse, recycling scrap materials, and designing for longer device lifespans. Buyers partnering with suppliers embracing these models can enhance their own sustainability credentials and meet regulatory requirements in Europe and beyond.

For B2B buyers, integrating sustainability criteria into supplier evaluation and procurement policies is not only ethically responsible but increasingly a market differentiator.

The commercial development of silicon carbide crystal structures dates back to the late 19th century when SiC was first synthesized for abrasive applications. However, its adoption in electronics gained momentum in the 1980s with advancements in crystal growth methods enabling high-purity wafer production. The evolution from small-scale laboratory synthesis to industrial-scale manufacturing has been driven by increasing demand for efficient power semiconductors.

In recent decades, improvements in SiC crystal size, defect reduction, and doping control have expanded its application scope. For B2B buyers, understanding this historical progression highlights the material’s maturation and reliability as a strategic component in next-generation electronics and energy systems. It also underscores the importance of partnering with experienced suppliers capable of delivering consistent quality aligned with evolving technological standards.

Illustrative Image (Source: Google Search)

How can I effectively vet suppliers of SiC crystal structure to ensure reliability?

Start by requesting detailed company profiles, including manufacturing capabilities and years of experience in SiC crystal production. Verify certifications such as ISO 9001 and industry-specific accreditations. Ask for client references, especially from similar industries or regions. Conduct factory audits or virtual tours if possible. Additionally, review sample quality and consistency before placing large orders. Using platforms that specialize in industrial suppliers with verified credentials can also reduce risk.

Is customization available for SiC crystal structures to meet specific technical requirements?

Yes, many suppliers offer customization options for SiC crystal structures, including doping levels, crystal orientation, size, and purity. Clearly communicate your technical specifications upfront and request detailed datasheets. Custom orders may require minimum quantities and longer lead times, so plan accordingly. Engage with suppliers who have R&D capabilities and can provide technical support to optimize the crystal structure for your applications.

What are typical minimum order quantities (MOQs) and lead times for SiC crystal structure procurement?

MOQs vary widely depending on the supplier and customization level but typically range from small pilot batches to several kilograms for industrial use. Lead times generally span from 4 to 12 weeks, influenced by order size, customization, and current production capacity. For buyers in Africa, South America, the Middle East, and Europe, it’s advisable to discuss MOQs early to align with your project timelines and inventory strategies.

What payment terms are common in international trade of SiC crystal structures, and how can I mitigate financial risks?

Standard payment terms include letters of credit, telegraphic transfers (T/T), or escrow services. Letters of credit provide security for both parties, especially in new supplier relationships. Negotiate partial upfront payments with balance due upon delivery or inspection. Ensure clear contract terms regarding payment schedules, currency, and penalties for late payments. Working with suppliers who accept internationally recognized payment methods and provide transparent invoicing reduces financial risk.

What quality assurance (QA) measures and certifications should I require for SiC crystal structures?

Demand comprehensive QA protocols including defect density analysis, X-ray diffraction (XRD), and electron microscopy reports. Certifications such as ISO 9001, RoHS compliance, and material safety data sheets (MSDS) are essential. Insist on batch traceability and third-party testing where feasible. Regular quality audits and supplier-provided inspection reports help maintain consistent product standards, critical for high-performance applications.

How can I optimize logistics and shipping for importing SiC crystal structures from international suppliers?

Work with suppliers experienced in international shipping and familiar with export regulations relevant to your country. Choose reliable freight forwarders offering door-to-door service and customs clearance support. Consider packaging that protects the fragile SiC crystals from damage and contamination. Plan shipments well in advance to avoid delays, especially when importing to regions with complex customs procedures like Africa or the Middle East. Consolidating shipments can reduce costs and improve efficiency.

What steps should I take if a dispute arises regarding SiC crystal structure quality or delivery?

First, review the purchase contract and quality agreements to understand your rights and remedies. Document all communications and discrepancies with photos or inspection reports. Engage the supplier promptly to seek resolution, possibly involving a third-party inspection or mediation. If unresolved, escalate through formal dispute resolution clauses such as arbitration. Maintaining clear contracts and open communication channels upfront helps minimize disputes.

Are there regional considerations for sourcing SiC crystal structures in markets like Africa, South America, the Middle East, and Europe?

Yes, regional factors such as import tariffs, regulatory compliance, and local standards can impact procurement. In Africa and South America, customs clearance can be slower, so allow extra lead time. The Middle East may require adherence to specific certifications or halal standards. Europe and the UK demand strict environmental and safety compliance. Understanding these regional nuances and collaborating with suppliers who have export experience in your target market will streamline transactions and reduce delays.

Illustrative Image (Source: Google Search)

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

The strategic sourcing of SiC (silicon carbide) crystal structures is pivotal for businesses aiming to harness the material’s exceptional thermal conductivity, chemical stability, and electronic properties. For B2B buyers across Africa, South America, the Middle East, and Europe, understanding supplier capabilities, crystal quality, and regional market dynamics can unlock significant competitive advantages. Prioritizing suppliers with proven expertise in producing high-purity, defect-controlled SiC crystals ensures superior device performance and durability.

Key takeaways include:

Looking ahead, the demand for SiC crystals is poised to grow rapidly, driven by emerging sectors such as electric vehicles, renewable energy, and 5G communications. International buyers are encouraged to proactively establish strategic partnerships and invest in supply chain intelligence to capitalize on these opportunities. By doing so, businesses will not only secure high-quality materials but also position themselves at the forefront of innovation in the global semiconductor landscape.

Tags: Black Silicon Carbide, White Fused Alumina, Brown Fused Alumina, Pink Fused Alumina, Black Fused Alumina